|  |

|  |

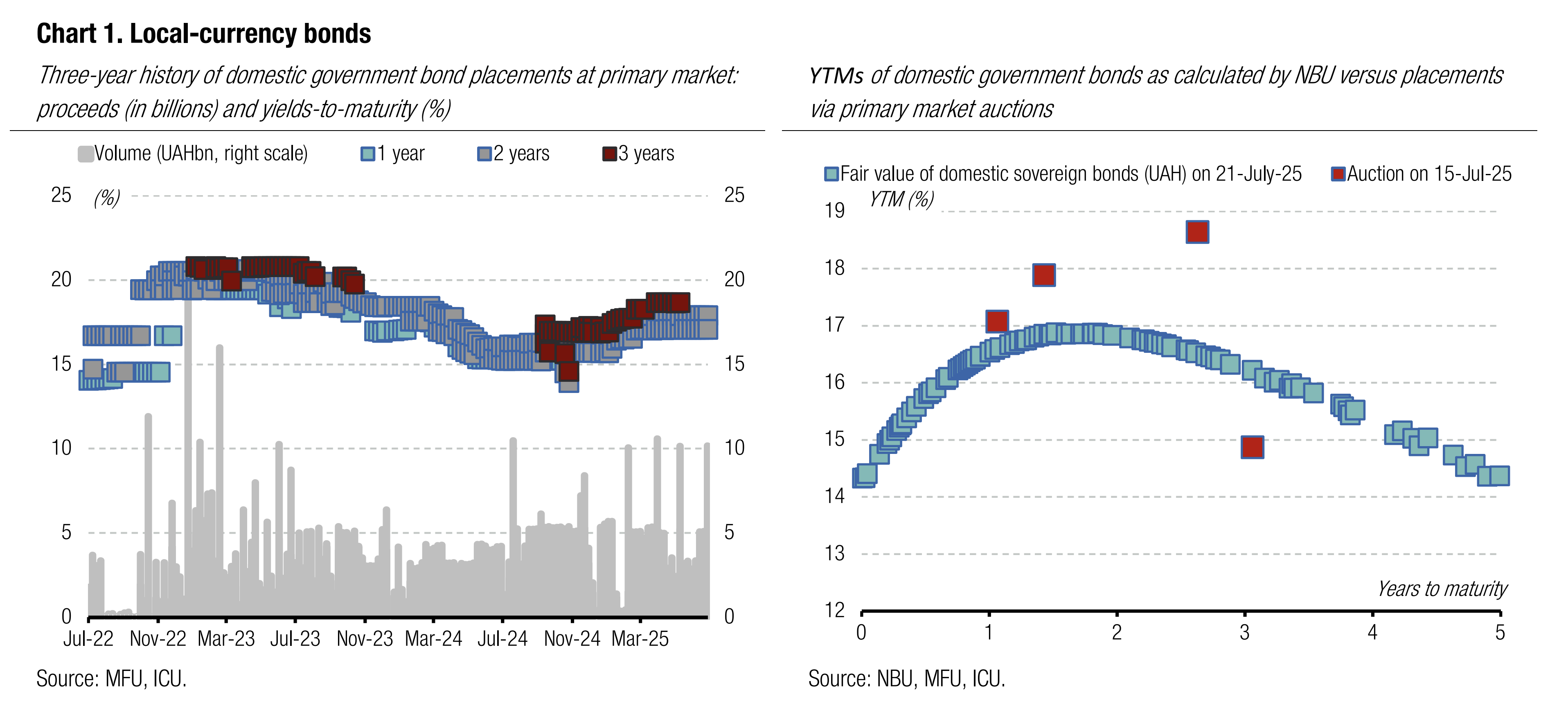

Bonds: MoF increases borrowings via reserve bonds

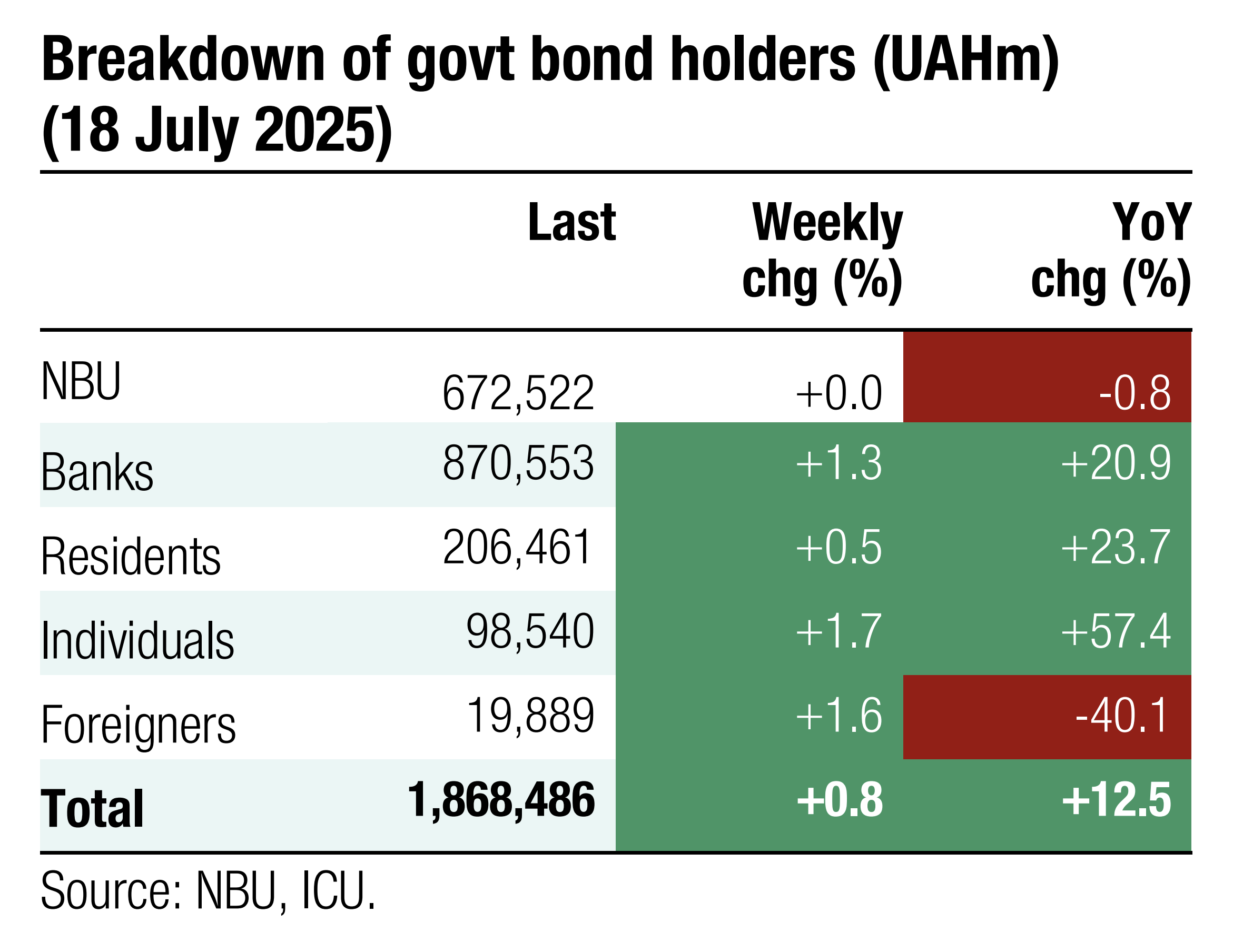

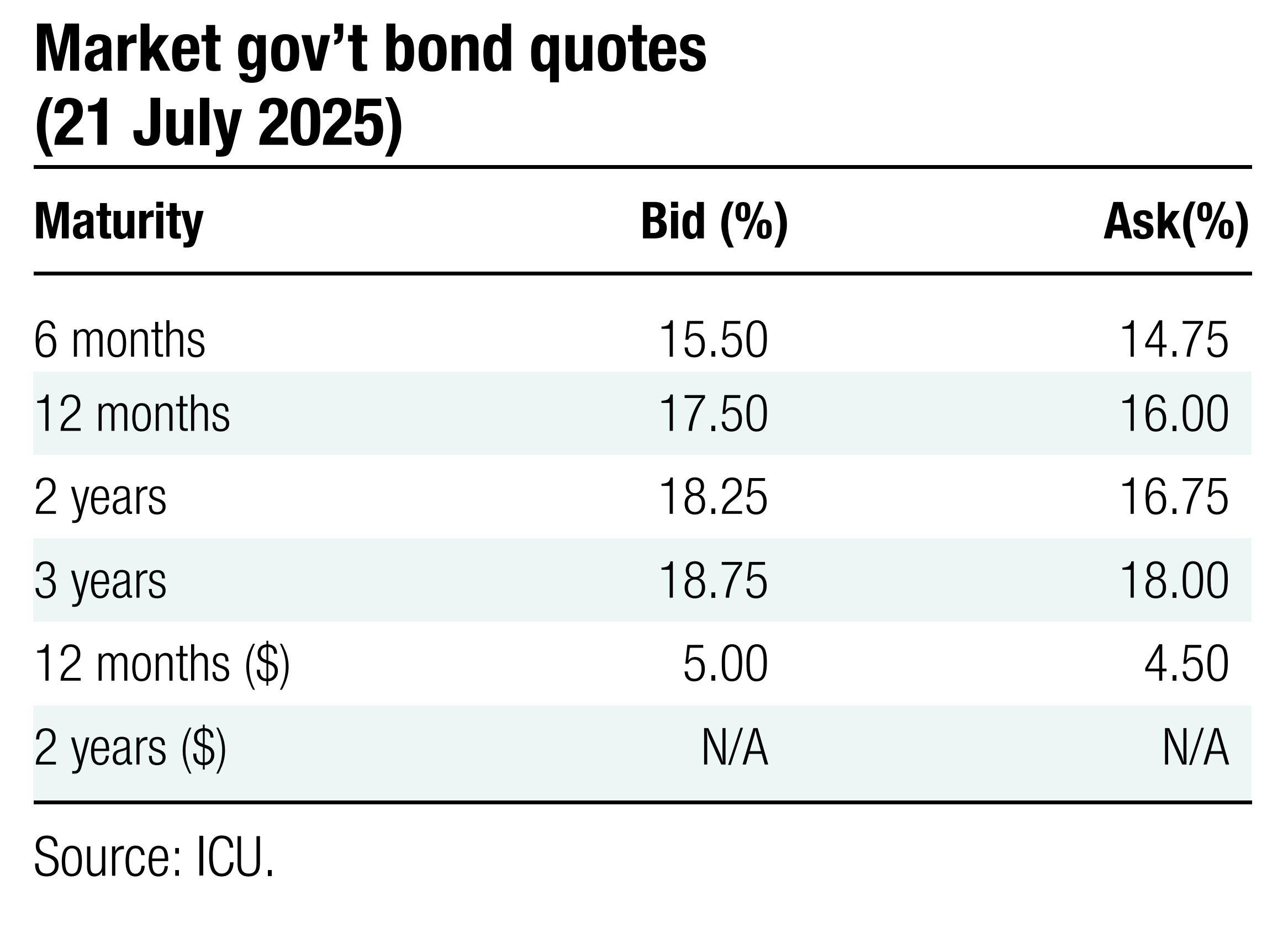

The MoF sold UAH10bn worth of a new four-year note last Tuesday, which will most likely be added to the list of reserve bonds. Tomorrow, the MoF will offer the same paper with a UAH10bn cap.

Last week, the MoF offered a new four-year paper with a UAH10bn cap and received 5x oversubscription: 69 bids for a total of UAH52bn with interest rates of 13.95-15.25%. The MoF satisfied only 33 bids, some only partially. See details in the auction review. New notes accounted for an almost quarter in secondary market turnover.

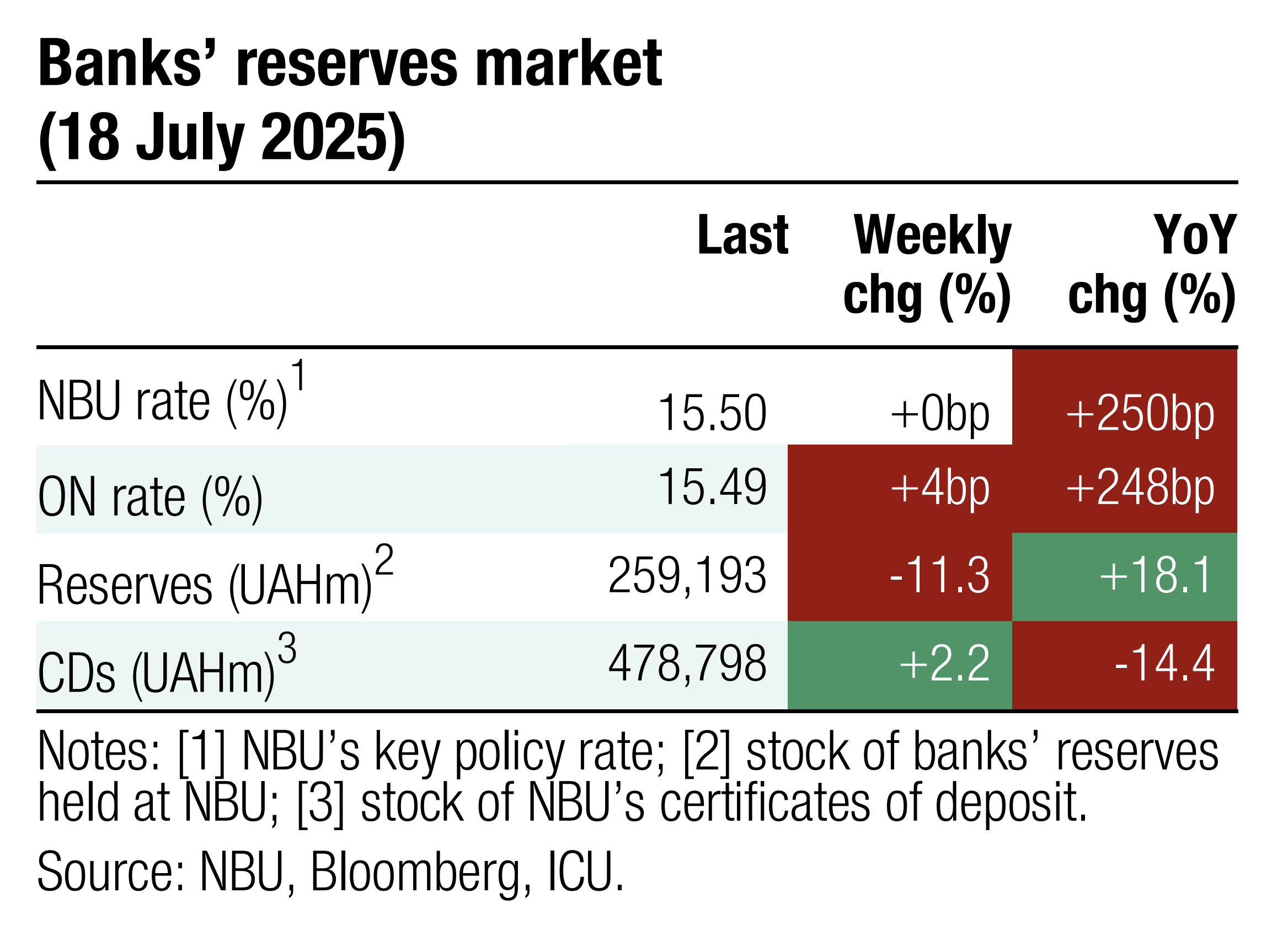

Currently, there are 17 bonds (including last week's issues) that banks can use to meet part of mandatory reserve requirements for a total of UAH319bn (at par). We expect the tomorrow's offering of the same four-year paper to also be oversubscribed. There is no doubt the MoF will be able to place the whole proposed amount of UAH10bn while trying to push the rate down slightly. The next redemption of a reserve bond of UAH13bn is scheduled for early August.

ICU view: The MoF increased borrowings, but it had to make a shift towards reserve bonds. It now prefers the classic placement to swap auctions that it tested in April and June. The MoF likely needs to close temporary liquidity gaps without resorting to its stock of FX holdings. In August, the MoF can offer yet another 4-year paper to replace a reserve bond that matures at that time.

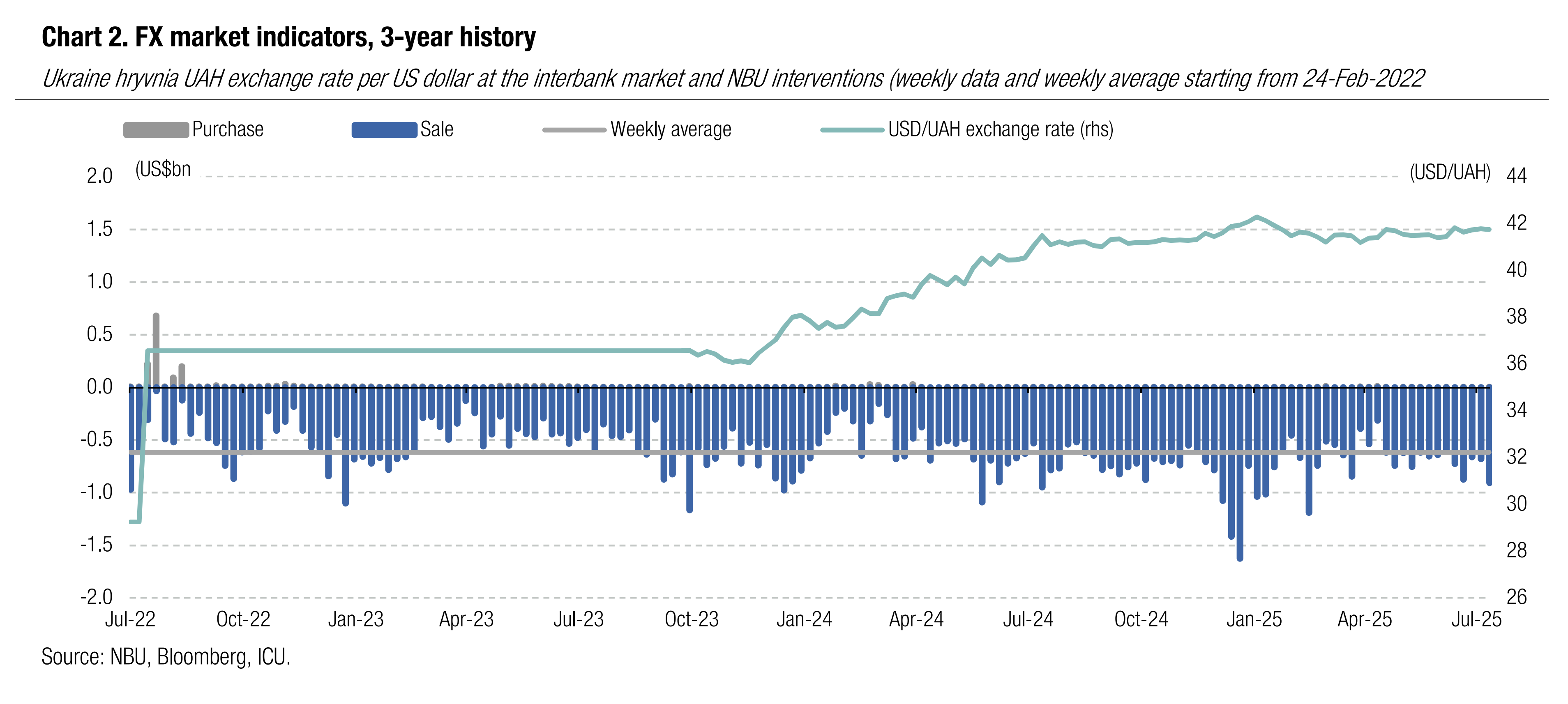

FX: NBU fully offsets spike in FX demand

Demand for foreign currency rose sharply last week, prompting the NBU to increase interventions to a five-month high.

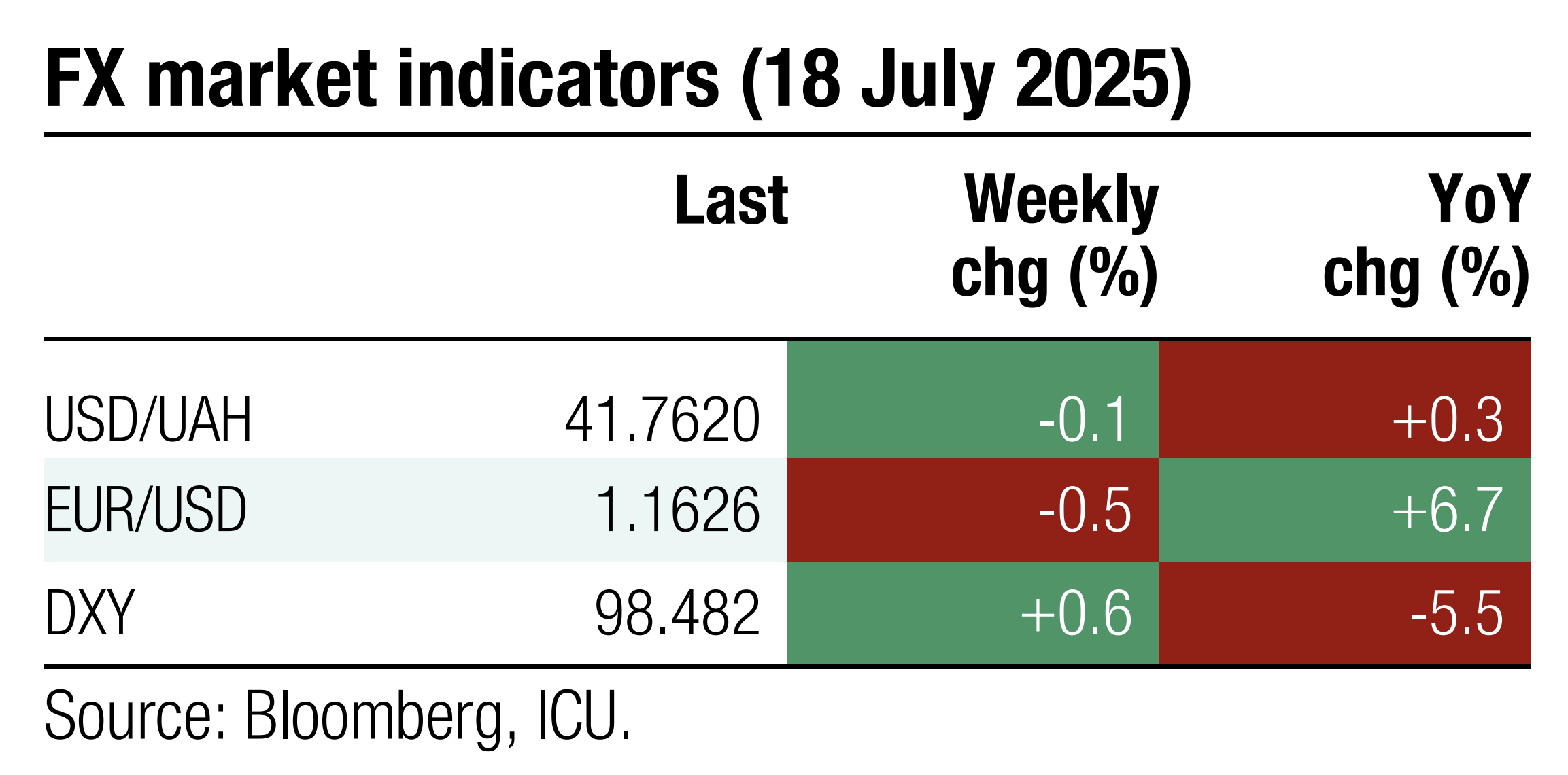

The hard currency shortage in the interbank FX market nearly doubled last week to US$558m, with the largest gap seen on Tuesday, when banks' clients purchased US$455m. In the retail segment, net hard currency purchases declined to US$31m, the smallest weekly amount this summer.

The NBU kept the hryvnia exchange rate above UAH41.8/US$ until Thursday, but allowed it to appreciate to UAH41.75/US$ on Friday, taking it back to the level seen a week ago.

ICU view: The FX shortage rose due to a larger demand and the regular mid-month decline in hard currency sales. Therefore, the NBU had to increase interventions significantly, but they were still below this year's maximum of US$1.2bn seen in February. The spike in demand was most likely temporary and related to payments for government import contracts. We do not anticipate the NBU changing its exchange rate policy stance in the near future, and it will keep hryvnia close to UAH41.8/US$ in following weeks.

Economics: A race to secure more budget funding for 2026

The government has to secure an additional US$10-15bn in funding for 2026 on top of the existing commitments of the foreign partners.

Key points of our new macro review, published last Wednesday, are given below.

Economic growth to remain slow as the economy will struggle to increase the stock of available resources, capital and labor, in the near future. The recovery will be supported by private consumption on the back of surging incomes in the private sector. Meanwhile, government consumption will remain a drag due to a gradual fiscal consolidation. Additionally, lower-than-expected harvest prompts a downgrade in our 2025 GDP growth forecast to 2.5%.

The key near-term challenge for the government is to secure an additional US$10-15bn in funding for 2026 on top of the existing commitments of the foreign partners. We expect the IMF will substantially revise its unrealistic baseline scenario for the BoP and budget during the next review in December 2025 and will use much more conservative assumptions admitting the need for more external funding.

Inflation sharply reversed the trend since June, and we expect it will keep decelerating robustly in the coming months. The NBU will remain very cautious in its shift to monetary-policy loosening, partly due to sustained huge imbalances in the FX market. We now expect only two key policy rate cuts for a combined 100bp through end-2025. We don’t expect the CPI to return to the NBU target next year or in the foreseeable future due to rapid growth in the prices for services against the backdrop of a tight labor market.

We upgrade our projection of end-2025 exchange rate to UAH42.6/US$ from 43.5 previously. We have seen little appetite from the NBU over the past year to weaken the hryvnia. If the government finds US$10bn of additional funding for 2026, the NBU will have all the necessary resources to keep the hryvnia strong through end-2026. We, thus, expect insignificant hryvnia depreciation in 2026 as well. The NBU reserves will spike to above US$55bn this year, but will take a U-turn back to the US$40-45bn range in 2026.

Our analysis assumes no major breakthrough in terms of a ceasefire in the near future. Even if a peace agreement is signed, that is unlikely to bring credible relief leading to a sustained improvement in business sentiment. This implies the revised baseline scenario in the IMF program in December 2025 will be close to the current downside scenario.