|  |

|  |

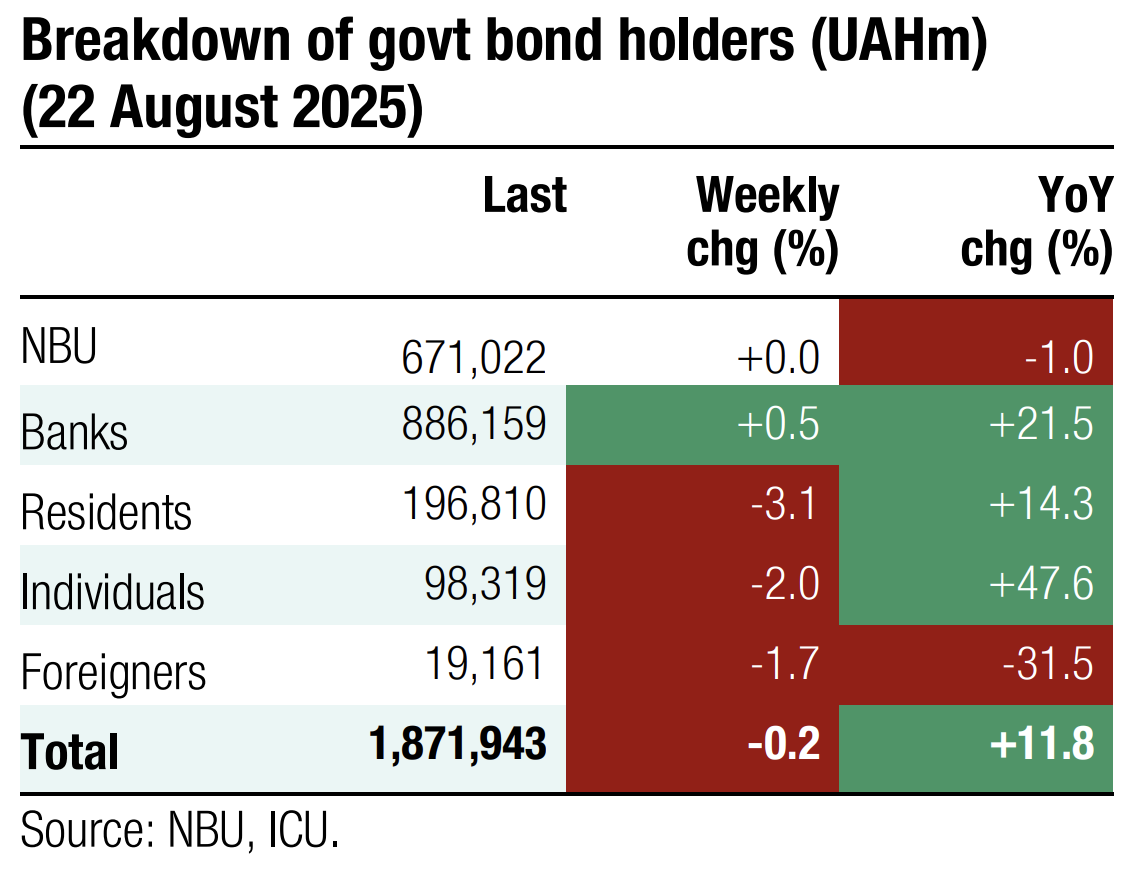

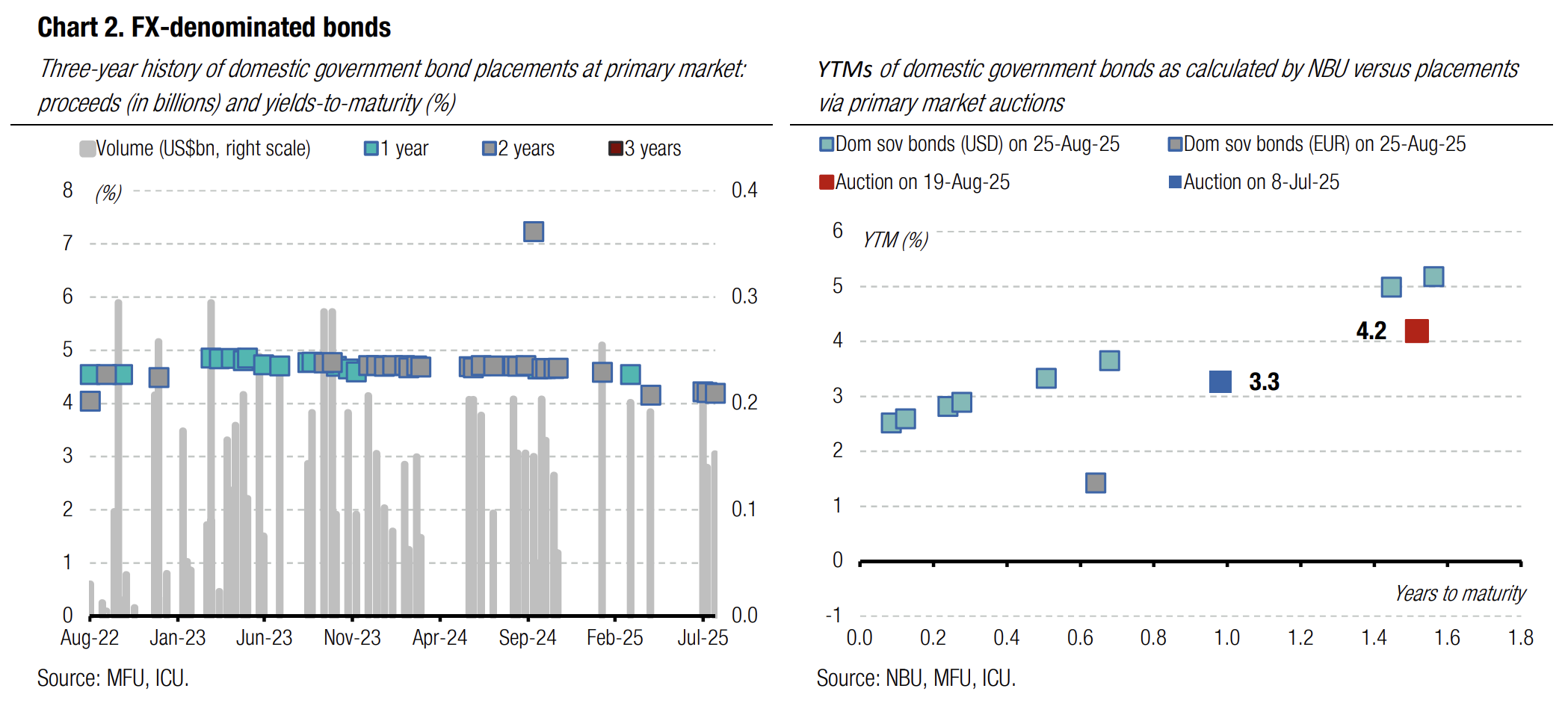

Bonds: MoF keeps reducing stock of FX bonds

The MoF remains on track to gradually reduce the stock of outstanding FX-denominated bonds, while shifting focus to UAH bonds.

At the end of July, the MoF redeemed US$400m worth of bonds and last week, another US$280m. Meanwhile, the offer of new FX paper fell short of recent redemptions: at the end of July and in early August, the Ministry sold US$352m of bonds, added another US$150m last week, and plans to offer another US$100m tomorrow.

Thus, the Ministry is gradually reducing the amount of FX-denominated bonds outstanding, which is down by about 13% YTD.

ICU view: The MoF continues to reduce the volume of FX-denominated bonds outstanding at a reasonably high rate. We expect the Ministry to continue encouraging investors to shift their focus to UAH bonds, keeping UAH bond yields attractive and reducing the supply of FX instruments.

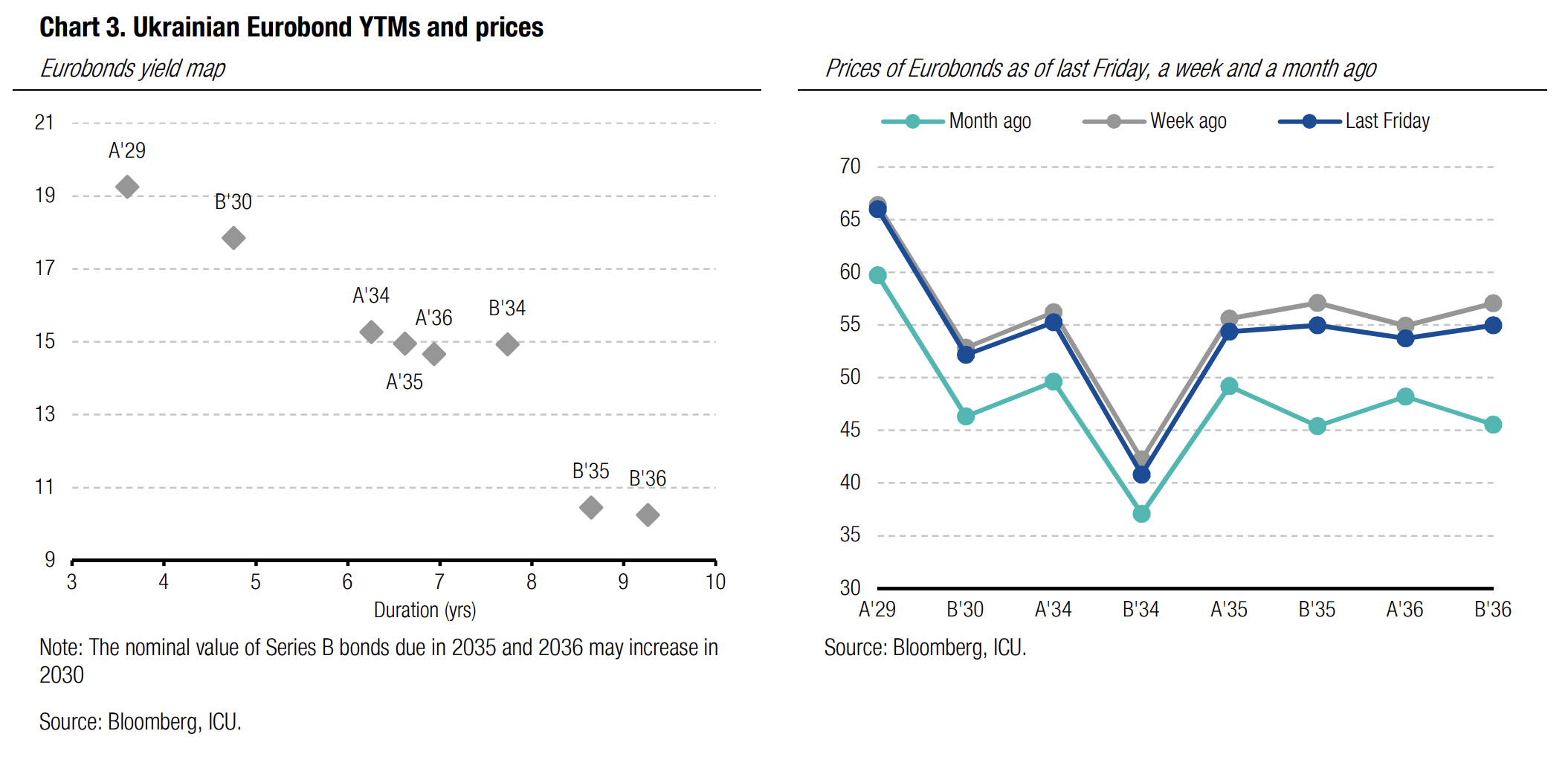

Bonds: Eurobond holders' optimism fades again

Attempts to stop the war in Ukraine through diplomatic efforts drag on, affecting the sentiment towards Ukrainian Eurobonds. At the same time, rumours of a possible new exchange offer from the MoF sparked more interested in VRIs.

The meeting between US President Trump and the russian president, and the visit of the Ukrainian president to the US last Monday, fell short of expectations. russia's ultimatum-style requirements were expectedly unacceptable, so Ukraine and its European allies maintain their efforts to persuade the US to take more decisive actions to force russia to strike a peace deal.

The positive reaction of Eurobond prices turned out to be premature. Therefore, after reaching peak values last Tuesday, they slid by about 3% last week.

Last Tuesday, the VRI price hit almost 79 cents per dollar of notional value, the highest level since the end of March. Subsequently, their price correction was less significant than for Eurobonds.

ICU view: We expect that diplomatic steps to end the war will continue. However, a breakthrough in the negotiations should not be expected soon since russia is apparently reluctant to proceed in a constructive manner without additional pressure from the United States. The prices of Eurobonds may remain volatile in the coming weeks.

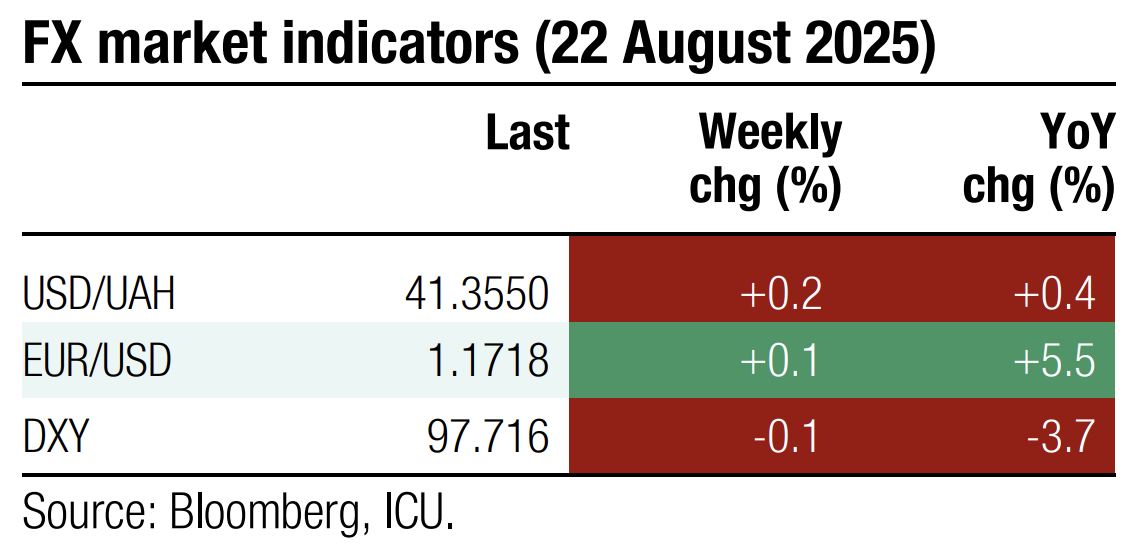

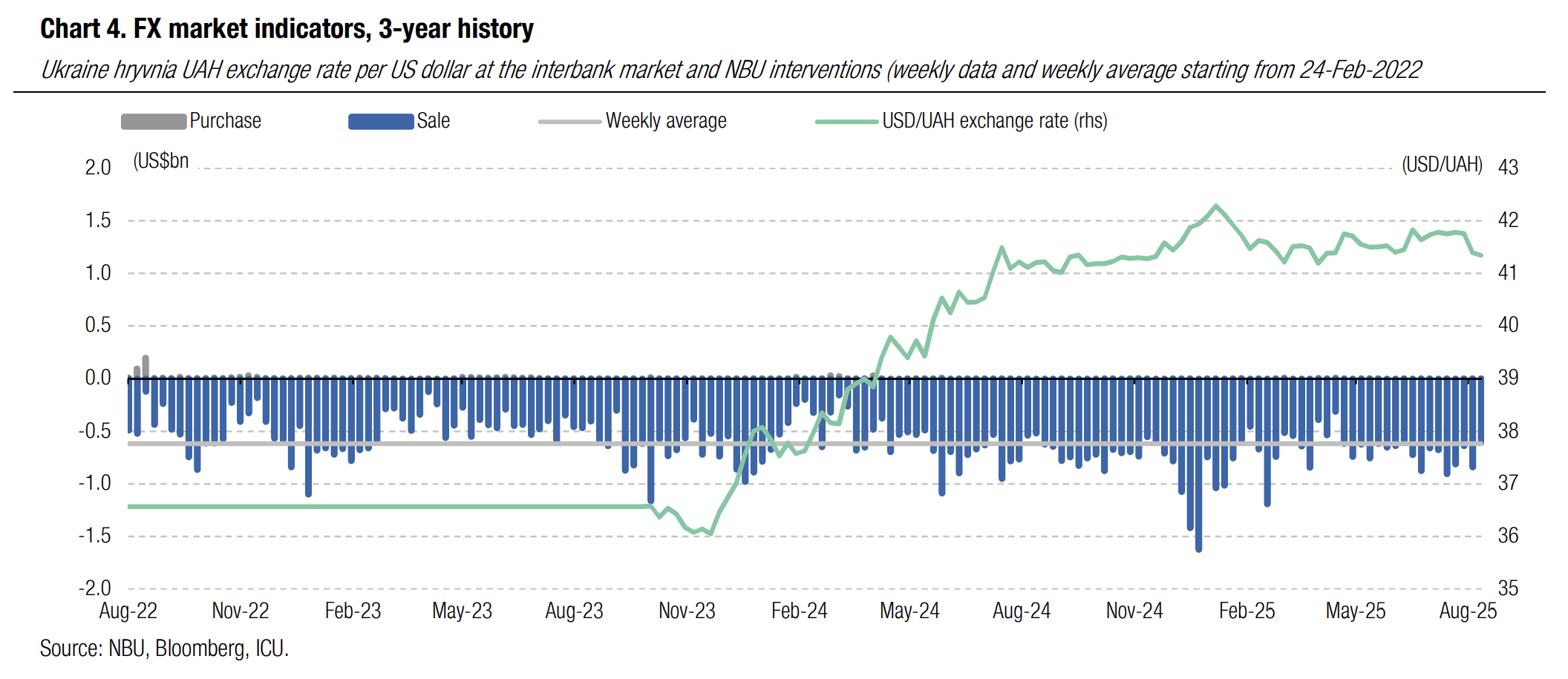

FX: NBU strengthens hryvnia further

The NBU strengthened the hryvnia again last week, while decreasing its FX interventions on the back of narrower FX market shortage.

The hryvnia appreciated to UAH41.22/US$ last Thursday, the strongest level since April, and an official exchange rate ended last week at UAH41.28/US$.

The hard currency shortage declined by 8% WoW to US$301m. To cover this deficit and while supporting hryvnia appreciation, the NBU sold US$551m from reserves, which is 9% less WoW and below the weekly average during the full-scale war.

ICU view: Strengthening the hryvnia and maintaining the exchange rate at the current level is a deliberate action by the NBU. The NBU may allow a slightly larger amplitude of hryvnia fluctuations during the fall, and then move to weaken it marginally towards the end of the year.