|  |

|  |

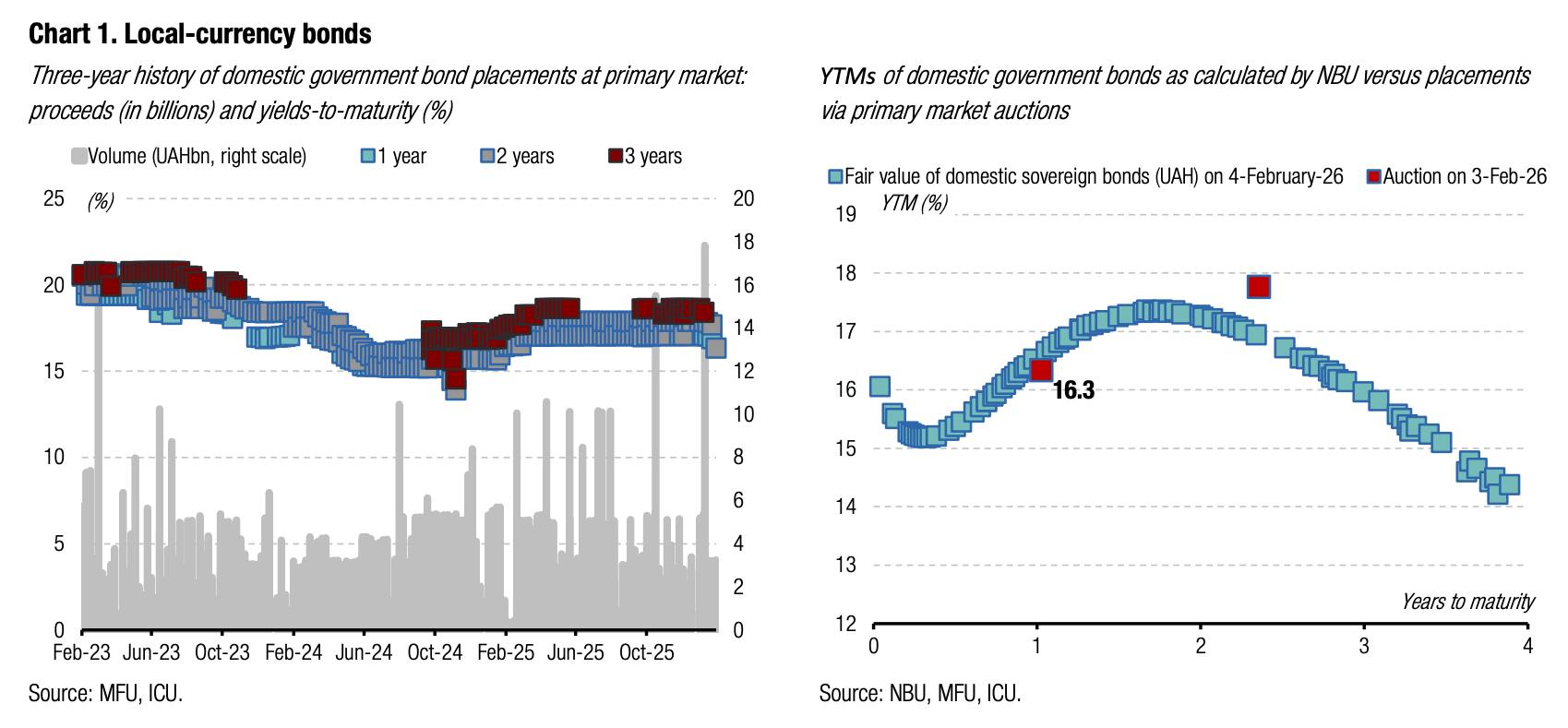

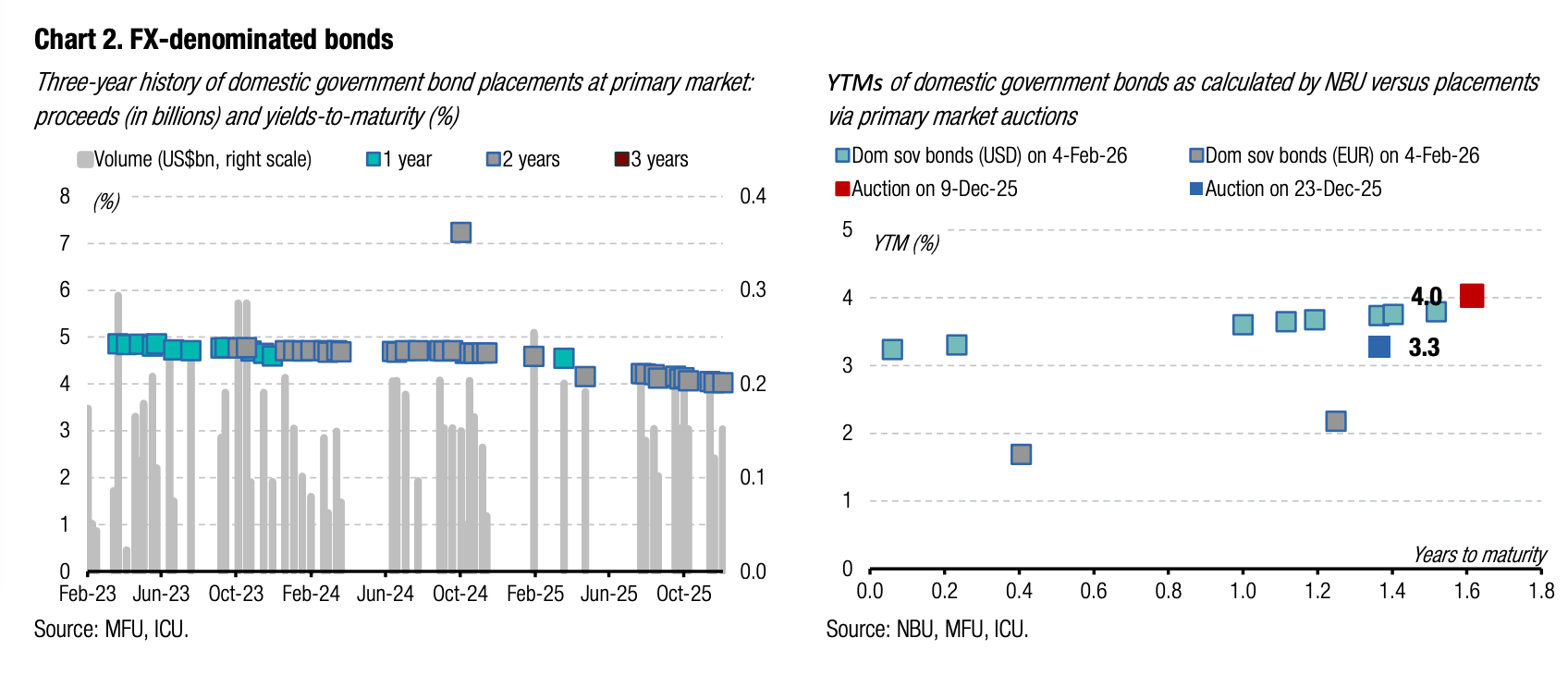

Bonds: MoF continues to cut yields

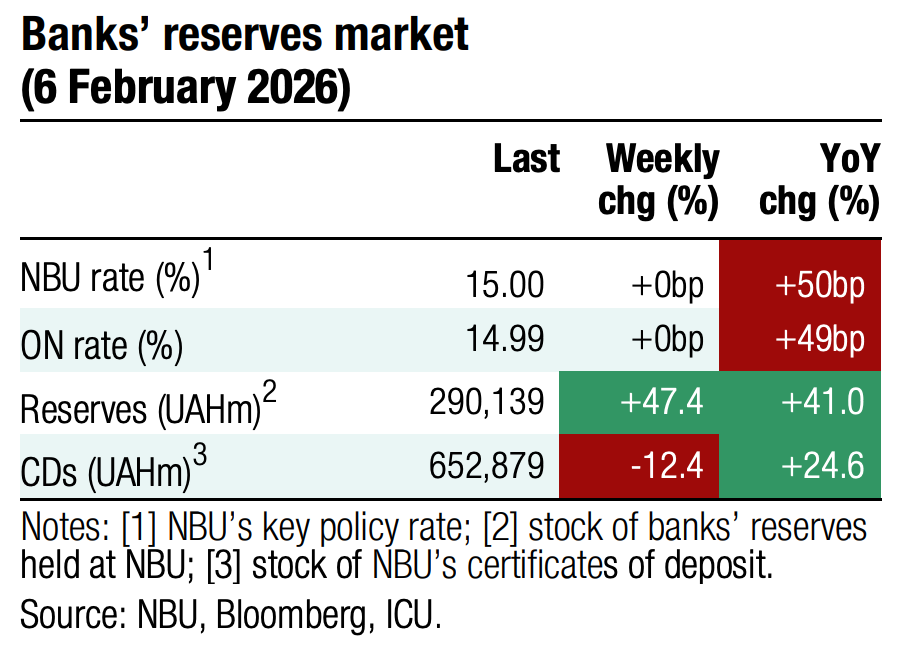

Last week, the Ministry of Finance continued to reduce yields on UAH bonds at the primary auctions, well ahead of the NBU's key rate cut.

The MoF offered a limited amount of UAH bonds at last week's primary auction to reinforce price competition among buyers. A one-year bond was 10x oversubscribed, a three-year note 7x. The MoF reduced interest rates on the one-year instrument by 51bp, and on three-year paper by 34bp. See details in the auction review.

As of today, the cumulative decrease in yields has already reached 80bp for three-year securities, while the decline in yields for shorter securities was less significant at 67bp.

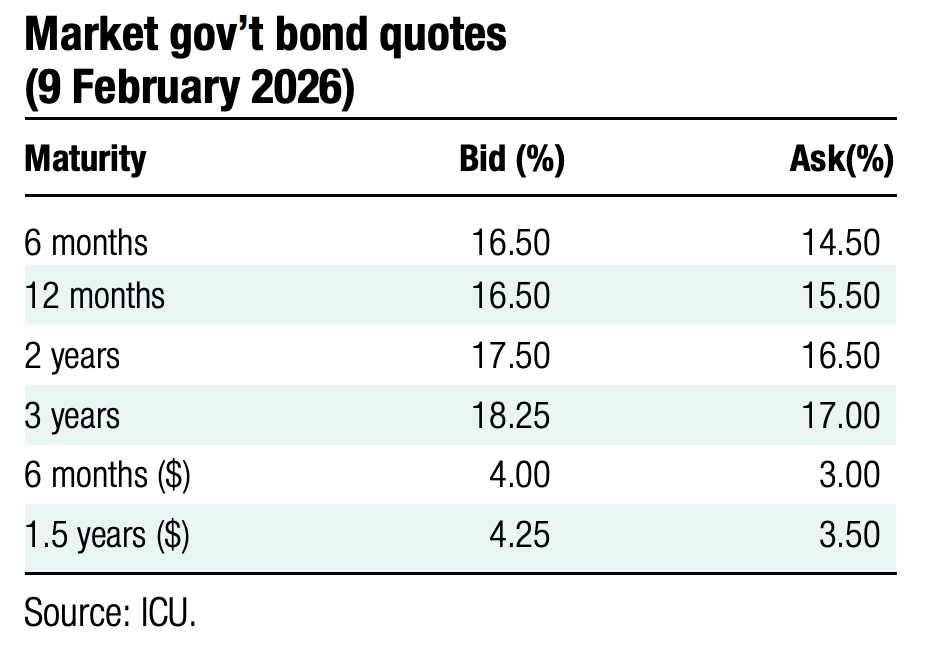

The MoF plans to hold a regular auction tomorrow to offer three UAH bonds and hold a swap auction on Wednesday. In addition to the usual three bonds, the MinFin will also offer a four-year paper. The new bonds may be designated as a reserve bond by the NBU soon.

At the swap auction, the MoF will offer to exchange bonds due on March 18, 2026 for a three-year note with a UAH10bn cap.

ICU view: The NBU’s signal that at least one more cut of 50bp is highly probable will likely keep price competition for new bonds intense. The MoF will likely aim to ensure at least one-to-one transmission of cuts in the key policy rate to bond yields. This contrasts with its vision during the rate hiking cycle when only half of the increase in the key rate was transmitted to bond yields. The planned swap auction may significantly reduce bids for the three-year note at the regular auction, so we may not see a significant decrease in yields tomorrow. At the same time, the decline in yields on the one-year instrument may be much more pronounced.

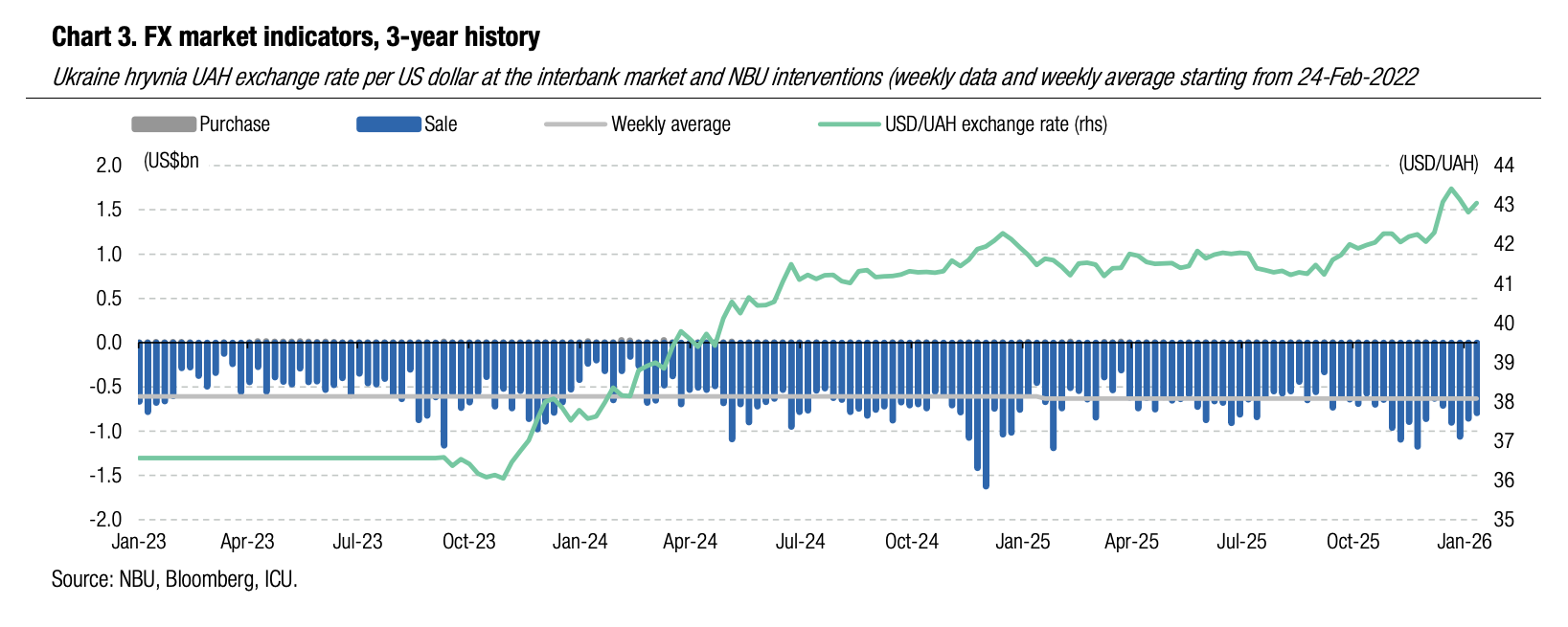

FX: NBU allows wider hryvnia volatility

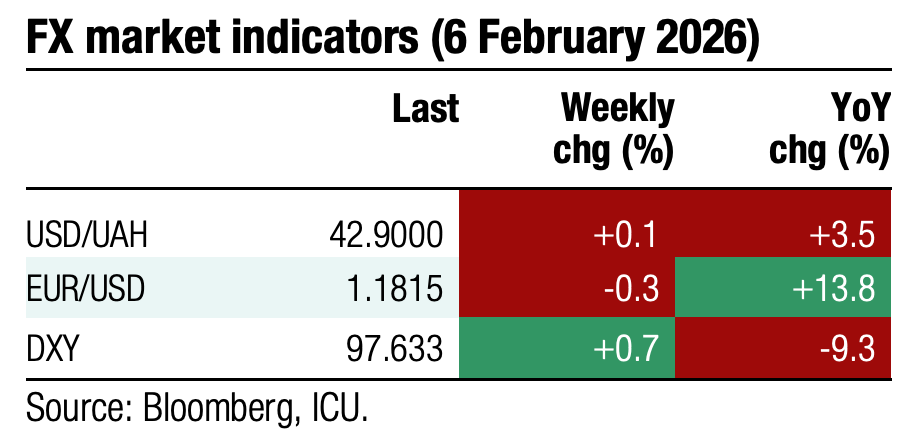

Last week, the NBU allowed the hryvnia to fluctuate in a fairly wide range while it was gradually reducing interventions.

The week started with a rise in hard currency shortage across both the interbank FX market and the retail segment. However, over four business days, the currency deficit increased by only 13% WoW.

Despite rising shortages, the NBU did not try to prevent wider fluctuations, but still did not allow the exchange rate to approach January’s highs. However, at the end of the trading session last Friday, the USD/UAH rate fell to UAH42.9/US$ leaving the interbank rate almost flat WoW. The official exchange rate weakened to UAH43.05/US$. NBU FX interventions were down by 8% to $794 million.

ICU view: The NBU again faced increased demand for foreign currency at the beginning of the month, but decided to allow the exchange rate to move in a fairly wide range and was in no hurry to increase interventions. We recently revised our 2026 exchange rate forecast and now expect UAH45/US$ at the end of the year. Please see our recent Macro Update for more details.

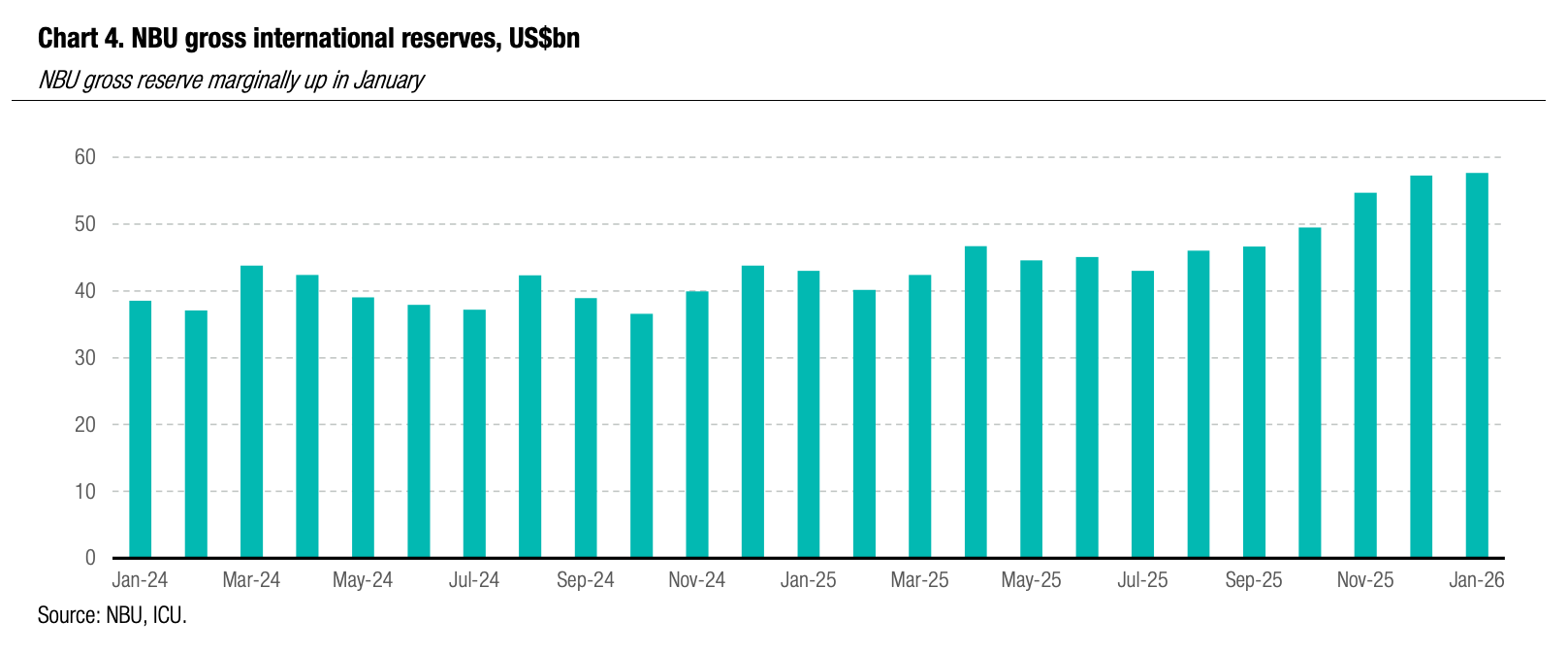

Economics: NBU reserves inch up 1% in January

Gross international reserves of the NBU were up 0.6% in January to US$57.7bn, an equivalent of 6.0 months of future imports as per NBU estimates.

The increase in reserves came on the back of a World Bank loan for $3.1bn, likely as a part of the ERA facility. Revaluation of FX reserves yielded another US$1.4bn. NBU sale interventions in the FX market were the key drag on the reserves as they totaled US$3.7bn.

ICU view: We expect NBU reserves will remain above US$50bn through 2026, but they are very unlikely to increase considerably YoY. This level will be sufficient to ensure that the NBU remains in a comfortable position when dealing with FX market imbalances.

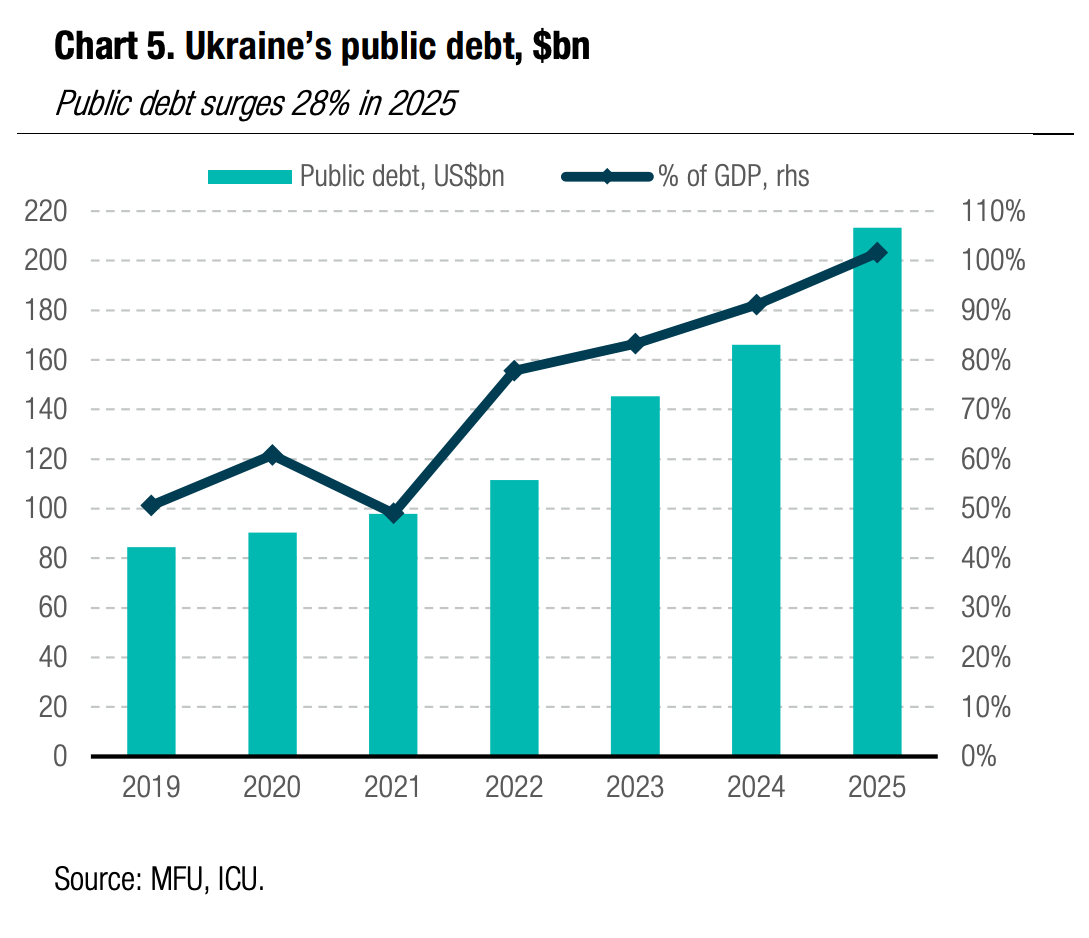

Economics: Ukraine’s public debt up 28% in 2025

Ukraine’s public debt surged 28.5% to US$213.3bn in 2025, an estimated 102% of GDP.

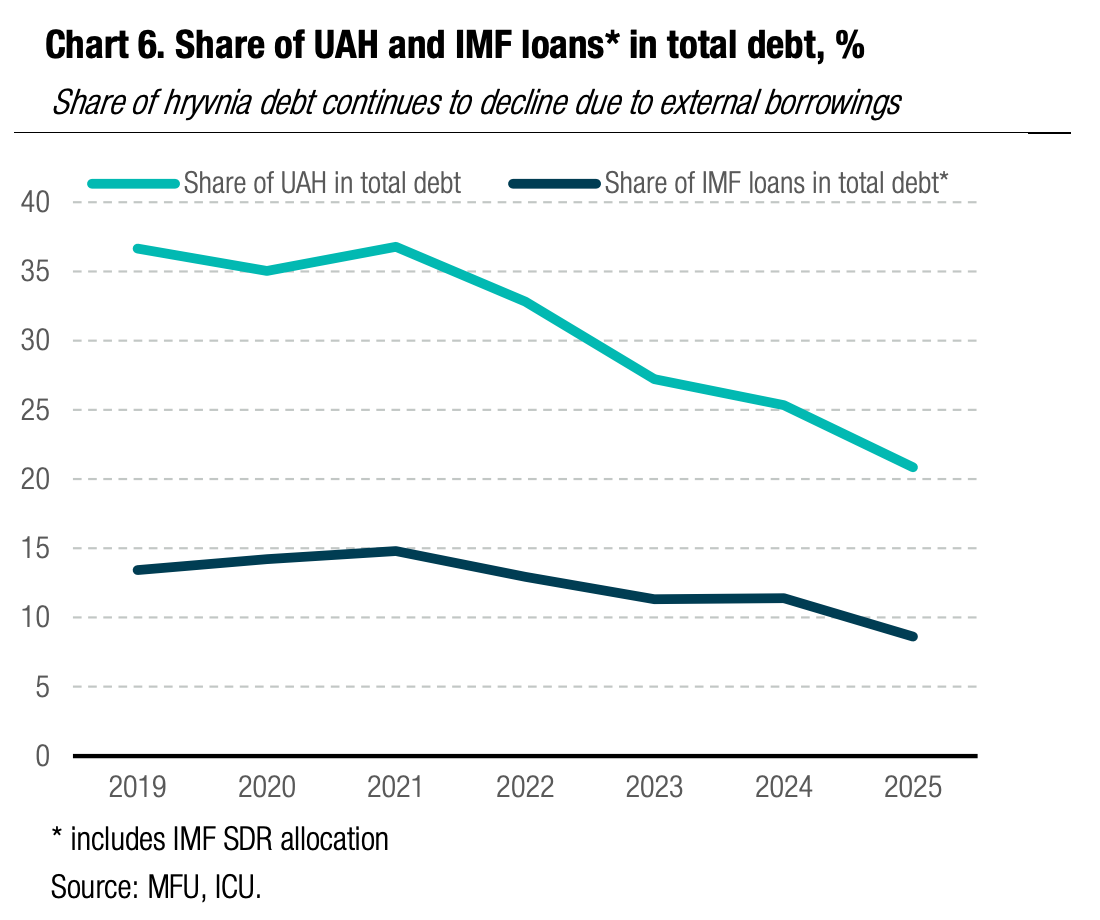

The growth in total debt by US$47.3bn was primarily driven by external borrowings with domestic debt contributing below 5% to the total increase. The EU was the largest provider of debt with its total exposure to Ukraine rising by $39bn on the back of the ERA and Ukraine Facility. The stock of Eurobond debt was up by US$3.5bn, as Ukraine swapped GDP warrants for Eurobonds in December. Other sources of debt increase were much less significant.

|  |

ICU view: The increase in public debt was primarily driven by concessional loans from the EU within the Ukraine Facility and ERA. ERA facilities from countries other than EU member states were treated as grants and were not added to the stock of public debt. Public debt will continue to grow this year and may reach 110% of GDP at end-2026. The EU will remain the largest lender and the remaining Ukraine Facility commitments will be complemented with Ukraine Support Loan. Importantly, the ERA and Ukraine Support Loan from the EU do not affect Ukraine’s debt sustainability and Ukraine has no obligation to repay them until it receives compensation from russia. While the total stock of debt is high, it doesn’t create any near-term liquidity pressures due to its concessional nature. Once the war is over, the government will need to develop a strategy to bring debt down to a sustainable path.