|  |

|  |

Bonds: MoF did not seek to improve debt rollover in November

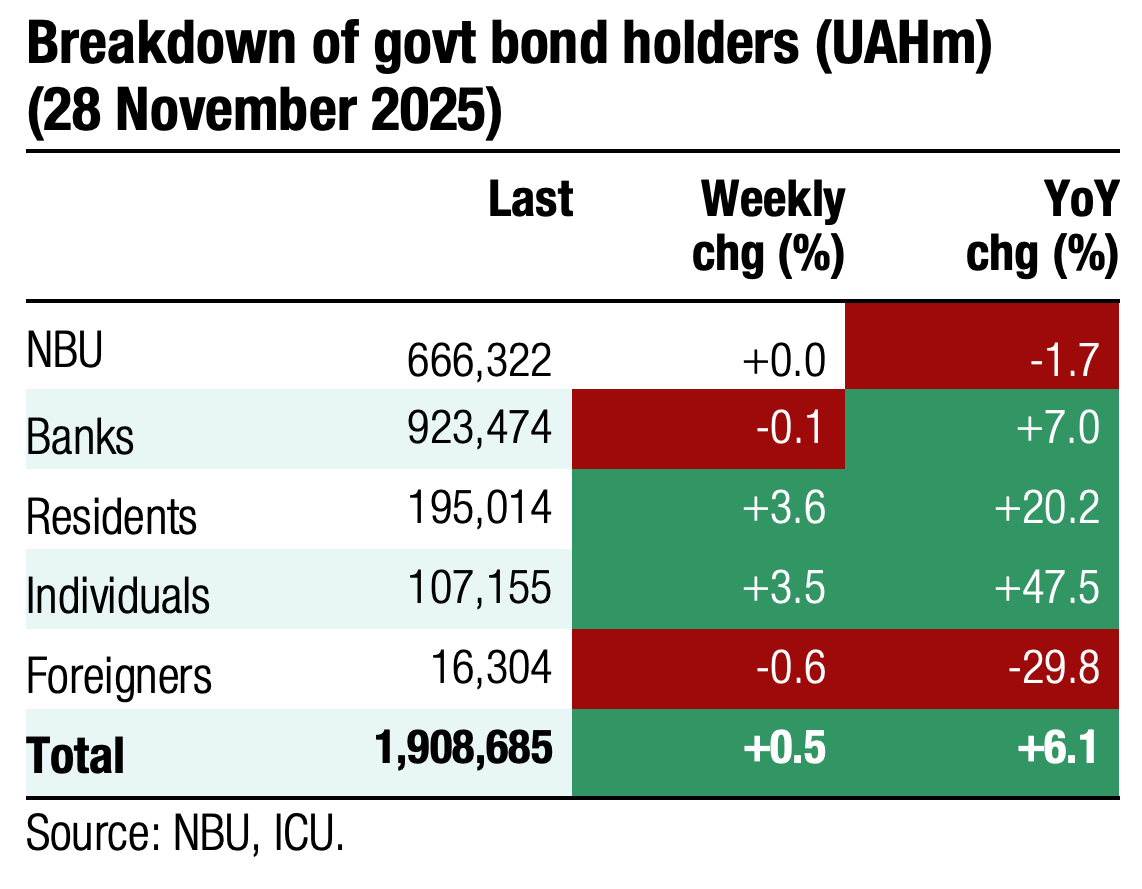

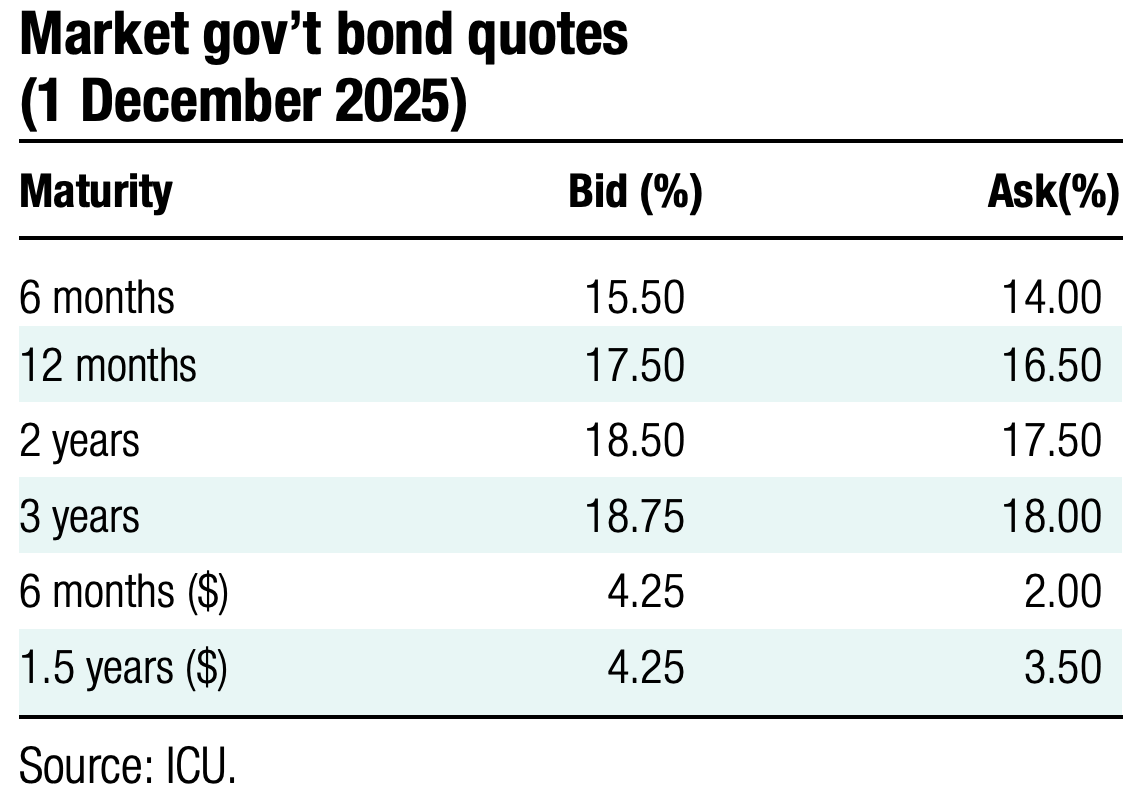

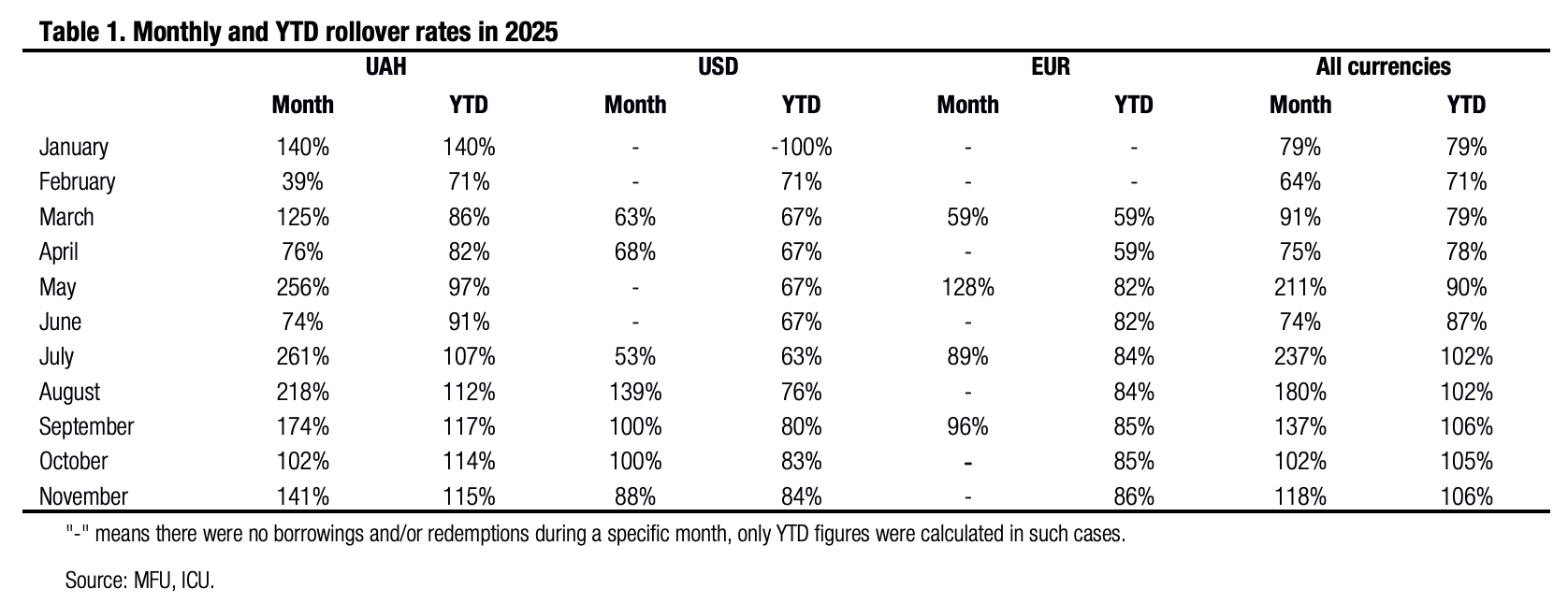

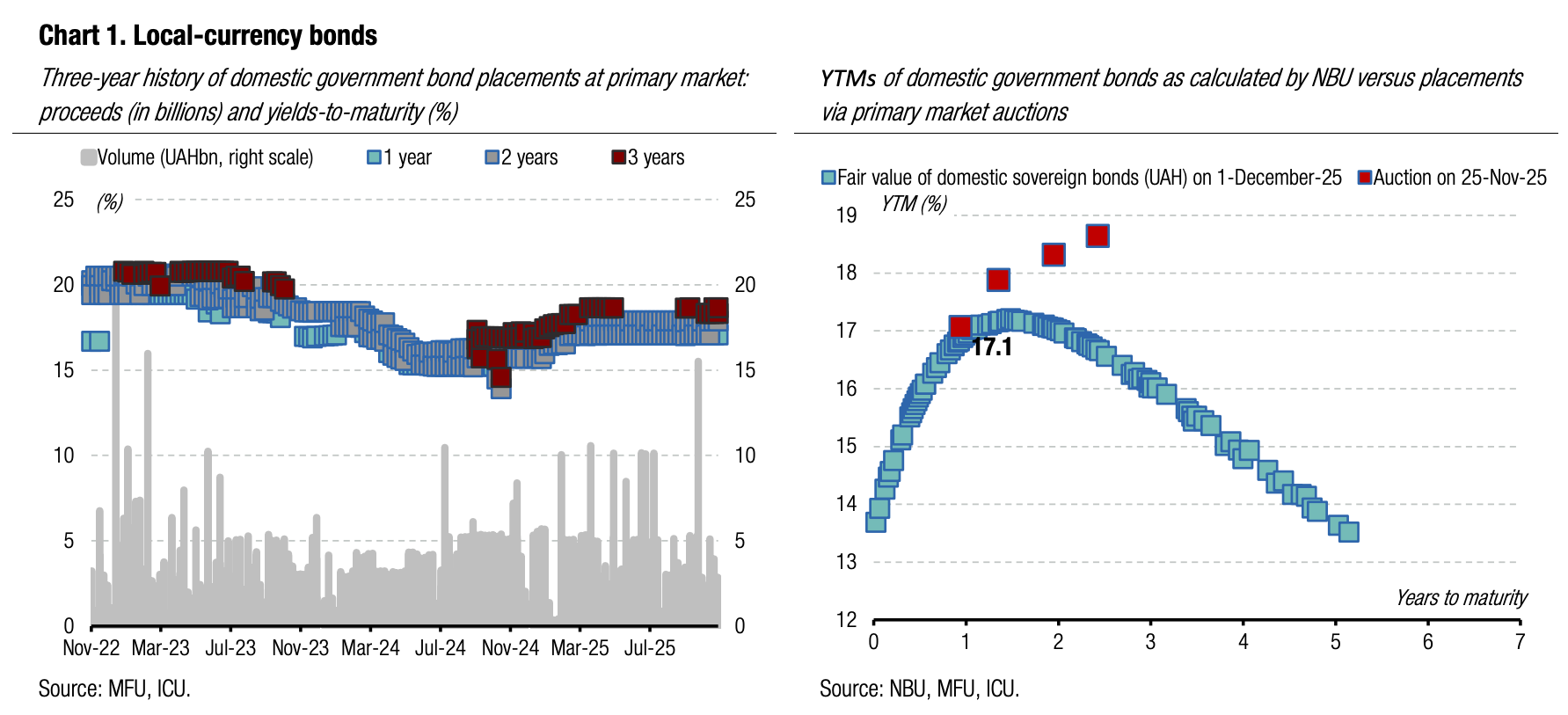

In November, the Ministry of Finance refinanced all maturing debt, but did not make any special efforts to increase net borrowings significantly.

Last month, the Ministry raised UAH25bn—US$319m and EUR6.7m—while debt repayments totalled UAH18bn and US$362m. The MoF did not offer reserve bonds in November. At the last auction of the month, the demand for USD-denominated bills was unexpectedly low, yet, even so, the MoF rejected some bids (details in the auction review).

Rollover in November was 141% for UAH debt and 88% for USD debt. Rollover YTD slightly improved in 11M25 compared with 10M25.

In December, the scheduled redemptions are small, with approximately US$188m of debt maturing this week and UAH7.2bn in the following weeks. In total, there are four auctions scheduled for the month. The MoF plans to offer UAH securities at each of these auctions while USD-denominated and EUR-denominated bonds will be offered next week only.

ICU view: The MoF has not made significant efforts to increase borrowings. The MoF is now relying more on international financial assistance to cover the budget deficit rather than on domestic funding. They may need to scale up domestic borrowings significantly in January-February 2026 if the inflow of foreign aid falls short of budget needs at the beginning of the year. However, according to the mass media, foreign partners are working to frontload the financial assistance that is already scheduled for 2026.

Bonds: Peace plan progress supports Eurobonds

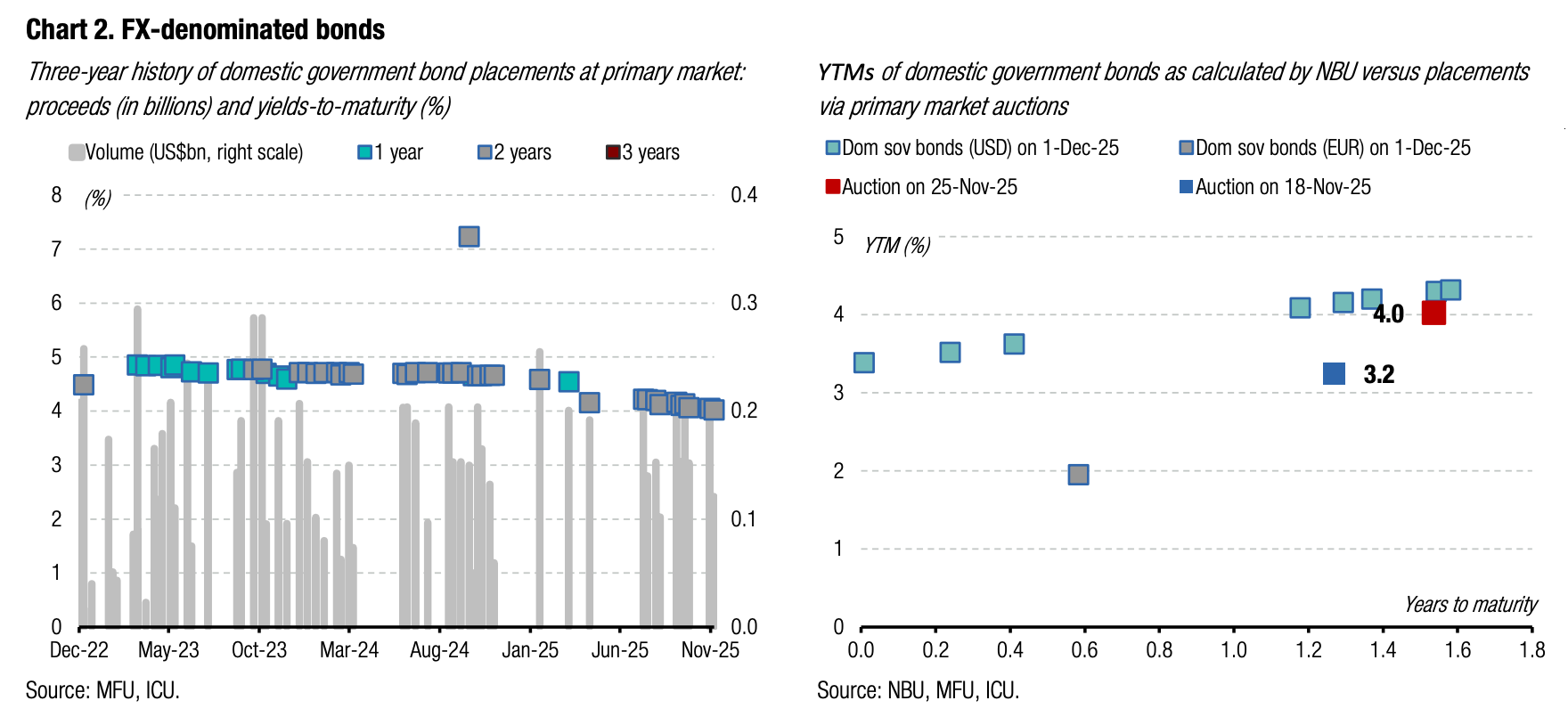

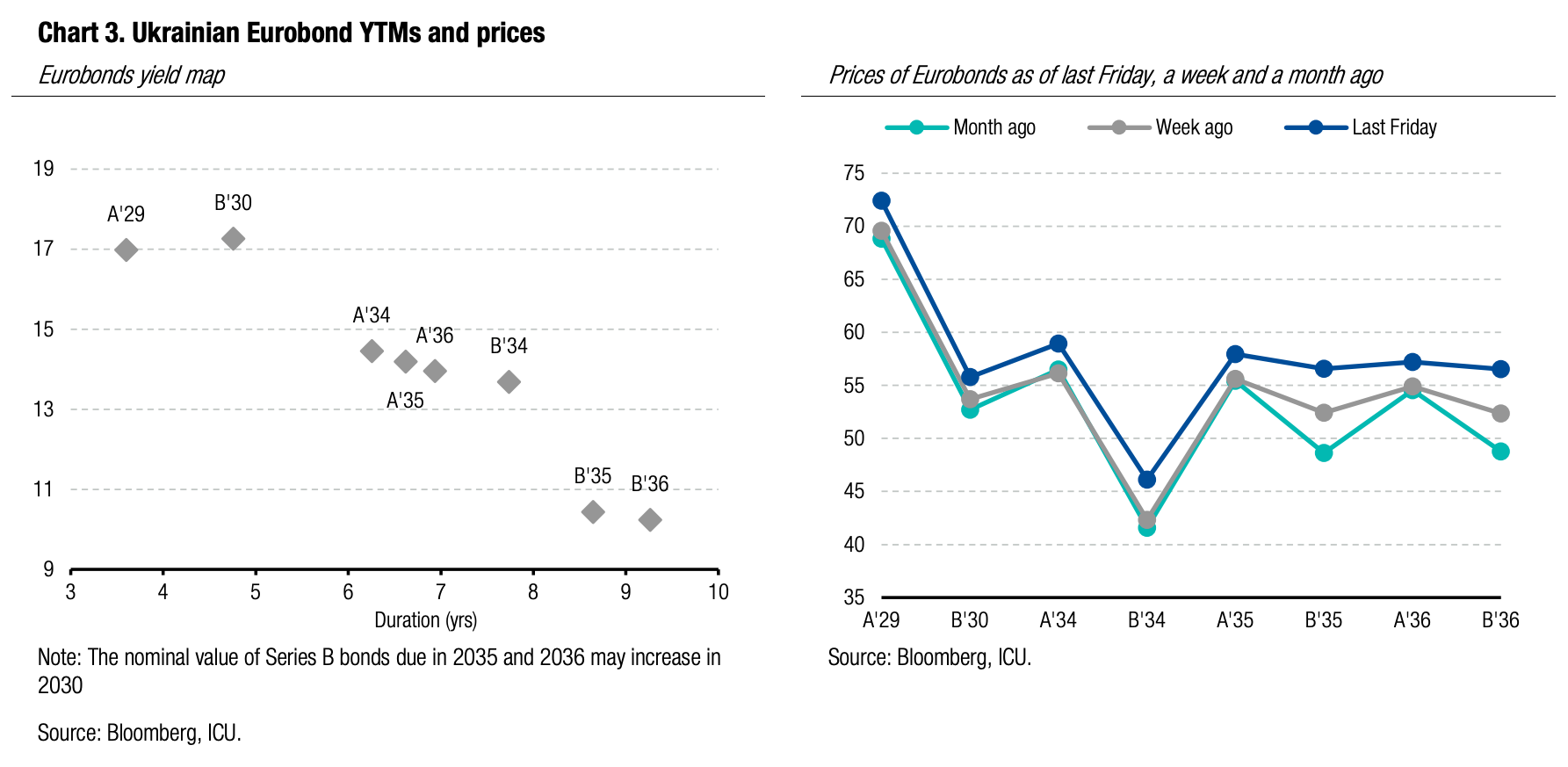

The progress made on the peace plan for Ukraine last week strengthened optimism of Eurobond holders.

At this stage, Ukraine has managed to remove some of the unacceptable components from the peace plan during the negotiation with the US in Switzerland. That fact was very much welcomed by the market, and Eurobond prices rose by 3-5% on Monday. The prices rose by 4-8% over the week. An additional supporting factor was the staff level agreement on the start of a new four-year IMF program for Ukraine.

VRI prices also grew steeply and exceeded 93 cents per dollar of notional value last Friday. However, the key news here was that the MoF and VRI holders restarted closed negotiations on the restructuring.

ICU view: We don’t rule out that market optimism may again prove premature, as we think russia is very likely to reject a proposal at this point simply to delay any meaningful negotiations on ending the war.

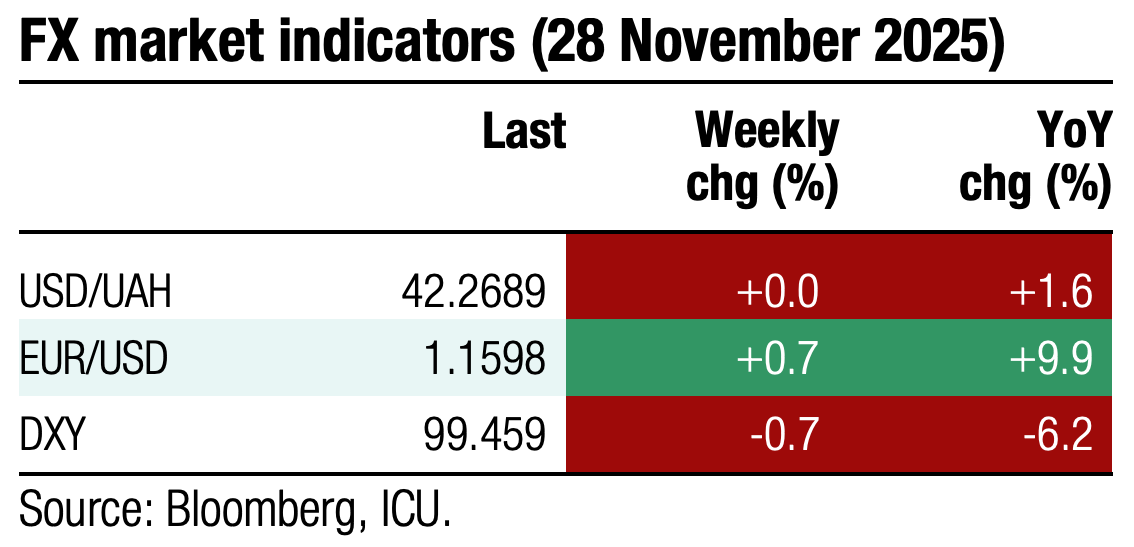

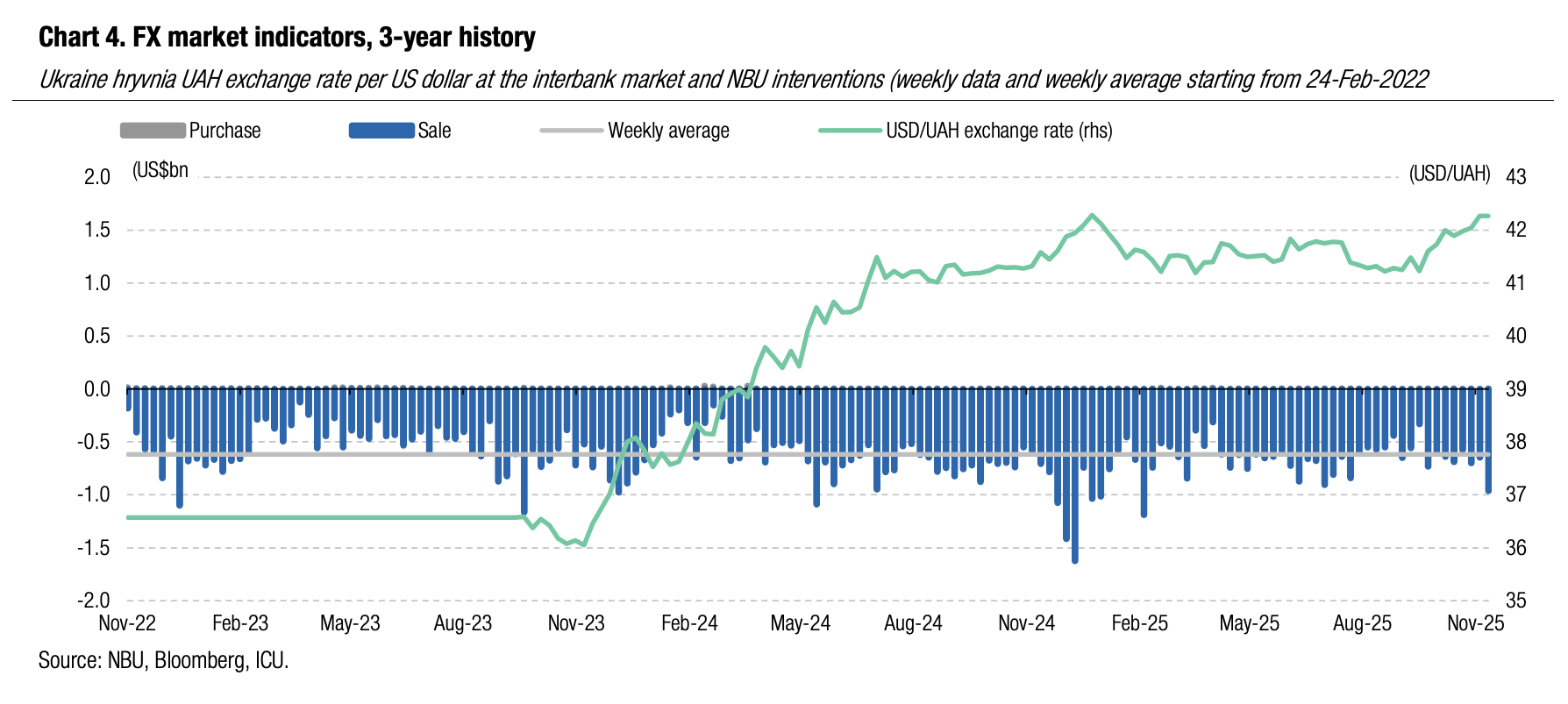

FX: NBU widens hryvnia volatility range

In late autumn, the National Bank further widened the band of hryvnia fluctuations compared with September and October, and even briefly weakened the hryvnia below its January lows.

Last week began with the hryvnia sliding further and reaching UAH42.5/US$ at the end of the day. The trend reversed on Tuesday, the NBU chose to strengthen the hryvnia and the rate was back to UAH42.2/US$ by Thursday. Thus, the NBU widened the range of hryvnia fluctuations from UAH0.1 in summer months and UAH0.2 for most of the autumn to UAH0.3 by the end of November. At the end of the week, the official hryvnia exchange rate was UAH42.27/US$ or unchanged WoW.

Yet, the increase in volatility somewhat worsened the market sentiment, driving an increase in the hard currency deficit, which more than doubled WoW. Therefore, the NBU had to increase interventions to US$963m last week, the biggest size since mid-February, when the NBU sold almost US$1.2bn.

ICU view: The NBU weakened the hryvnia to new historical lows, but this was a very short-term move. More importantly, the NBU has demonstrated its willingness to significantly expand the range of exchange rate fluctuations. Historically, demand for foreign currency consistently increases in December, and we expect this pattern to repeat this year. Despite that we do not expect a significant weakening of the hryvnia in the near future.