|  |

|  |

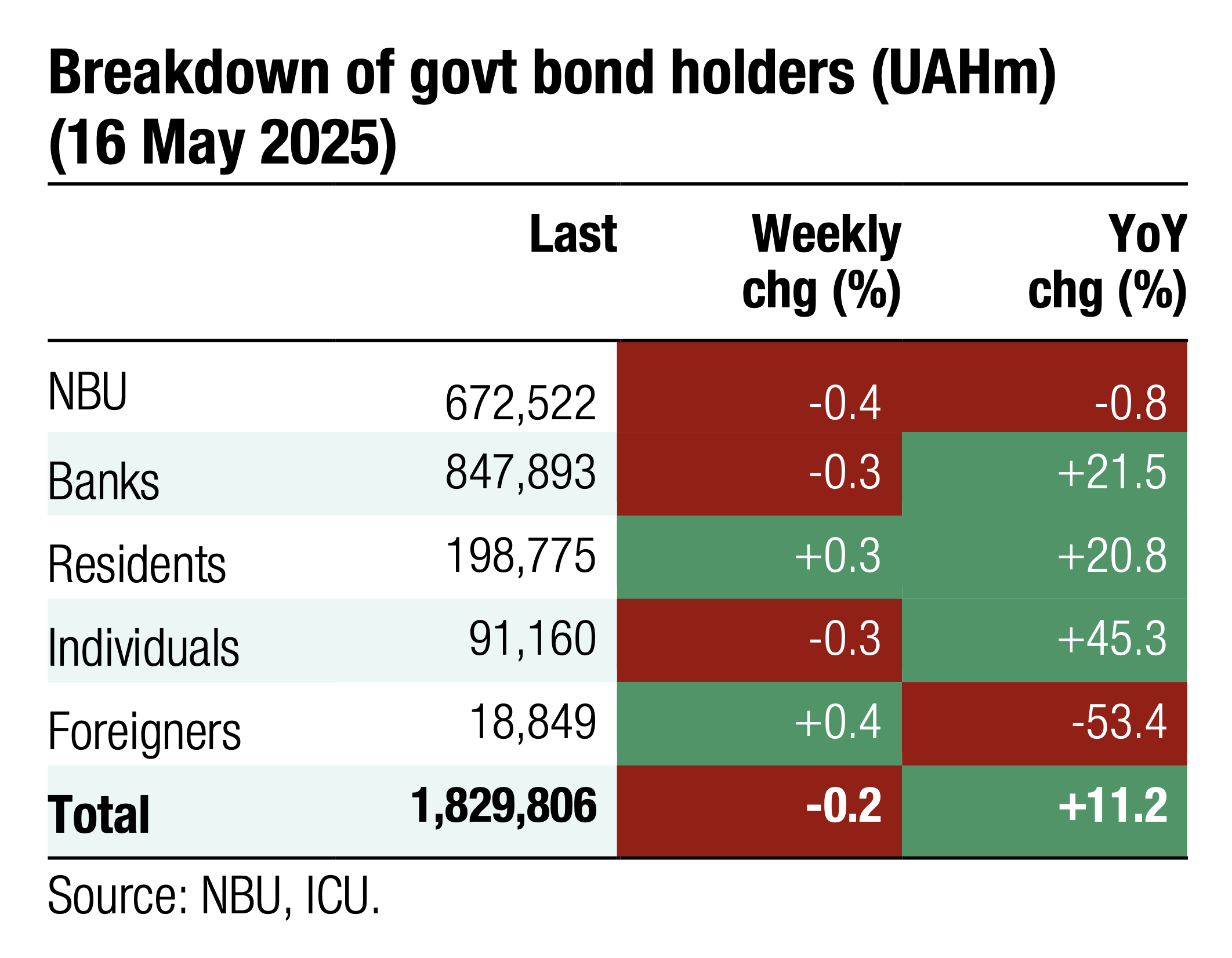

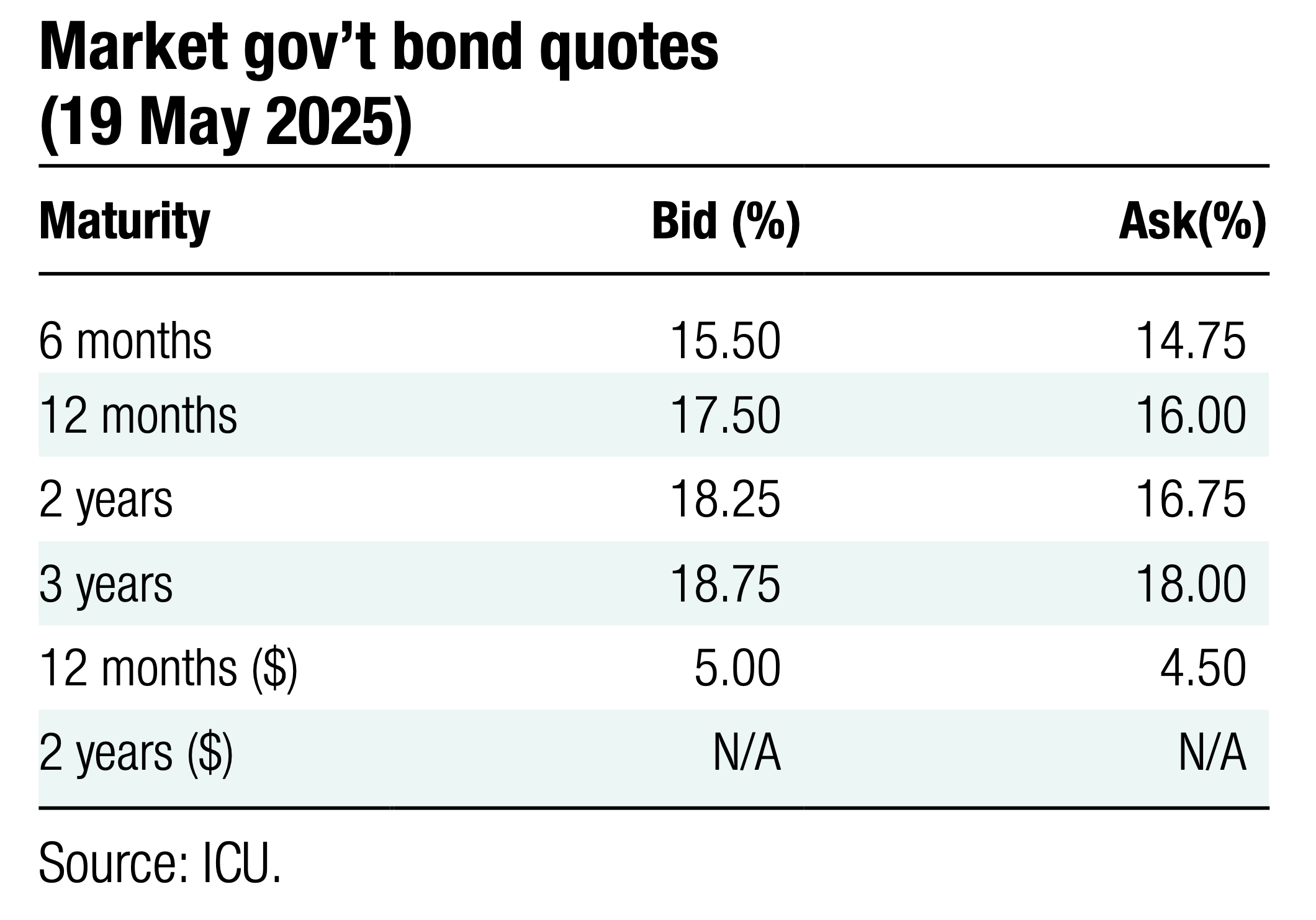

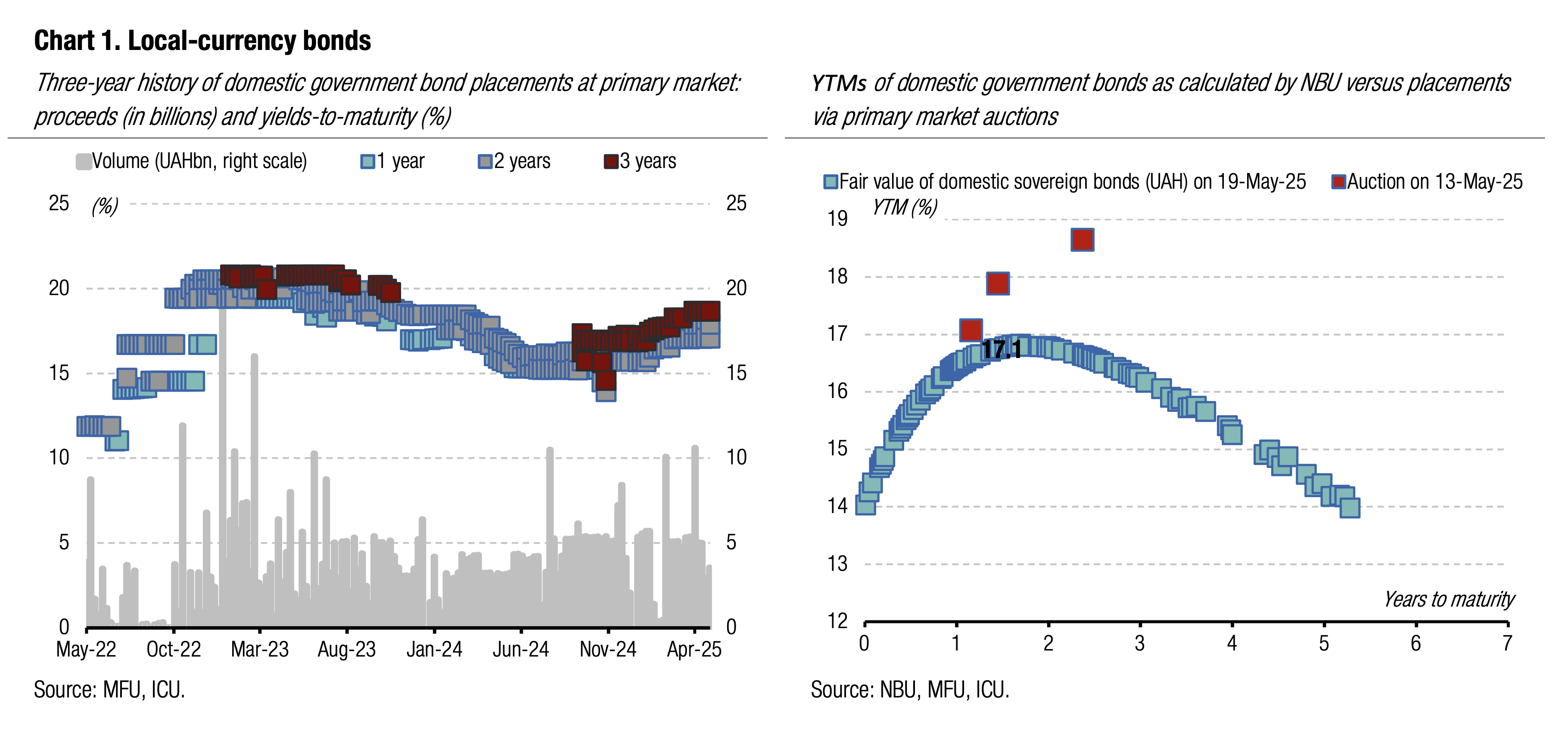

Bonds: UAH bond trading becoming more fragmented by maturity

Last week, demand for UAH bonds concentrated mostly in short-term bills with maturity of up to one year and also three-year notes.

At the primary auction, the MoF offered a 15-month military bill and a 20-month and a three-year regular bond. Investors were the most interested in bills due next year and in 2028, while the paper due in January 2027 collected just six bids for UAH90m – less than 1/10 of the average weekly demand in April and early May. The MoF accepted all bids without changes in interest rates. See details in the auction review.

In the secondary bond market, the trading pattern was very similar. The most traded were bills due in June 2026 (26% of total UAH bonds trading), this September (18%), and April 2028 (16%). At the same time, the share of all UAH bonds maturing in 2027 was just 8%.

ICU view: Investors' focus now is predominantly on short-term bills as well as on the longest available maturity. Demand for bills with maturities of up to one year likely comes from non-bank legal entities and individuals. At the same time, another large share of demand is concentrated in three-year paper. Buyers are locking in current yields that are likely at their peak during the current monetary policy tightening cycle. Therefore, we see a decline in demand for 20-month paper at primary auctions and in the secondary bond market, while short-term bills and three-year notes gained more interest.

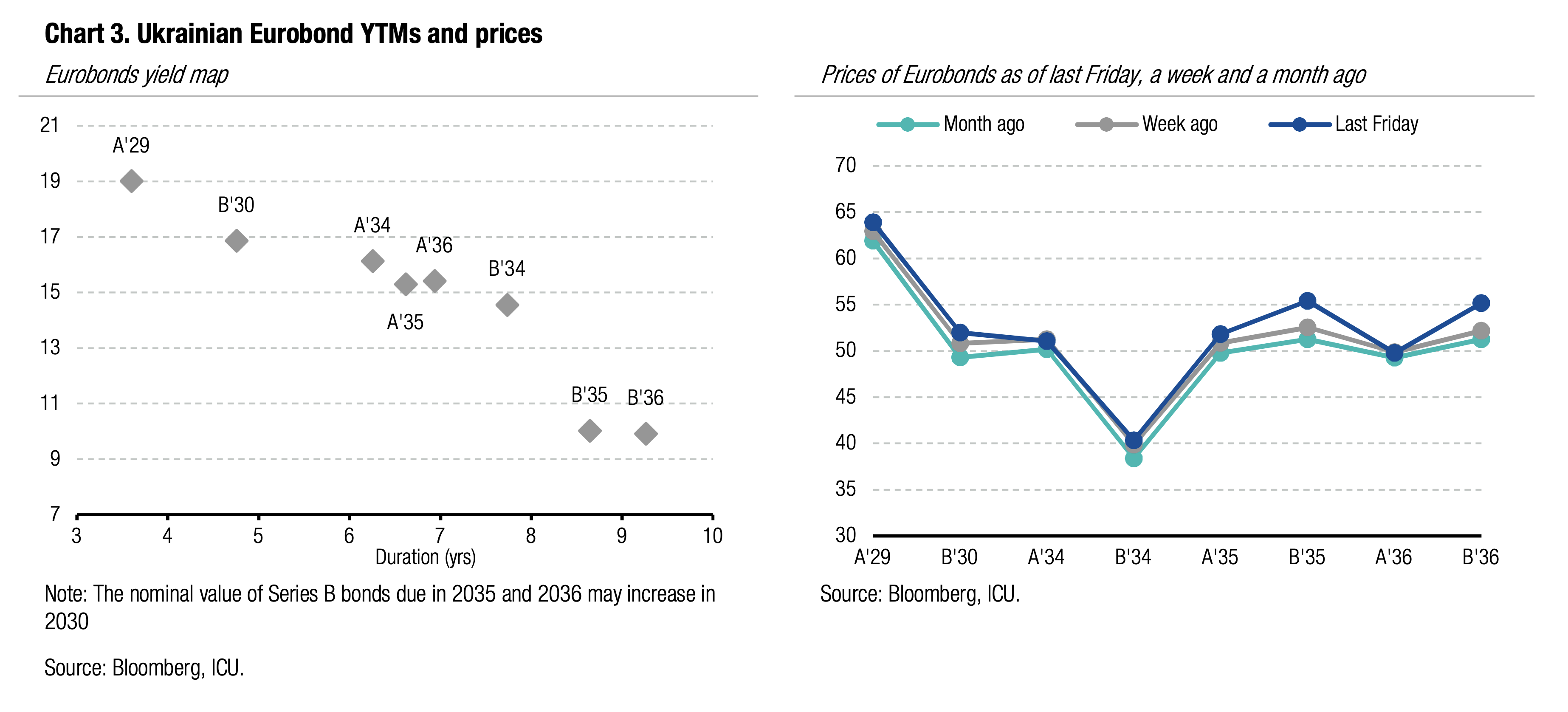

Bonds: Ukraine-russia talks end with no breakthrough

The first negotiation between Ukraine and Russia in more than three years was held last Friday in Istanbul. They did not bring any material results except for an agreement to exchange prisoners.

As Ukraine agreed to the russian proposal to meet in Istanbul, investors hoped they may yield some tangible, even if small benefits. Before the talks, the presidents of Ukraine and France, the Prime Ministers of the United Kingdom and Poland, and the new Chancellor of Germany agreed that the ultimate outcome should be an unconditional and a full-fledged ceasefire. However, the announced composition of the russian delegation was technical rather than political, and they came up with completely unrealistic demands so as to make the talks fully non-productive. The only significant result of the negotiations was the declared intention to swap of a thousand prisoners.

Fluctuations of Eurobond prices were within a few cents last week despite the intense exchange of messages between all the parties involved. Eventually, Eurobond prices rose by 2.2% last week, while VRIs rose by 2.8%. The EMBI index rose by 0.8%.

ICU view: The meeting clearly showed russia does not see any advantages of having constructive negotiations. Its position is unlikely to change until there is a clear and credible threat of new painful sanctions from the Western countries. The largest European countries seem prepared for a new wave of sanctions, but they would not be powerful if not coordinated with the United States. Today's conversation between the US President and the presidents of russia and Ukraine should add more clarity to the possible further development of events.

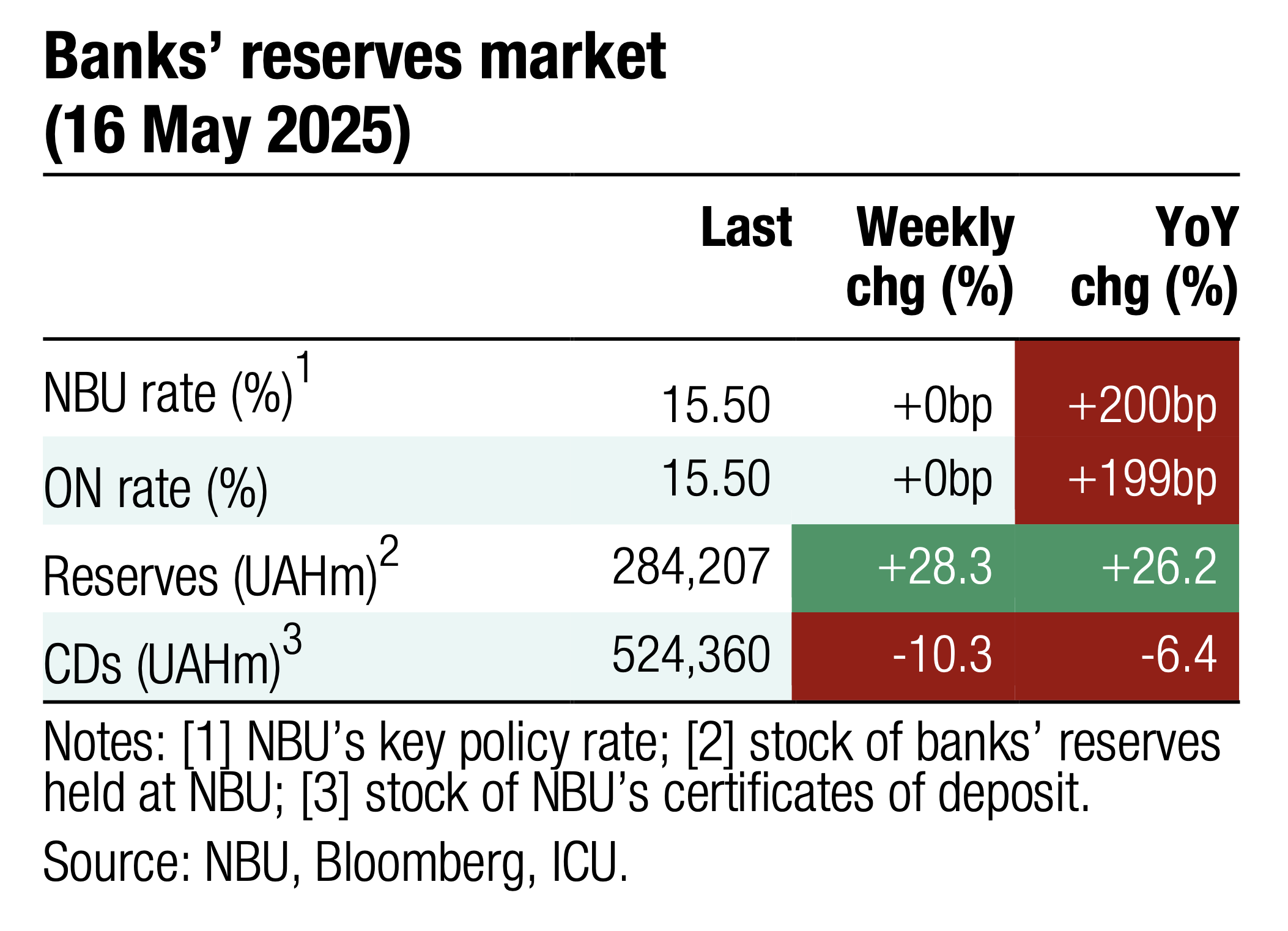

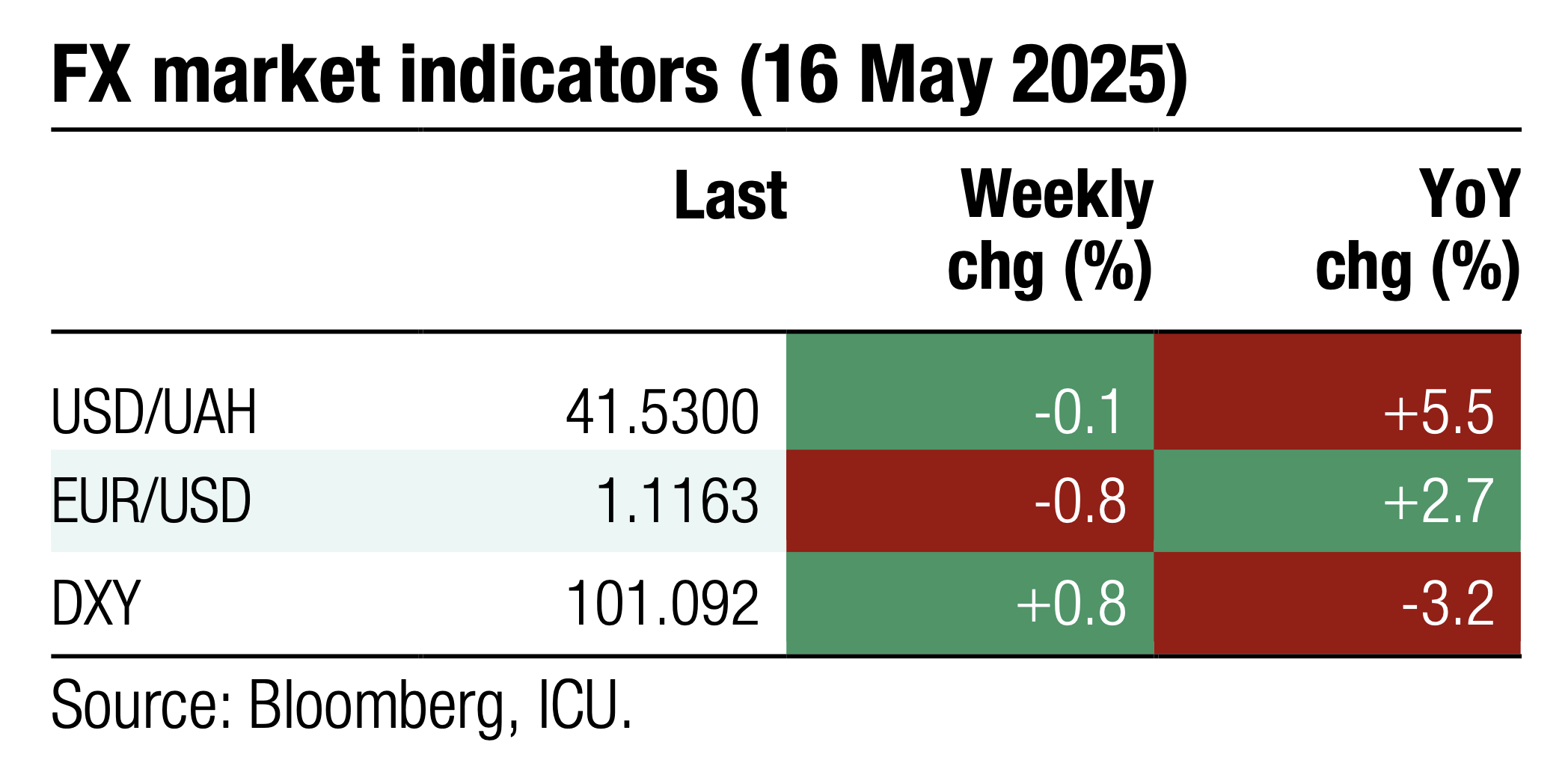

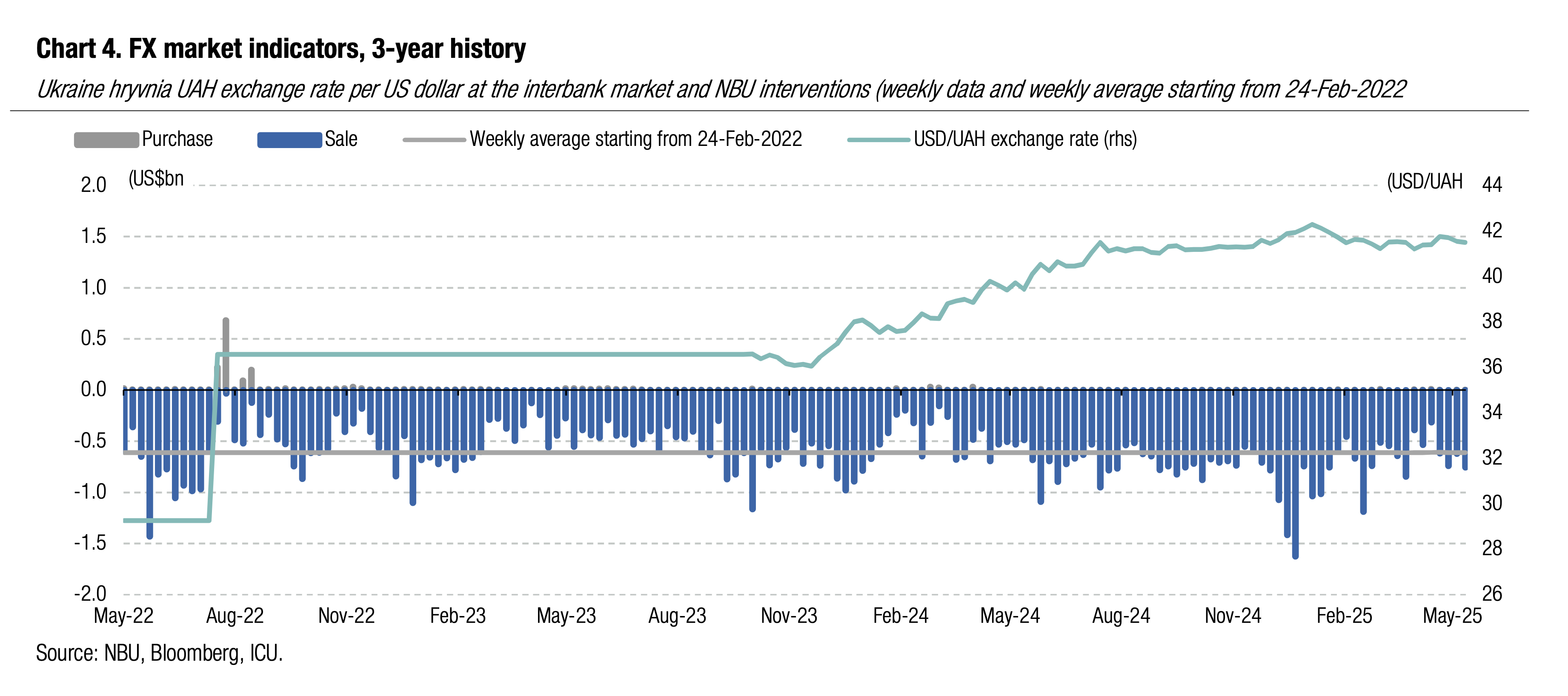

FX: NBU balances FX market to keep hryvnia strong

Last week, the NBU increased its interventions to keep the hryvnia stronger than UAH41.5/US$.

The hard currency shortage remains high. Net foreign currency purchases in four business days remained almost unchanged WoW at US$326m. However, the NBU sold US$755m from international reserves, up 21% WoW. The NBU kept the hryvnia official exchange rate at about UAH41.5/US$ with insignificant fluctuations.

ICU view: A spike in FX intervention last week signals the NBU did not hesitate to supply hard currency from its reserves to keep the hryvnia strong. The NBU will likely maintain its policy of a strong hryvnia in the coming months and may switch to a gradual depreciation policy closer towards the end of the year.