|  |  |

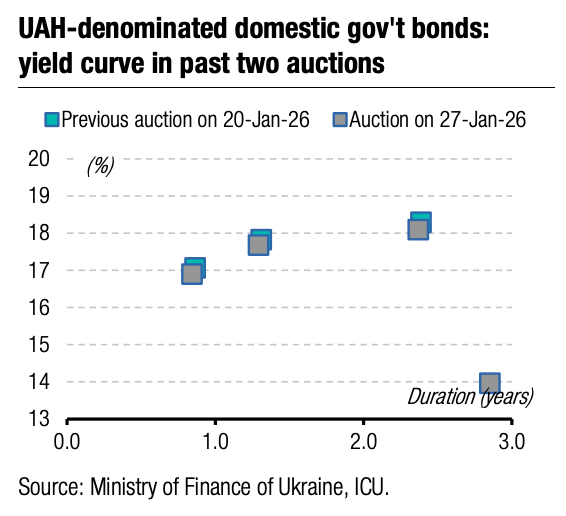

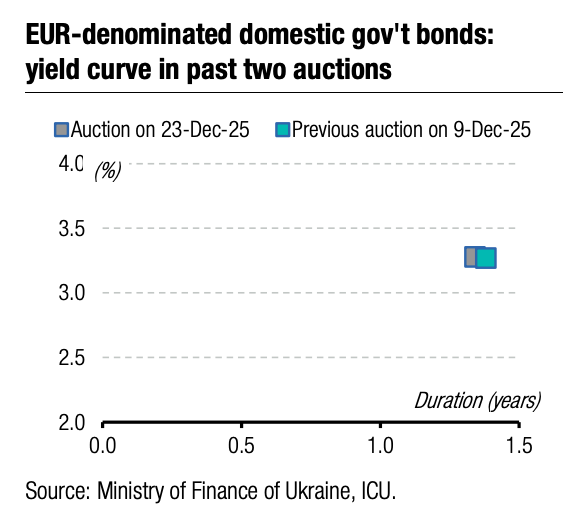

Due to the small volume of supply, the Ministry of Finance not only continued to reduce yields on 1.5 and 3-year bonds but also extended the reduction to other instruments.

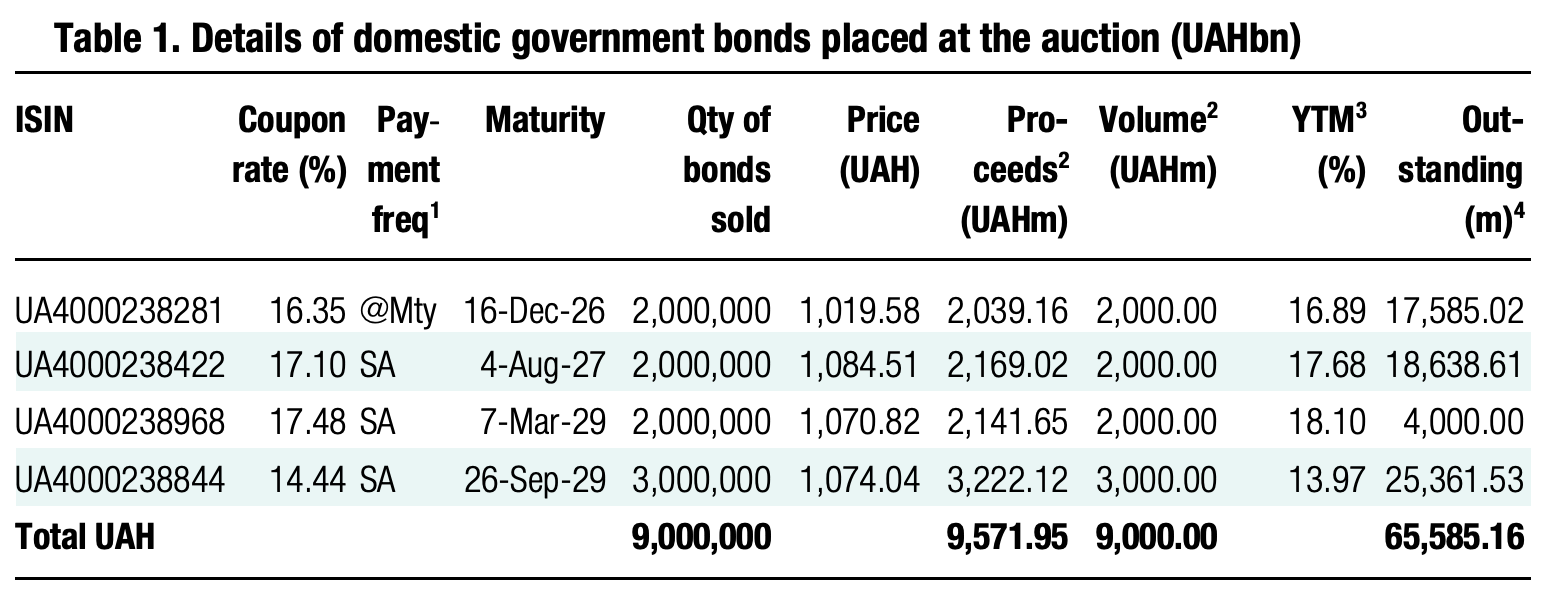

Demand for the shortest 11-month bill exceeded UAH8.4bn vs the UAH2bn cap, so the Ministry of Finance satisfied only 16 out of 47 bids, reducing the cut-off rate by 16bp to 16.19%.

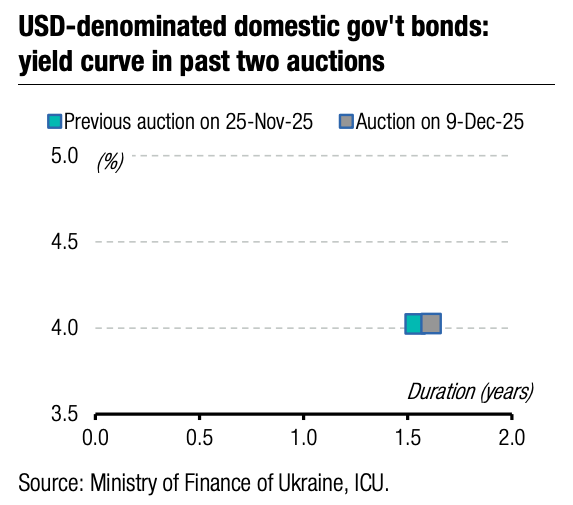

The volume of bids for 1.5-year paper increased to almost UAH12bn in 27 bids. The MoF satisfied 21 bids, reducing the cut-off rate by another 10bp to 16.95%, and the weighted average by 13bp to 16.91%. In total, across two auctions, the rates on this instrument decreased by 15bp and 19bp, respectively.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.53/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The yields on the three-year instrument continued to decline. The volume of submitted bids exceeded UAH15bn vs thee UAH2bn cap. So, the Ministry of Finance satisfied 32 bids, with rates in the applications not higher than 17.34%, and most likely a significant number of them partially. So, for yesterday's auction, the cut-off rate decreased by another 15bp, and the weighted average by 18bp. So, in total, for the two auctions, the decrease is 46bp and 50bp, respectively.

The yields on reserve bonds decreased the most. The Ministry decided to place this paper for another UAH3bn, increasing the bond outstanding to UAH25bn. Since banks are very interested in such instruments, they submitted as many as 65 bids for more than UAH42bn. Therefore, the Ministry of Finance reduced the yields on them the most, satisfying only 17 bids. The cut-off rate fell by 110bp to 13.5% compared with the auction in early January, and the weighted average rate fell by 97bp.

The dynamics of interest rates in the primary market will depend on the NBU's decision on the key policy rate tomorrow, as well as on the volume of bonds the Ministry of Finance offers at its auctions.

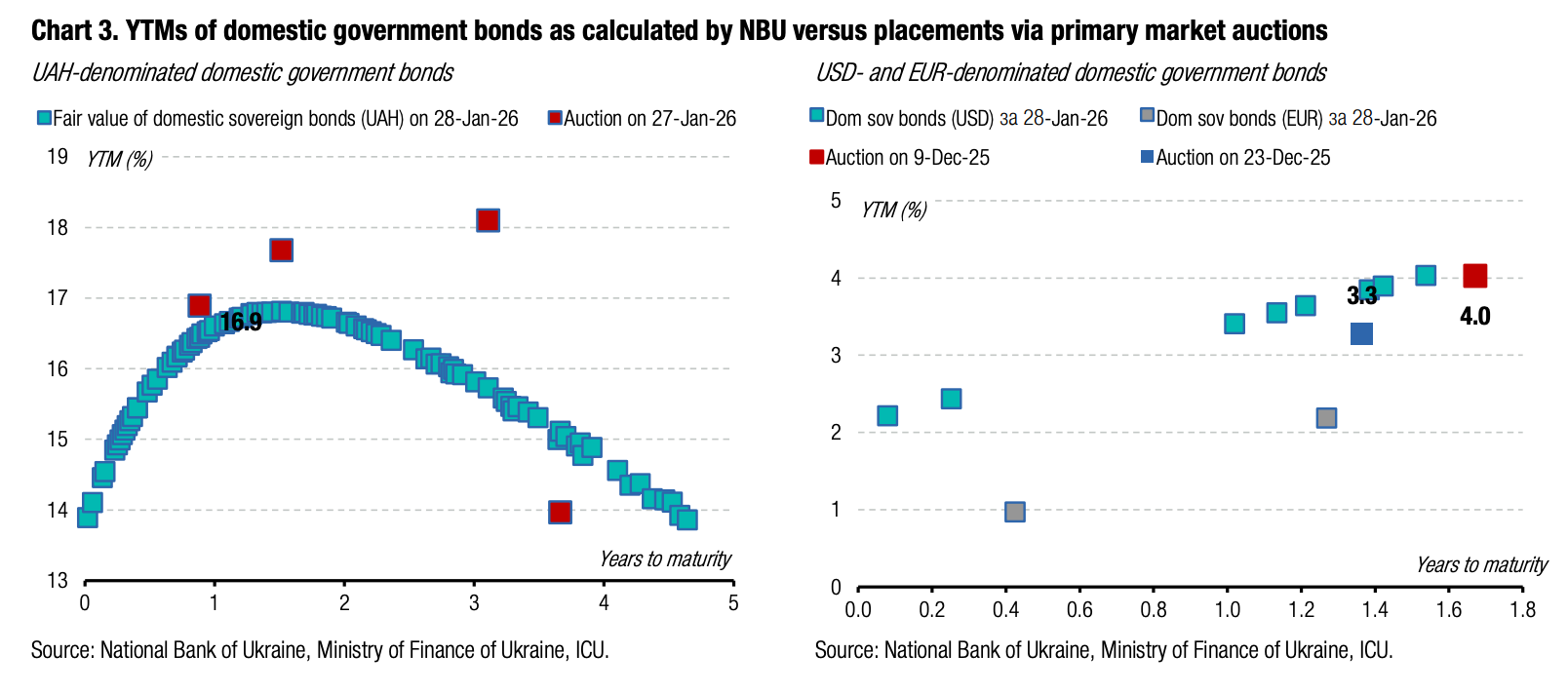

Appendix: Yields-to-maturity, repayments