|  |

|  |

Bonds: Short-term paper shortage increases

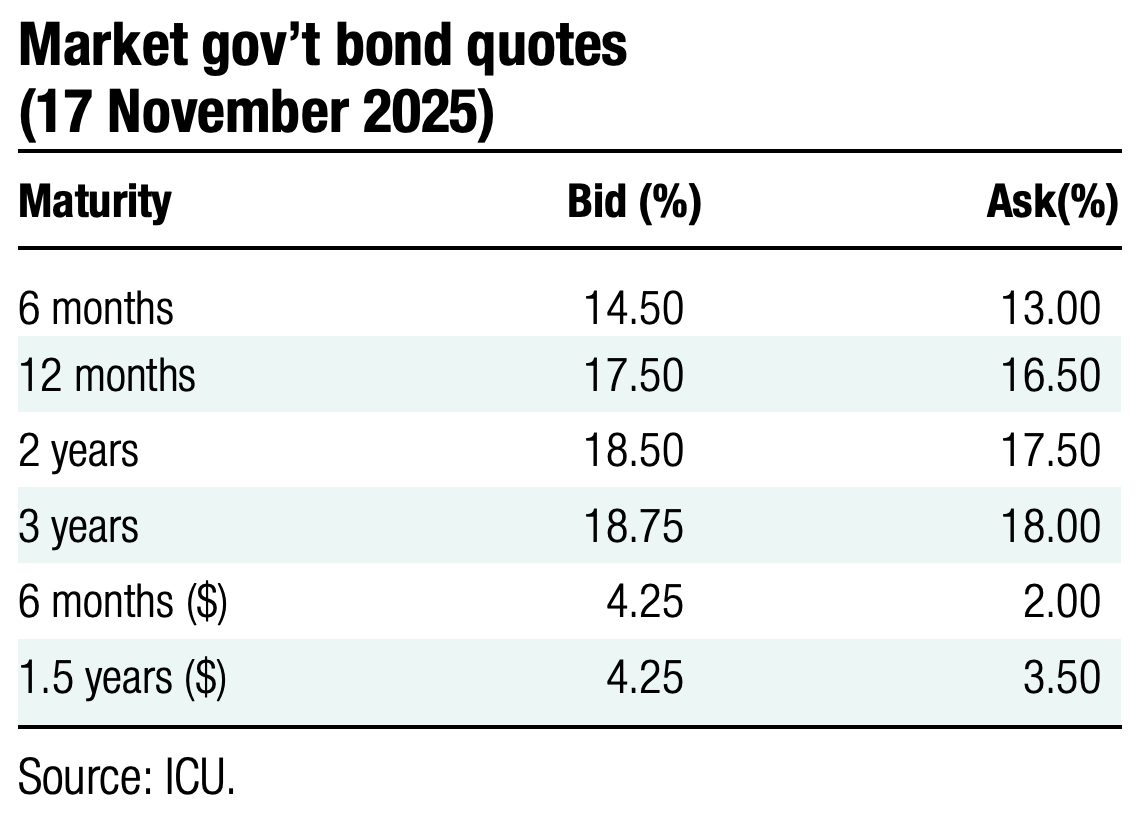

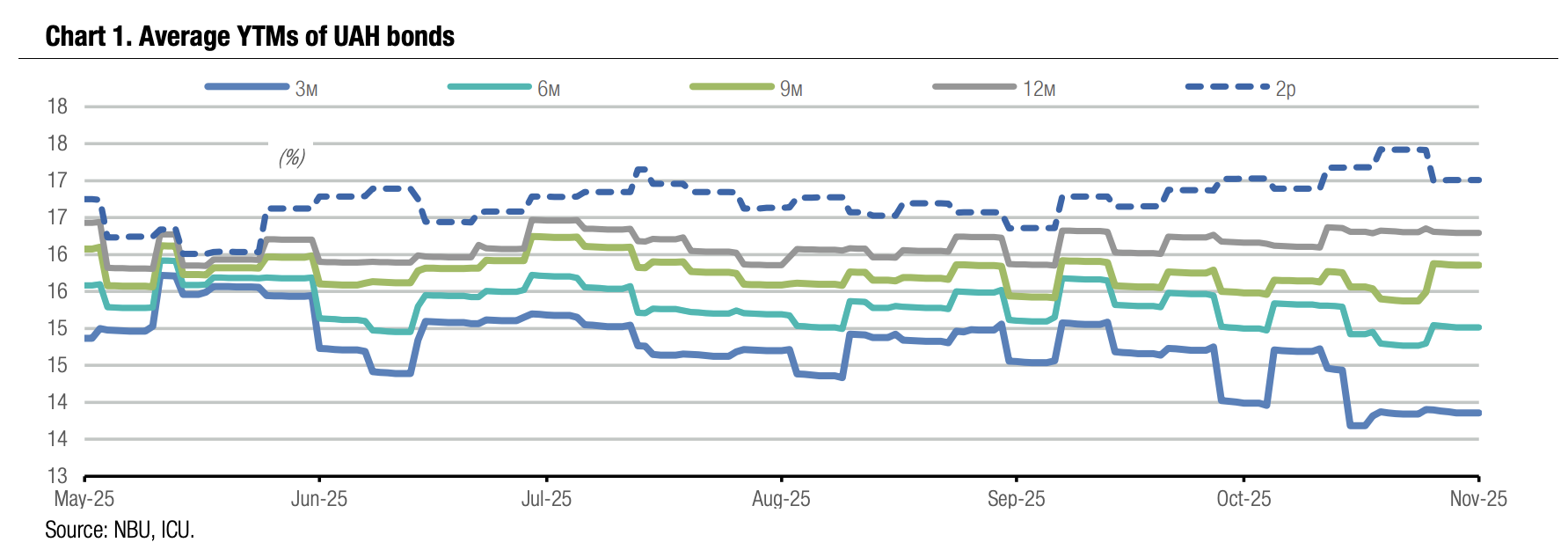

For about two months, trading in the secondary market was concentrated in bonds with a maturity less than one year, driving a gradual decline in their yields.

The total volume of UAH bonds traded in the secondary bond market last week was UAH9.1bn, as paper with a remaining maturity of less than 12 months totalled UAH4bn. Trading in securities with maturity within the next six months stood at only UAH0.1bn.

There is a persistent shortage of short-term instruments in the bond market, which adds pressure on rates. In the past six months, yields declined to less than 13% from over 15% for three-month instruments and to 15% from almost 16% for six-month securities. At the same time, yields for longer instruments have remained broadly stable and are close to 16% for bonds maturing in 9-12 months.

ICU view: In primary auctions, the Ministry of Finance does not offer new bonds with maturities of less than a year. This paper is only available in the secondary bond market, implying the demand often exceeds supply significantly. We expect this pattern to continue as the MinFin has no plans to offer short-term securities in the near future.

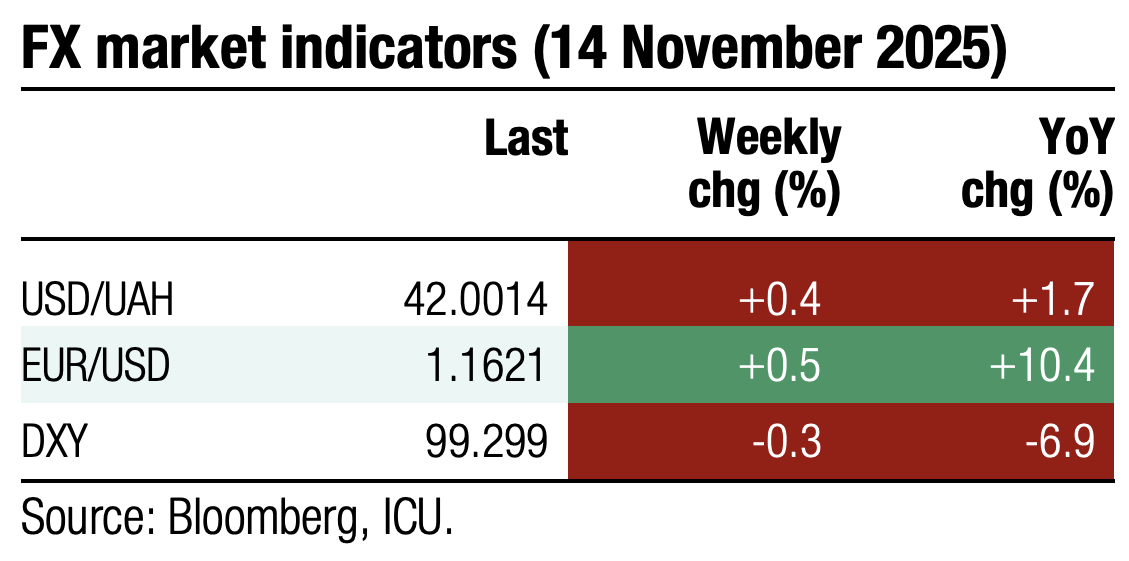

FX: NBU keeps tight control on exchange rate

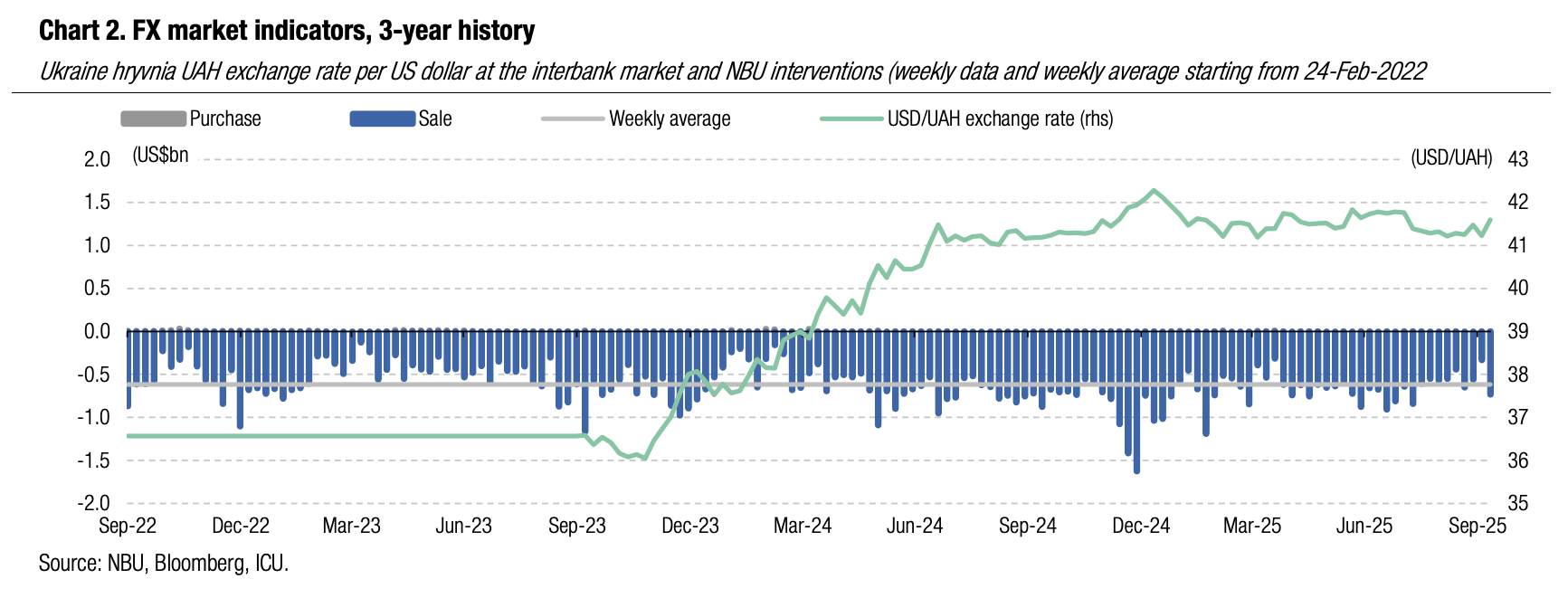

Last week, the NBU maintained the hryvnia/dollar exchange rate slightly above UAH42/US$.

The National Bank increased its interventions by 22% WoW to US$701m, but did not allow the dollar price to exceed UAH42.1/US$. According to our calculations, daily interventions were small at the beginning of the week, but likely spiked on Friday (with some deals likely to be settled today). Fluctuations in the hryvnia exchange rate on the interbank market were approximately within a range of UAH0.2.

Over four business days, the foreign currency shortage was hardly changed WoW at US$419m. The deficit was driven by trade in the interbank market while in the retail segment, net hard currency purchases decreased by 23% to US$134m.

ICU view: The National Bank broadened the band for hryvnia fluctuations vs the US$ recently compared with the summer months. Yet, the NBU is definitely in no hurry to weaken the hryvnia exchange rate further, despite the IMF's insistence. We do not expect a significant weakening of the hryvnia in the foreseeable future.

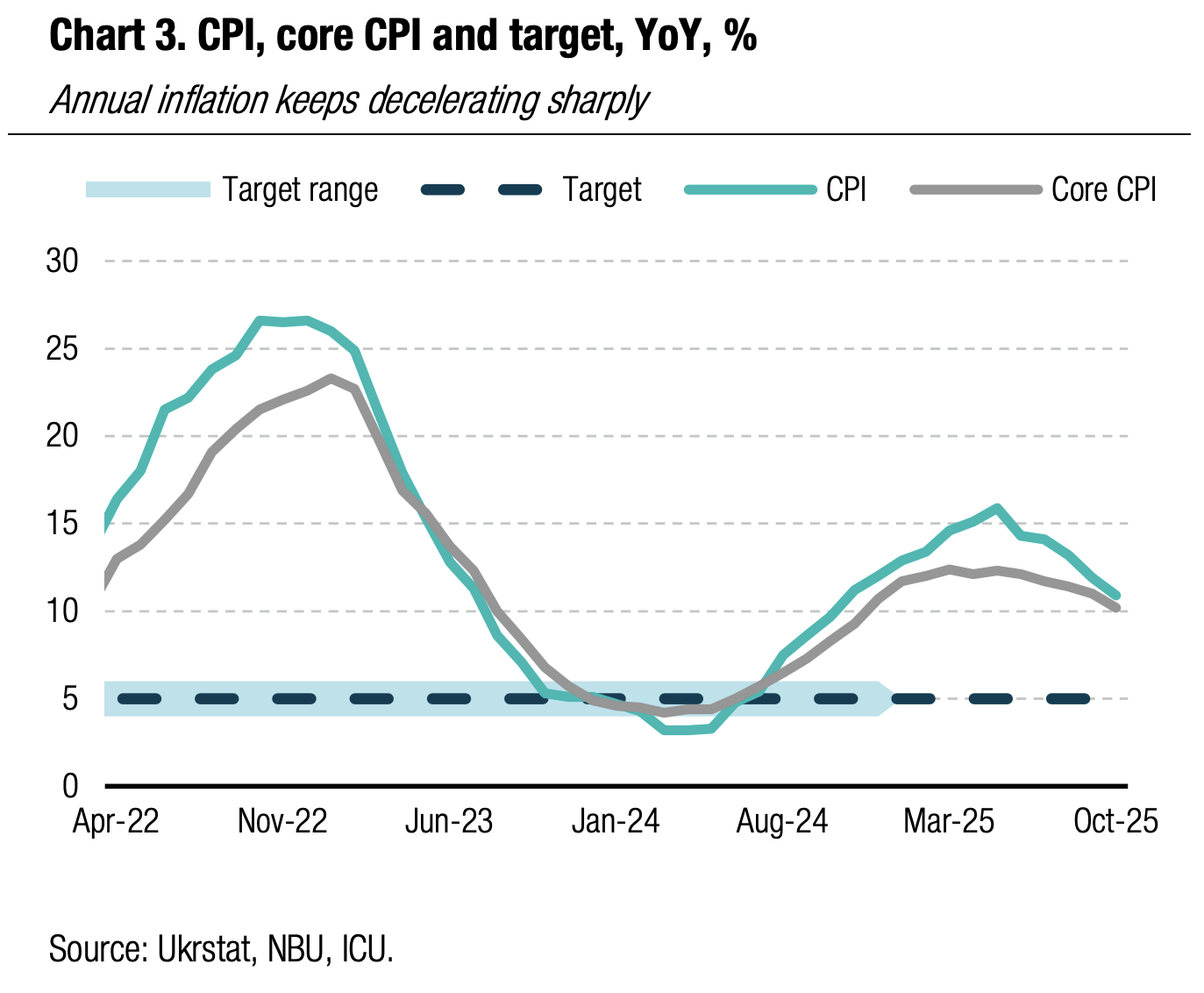

Economics: Annual inflation on a steep downward trend

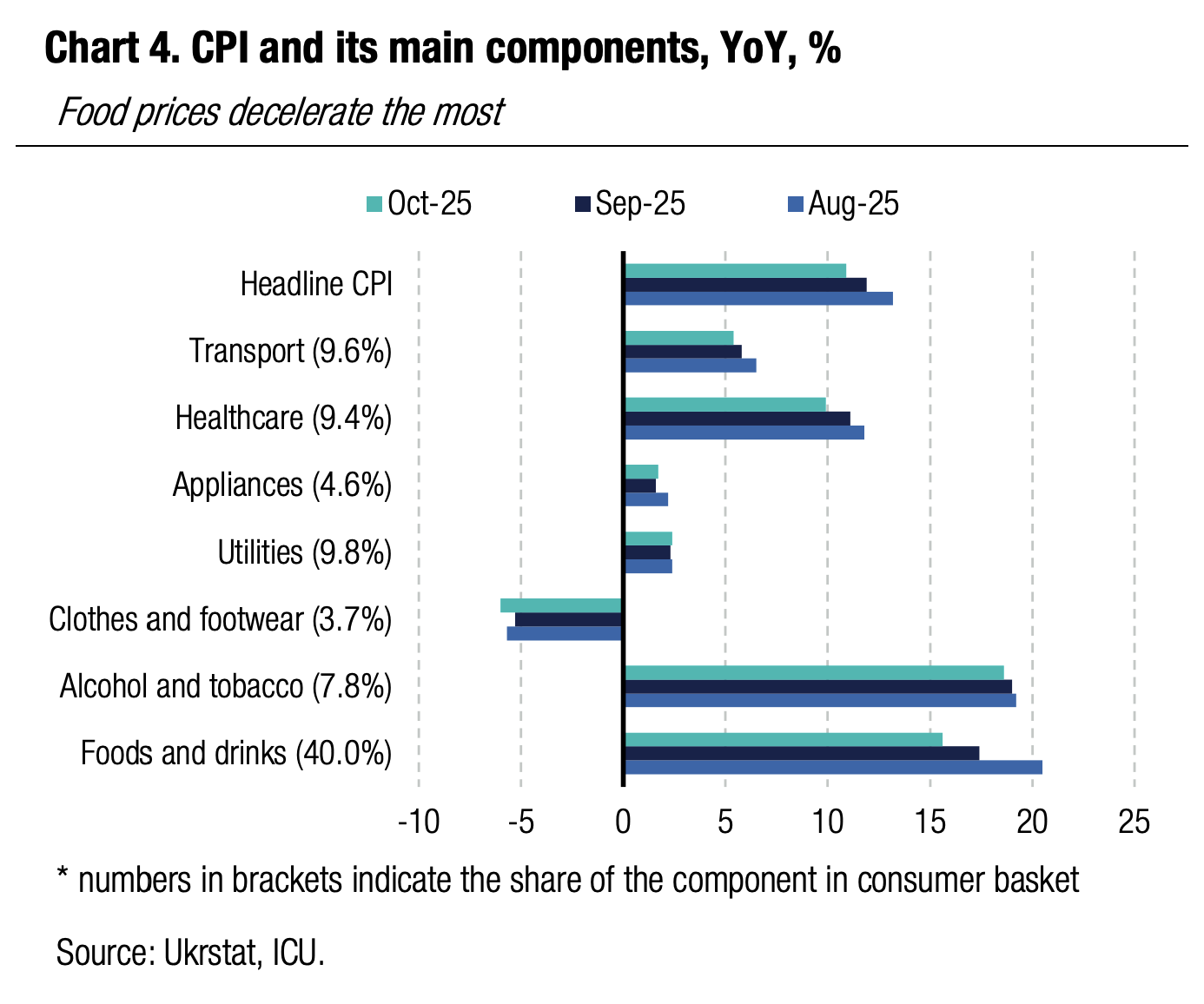

Annual CPI slowed to 10.9% in October from 11.9% in September and a peak of 15.9% in May. Core CPI was down to 10.2% from 11.0% in September.

The greatest relief came from food, the largest consumer basket component, as price growth moderated to 15.4% YoY from 17.2%. The deceleration in annual prices was broad-based, with pronounced declines in rates also seen in health services (9.9% in October vs 11.1% in September) and communication (16.4% vs 17.1%).

|  |

ICU view: Inflation should remain on a steep downward trend in the coming months against last year’s unusually high base. We see annual inflation slipping to single-digits already in November and decelerating further in every month at least until May 2026. We don’t rule out that the NBU may start its monetary policy easing cycle as soon as December and deliver a 50bp cut despite its earlier surprise guidance of keeping the rate unchanged at least until January 2026.