To mark the 20th anniversary of private pension provision in Ukraine, ICU Investment Group has presented the performance results of the non-state pension funds (NPFs) under its management.

The NPF Market in Ukraine

As of June 30, 2025:

- the assets of all non-state pension funds amounted to UAH 6.2 billion;

- there are over 887,000 participants, of whom 92,000 have already received or continue to receive pension payments;

- total pension contributions reached UAH 3.5 billion;

- pension payments amounted to UAH 2 billion;

- the total investment income of all funds exceeded UAH 5.3 billion.

(Source: NSSMC report for Q2 2025)

ICU Investment Group results

- The assets of the six NPFs managed by ICU amount to UAH 1.17 billion, an increase of UAH 103 million (+10%) since the beginning of 2025.

- The number of participants in these funds exceeds 124,000.

- ICU’s asset management company also administers five NPFs with nearly 81,000 participants.

- ICU’s market share has reached 19% of assets under management, including the National Bank of Ukraine’s NPF, or 32% excluding it.

ICU-Managed Funds Among Market Leaders

By asset size, the following ICU-managed funds are among the ten largest NPFs in Ukraine:

- “Ukreximbank” — 4th place,

- “Dynasty” — 5th place,

- “Emerit-Ukraine” — 6th place.

By relative asset growth in 2025:

- “Care” — 1st place,

- “Dynasty” — 3rd place.

Returns for Participants

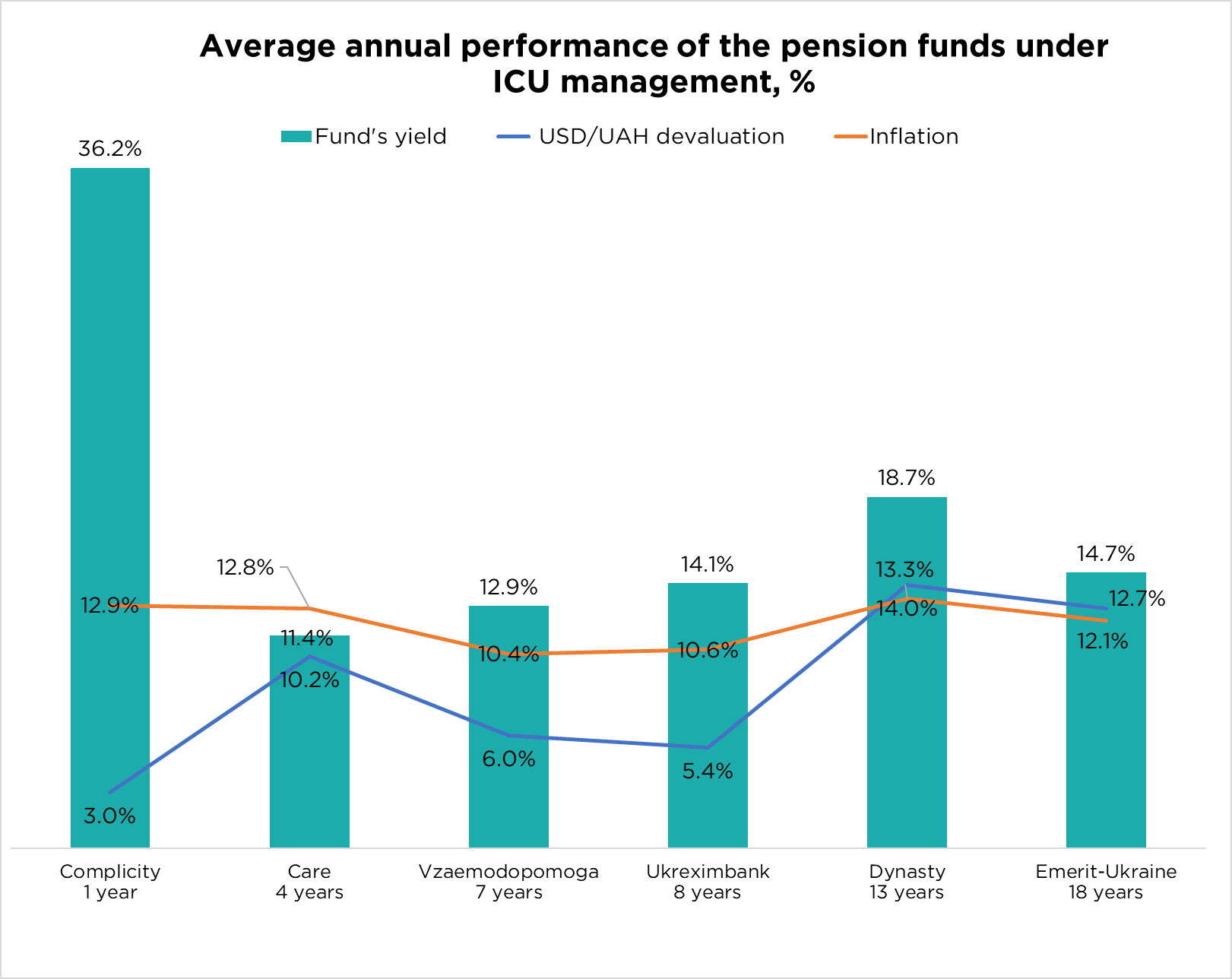

Since ICU Investment Group began managing them, all six NPFs have delivered net returns exceeding the official hryvnia-to-U.S. dollar exchange rate growth, and five of the funds have also outperformed inflation. This ensures that participants’ purchasing power is preserved, while pension savings remain reliable and protected.

“Our experience proves that pension savings can remain both secure and profitable even in conditions of an underdeveloped stock market, financial crises, and a limited range of financial instruments,” said Grygorii Ovcharenko, Head of Local Asset Management at ICU Investment Group.

About ICU

ICU is an independent investment group providing brokerage, asset management, and private equity services, as well as venture and fintech investments. The group focuses on emerging markets.

For more than 15 consecutive years, ICU has been the largest broker in Ukraine’s government bond market. The group is also a market leader in asset management and pension savings.