|  |  |

The Ministry of Finance has already raised UAH29bn in two auctions, selling UAH5bn of reserve bonds.

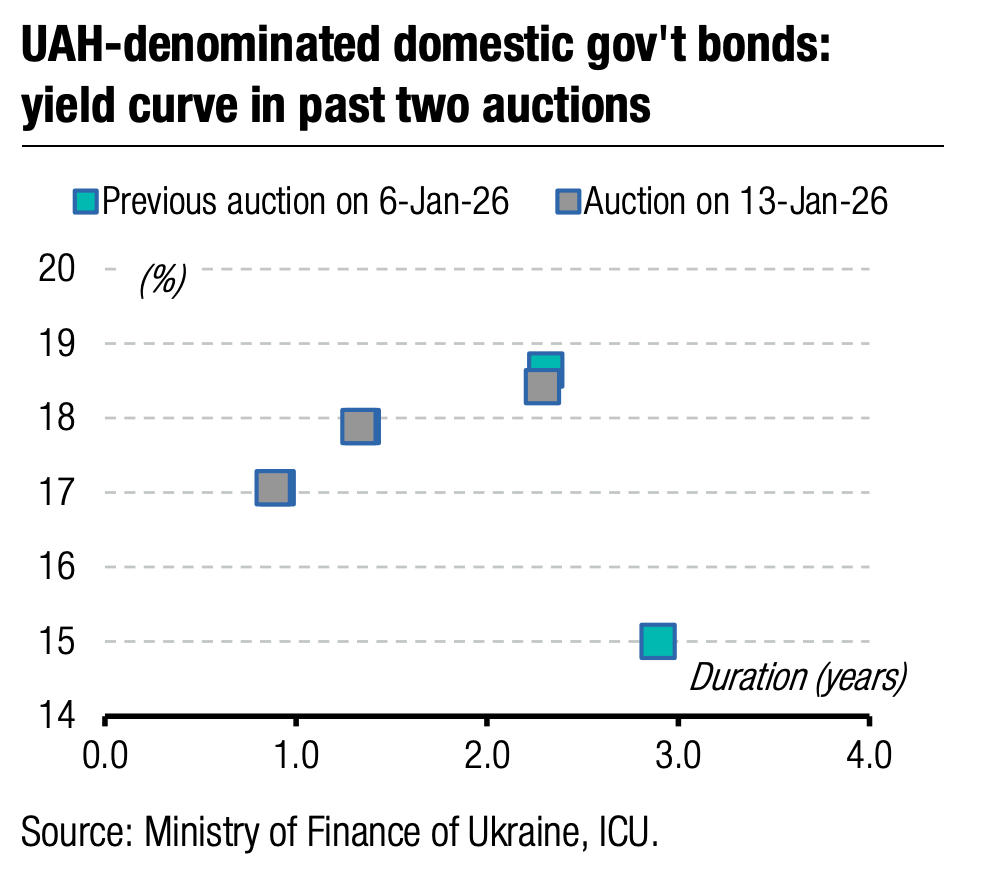

Last week, the MoF raised UAH16.1bn for the budget, a third of which came from a new bond maturing in July 2029. The MoF will hold an exchange auction today, where it will offer an additional UAH20bn of new 2029 bonds to swap the reserve bond maturing this February.

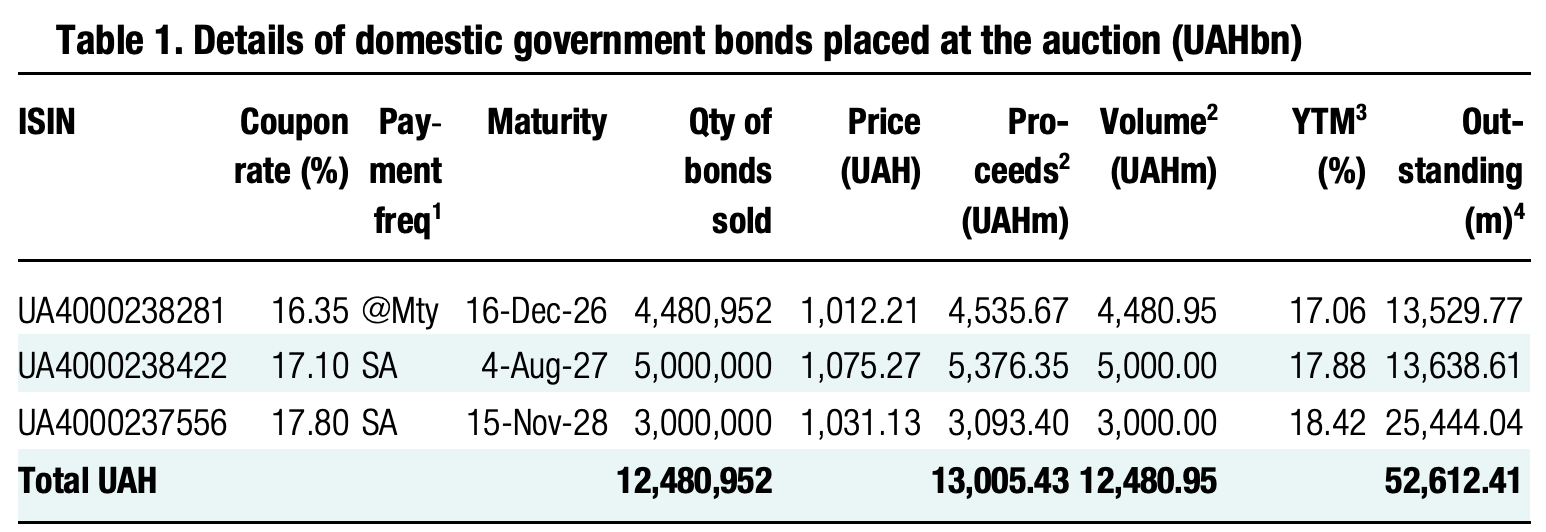

Yesterday, borrowings from military and regular bonds increased to UAH13bn.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.53/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The Ministry sold almost UAH4.5bn of annual military bonds, raising UAH4.5bn of funds without significant changes in interest rates - only the weighted average rate slid by 1 bp.

The 19-month bond maturing in August next year was oversubscribed for the first time, and a similar maturity was oversubscribed for the first time since October last year. Since the yields in the bids were typical for such paper, the MoF satisfied all of them.

Yesterday, the Ministry completed the placement of three-year bond maturing in November 2028. The MoF offered only UAH3b of these bonds, receiving over UAH10.2bn of demand with quite diverse yields - from 17.5% to 17.8%. Given the cap, the MoF satisfied only 17 out of 35 bids, lowering the cut-off rate to 17.7% and the weighted average rate to 17.59%. It is noteworthy that the outstanding bonds reached over UAH25bn, which may become a new standard outstanding for UAH-denominated bonds.

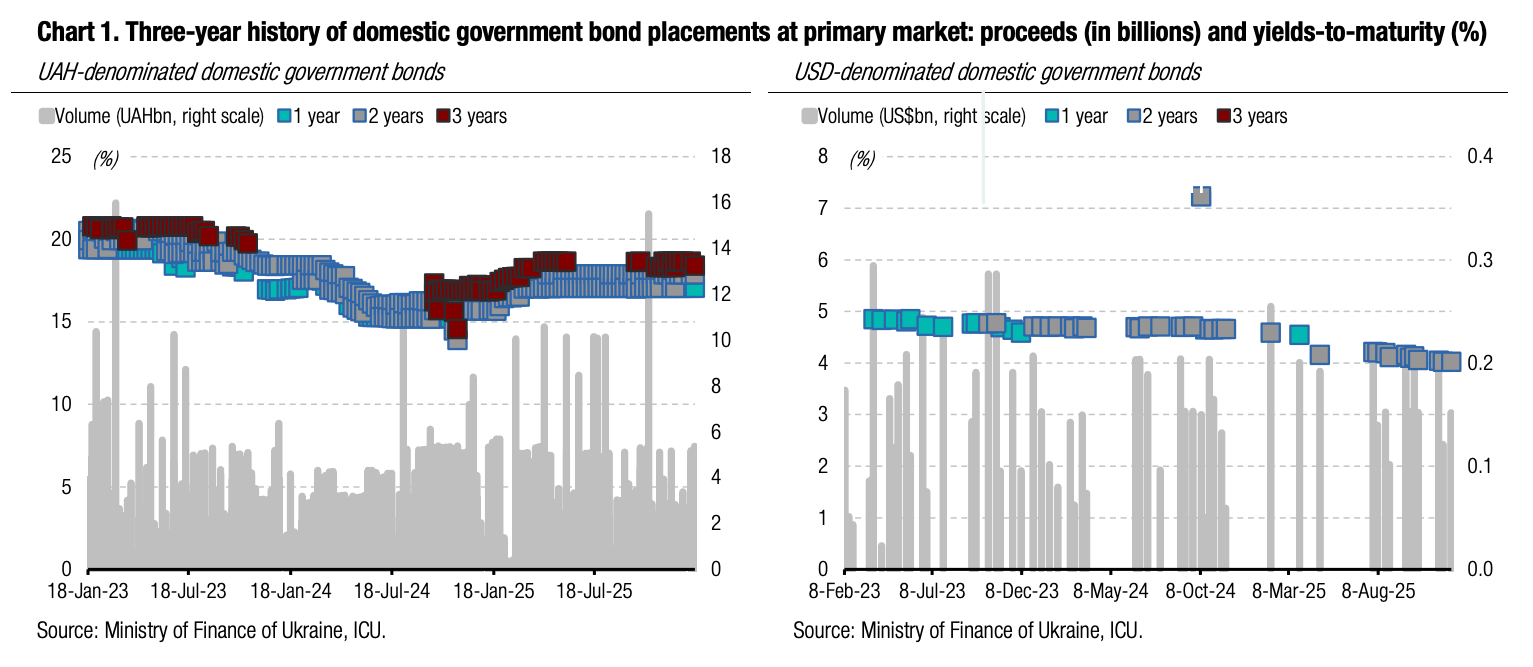

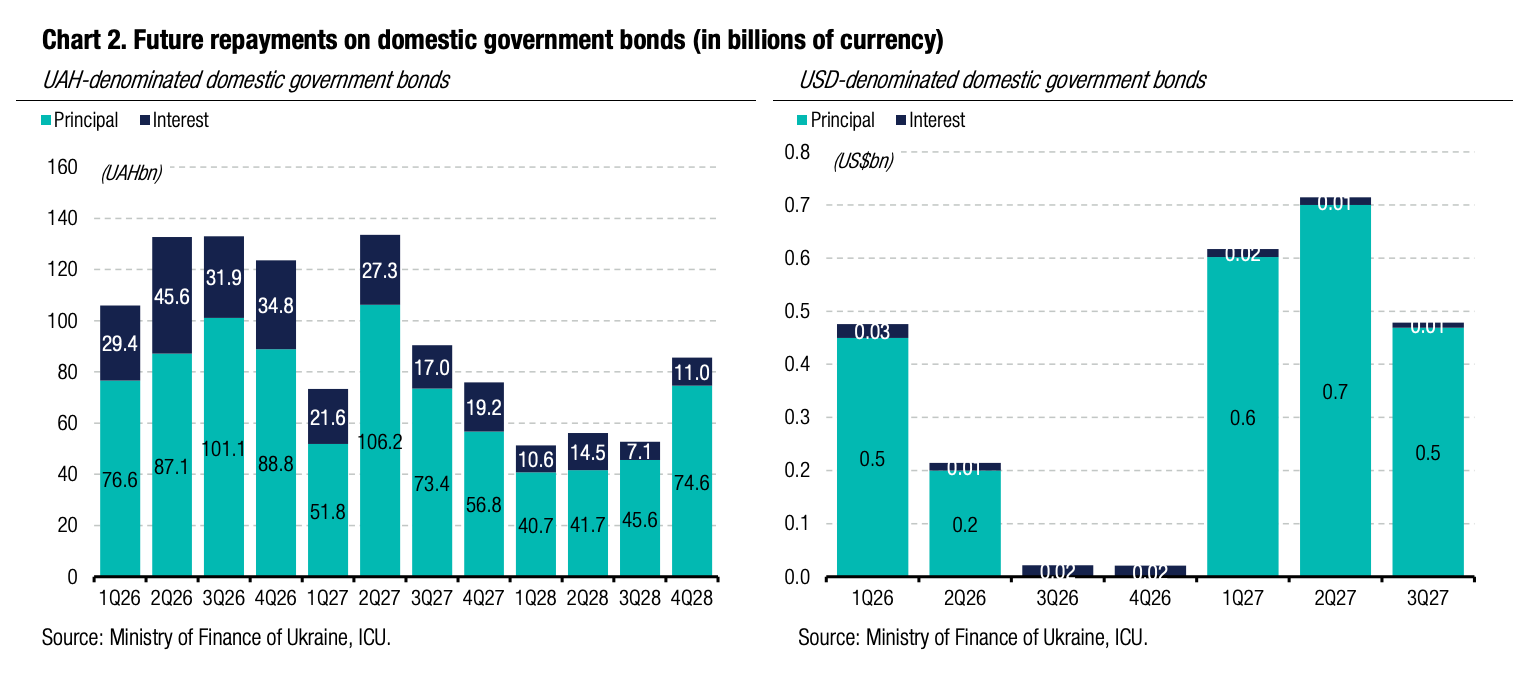

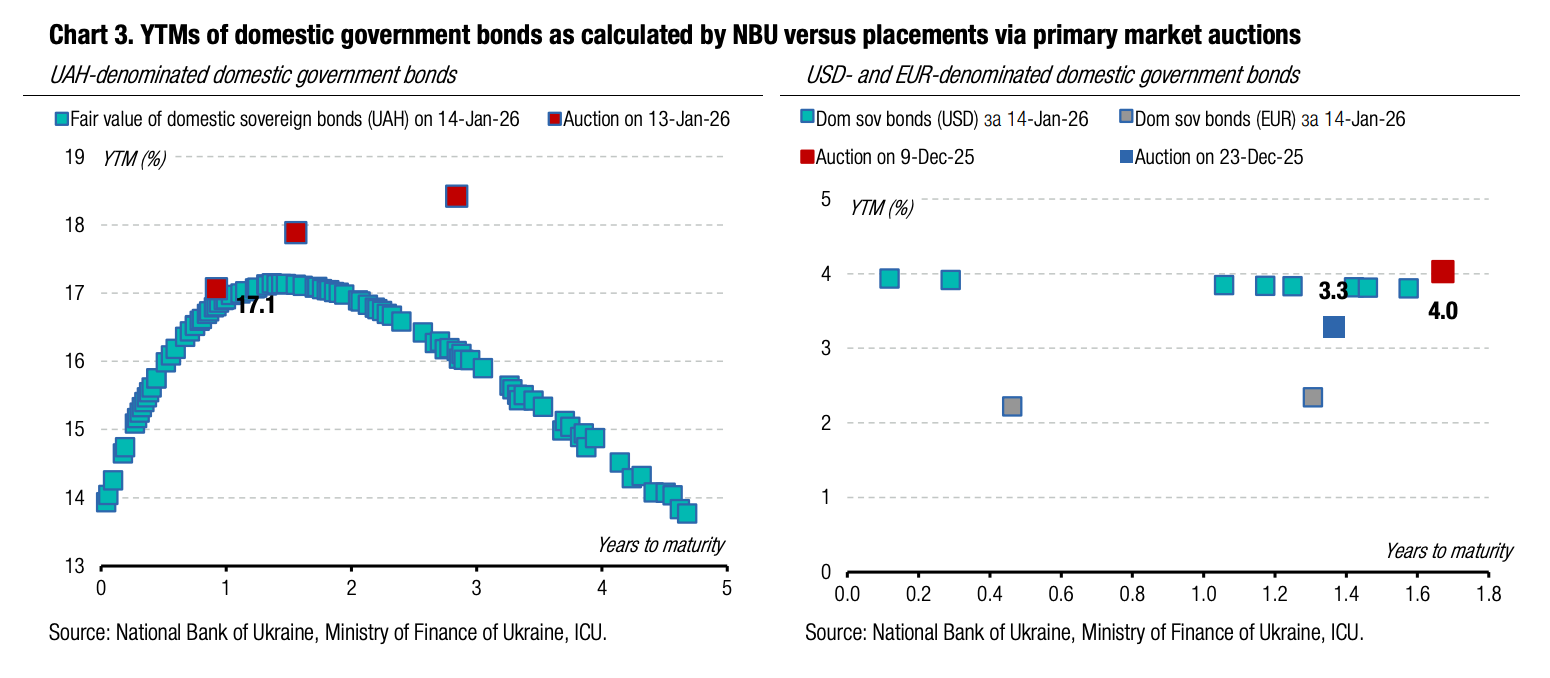

Appendix: Yields-to-maturity, repayments