|  |  |

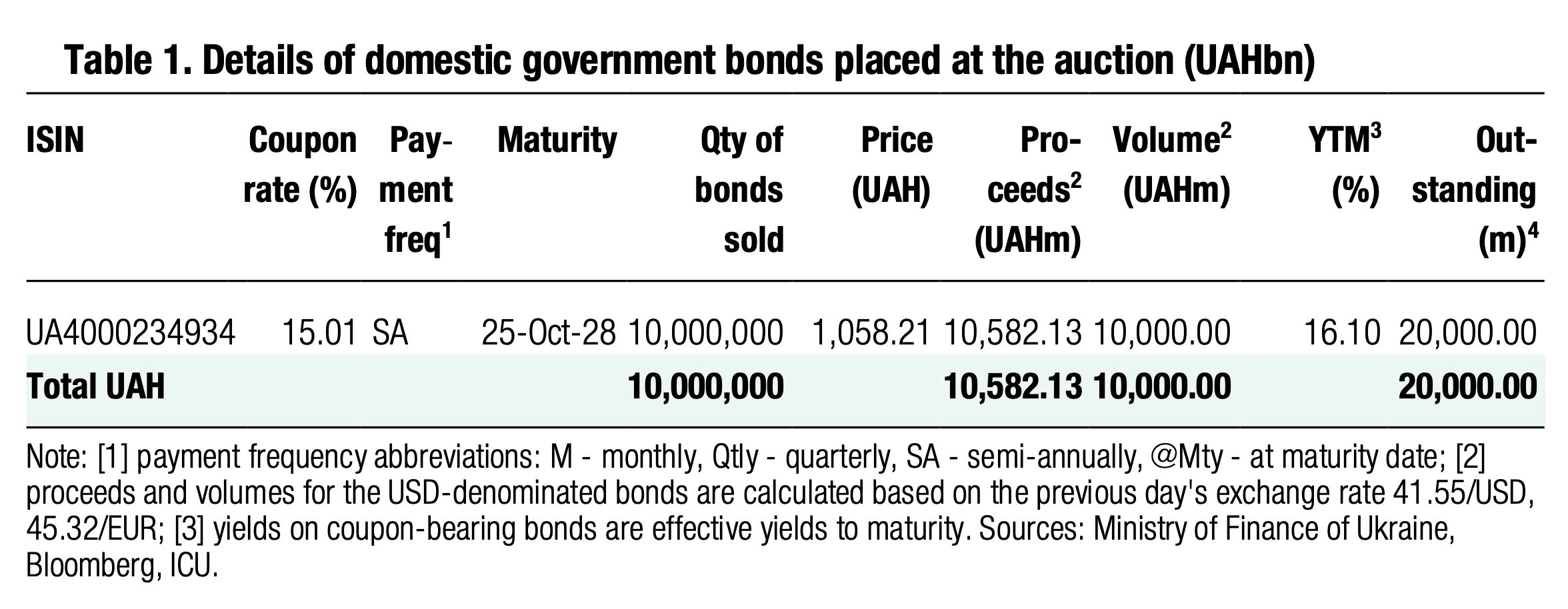

Yesterday, the MoF held a second bond exchange auction. The Ministry received enough bids to sell the planned amount of bonds.

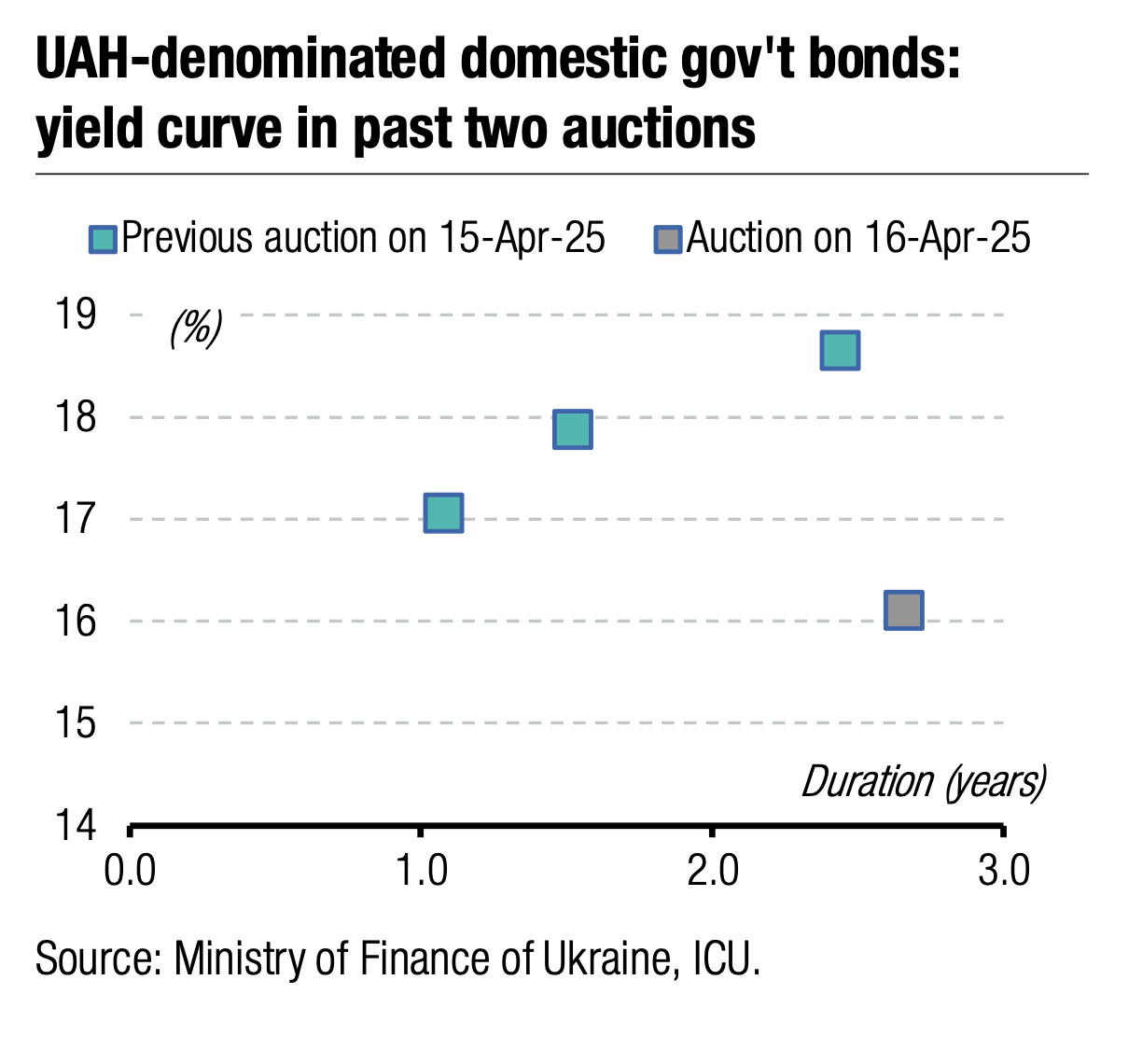

The MoF offered banks the opportunity to buy new reserve bonds due in October 2028 in exchange for another issue of reserve bonds with a month's maturity at the end of May. Total demand was UAH13.4bn in 22 bids vs. the cap of UAH10 bn. The MoF fully rejected only three bids, but some may have been partially satisfied. Interest rates ranged from 14.95% to 15.97, but the cut-off rate set at 15.6% (65bp above last week's auction), and the weighted-average rate at 15.45% (64bp above last week's auction).

Such a difference may result from banks' wish to have yields above the NBU key policy rate and because this exchange was for bonds maturing in a month, not reinvesting funds from recent redemptions.

Finally, the MoF will make early redemption of bonds due in May and reduce its need for borrowings. However, banks still need reserve bonds to reinvest funds from the redemption two weeks ago. Therefore, we may see a new offering of reserve bonds soon.

Appendix