|  |  |

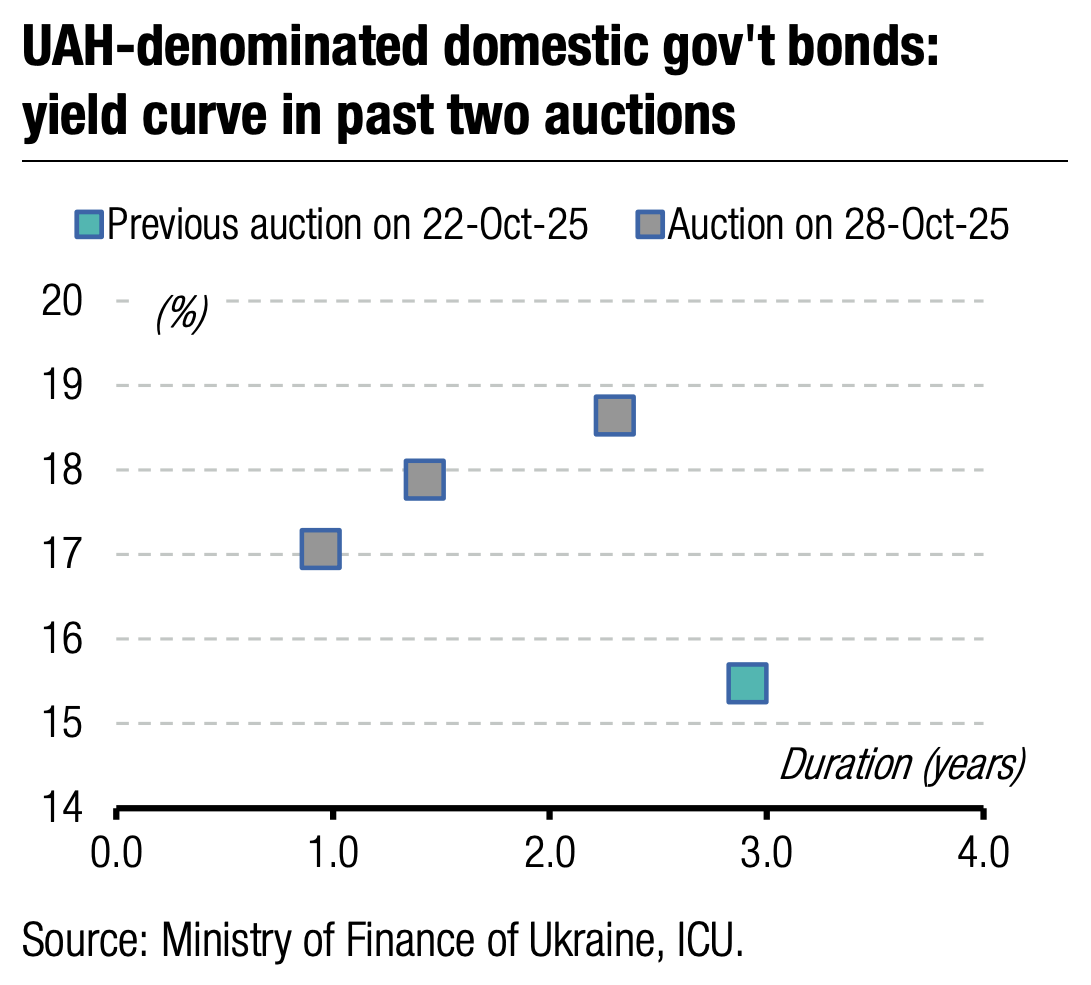

Yesterday's auction provided the MoF with the least amount of funds in October.

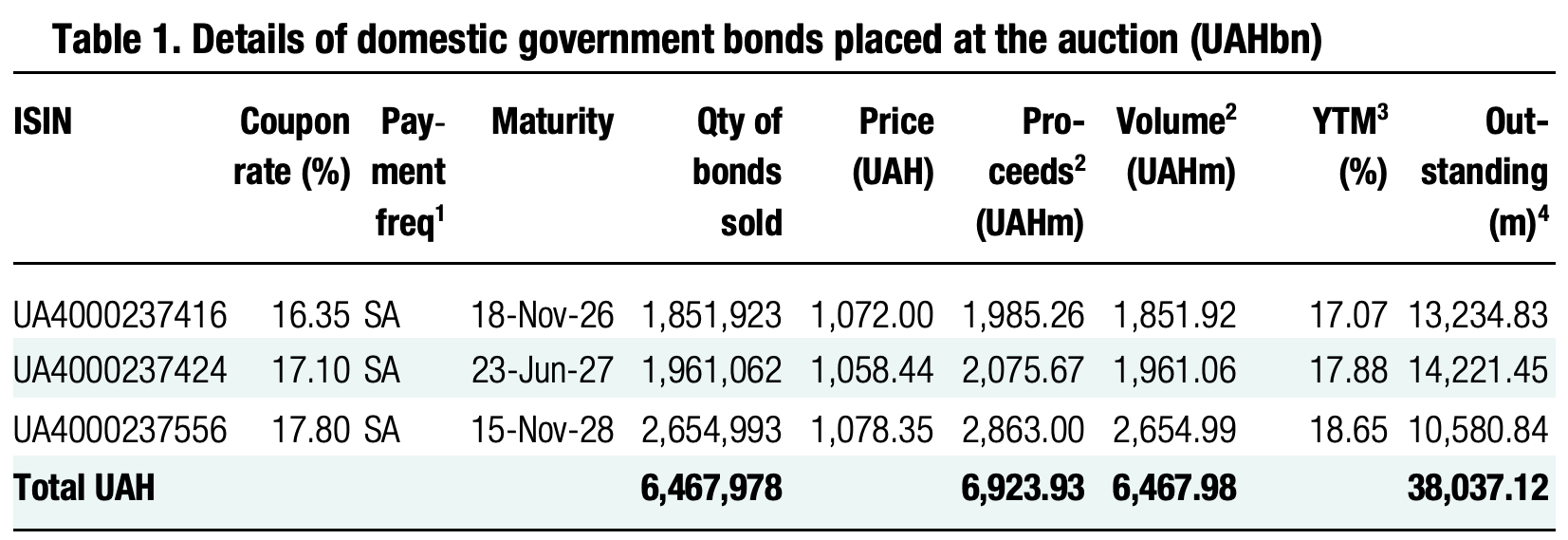

Yesterday, the MoF received restrained demand for new bonds. The total volume of bids was slightly below UAH6.5bn, with a focus on the three-year note. All bids were at the usual rates, so the ministry satisfied all of them.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.66/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

One-year military bonds brought the budget almost UAH2bn. Proceeds from 20-month securities amounted to slightly less than UAH2.1bn. The largest amount—almost UAH2.7bn—came from three-year notes. So, in total, proceeds amounted to UAH6.9bn, less than half of last Tuesday's proceeds from the same bond issues.

With this auction and the reserve bond swap auction last week, the ministry raised over UAH80bn in all currencies in October, the largest monthly borrowings this year.

Appendix: Yields-to-maturity, repayments