|  |

|  |

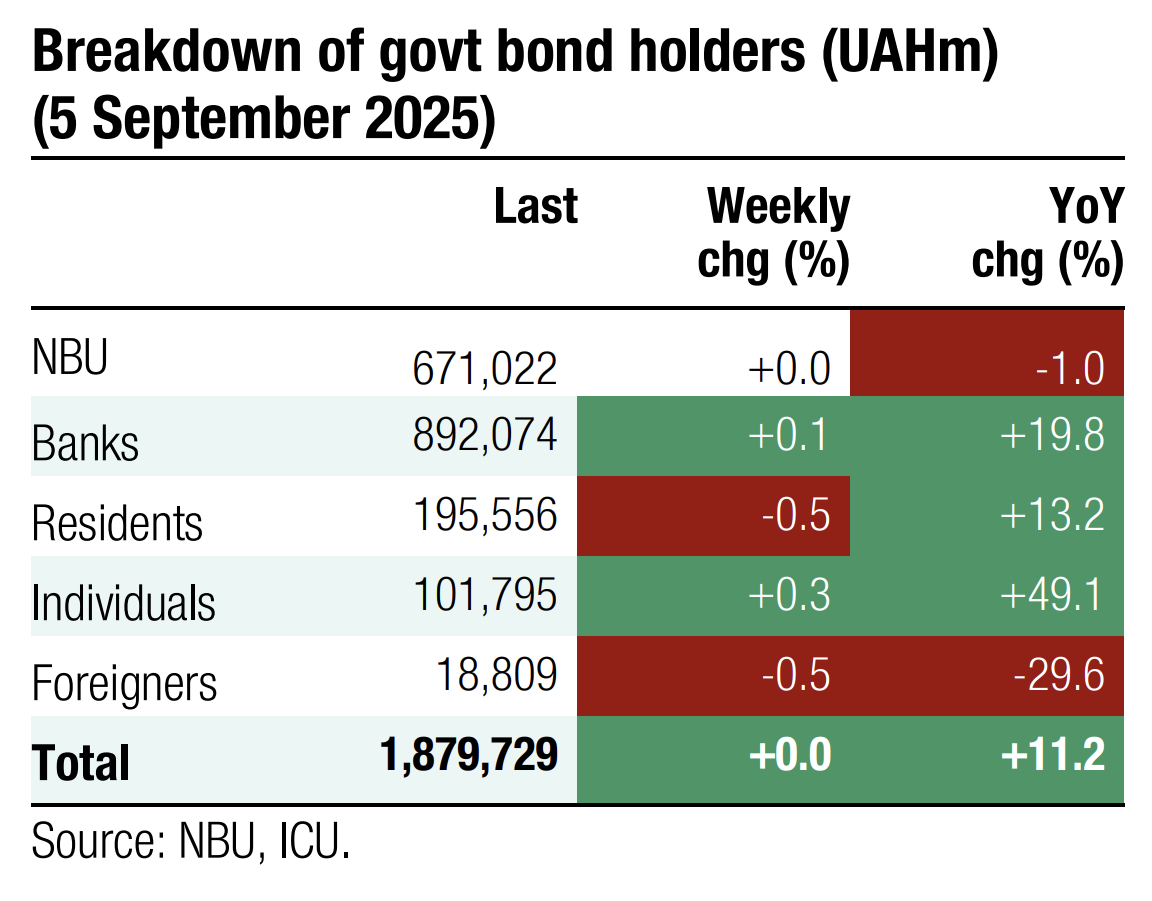

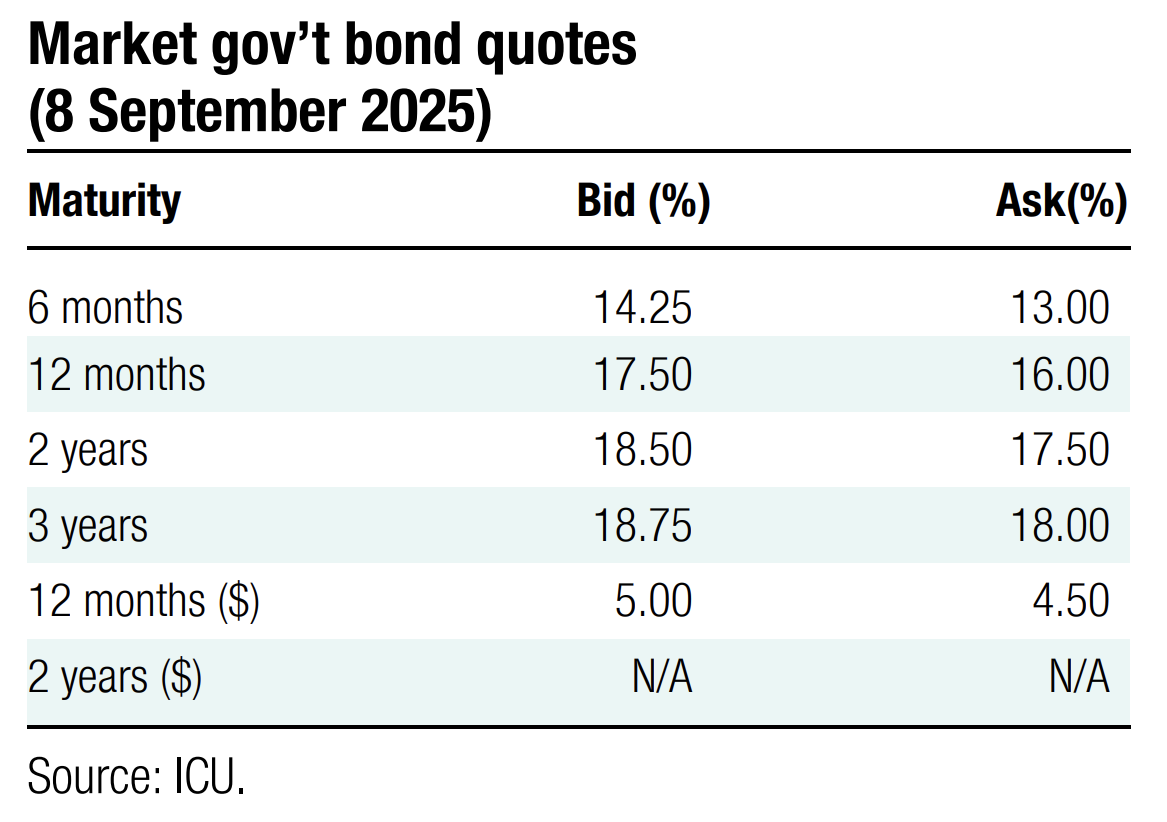

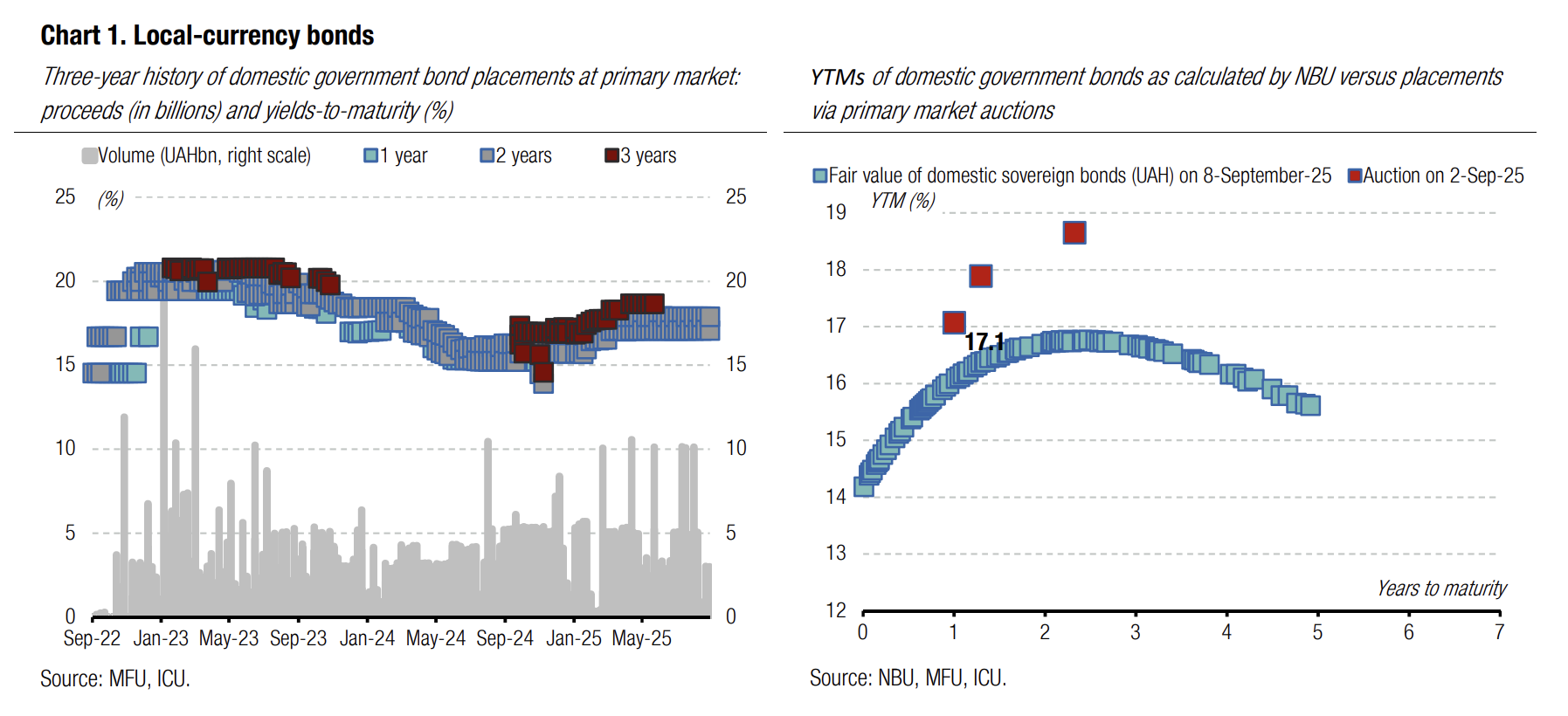

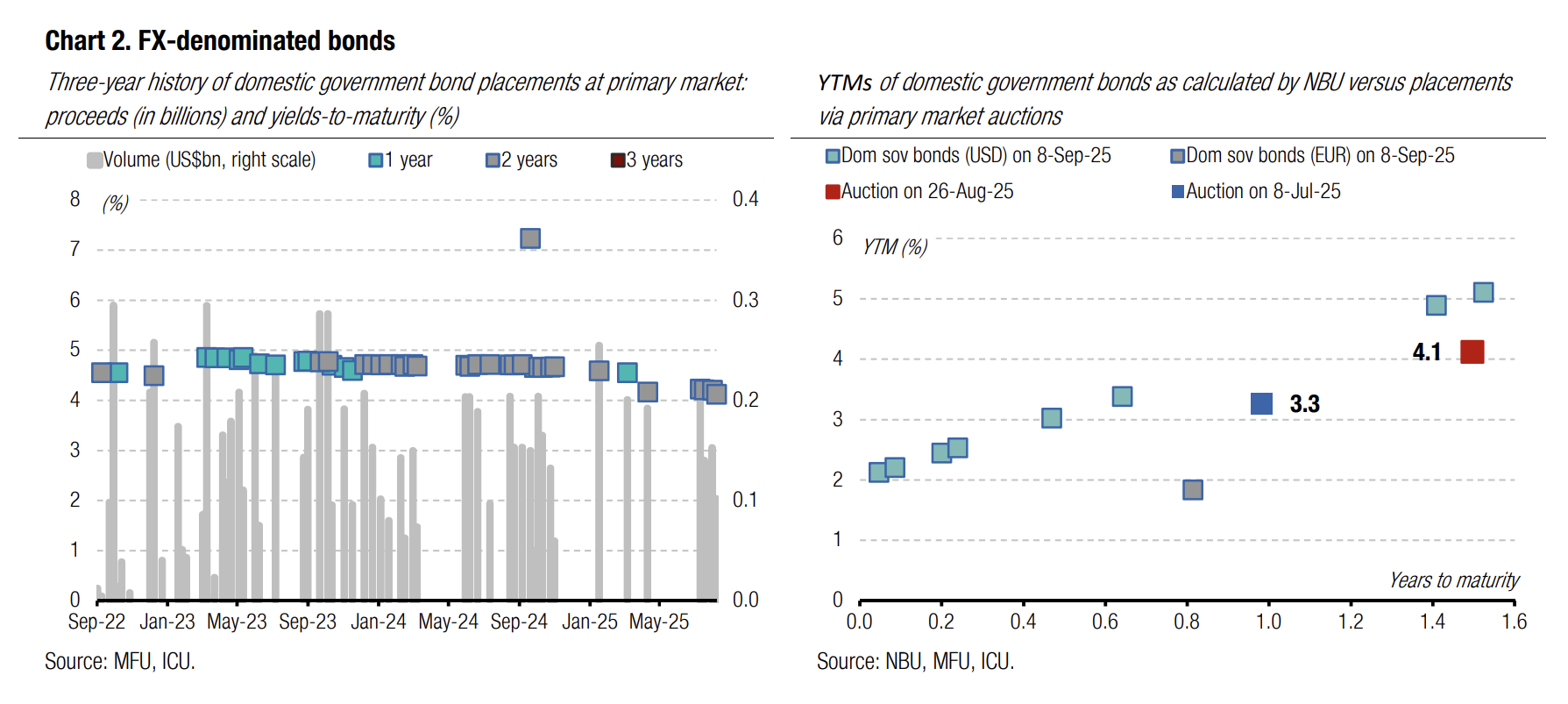

Bonds: MoF downsizes supply of reserve bonds in September

The Ministry of Finance will offer UAH5bn of reserve paper tomorrow. It does not plan to sell reserve bonds later this month.

The MoF announced a four-year reserve bond sale for tomorrow. This paper was first offered in early August, and the total size outstanding reached UAH15bn after two auctions. Tomorrow's offering will increase the total volume on the market to UAH20bn. Currently, this is only the placement of reserve securities scheduled for September.

Since the beginning of the year, the Ministry placed over UAH113bn of reserve bonds and redeemed only UAH59bn. If tomorrow's auction is factored in, the volume of new placements will twice exceed redemptions.

The total outstanding size of reserve bonds currently stands at almost UAH332bn at par value. Only UAH20bn will be redeemed before the year-end, namely this November.

ICU view: The offering of reserve bonds implies the current pace of placements of regular and military bonds is not sufficient. Last week, the Ministry of Finance raised just over UAH5bn via such UAH bonds (see auction review). However, the MoF is in no rush to place significant volumes of reserve bonds that banks can use to cover mandatory reserves, and apparently it plans to scale up sales in 4Q25. The NBU, for its part, also will likely encourage banks to buy more reserve bonds by raising reserve requirements and/or increasing the limits for including reserve government bonds in mandatory reserves.

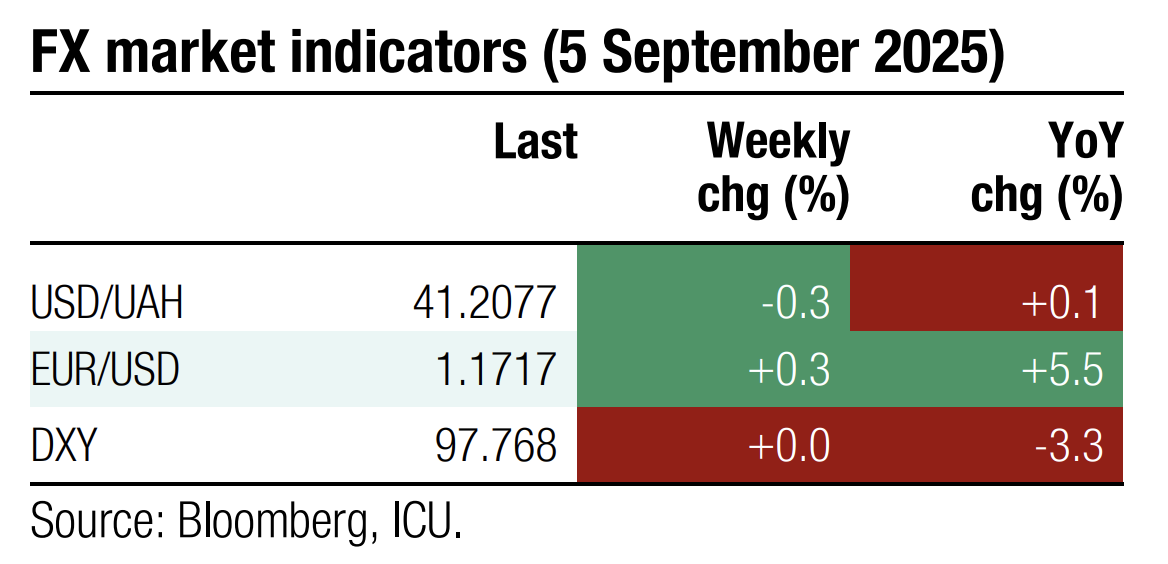

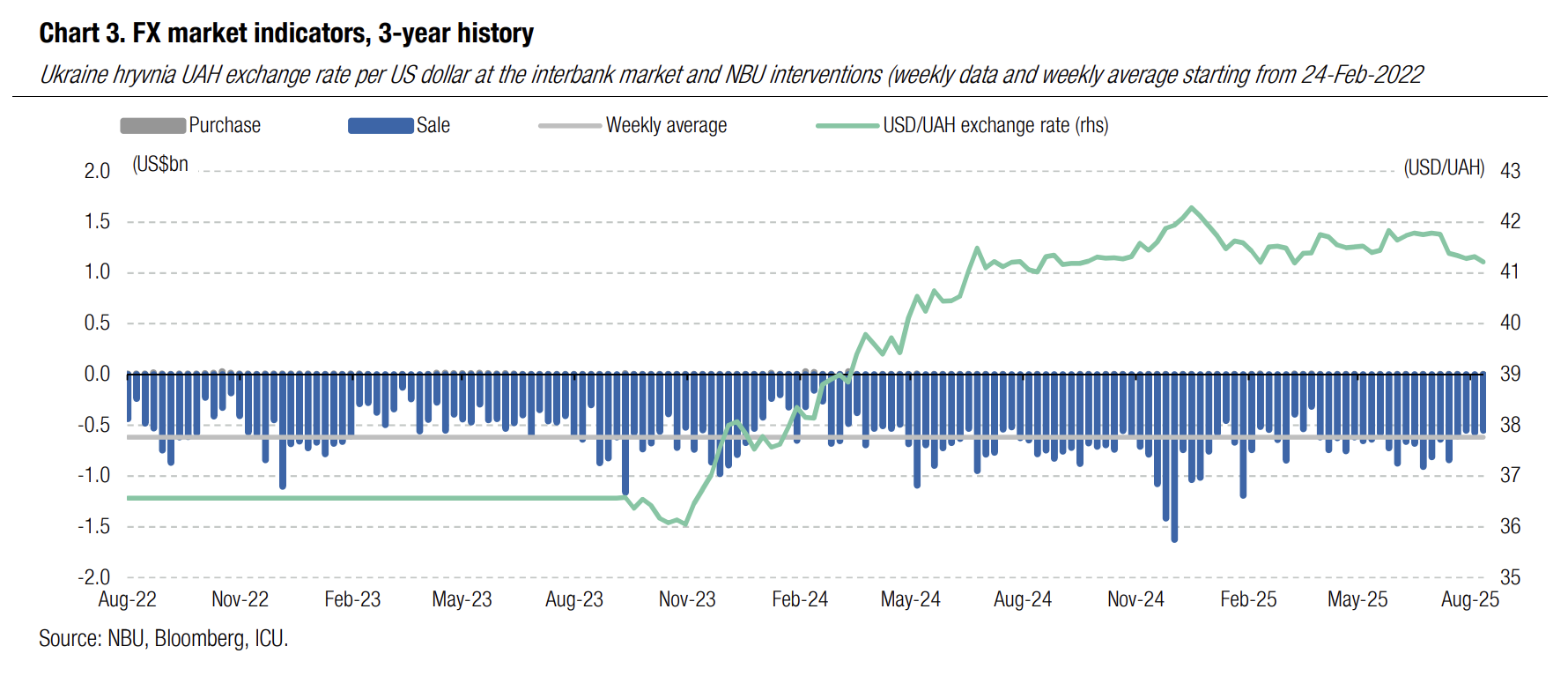

FX: NBU unexpectedly strengthens hryvnia on Friday

The National Bank kept the hryvnia at around 41.3 UAH/USD most of last week, but then strengthened it by more than UAH0.1 on Friday.

The hard currency shortage in the market was up by almost a third to US$390m on lower sales of foreign currency. The NBU sold US$551m from international reserves during the week. This implies that for the fourth week in a row, NBU interventions remained below the weekly average level since the start of the full-scale war.

The NBU maintained the official hryvnia exchange rate with nearly symmetrical fluctuations within 41.35-41.37 UAH/USD from Monday to Thursday. Still, on Friday, it strengthened the hryvnia to 41.22 UAH/USD, selling about US$120m from reserves on that day.

ICU view: The National Bank continues to keep the hryvnia exchange rate below UAH41.5/USD and has even deliberately pushed it closer to this year's high record in April. Most likely, the NBU will keep the hryvnia exchange rate close to current levels for some time, but may proceed with a moderate weakening later this year.

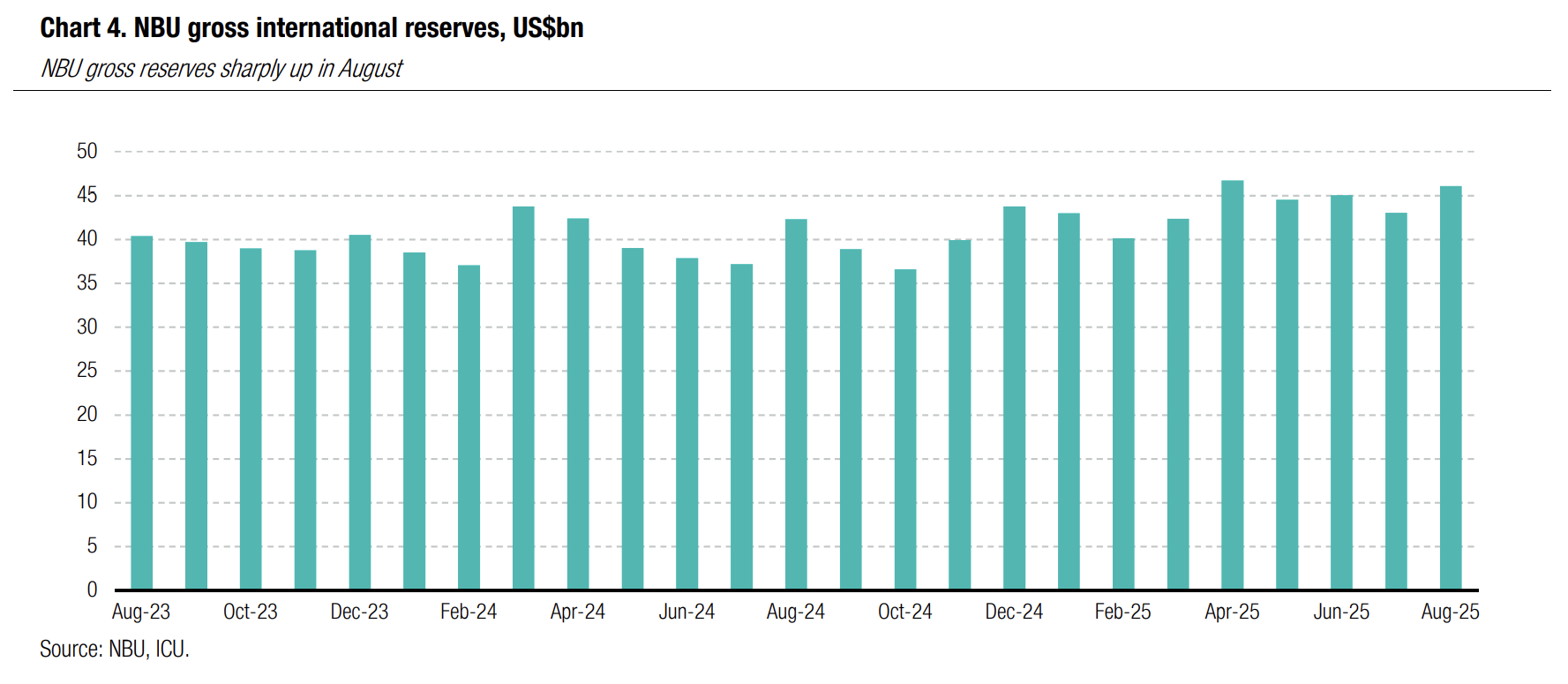

Economics: NBU reserves get boost in August

The gross international reserves of the NBU surged 7.0% in August and 5.1% in 8m25 to US$46.0bn.

Ukraine received a sizeable amount of foreign financial aid over the month, including $4.7bn via Ukraine Facility and ERA program and $1.1bn from the World Bank, which boosted NBU reserves. Meanwhile, the central bank spent $2.7bn on FX sale interventions in the market, and the country paid over $0.7bn on foreign debt service.

ICU view: NBU reserves got an expected boost from an upsurge in inflows of foreign financial aid. We expect the trend to continue through end-2025 with new net inflows of foreign aid exceeding NBU’s outlays for FX interventions and debt service. We see end-2025 NBU reserves exceeding $55bn thus empowering the NBU to keep the FX market and hryvnia exchange rate under full control at least over the next 12 months.