|  |  |

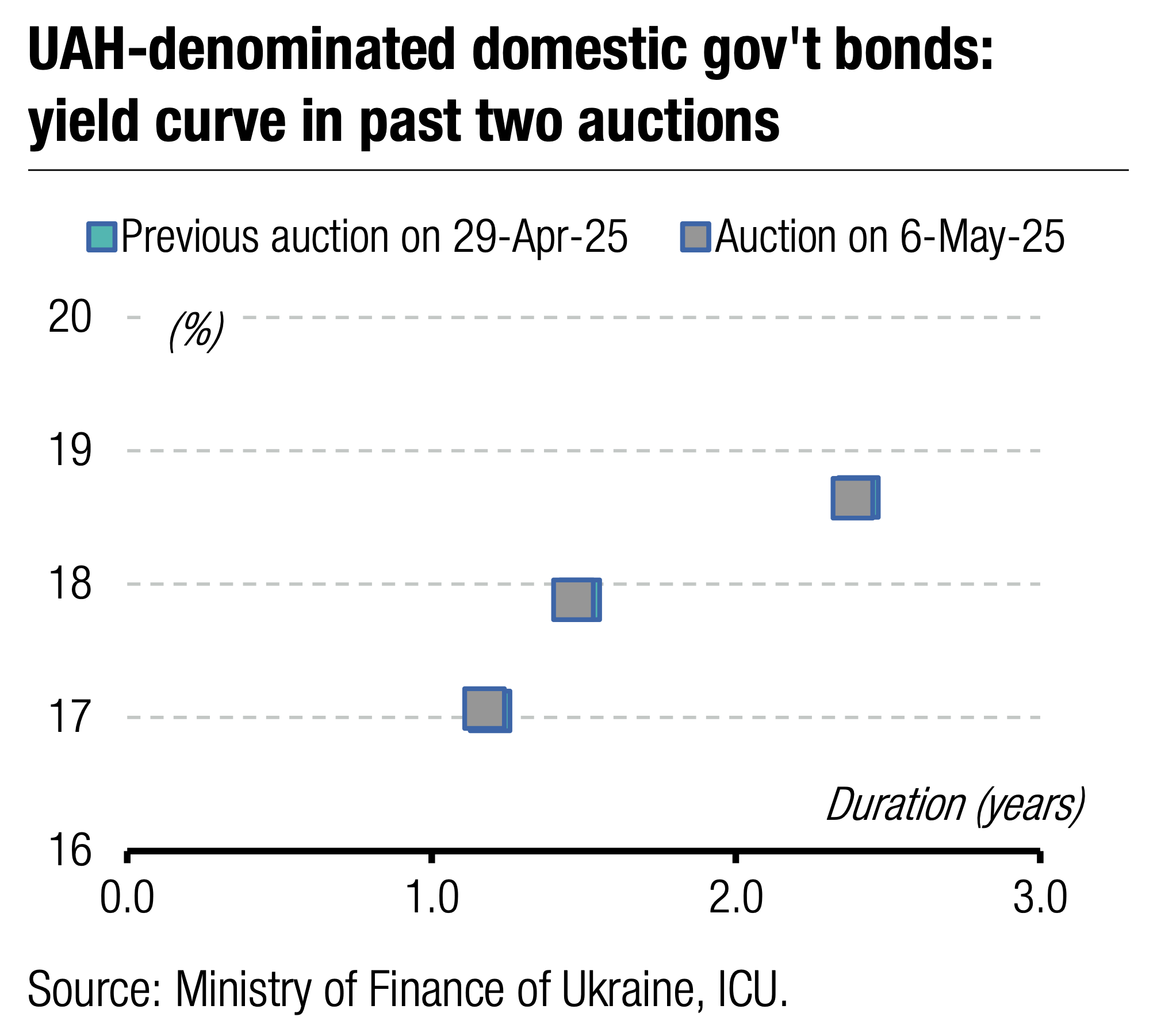

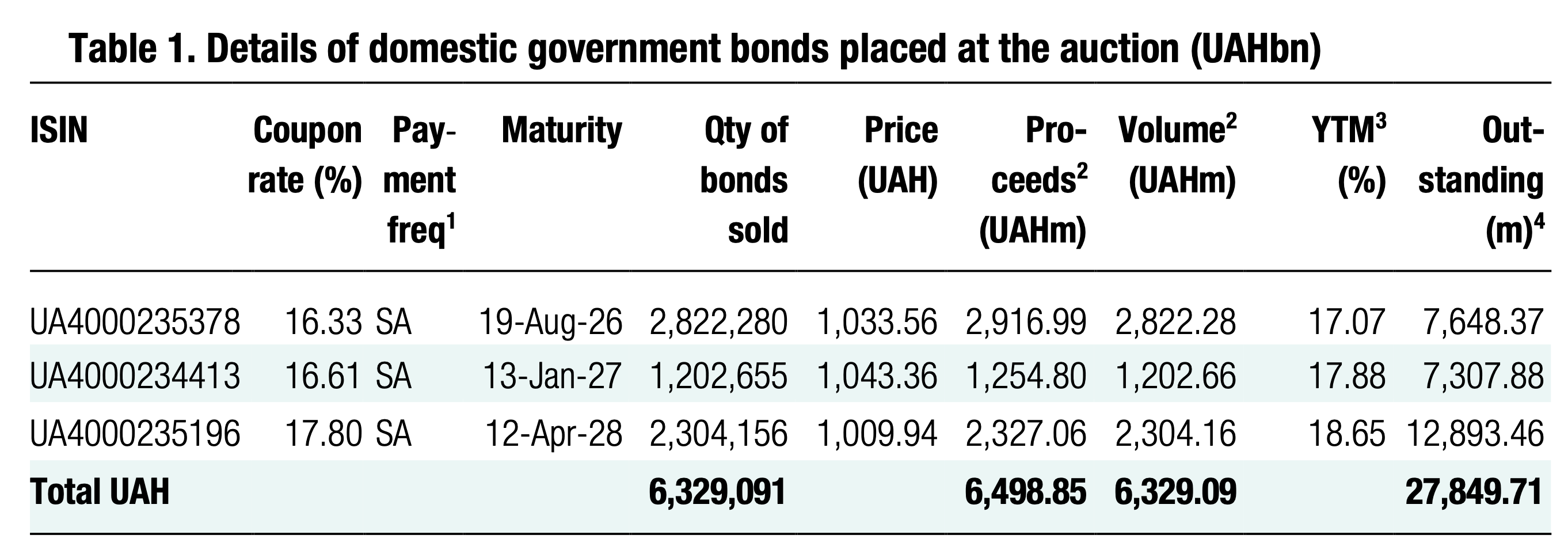

The MoF’s first auction in May started on a positive note. No one paper was oversubscribed, but the MoF borrowed UAH6.5bn without changes in interest rates.

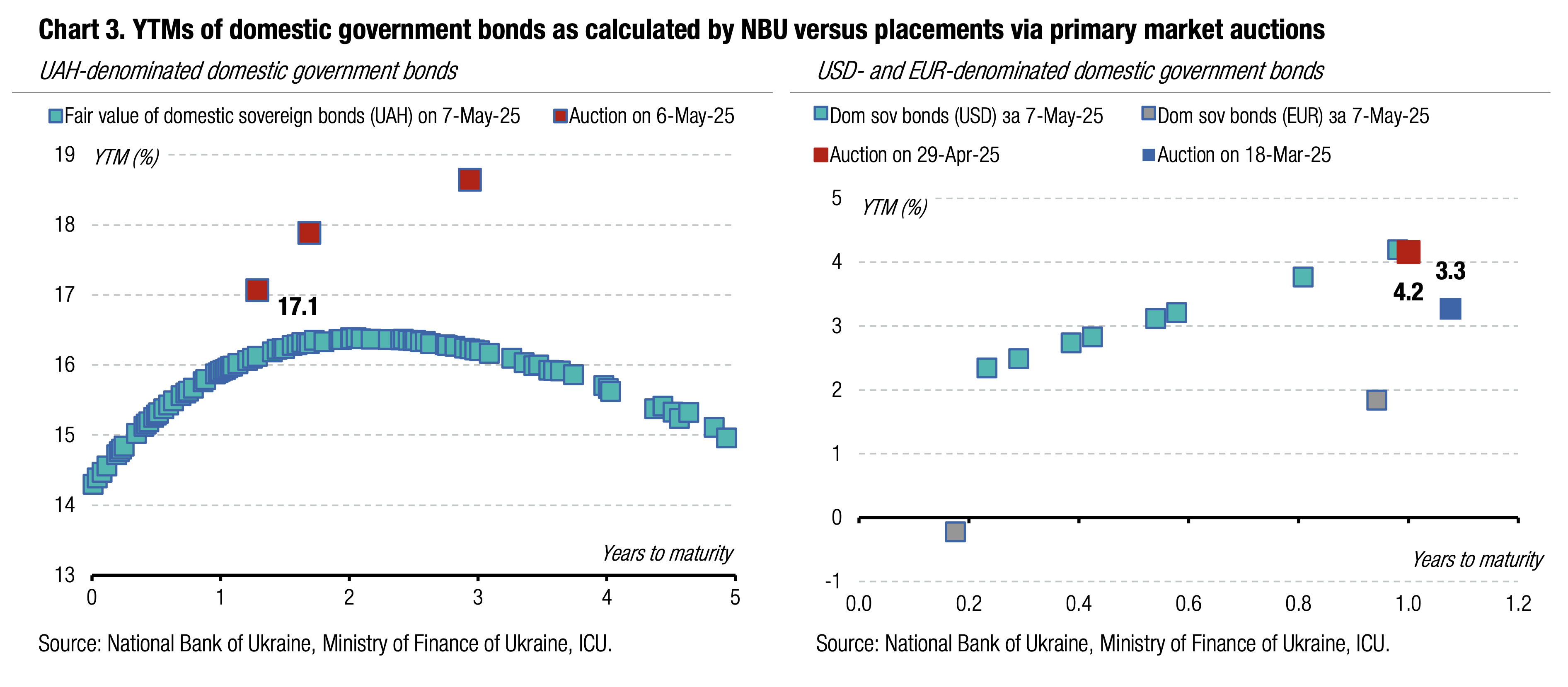

All bids had the same interest rates as in previous weeks. In a few weeks during April, the MoF rejected some demand that requested an increase in interest rates, but later in April and yesterday, all bids were within the same range without attempts to get higher yield.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 45.32/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Therefore, the cut-off and weighted average rates remain the same for the third week: 16.35% for 16-month military bills, 17.1% for 1.7-year regular paper, and 17.8% for the three-year regular note.

The MoF's UAH6.5bn proceeds are new funds, as there are no redemptions rollover needs today.

Appendix