|  |

|  |

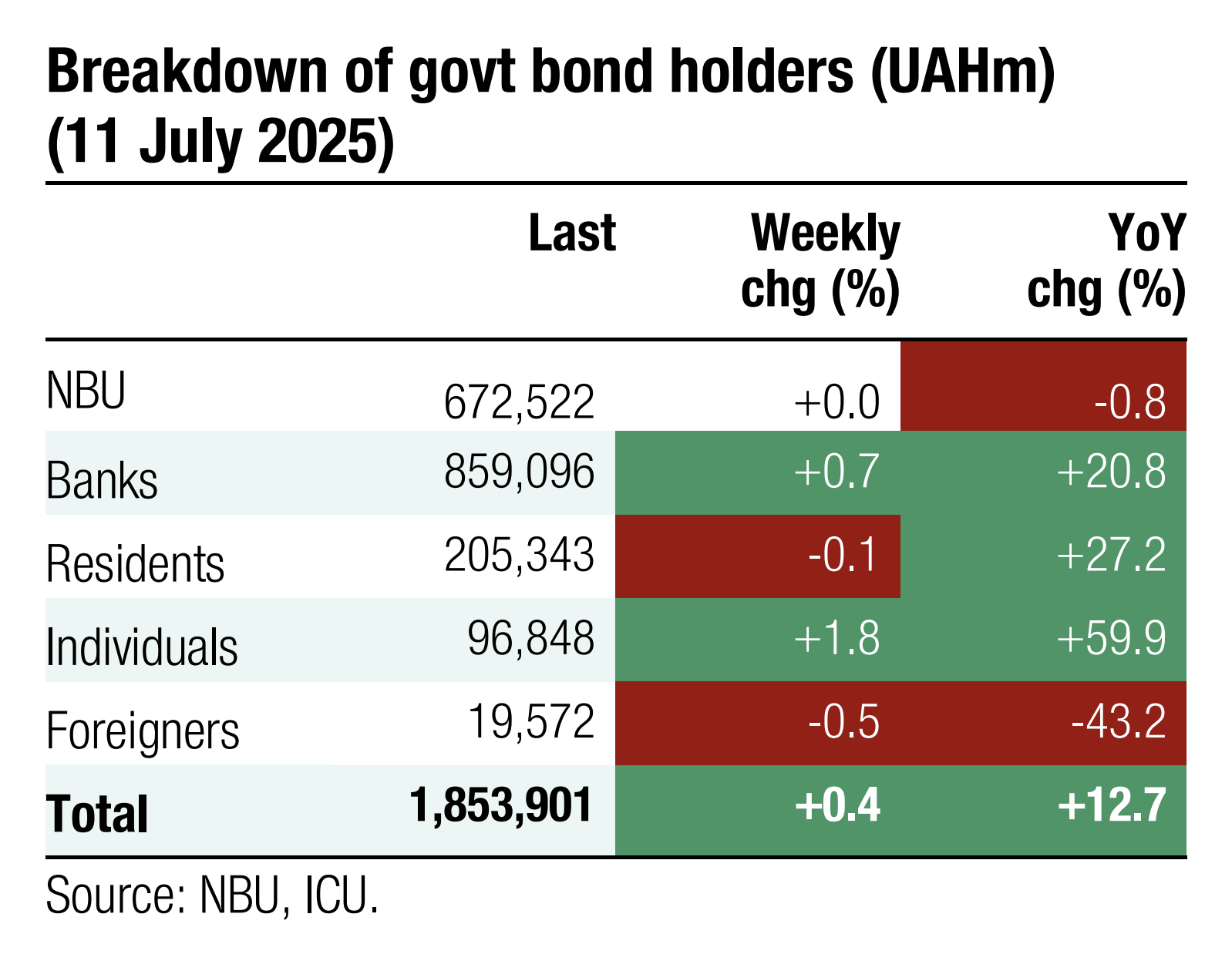

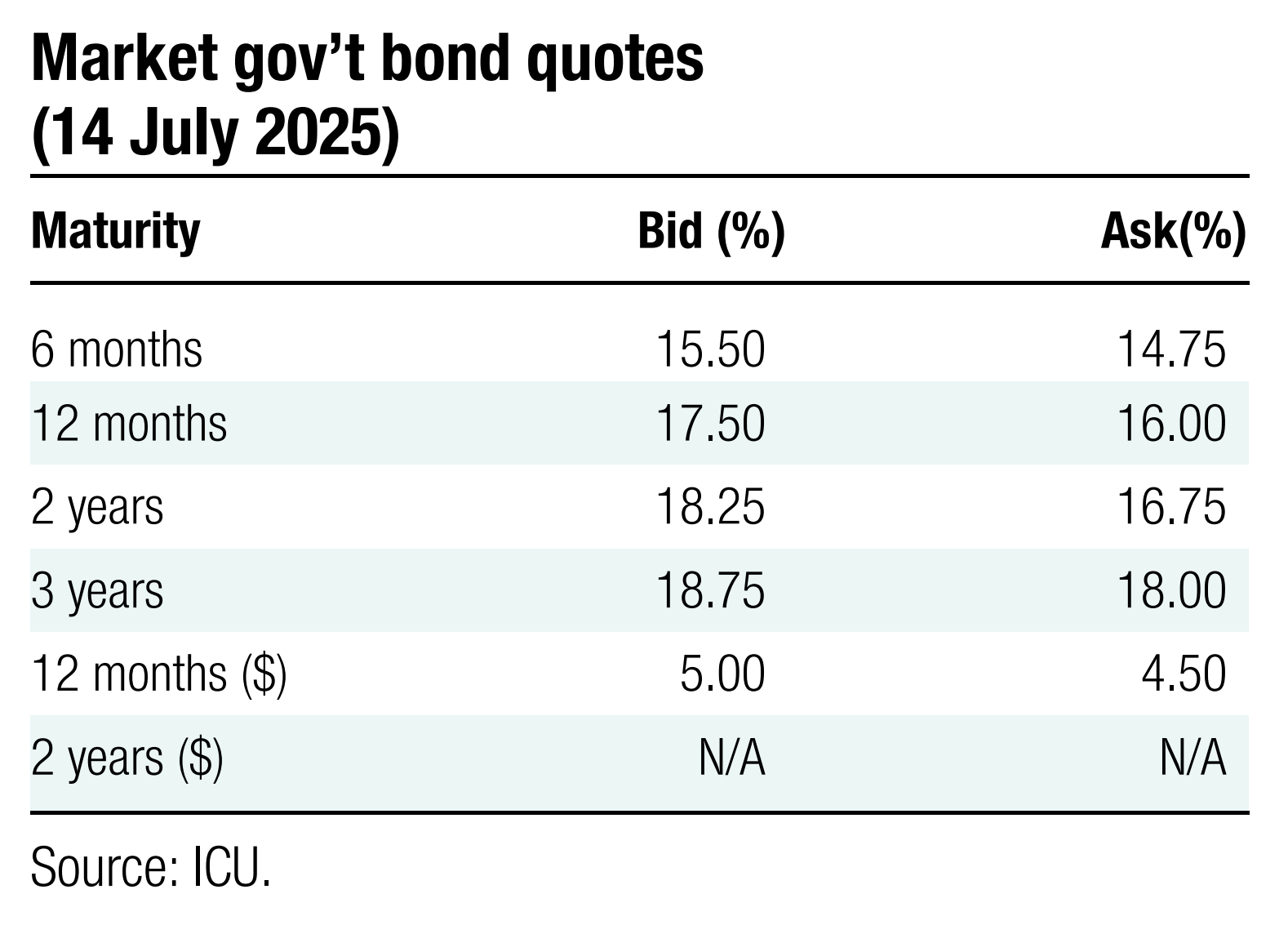

Bonds: Retail bond portfolios reach new high

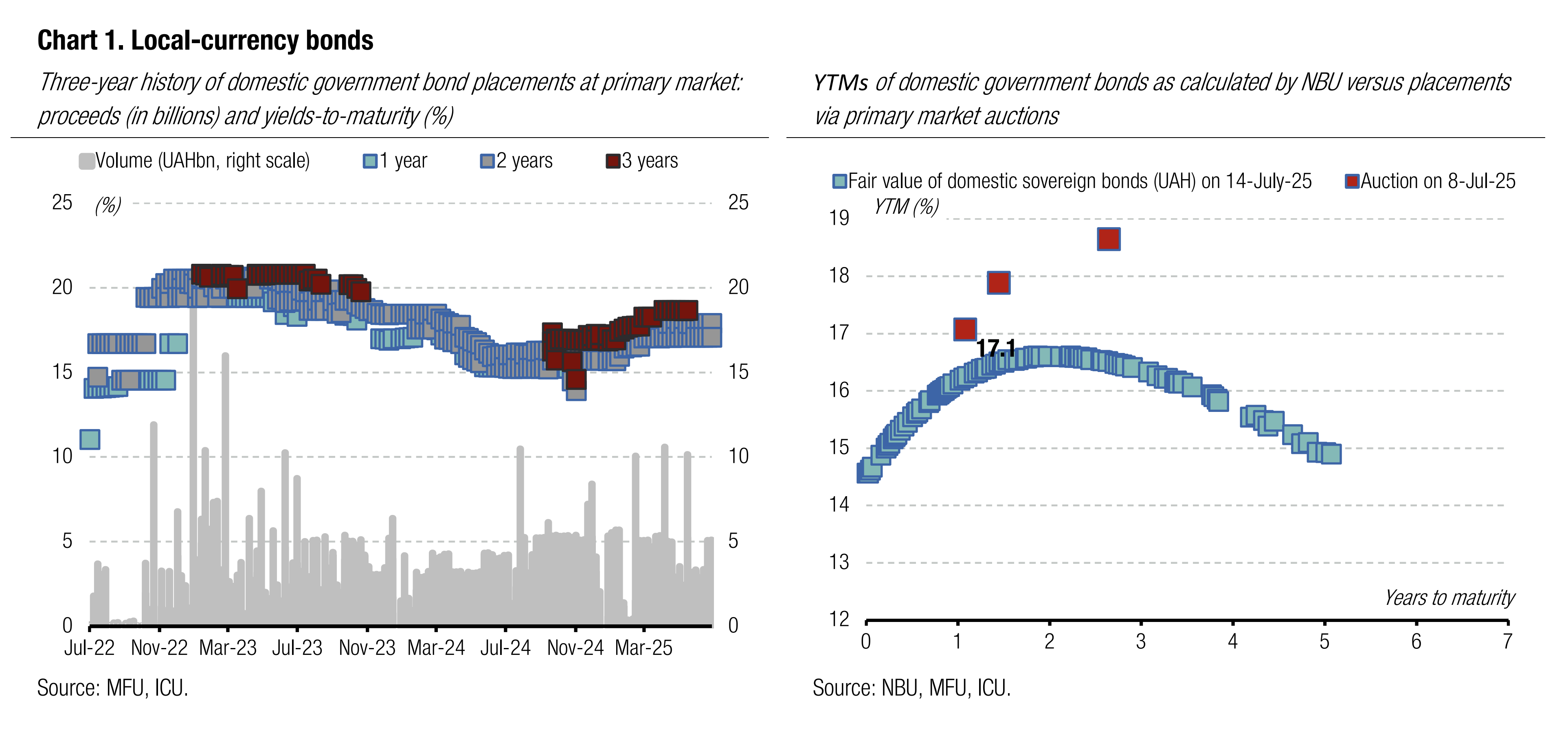

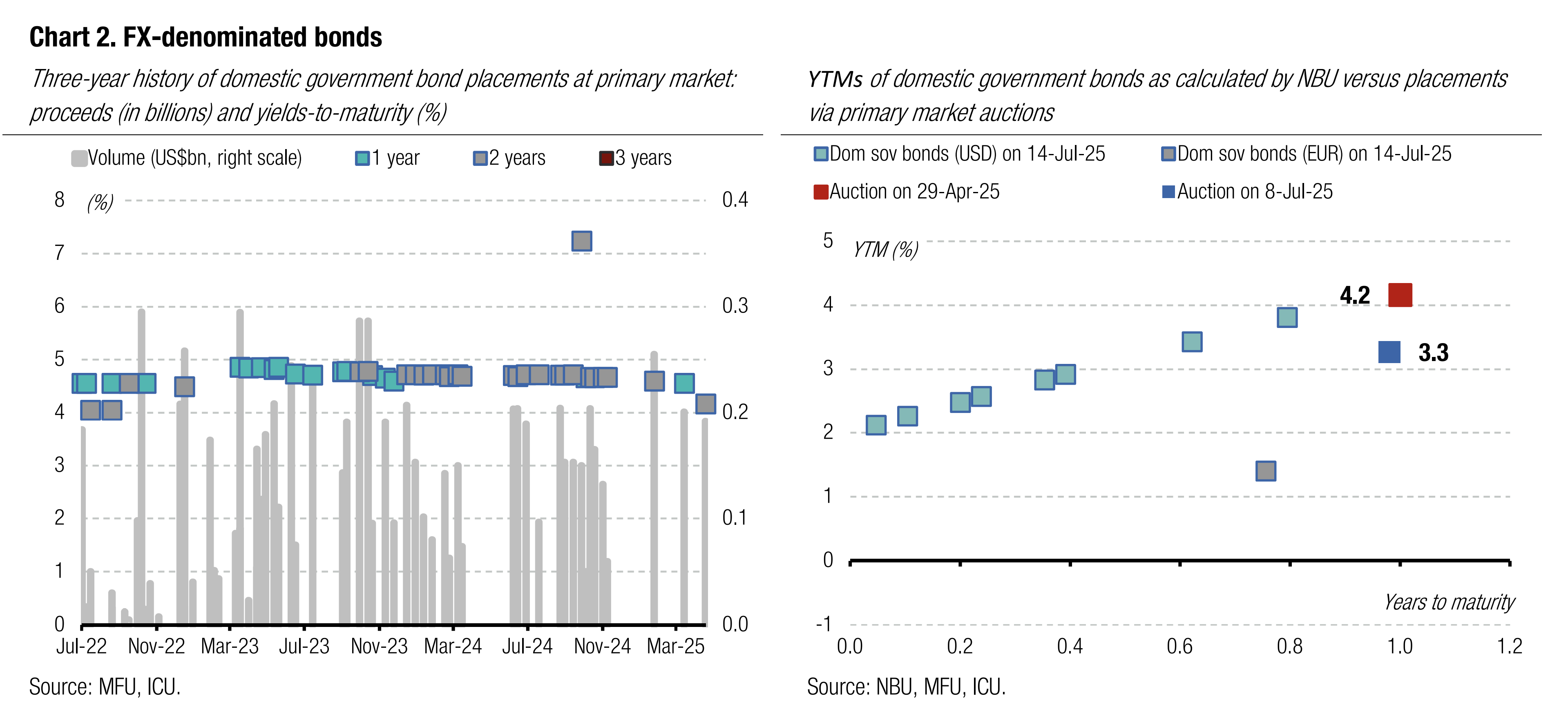

Last week, bond holdings of retail investors reached a new high. The share of UAH bonds in total retail portfolio continues to grow.

Last month, the households' bond portfolio fell by UAH5bn to UAH91bn on the back of redemptions. Yet, recently, retail investors rebuilt their portfolios to UAH97bn, a new historical high. Their portfolios are up 24% YTD, more than double the growth in 1H24.

The share of UAH paper rose to 54% last week from below 50% in recent years. According to our estimates, about three quarters of the portfolio are invested in short-term bonds maturing within a year, while about 20% of bonds are due in 2027-2028.

ICU view: Individuals kept increasing their bond portfolios and the share of hryvnia paper. Hryvnia-denominated papers remain attractive due to a combination of reasons: 1) the MoF is gradually decreasing the volume of outstanding FX bonds, prompting their shortage in the market; 2) FX-denominated bonds have low effective yields due to broker commissions; 3) however, the main explanation seems to be related to attractive yields on hryvnia papers that properly cover risk of a likely gradual hryvnia devaluation. Given this, we expect the share of UAH bonds will continue to grow in the portfolios of retail investors. Similarly, we expect higher-yielding two and three-year bonds will also attract greater attention.

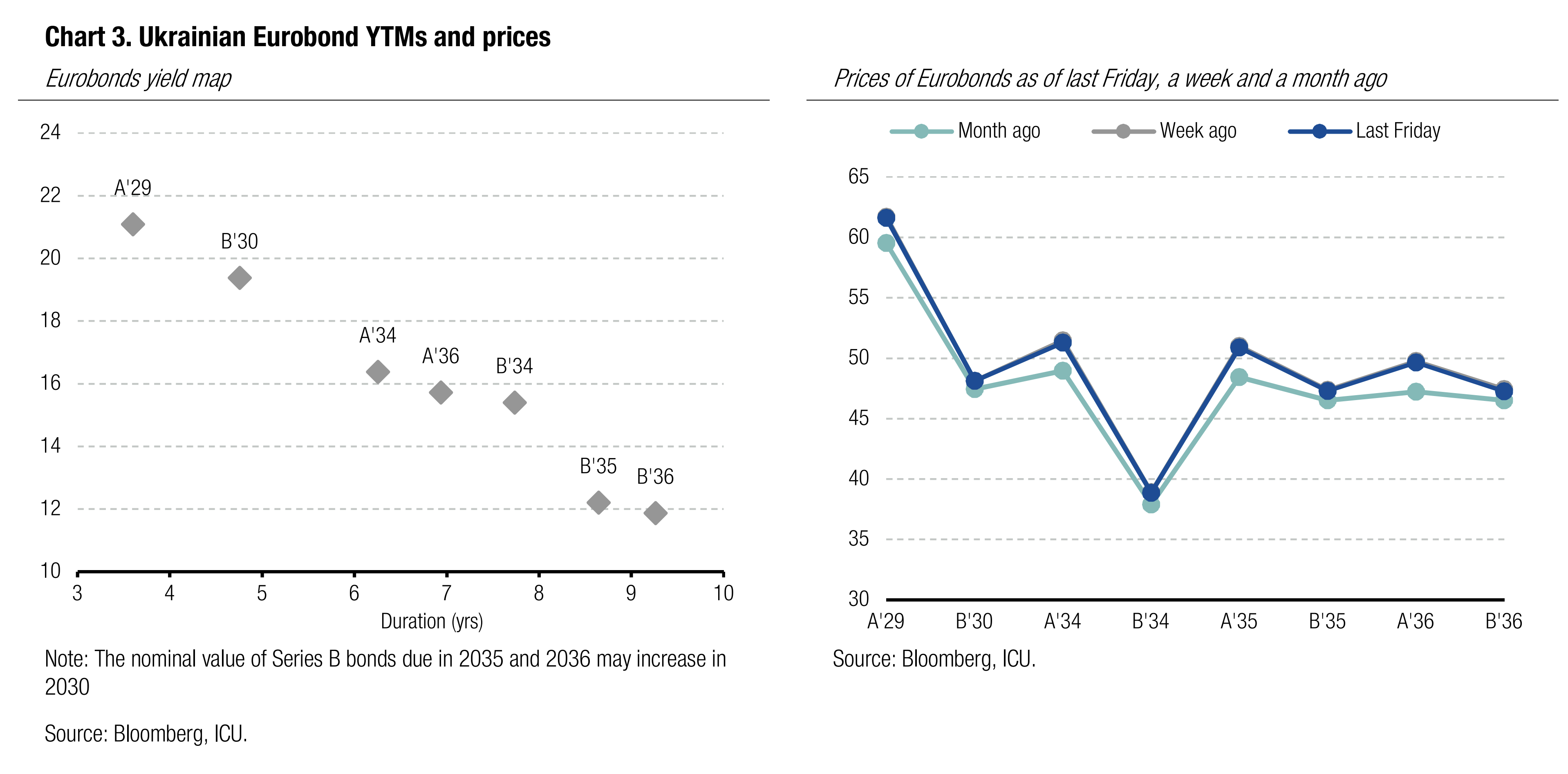

Bonds: Markets await clarity on US position

Last week, President Donald Trump reiterated his displeasure with the lack of progress that russia is making to end the war in Ukraine. However, at this point, markets did not take this message as an indication of a systemic change in the administration's stance on the war.

Prices of Ukrainian Eurobonds continued to fluctuate, mostly close to 50 cents. Last week’s news about a meeting of The Coalition of the Willing, a shift in President Donald Trump's rhetoric about war in Ukraine, a renewal of weapons supply by the US, and the Ukraine Recovery Conference in Rome went largely unnoticed by the markets.

ICU view: This week, markets are waiting to hear more from President Trump on what his steps could be if russia remains unresponsive to his request to hold credible peace negotiations with Ukraine.

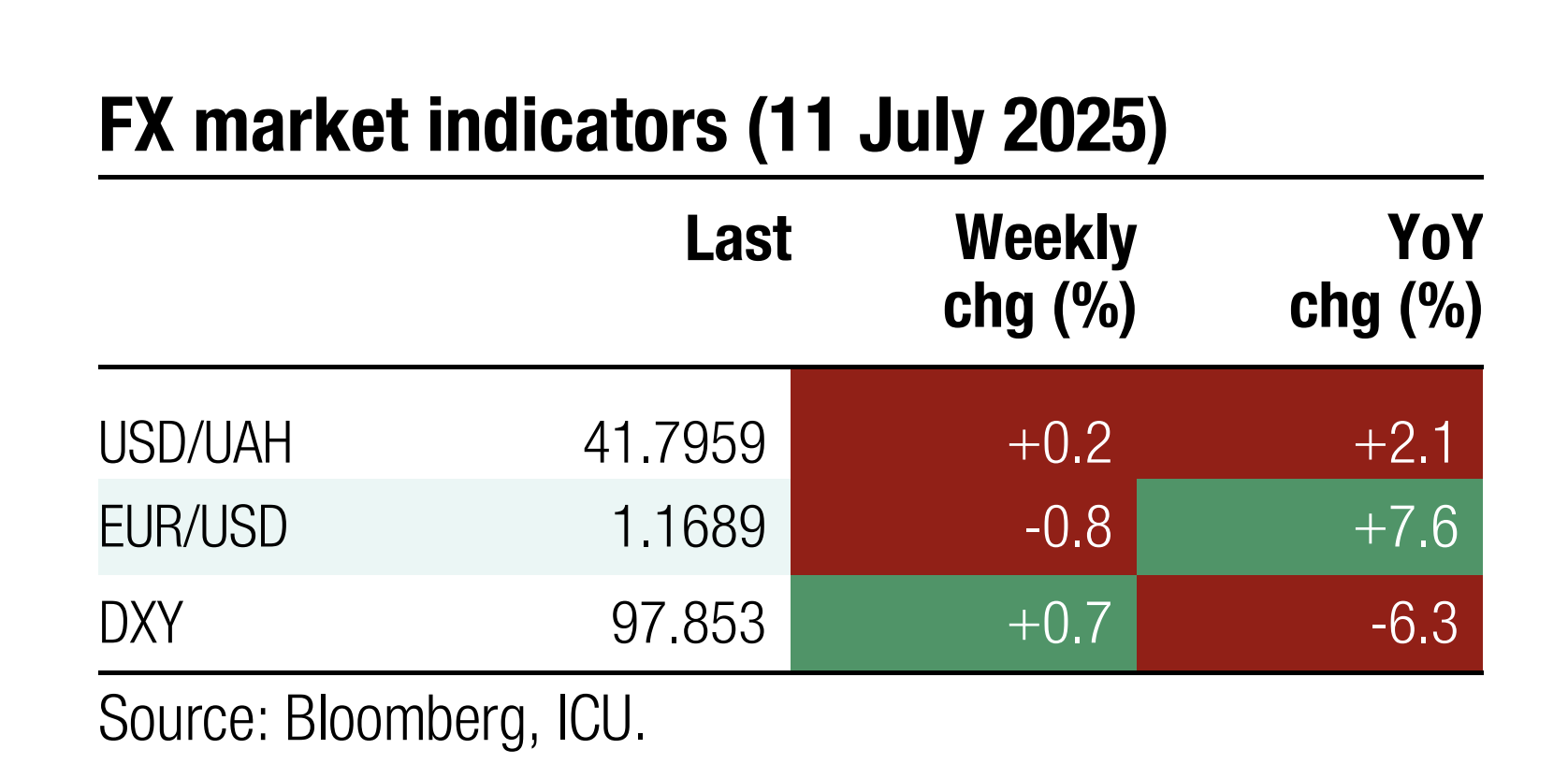

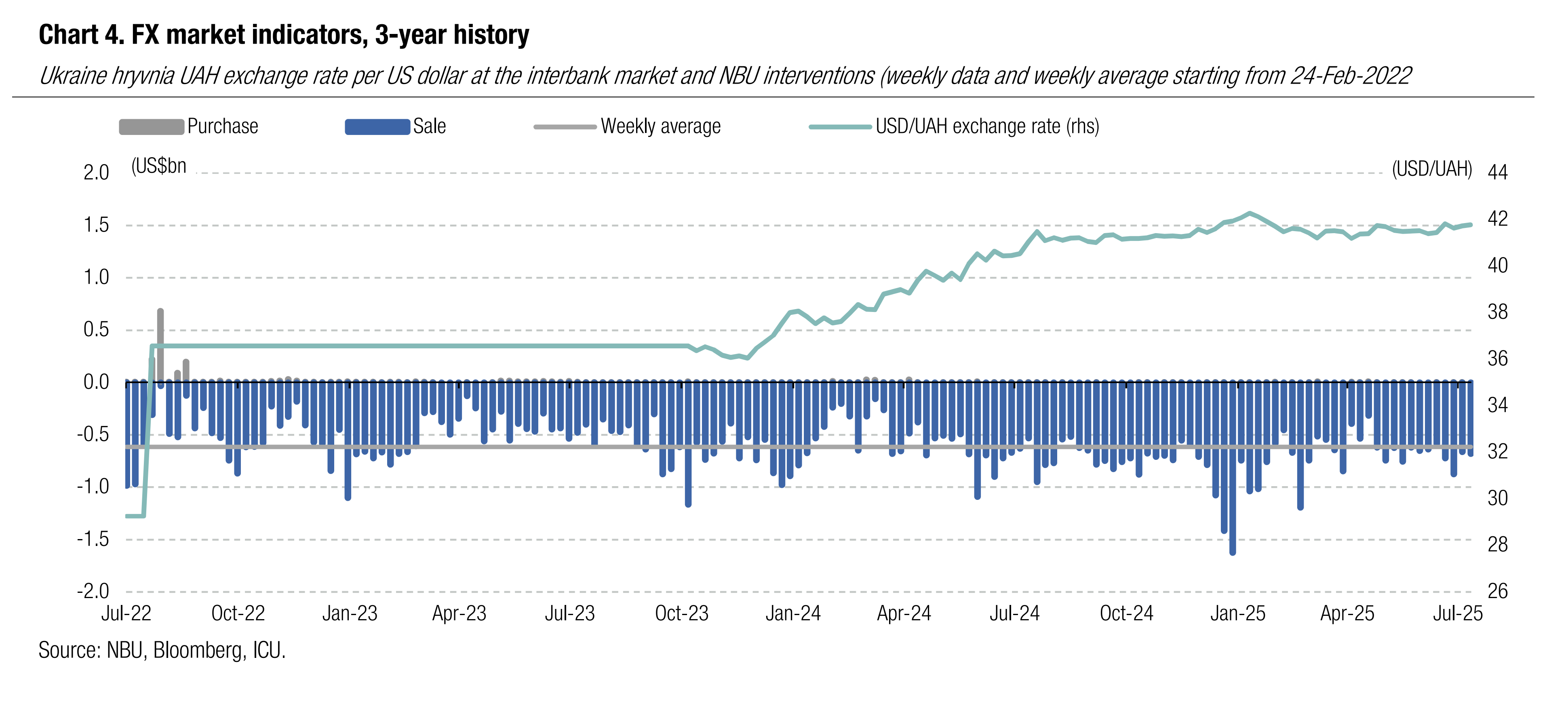

FX: NBU satisfies postponed demand

The NBU kept its interventions at a high level despite lower hard currency shortage. The hryvnia fluctuated in a narrow range.

NBU interventions rose slightly to US$679m while the FX shortage declined again, by 17% WoW to US$346m.

The NBU allowed the hryvnia's official exchange rate to fluctuate marginally. The hryvnia weakened by 0.1% against the US dollar to UAH41.78/US$ and appreciated against the euro by 0.6% to UAH48.84/EUR.

ICU view: NBU appears to be comfortable with the current USD/UAH exchange rate and the size of its weekly interventions that are just above the war-time average. We assume the NBU will not allow the hryvnia to appreciate to this year's highs seen in the spring, but a significant devaluation is also very unlikely. We see the official exchange rate close to UAH41.8/US$ in the following weeks.

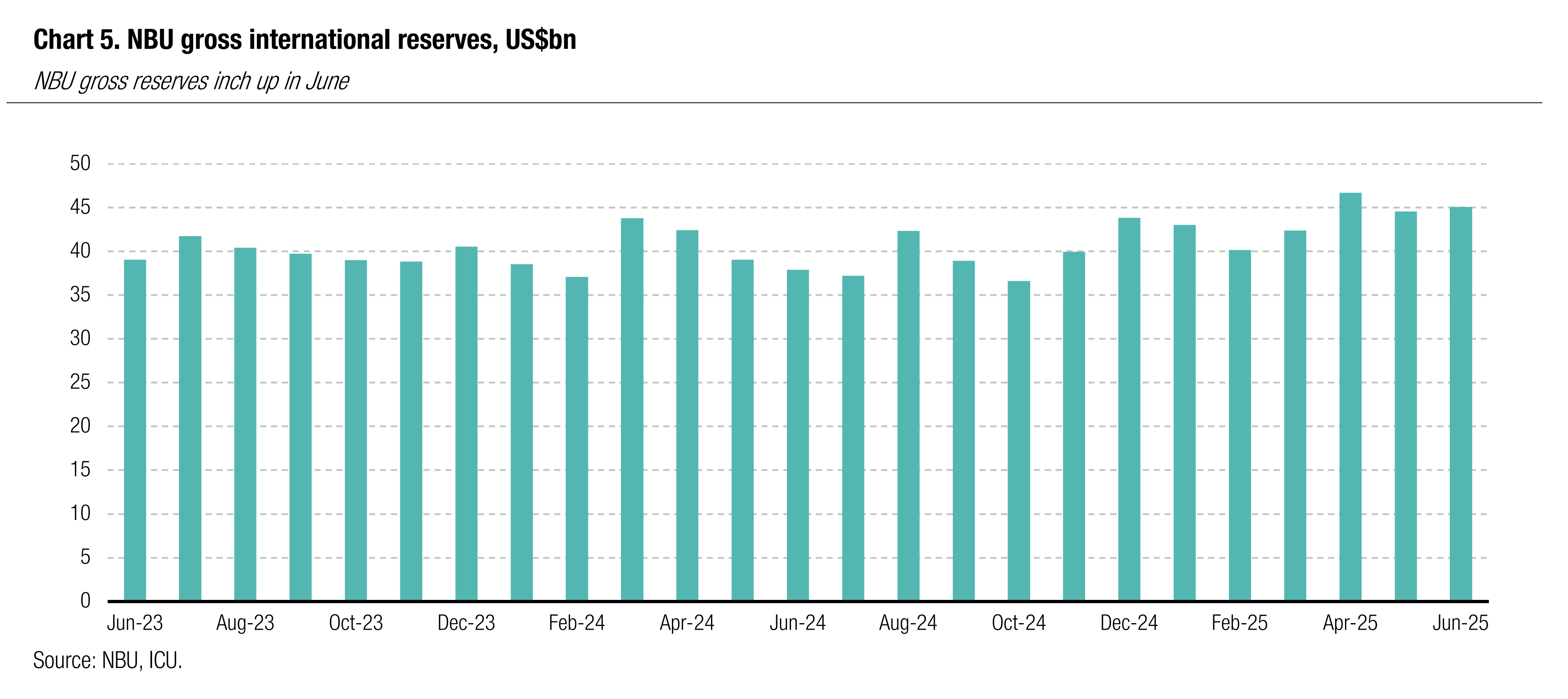

Economics: NBU reserves inch up in June

The gross international reserves of the NBU edged up 1.2% in June (+2.9% in 1H25) to US$45.1bn.

Ukraine received significant amounts of foreign financial aid in June, including US$1.7bn from Canada, US$1.2bn from the World Bank, and US$1.2bn from the EU. Meanwhile, the NBU spent almost US$3.0bn on FX market interventions and Ukraine spent US$0.9bn on servicing its external official debt. The end-June stock of reserves is equivalent to 5.6 months of future imports, according to the NBU.

ICU view: The NBU reserves continue to be replenished with foreign financial aid as Ukraine received just over US$20bn in 1H25. According to the most recent IMF memorandum, Ukraine may further receive over US$30bn in 2H25. Given this, we expect NBU reserves will exceed US$55bn at the end of 2025, but the reserves are likely to fall substantially in 2026 on lower inflows of grants and concessional loans.

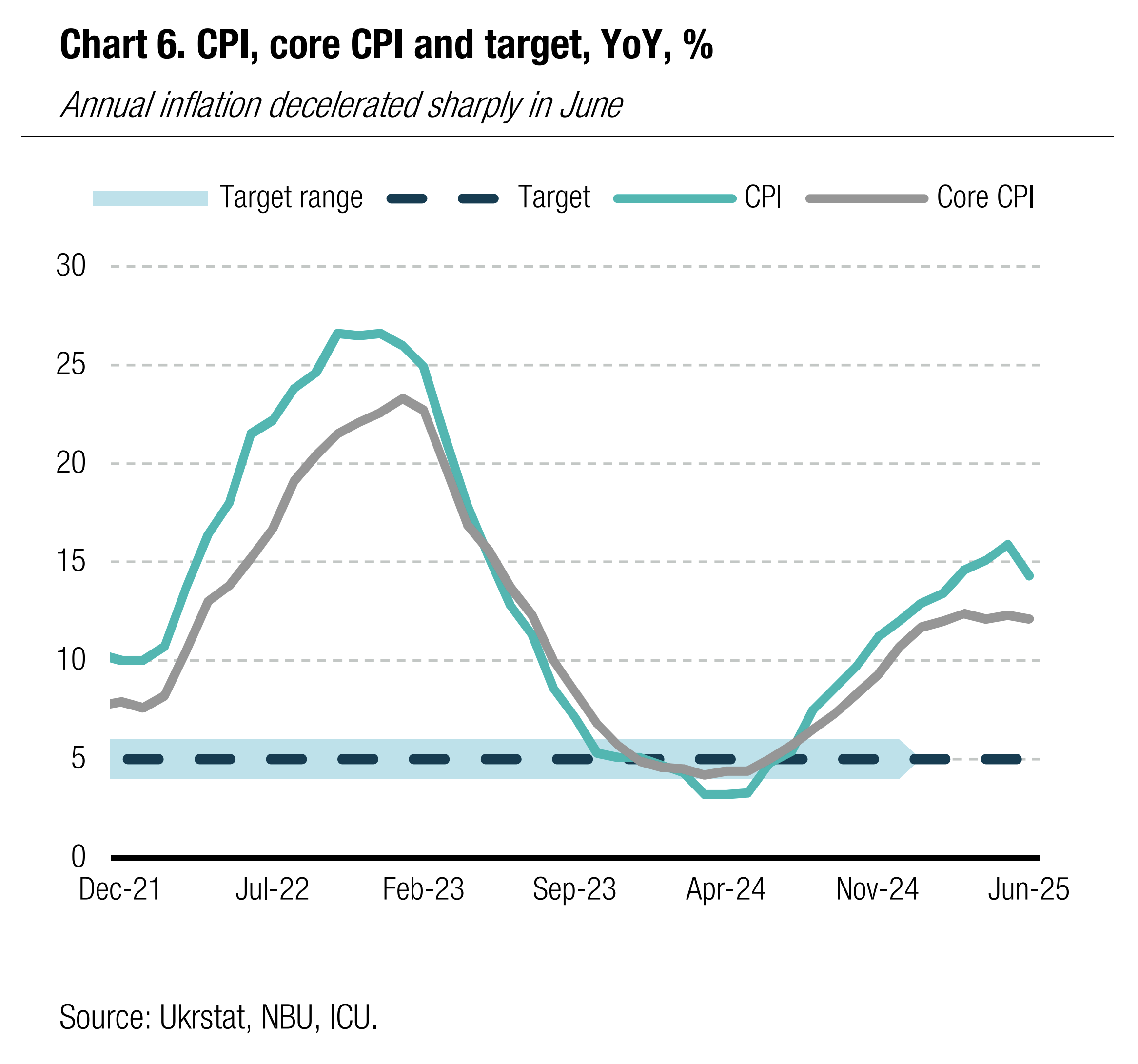

Economics: Annual inflation expectedly decelerates in June

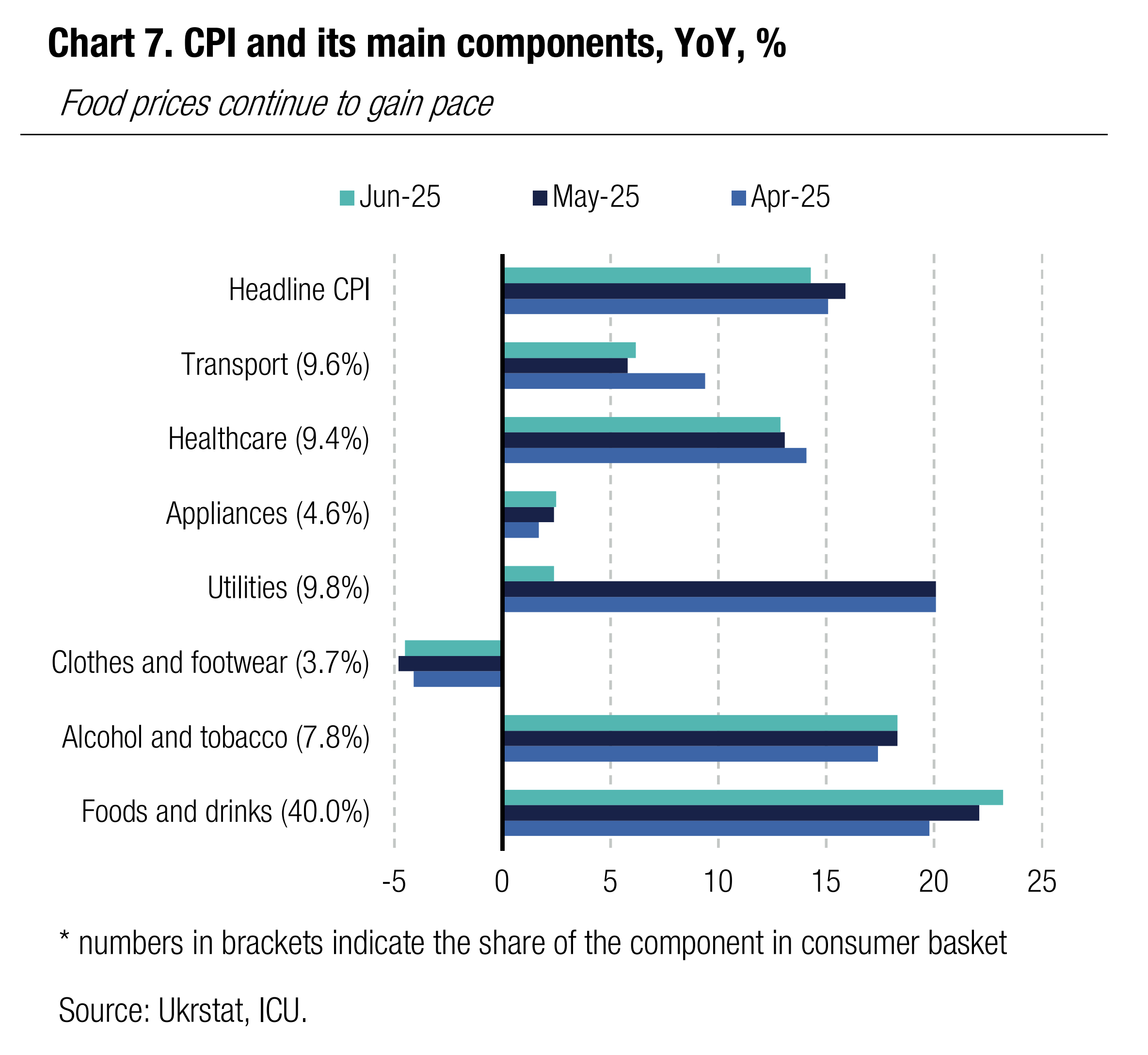

Annual inflation fell to 14.3% in June from 15.9% in May due to statistical effects of last year’s high base. Monthly inflation decelerated to 0.8% from 1.3% in May.

Food prices remain the key inflation driver as they were up 1.3% MoM (+23.2% YoY vs. 22.2% in May) and have a weight of 38% in the consumer basket. Annual prices also accelerated somewhat for transportation services (+6.2% vs 5.8% in May) on an upsurge on global oil prices last month. The major relief came from a sharp slowdown in utility tariffs that decelerated to annual 2.4% from 20.1% in June.

|  |

ICU view: The dramatic change in CPI trend in June was fully expected and the most important message at this point is that CPI will most likely stay on a firm decelerating trend at least for the next three quarters. While this year’s harvest is going to be weaker than we expected at the beginning of the year, it should still present a noticeable improvement vs. dismal numbers of 2024. That should favour deceleration in food prices through end-2025. We see end-2025 inflation close to 8.0% and that will open a way for a gradual and marginal decrease in the NBU key policy rate.