|  |

|  |

Bonds: MoF modifies UAH bond offering

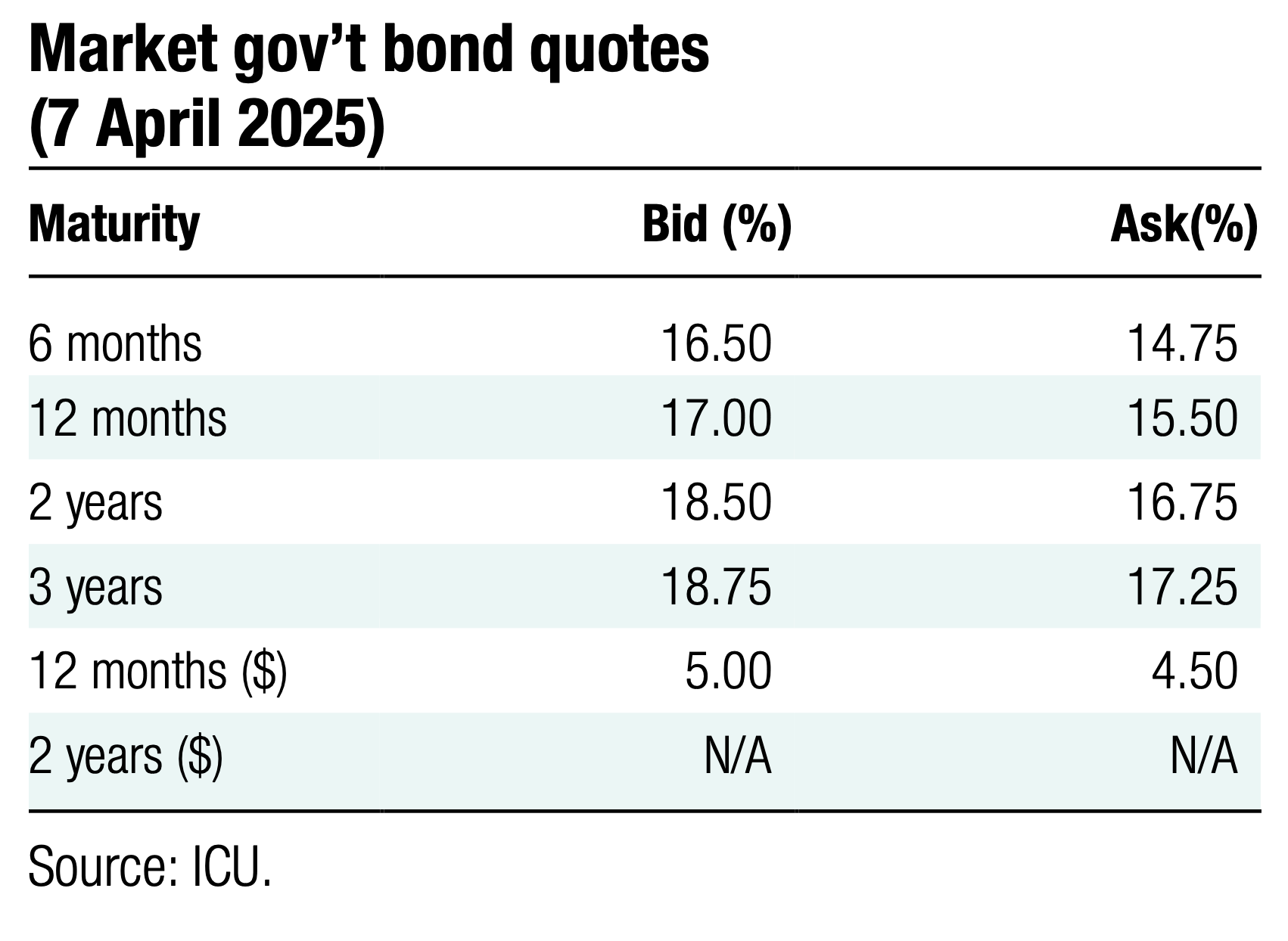

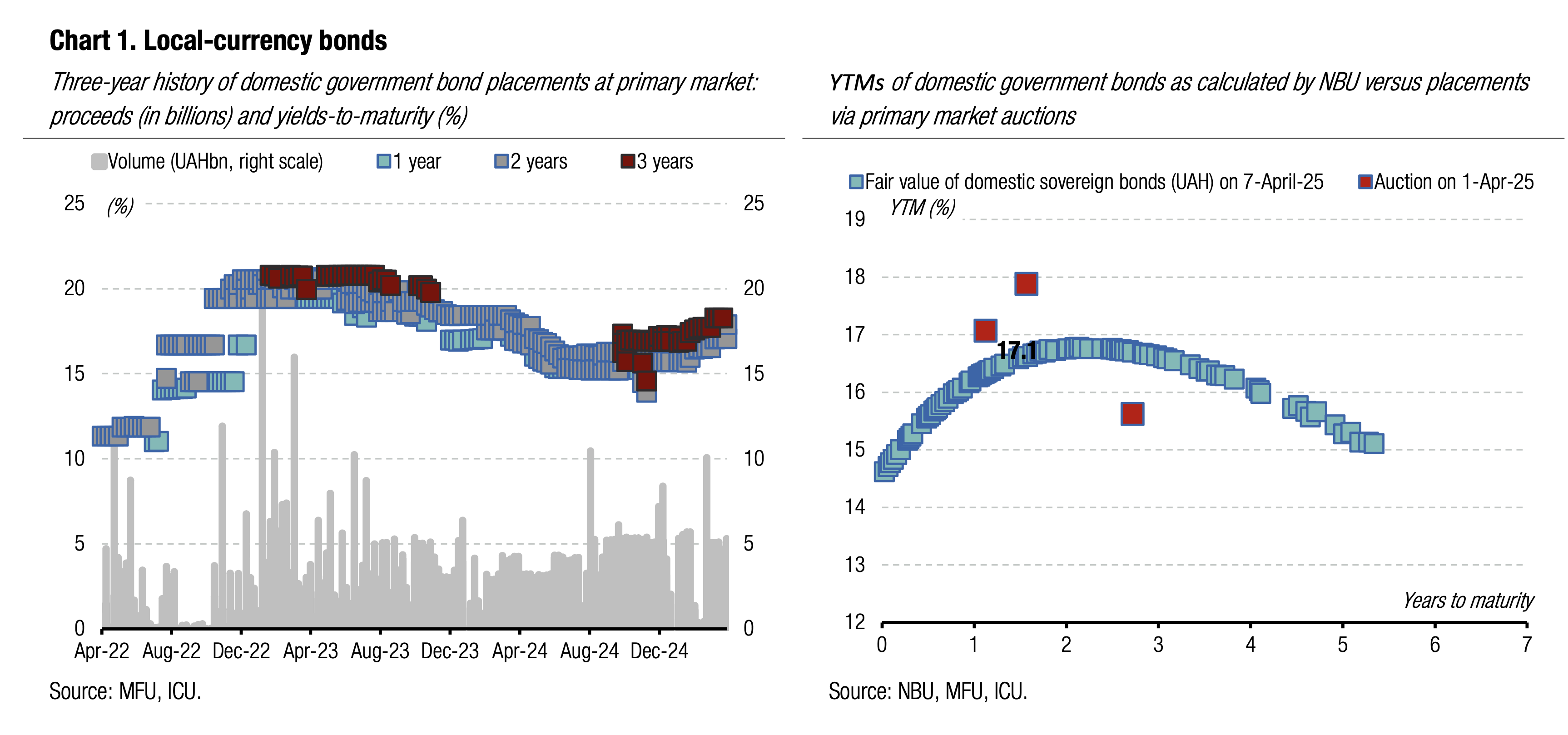

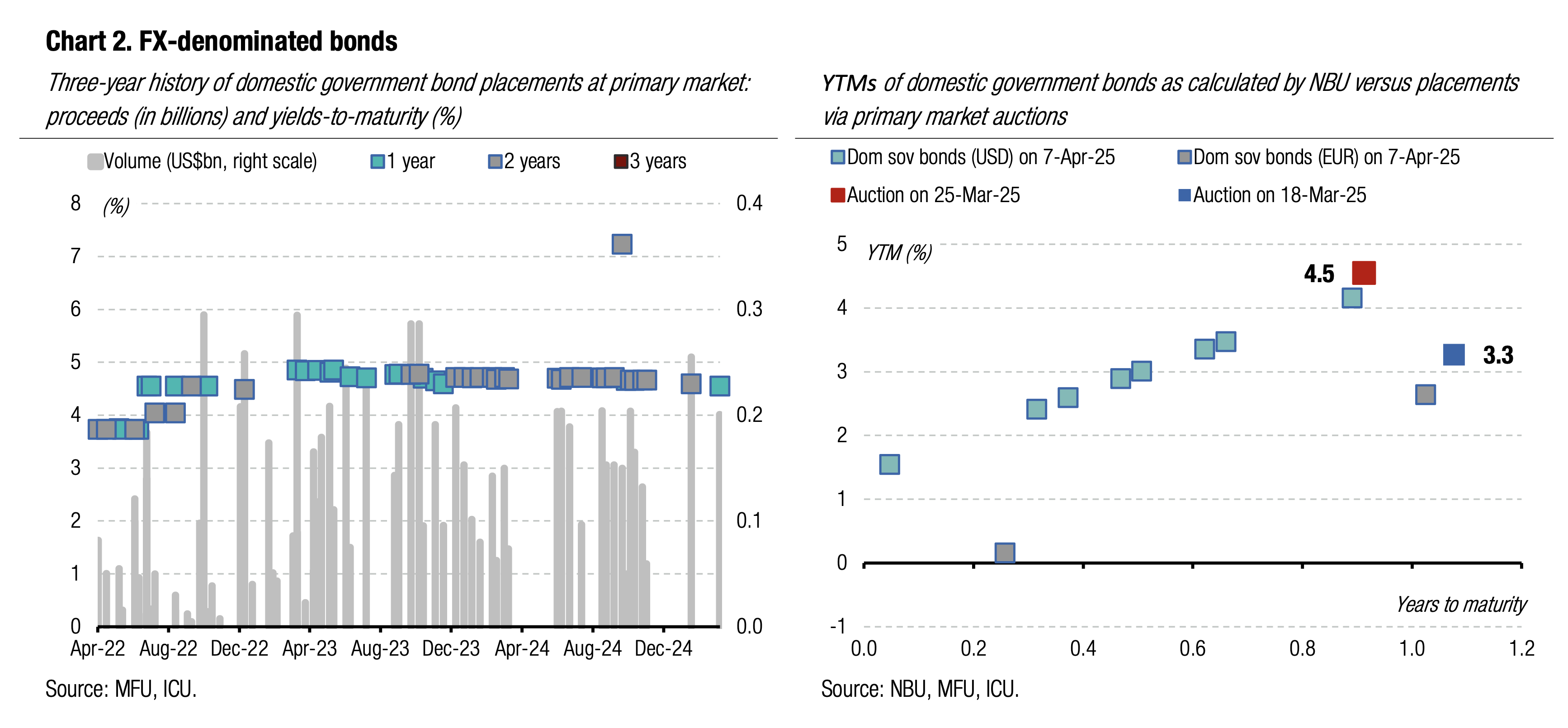

The Ministry of Finance modified the supply structure of UAH bonds last week, offering banks a new reserve bond and replacing a two-year military bill with a regular two-year paper.

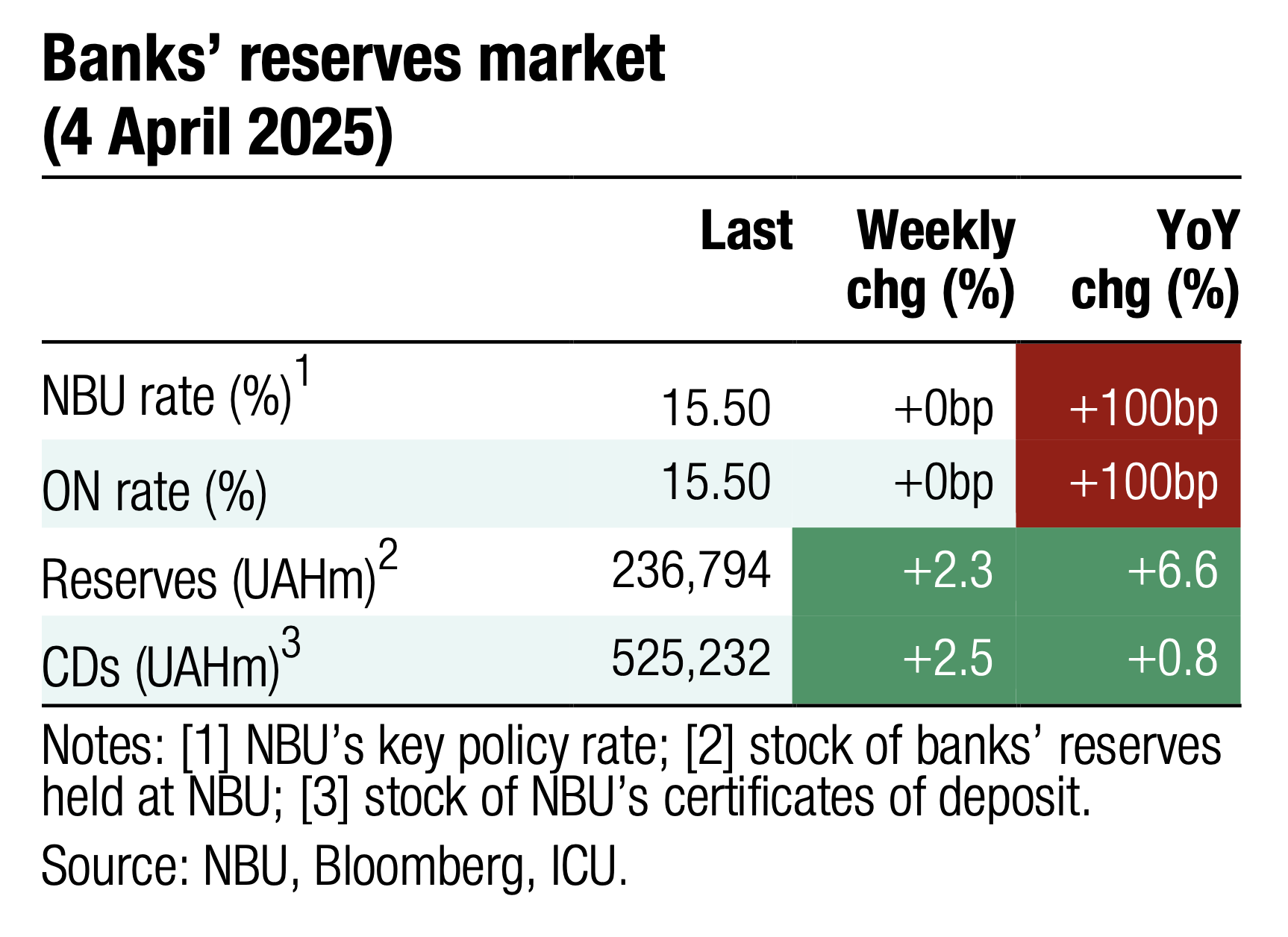

At the primary bond auction, the MoF offered three UAH bonds: a 15-month military bill that the MoF has been selling since January, a two-year regular bond that was offered only once in February, and a new three-year reserve note. Military and regular bonds received relatively small-sized bids, contributing only UAH2bn to the budget proceeds. At the same time, new reserve bonds expectedly saw a significant oversubscription. The volume of bids was 7x larger than the cap, and due to competition, the cut-off rate decreased to 15.5, while the weighted average rate slid to 15.01%. See details in the auction review.

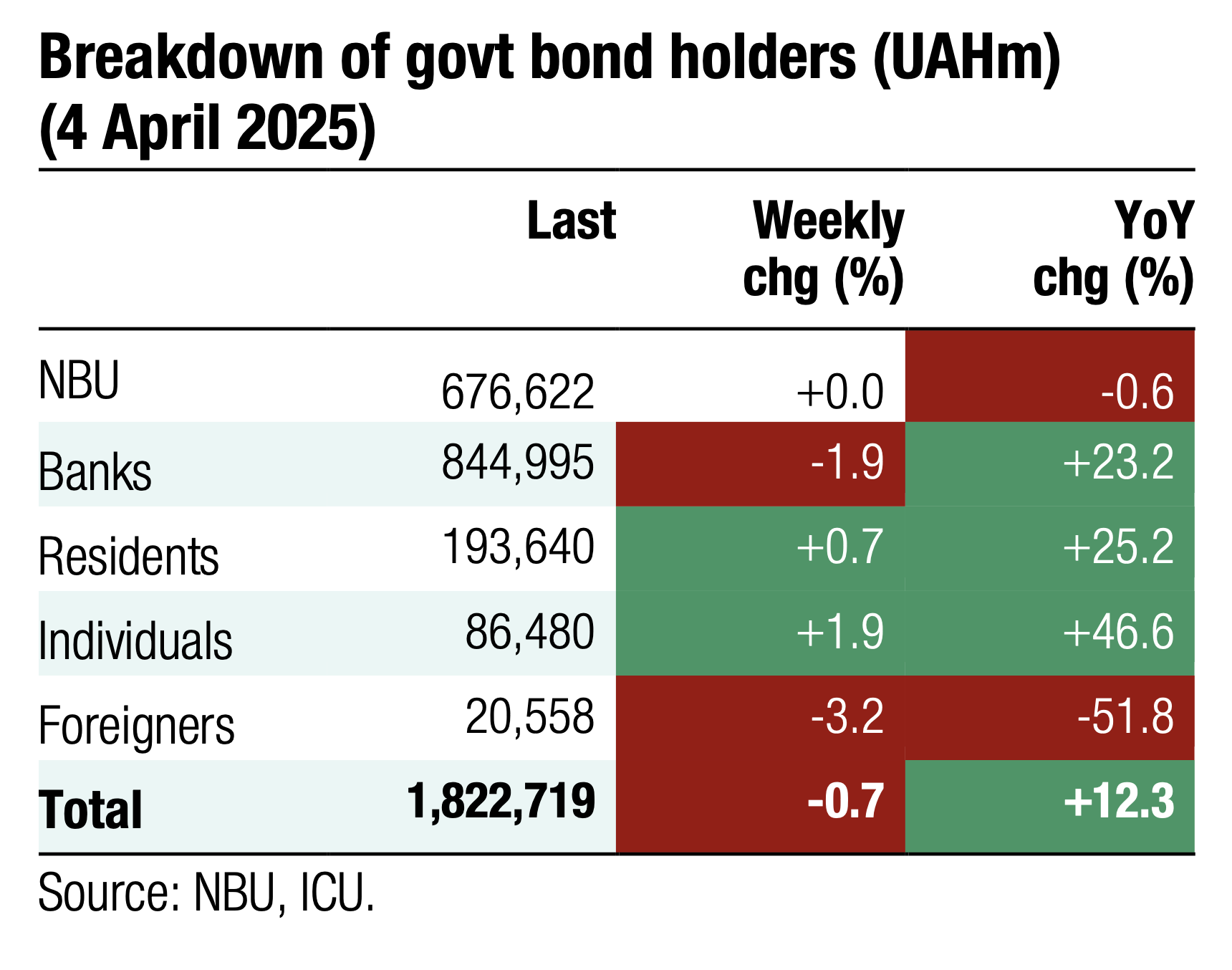

Last week, the MoF redeemed reserve bonds, so only banks' portfolios declined, while portfolios of retail investors grew by 3.2% to UAH88.1bn, a new record high. The next large redemption is scheduled for the end of the month and includes US$281m and UAH20bn.

ICU view: Last week, the MoF redeemed a reserve bond, which banks could use to partly meet the mandatory reserve requirements. Naturally, they immediately chanelled funds to purchase a new three-year note, which the NBU may also soon add to the list of reserve bonds. This paper will continue to enjoy significant oversubscription in the coming weeks, likely with a further decline in yields. At the same time, military and regular bonds will have limited demand with no changes in yields expected. Therefore, the rollover will remain below 100% in April, especially considering that a large repayment is scheduled at the end of the month, and the MoF will not have time to roll repayments in full.

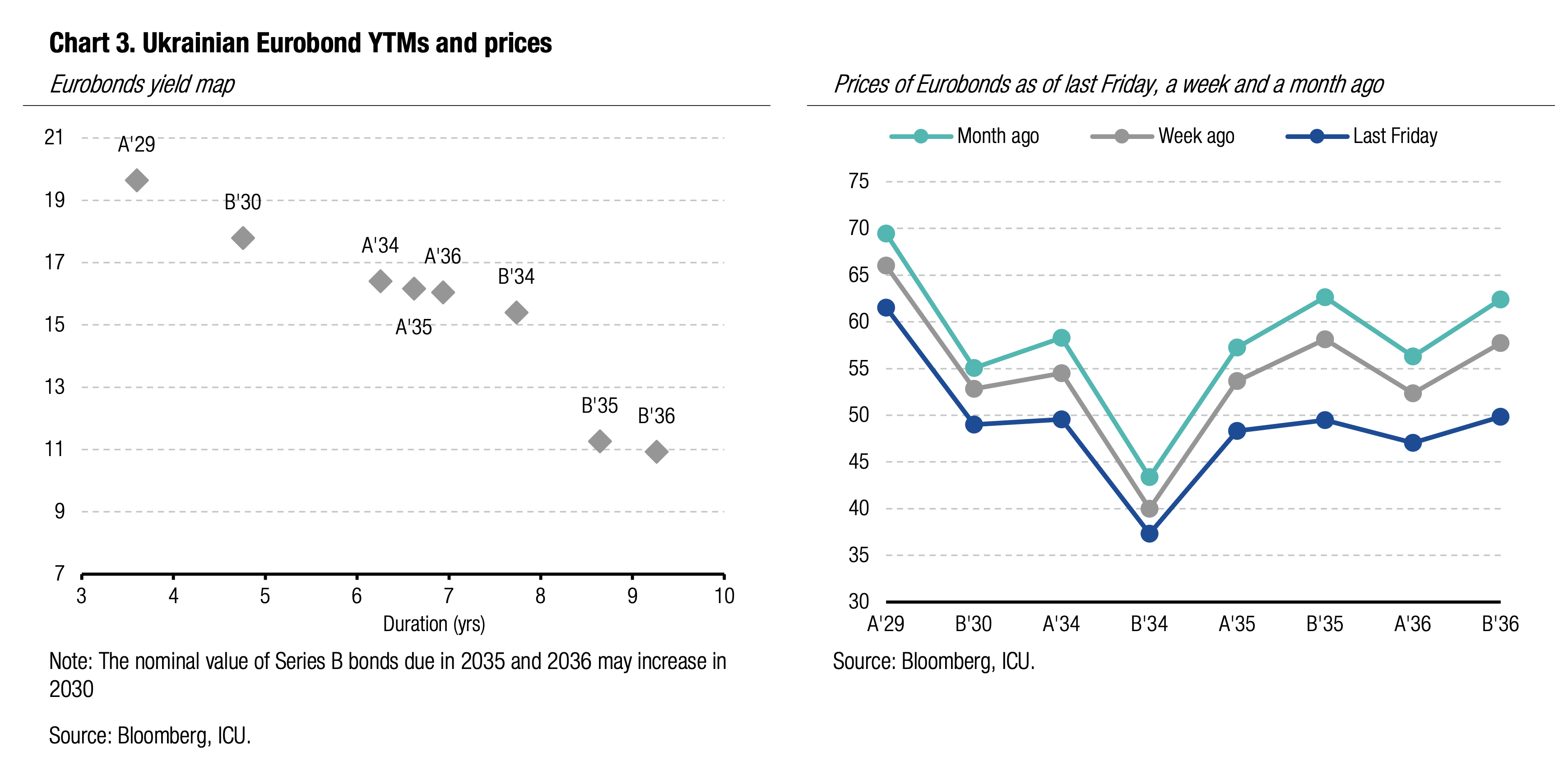

Bonds: Eurobond holders remain pessimistic

Prices of Ukrainian Eurobonds plunged again last week, nearly completely erasing gains made after the last year's US elections.

Last week, there was no noteworthy news about the ceasefire talks. The global investor community was first of all focused on the rollout of import tariffs by the US president and assessment of their potential impact on global economic growth and asset prices. Against this background, investor interest in developing countries fell sharply—the EMBI index slid by another 1% last week. In addition, last week, Ukrstat published Ukraine's GDP growth data for 2024, which turned out to be lower than expected, slashing the chances of a principle recovery for Series B Eurobonds in 2030. Therefore, bondholders had additional reasons for pessimism.

Against this background, the value of Ukrainian securities decreased by about 10% last week. Prices of Eurobonds maturing in 2035-36 lost 14-15%, and StepUp Bonds B maturing in 2034 are already cheaper than in early November before the US elections. The VRI's price fell by 10.5% to 67 cents per dollar of notional value.

ICU view: Eurobond holders' sentiment is deteriorating due to growing scepticism about the chances of ending the war quickly. The extremely poor reading of real GDP adds even more to negative expectations, as the likelihood of additional issuance of StepUp Series B bonds maturing in 2035-36 is diminishing rapidly. Ukraine’s real GDP is unlikely to reach the threshold in 2028 as specified in the Eurobond issuance conditions. VRI holders remain concerned about the lack of a finalized restructuring proposal despite approaching deadlines. Although almost all Eurobonds are still above levels seen before the US elections, Eurobonds may shortly lose the remaining post-elections gains made on expectations the new US president would be able to end the war soon.

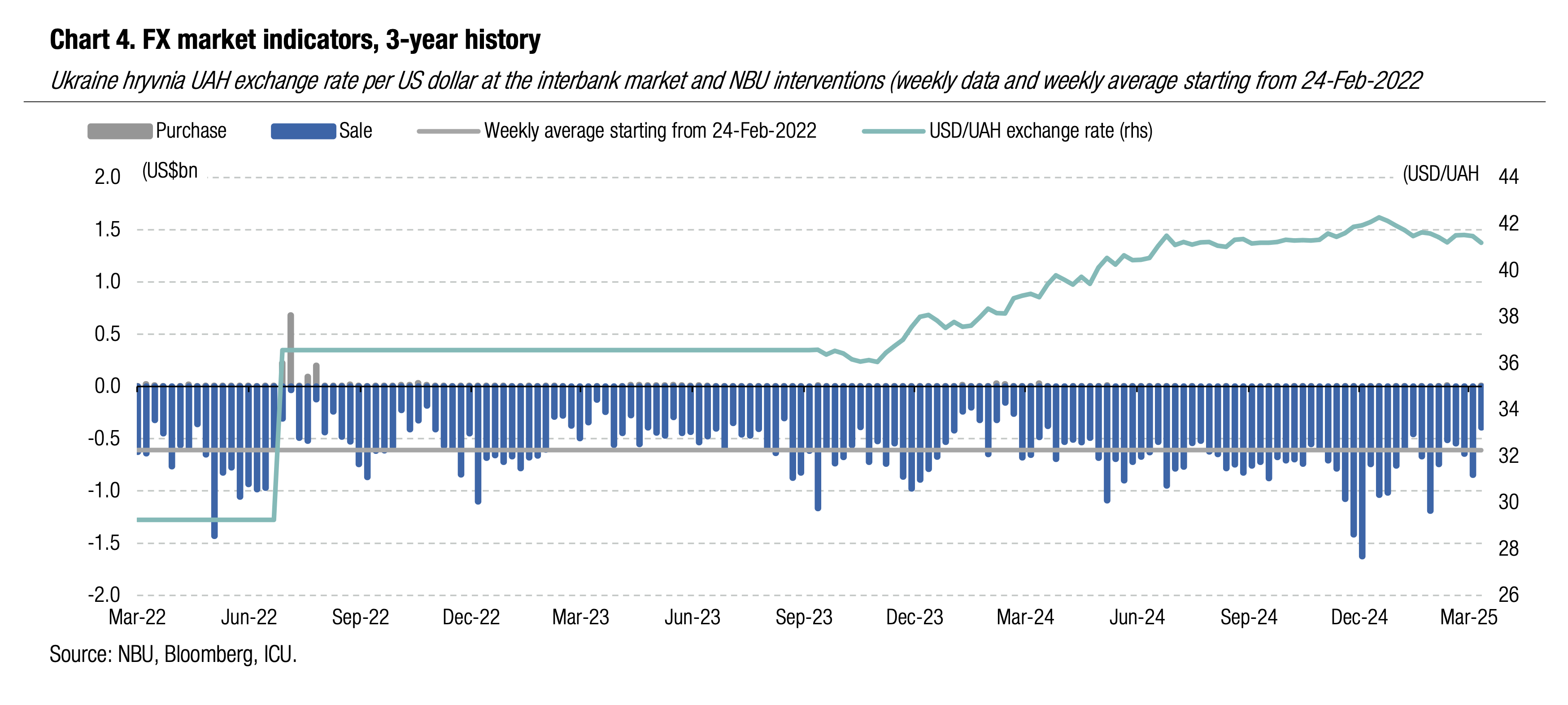

FX: NBU strengthens hryvnia to new record

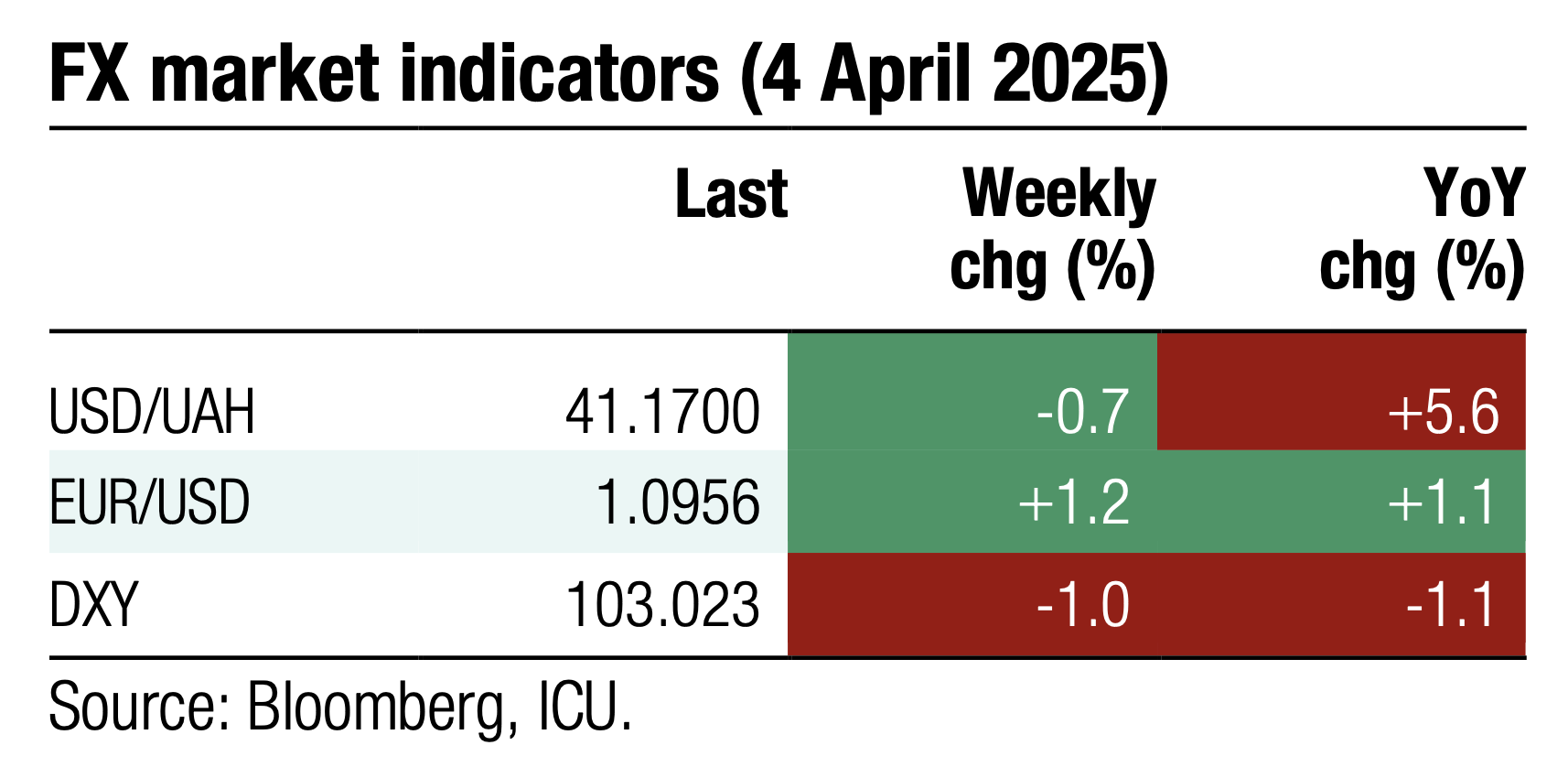

The NBU set the official hryvnia exchange rate at this year's high while reducing interventions to the lowest level YTD.

Last week, the hard currency deficit in the interbank FX market decreased significantly due to a 6% pick up in foreign currency sales and a 18% reduction in purchases. Net FX purchases in the interbank market decreased by 65% to US$169m. In the retail segment, net purchases of foreign currency were up by 64% to US$124m. All in, the total shortage halved to US$293m, the lowest level since May last year.

Under these conditions, the NBU halved interventions to US$392m, the smallest size since last April. The National Bank strengthened the hryvnia against the US dollar to UAH41.19/US$, an almost six-month high. Still, a significant weakening of the US dollar against other currencies implied the NBU had to weaken the official hryvnia exchange rate against the euro to UAH45.55-45.85/EUR, which is a historic maximum.

ICU view: The reduction in interventions and the strengthening of the hryvnia against the US dollar may result from a situational coincidence of favourable factors and should not be interpreted as a new normal. The NBU remains reluctant to weaken hryvnia gradually, while apparently trying to demonstrate it is capable of maintaining long-term exchange rate stability. The increase in planned volumes of international financial assistance in 2025 may imply that the NBU will keep the hryvnia strong for longer time than we previously expected.

Economics: Ukraine GDP slows dramatically

Ukraine’s real GDP grew 2.9% YoY in 2024, below our and market expectations. The 4Q data was particularly disappointing as the economy contracted 0.1% YoY.

Real GDP in 2024 stood at 77.4% of the level of 2021, the last year before russia’s full-scale invasion of Ukraine. Nominal GDP is estimated at UAH7,659bn (+16% YoY). In FX terms, GDP amounted US$191bn (+5% YoY) based on the 2024 official average exchange rate.

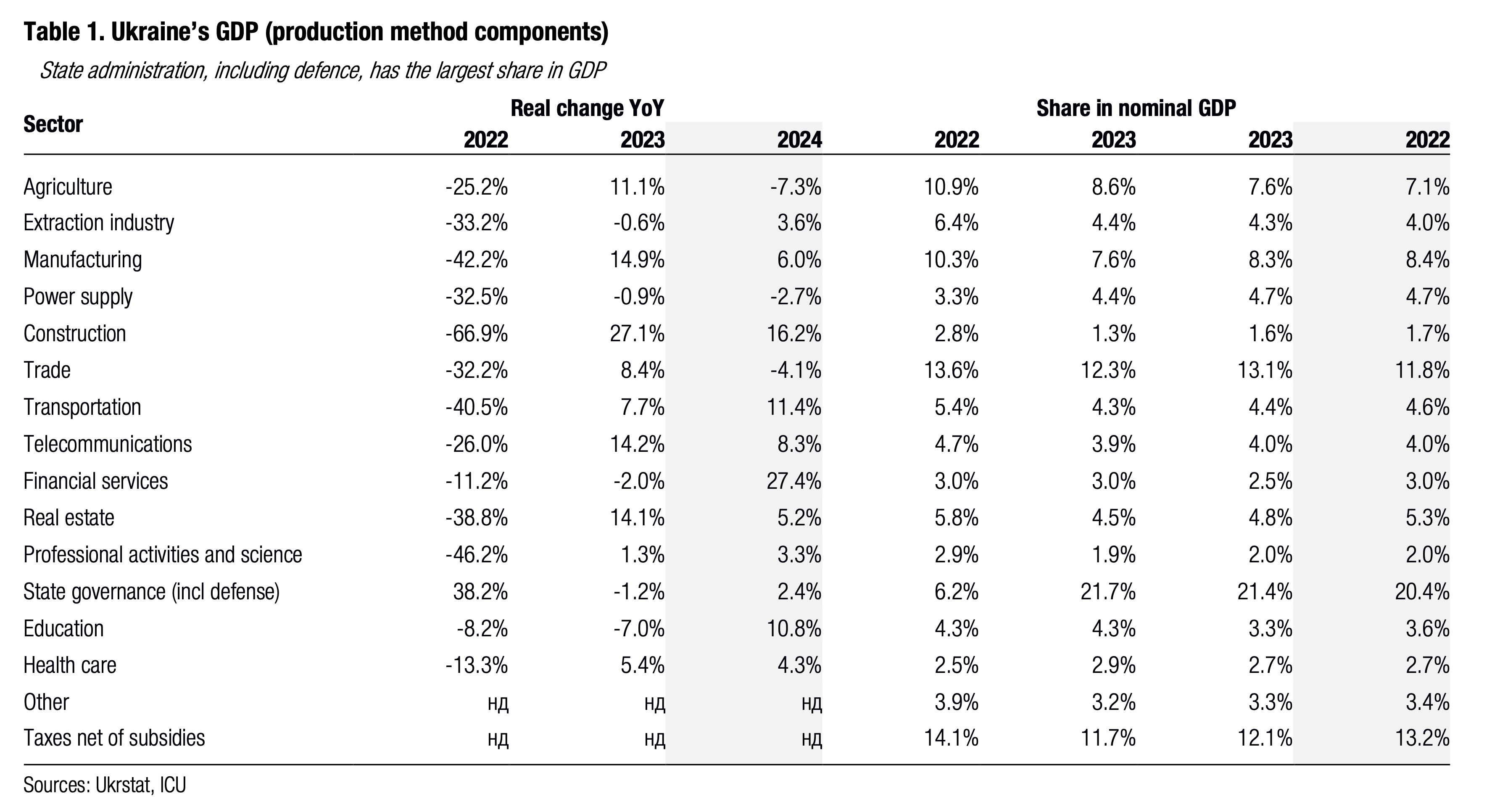

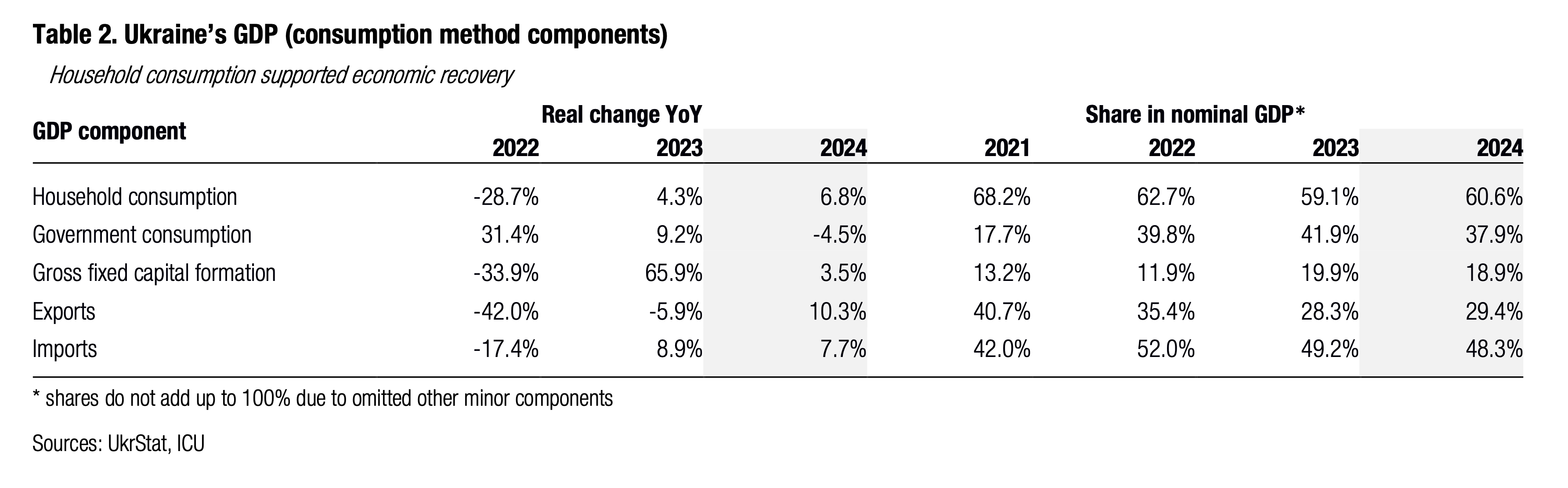

The only significant positive contributor to last year’s economic growth was households’ private consumption that increased 6.8% YoY (even though it slowed to 4.2% YoY in 4Q) supported by increases in salaries in the private sector. Gross fixed capital formation also had a positive but far less significant contribution. Meanwhile, government consumption and net exports weighed on economic growth and their contribution to real GDP was negative. On the production side, the agricultural sector was the largest drag on the economy as it contracted 7.3%. Surprisingly, trade was also down in real terms despite significant increase in private consumption. Power supply is another sector that reduced output because of destruction of power generating and transmission capacity due to russia’s missile and drone attacks. All other sectors increased output last year.

The 2024 data show that Ukraine’s war economy remains reliant on the government sector whose share in the consumption structure stood at 38%, far above 18% in 2021. On the production side, state governance, including defense, contributed about 20% to GDP, up from 6% in 2021.

ICU view: Economic growth in 2024 was severely hurt by a sharp reduction in agricultural production (with a related hit on the food industry) and ongoing fiscal consolidation as the state budget deficit (excluding budgetary grants) narrowed to 24% from 27% a year before. While agriculture should recover sharply this year (assuming no repeated weather shocks) the reduction in government expenditures relative to GDP will continue to have an adverse effect on economic growth. At this point, we believe our 2025 GDP growth forecast of 3.4% YoY may be somewhat optimistic, and we downgrade it to 3.0%. We don’t expect any significant acceleration of GDP growth next year providing no major improvement in the safety situation takes place. All in all, the chances of the principle increase condition being met for Series B bonds in 2028 are becoming nominal.