|  |  |

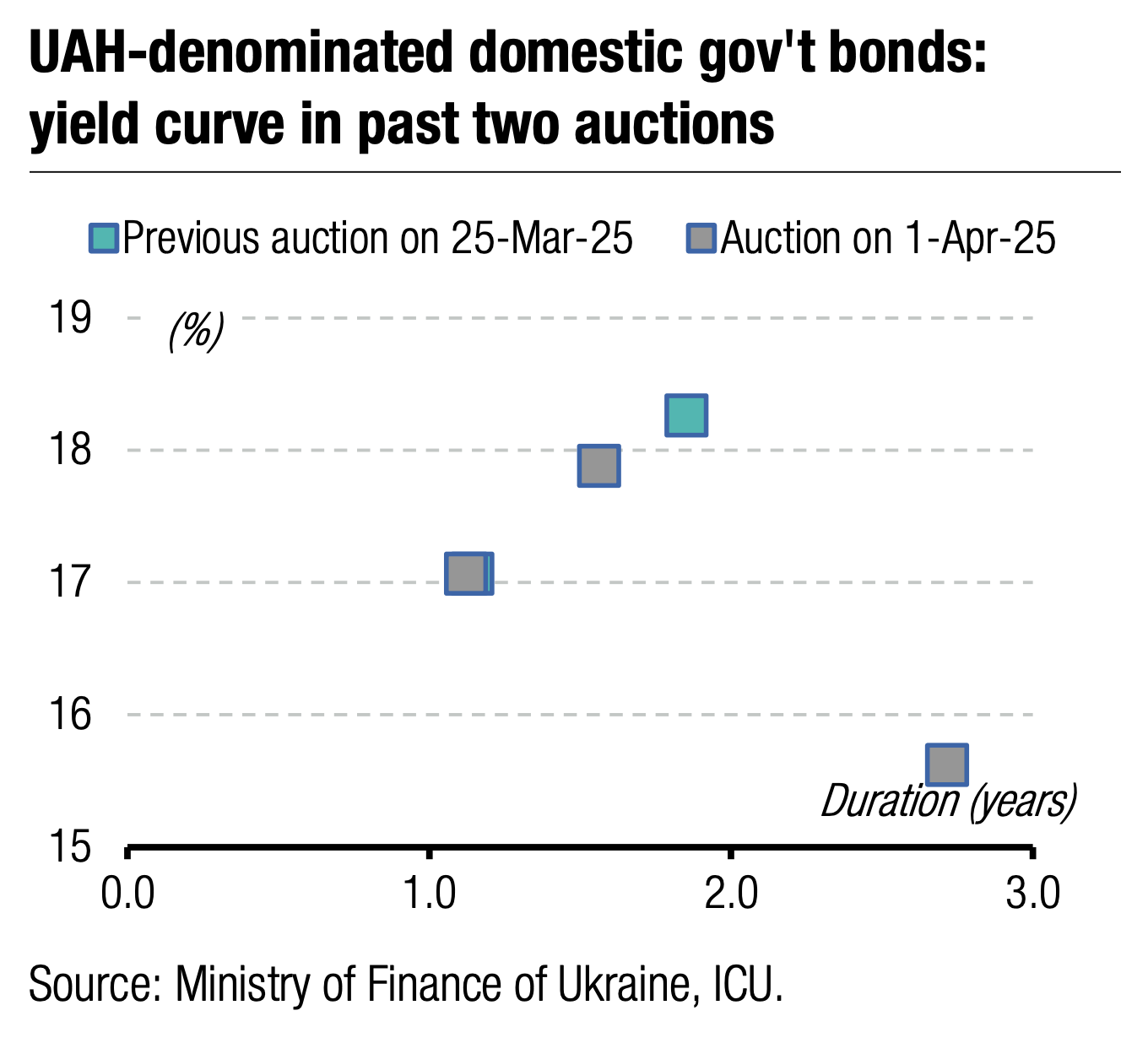

The Ministry of Finance refused to raise interest rates on two-year bonds and continued to lower yields on reserve bonds.

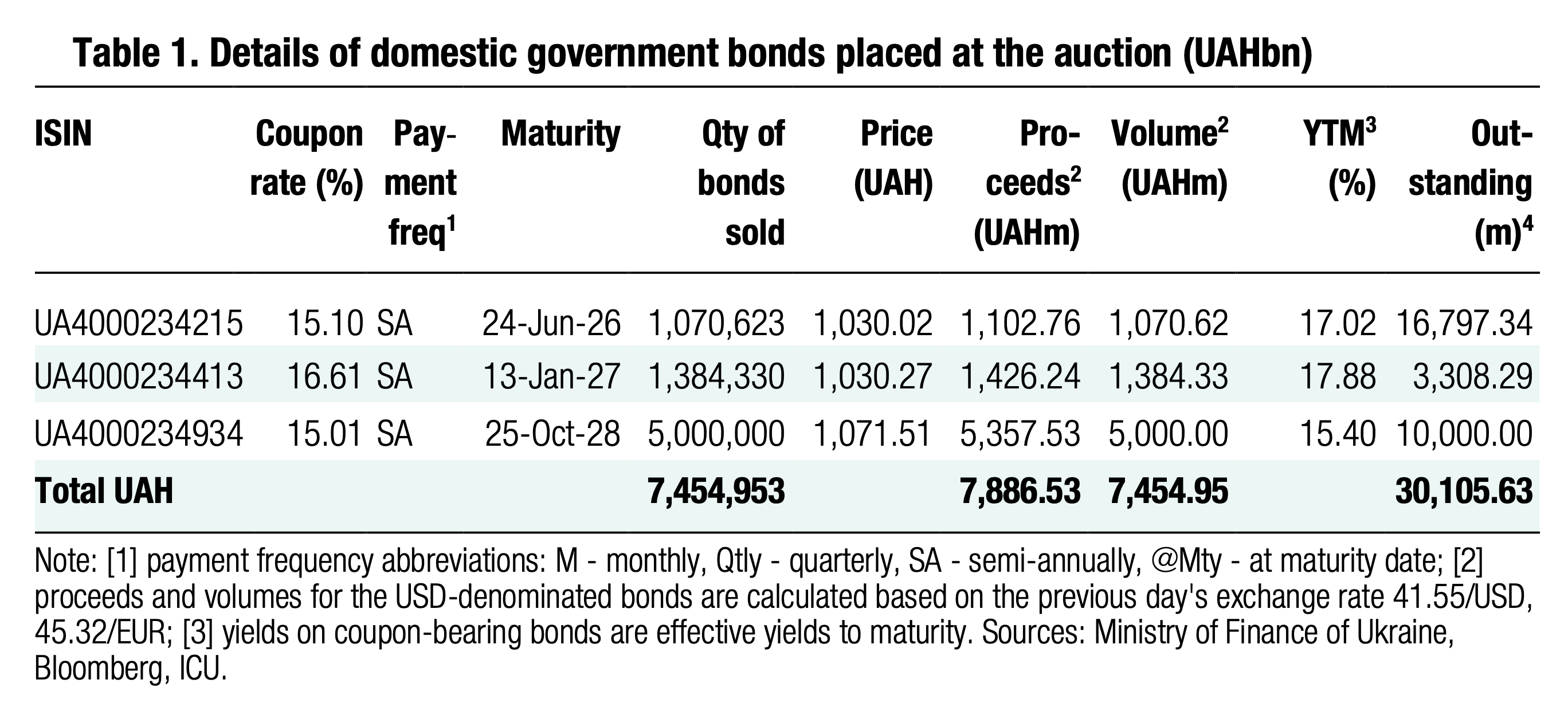

The MoF again sold a 15-month military bill without changing the cut-off rate. The amount in demand increased slightly with an increase in the number of bids. As a result, the cut-off rate remained at 16.35% for the fifth week, while the weighted average rate slid by 4bp to 16.31%.

Demand for almost two-year paper also rose by 40% to almost UAH2.9bn. However, a significant part of this demand was in five bids that requested the MoF increase the cut-off rate to 17.75%. The MoF satisfied 23 out of 28 bids, refusing to raise rates above 17.1%, and sold just UAH1.4bn of bonds.

At the same time, demand for reserve notes plunged. Yesterday, oversubscription decreased from more than 7x last week to 5.5x, while the number of submitted and satisfied bids increased. The range of rates in bids shifted from 14.9-16.2% to 14.74-15.59%, and the MoF satisfied only bids with rates no higher than 14.95%. The cut-off rate dropped by 55bp, and the weighted average rate by only 20bp to 14.81%.

Banks are especially competing for the new three-year note, which will soon become a reserve paper. The demand is most likely inflated, as placement participants may submit multiple bids with different rates. At the same time, military and regular bonds are less interesting to investors.

Appendix