|  |  |

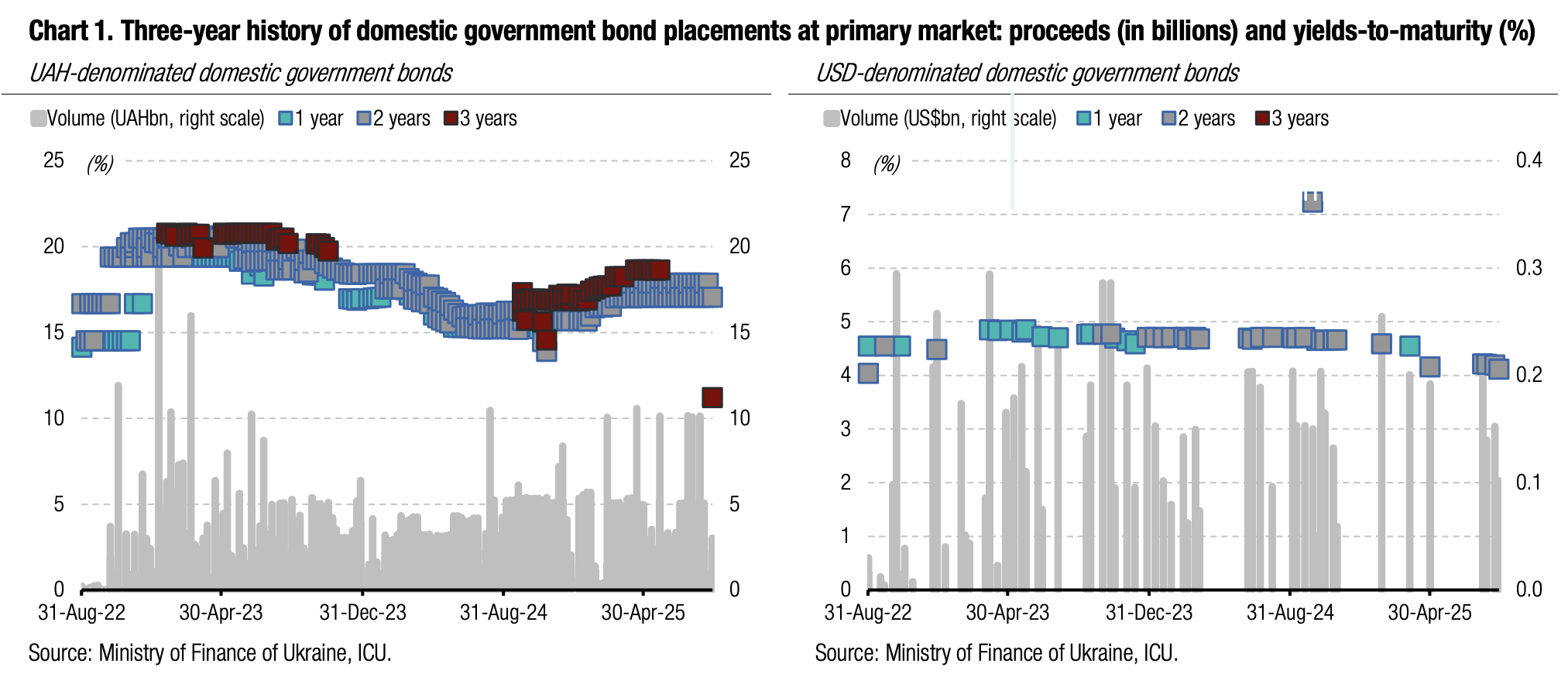

Interest in hryvnia-denominated bonds has increased again, their proceeds outweighing those from FX-denominated bonds.

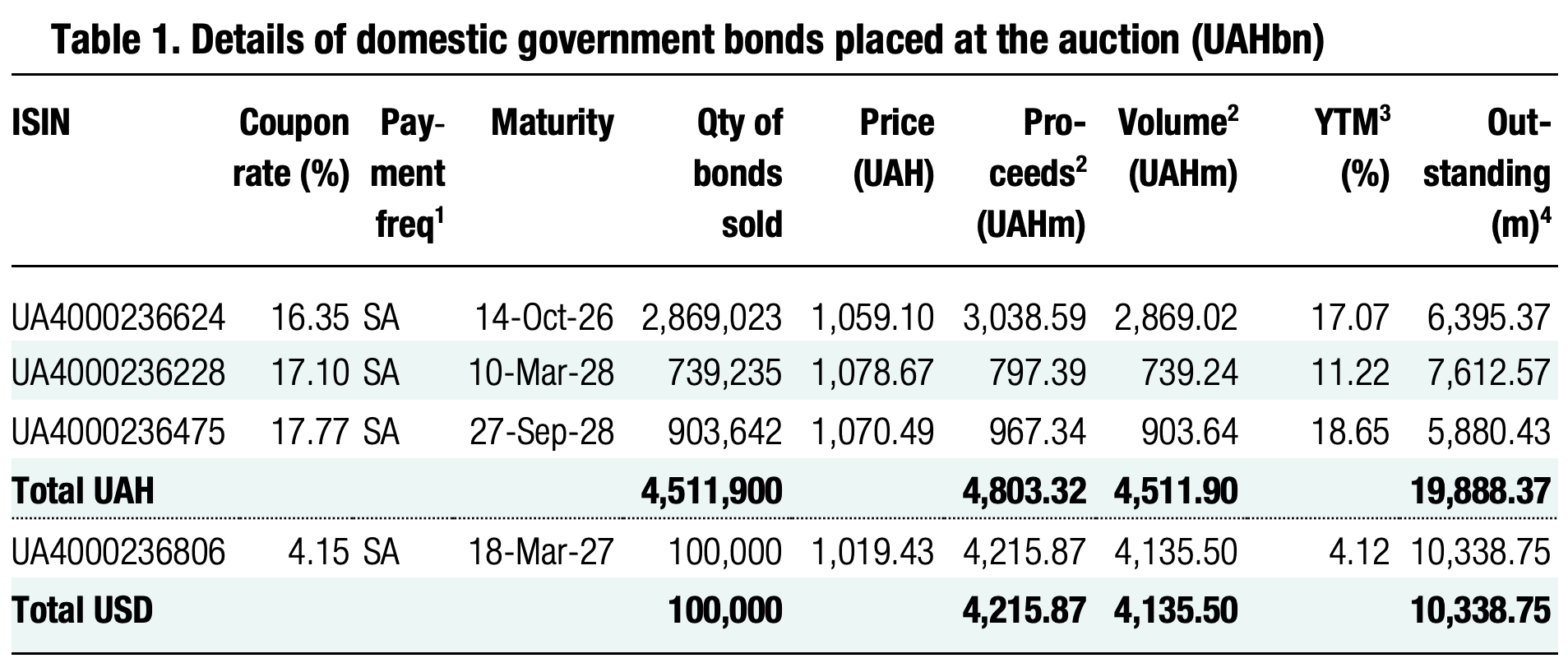

Most of the UAH proceeds came from military government bills, which totalled almost UAH2.9bn, which brought most of the local-currency funds for the budget. In addition, almost UAH1.8bn came from the 1.5 and 3-year hryvnia securities. So, the MoF raised UAH4.8bn from hryvnia instruments.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.36/USD, 48.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

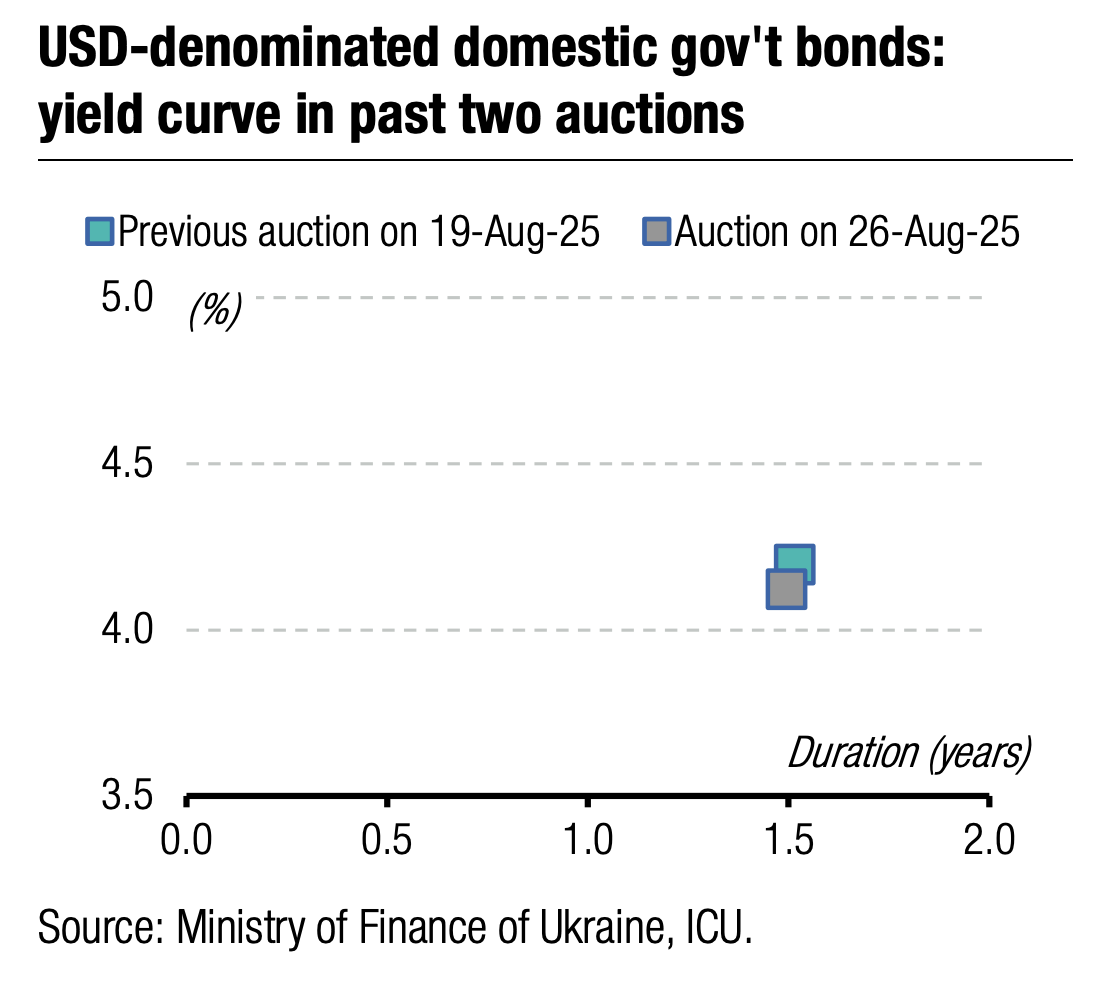

The budget received less from FX-denominated instruments. Nineteen-month USD-denominated securities collected almost US$390m in demand, but the cap was only US$100m. So, the MoF satisfied 65 out of 69 applications, but a significant number only partially.

In total, the budget received over UAH9bn, which is generally a good result, especially in conditions when UAH instruments compete with FX-denominated instruments. The advantage of UAH borrowing is primarily due to the small supply of foreign exchange instruments.

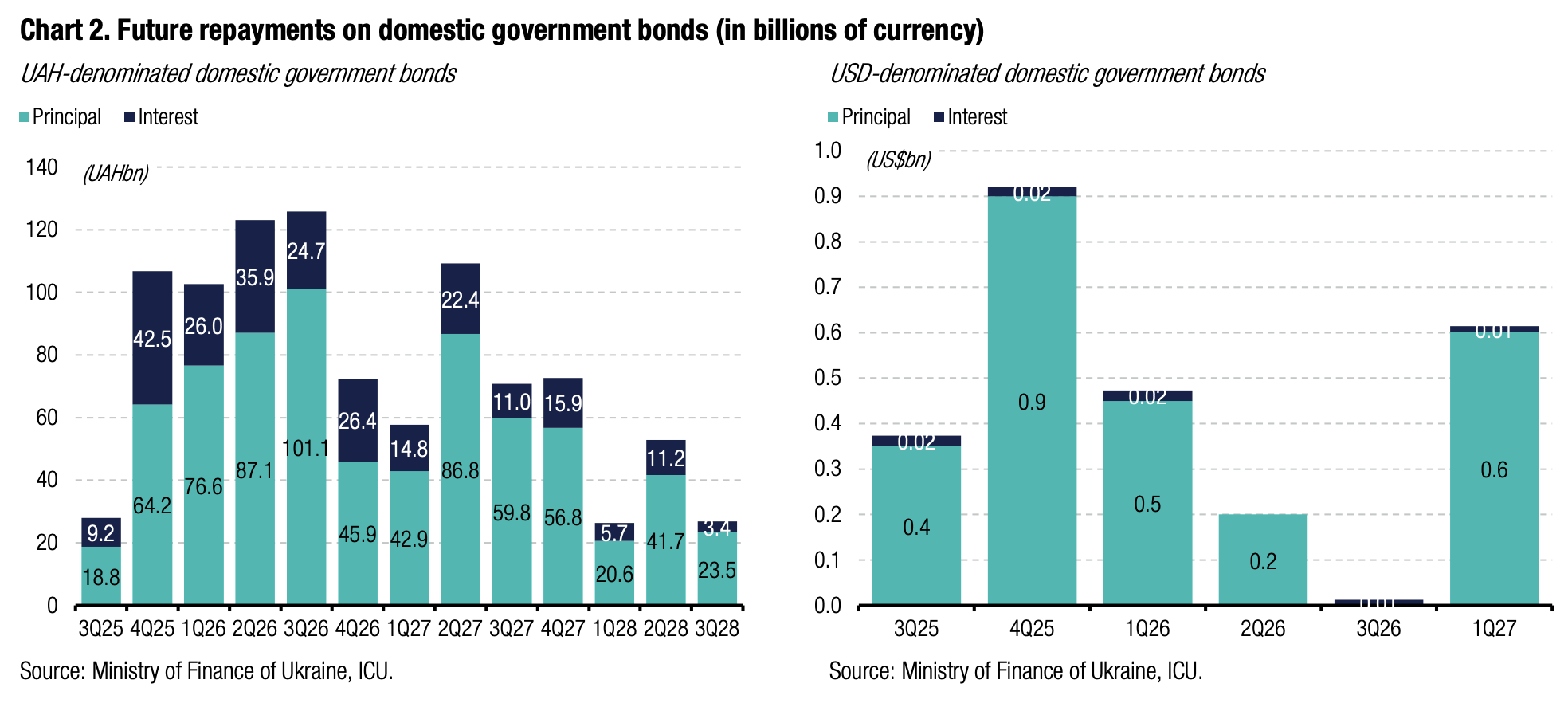

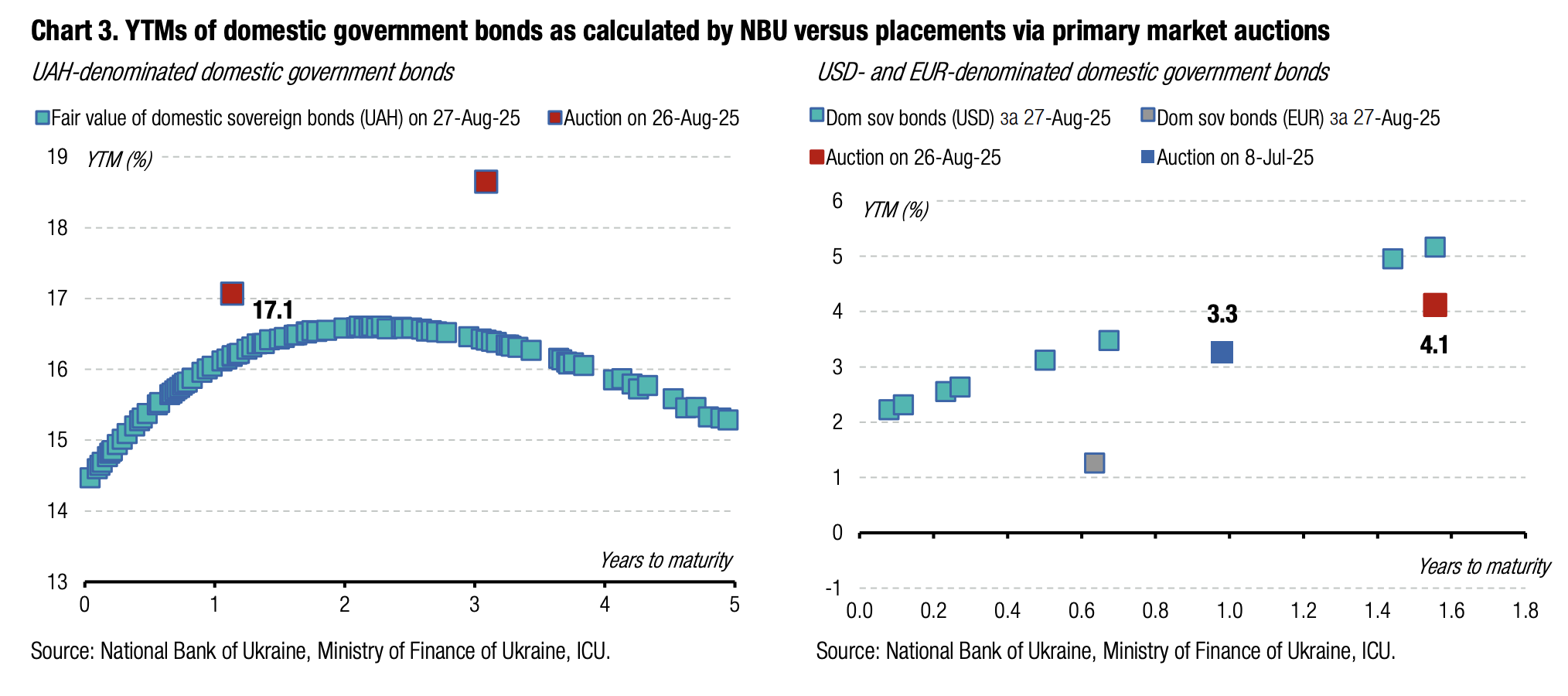

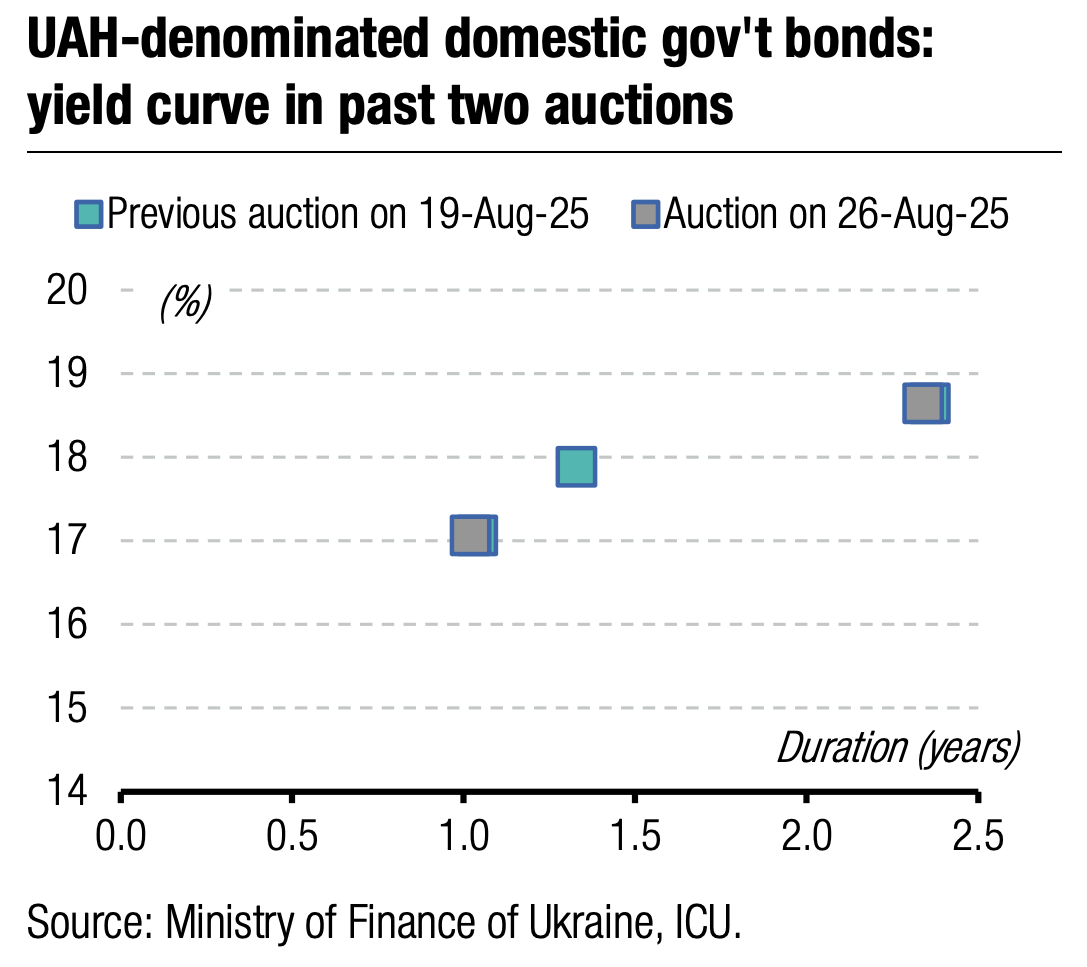

Appendix: Yields-to-maturity, repayments