|  |  |

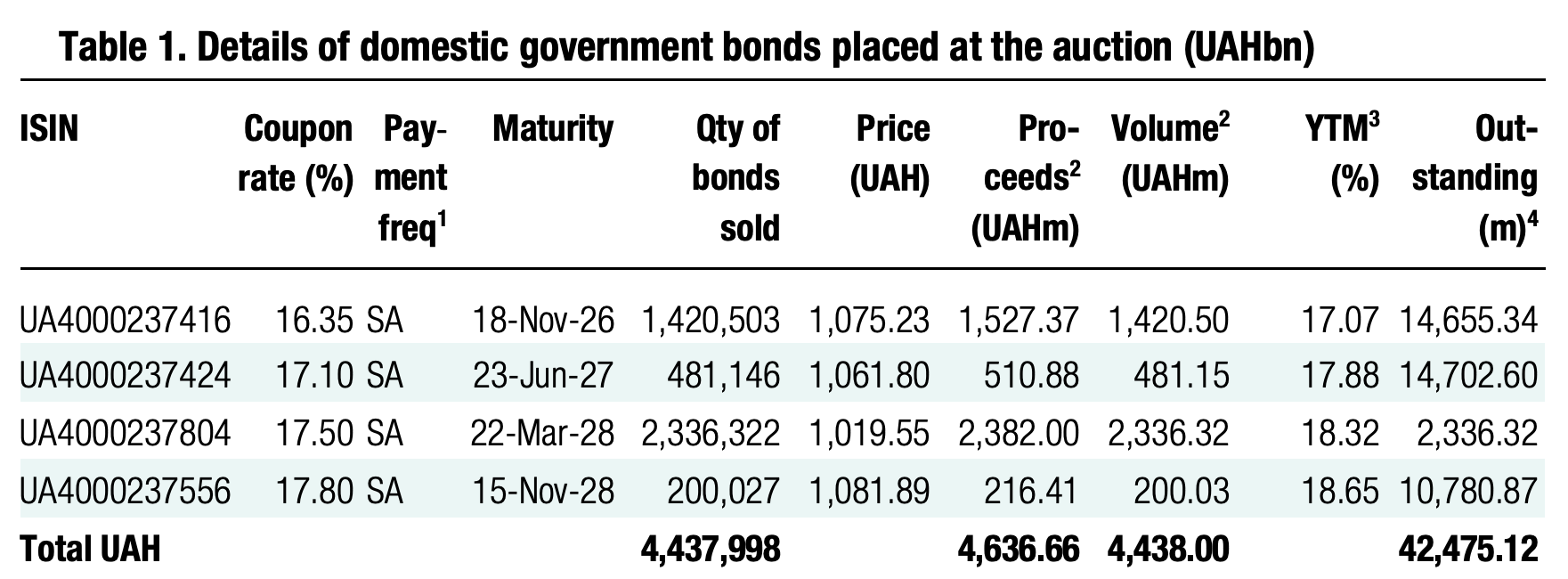

Yesterday, the MoF launched new UAH bond, which accounted for more than half of the budget proceeds raised. The MoF has not placed this maturity of UAH securities since March.

Yesterday, the Ministry offered a traditional set of UAH bonds with three maturity dates, which saw low demand. They collected just UAH2.1bn together and provided the state budget with just less than UAH2.3bn.

At the same time, the new paper was the most popular among bidders yesterday. The total volume of bids amounted to UAH2.3bn, with budget proceeds totalling almost UAH2.4bn.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.66/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

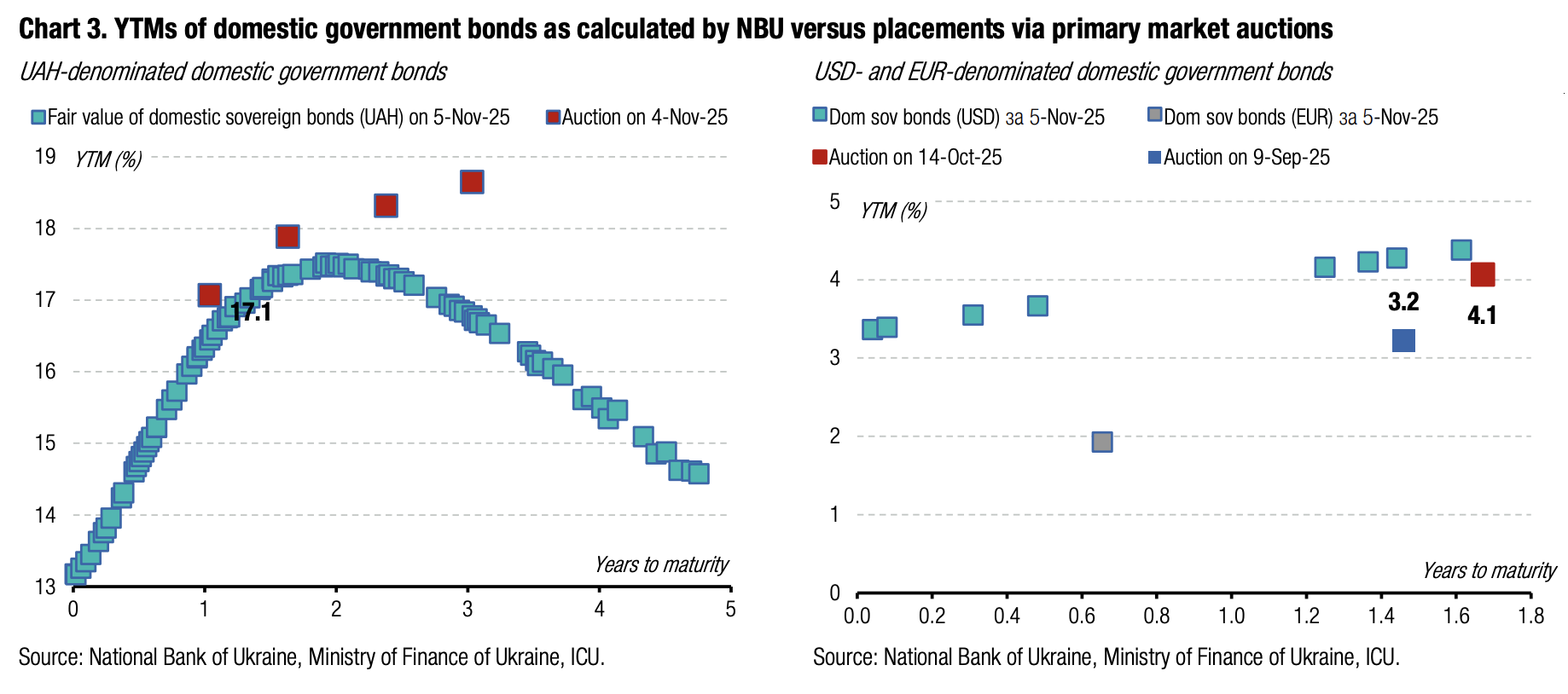

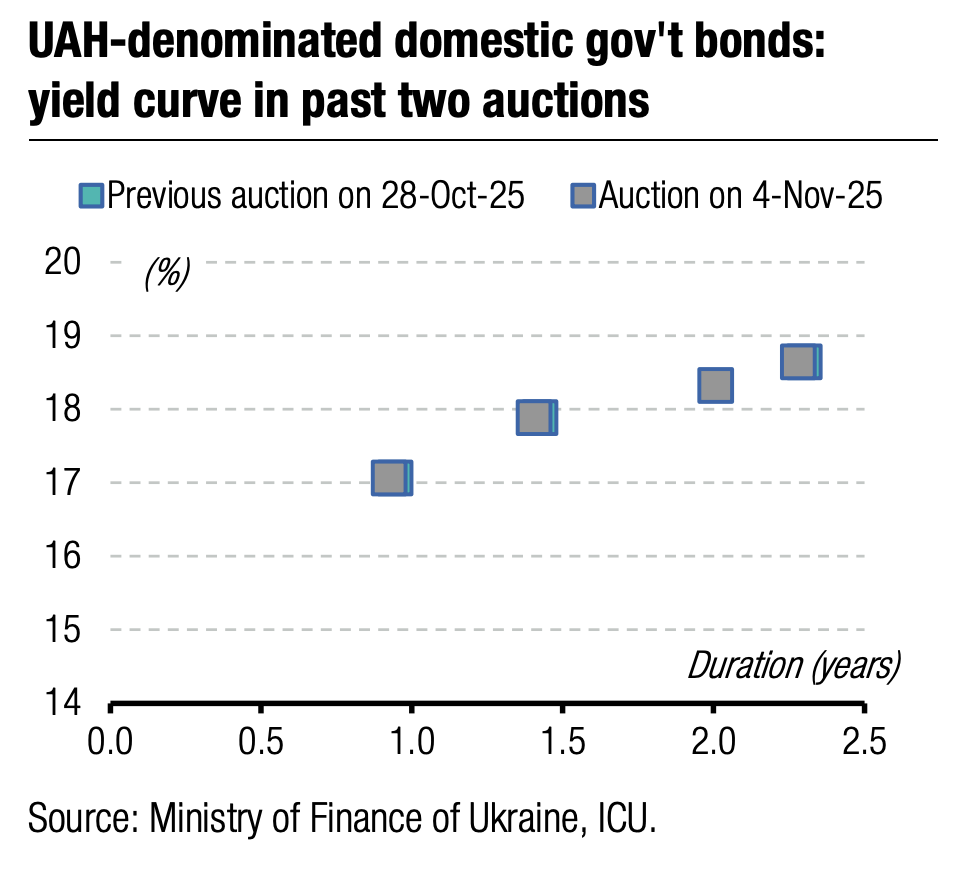

The yield of the new issue was 17.5%, which is 40bp higher than the yield for 20-month bonds and 30bp below the coupon rate of the three-year note. The yield for the new bond is close to expectations, as its maturity date, March 22, 2028, is nine months longer than the 20-month bill, and eight months shorter than the three-year note.

Additionally, the cut-off rate is 55bp higher than the yield on similar paper placed at the end of February or about half of the NBU's key policy rate increase in March.

The MoF remains within the framework of its usual policy that it has followed since the beginning of this year, increasing yields of UAH bonds by only half of the change in the NBU key rate.

Appendix: Yields-to-maturity, repayments