|  |  |

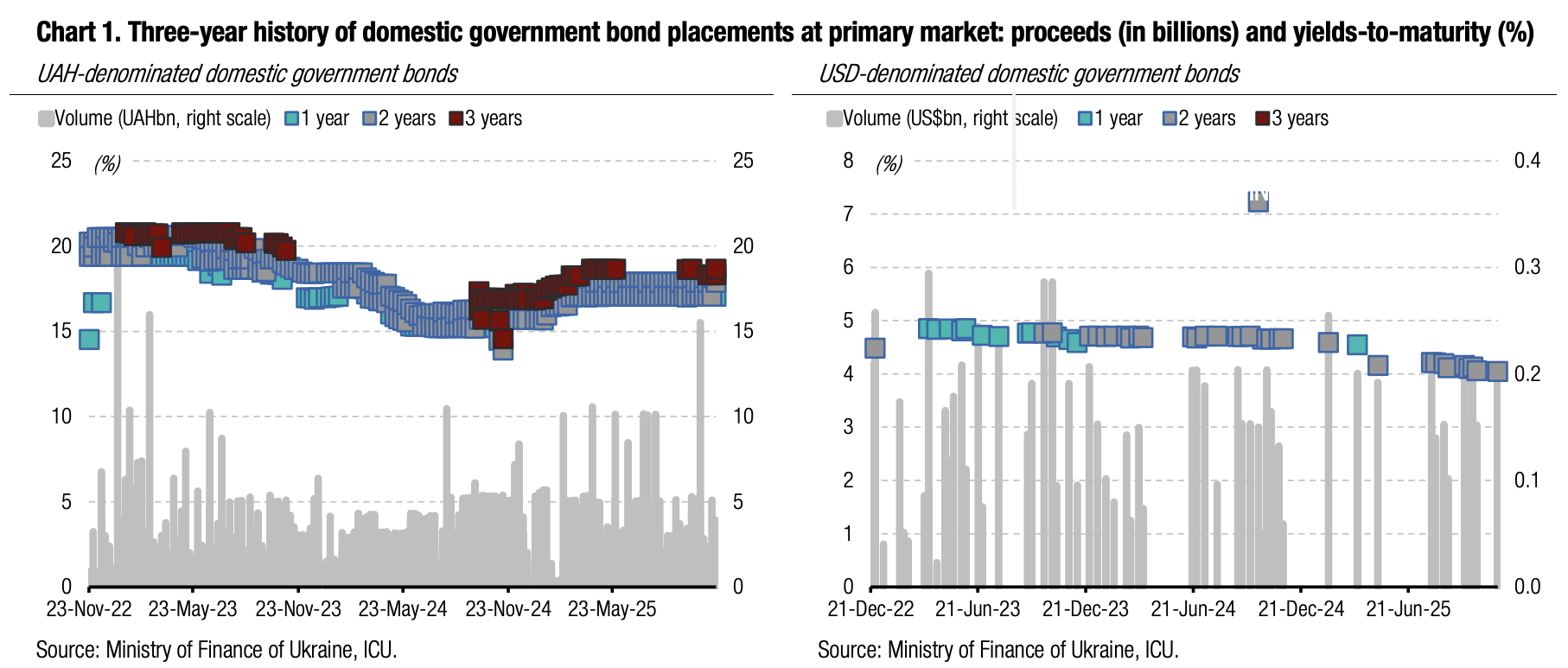

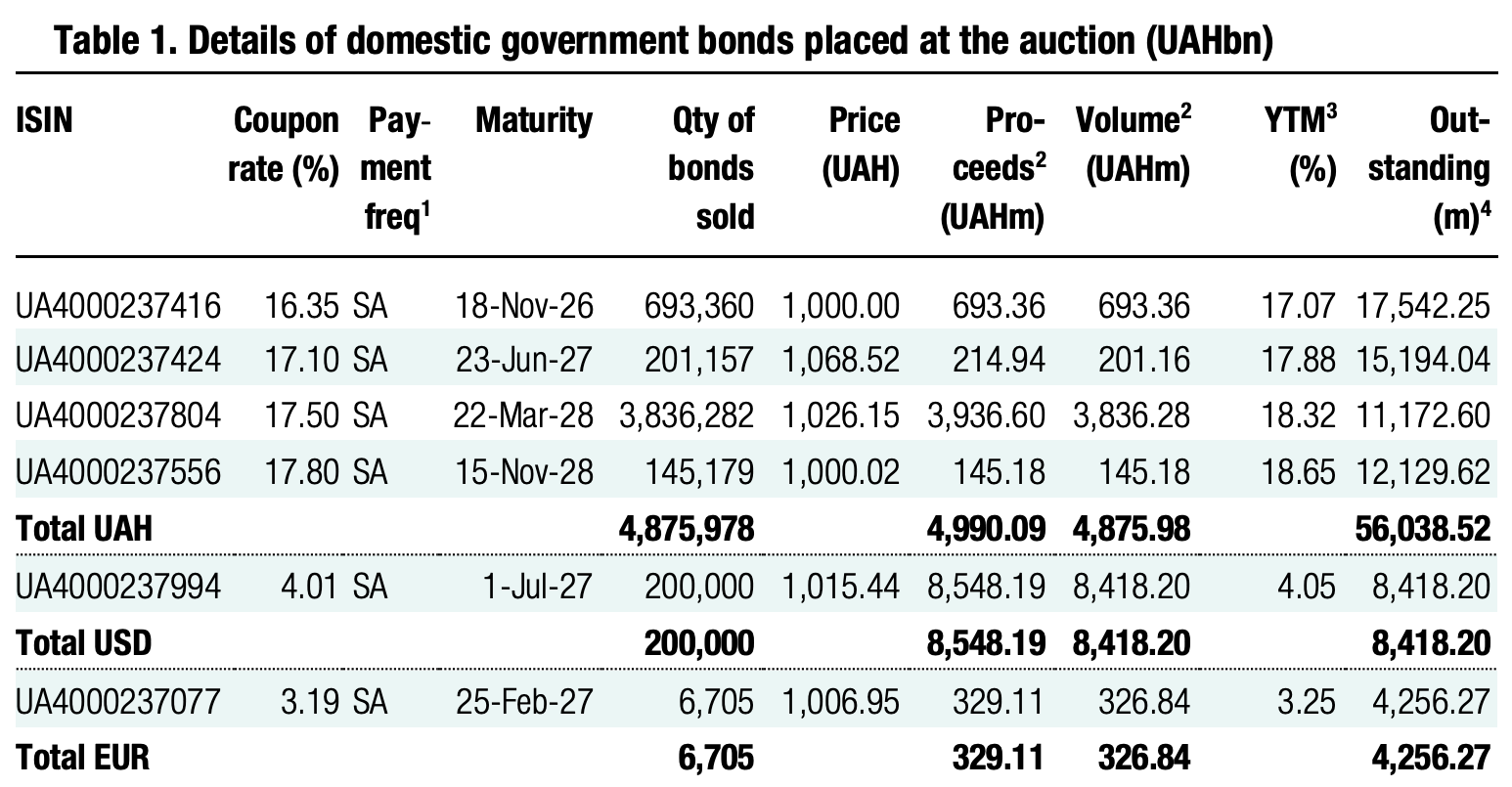

Interest in UAH bonds decreased again, as investors have shifted their focus to USD-denominated and EUR-denominated securities. Most proceeds for the budget were from USD-denominated bills and UAH military bonds maturing in 2028.

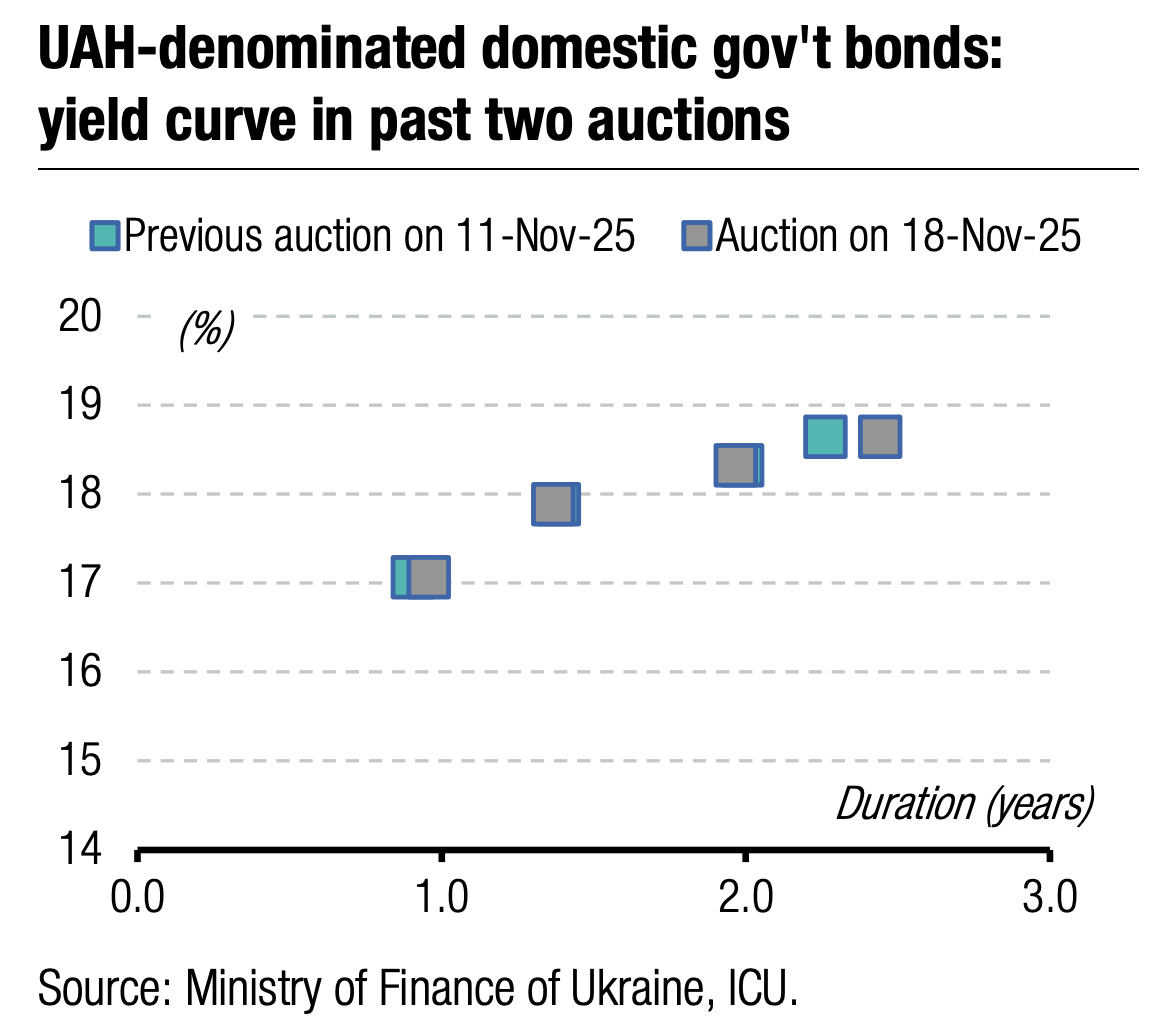

Although one-year military paper received considerable interest, it was only for UAH0.7bn, one-third of last week's demand. Interest in ordinary 19-month paper decreased by almost a third WoW to UAH0.2bn in only two bids. The volume of bids for the three-year note fell significantly, from UAH1.2bn last week to UAH145m yesterday.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.09/USD, 48.75/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Demand for the two-year military paper maturing in 2028 also declined, but only to UAH3.8bn from almost UAH6.3bn a week ago. All UAH instruments received bids at the usual yield levels, so the maximum satisfied and weighted average rates remained unchanged.

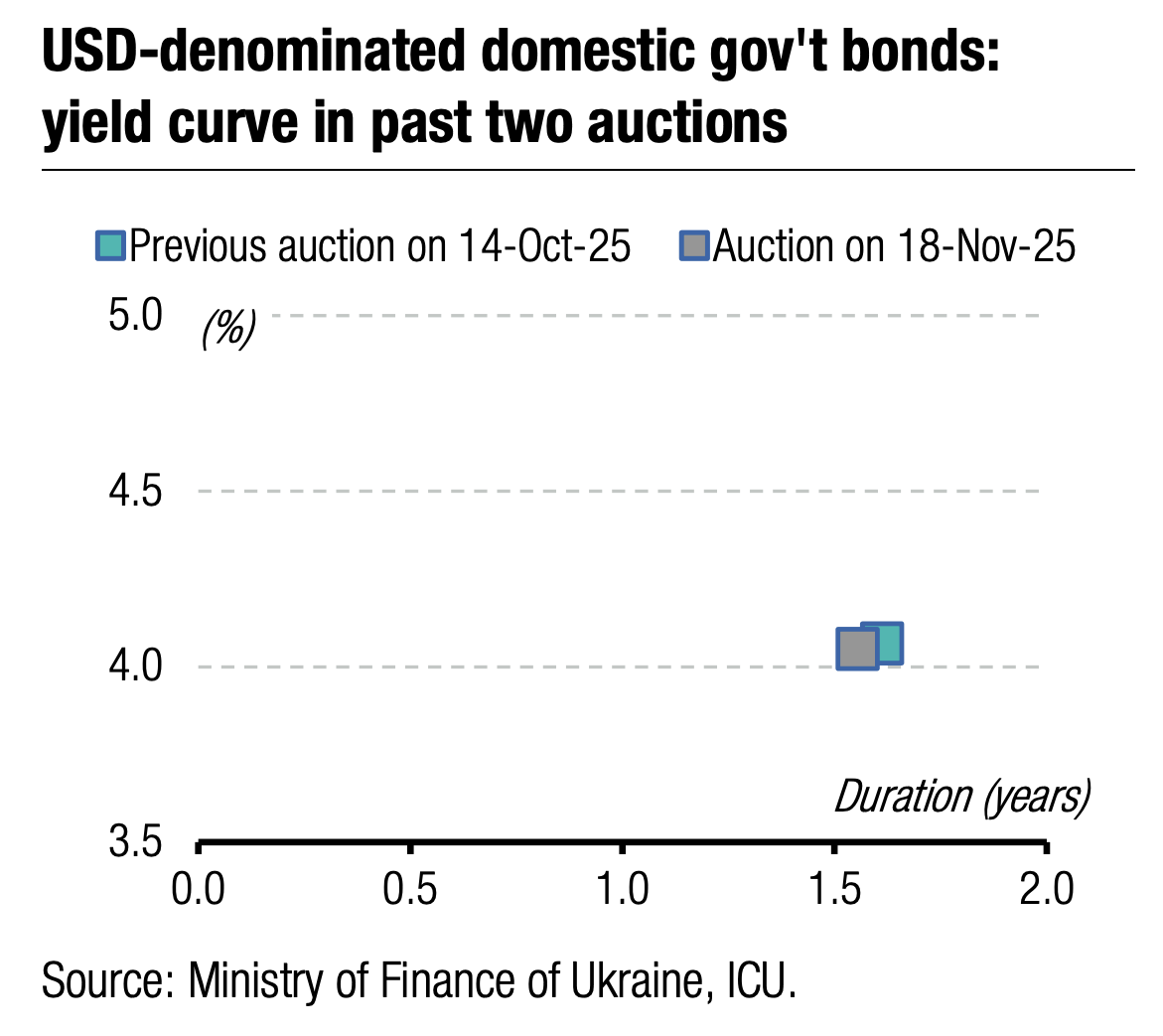

At the same time, there was considerable interest in FX-denominated bonds. USD-denominated bills collected almost US$232m in 83 bids, which was US$32m more than the cap. Therefore, the Ministry of Finance had to reject two bids with high rates and distribute the offering among the remaining participants. Participants with non-competitive bids (satisfied at the weighted average rate) received 30% of the cap or US$60m. Participants with the lowest bid rates got the requested volume of bonds. The remaining bonds the MoF distributed among participants who submitted bids at the cut-off rate. Therefore, a significant number of participants received fewer bonds than they wanted to purchase.

The last time the Ministry of Finance sold bonds in euros was in early September, but yesterday they received little demand, only EUR6.7m in 14 bids. Given that the bids were with yields not higher than the cut-off rate of the last auction, the MoF satisfied all of them.

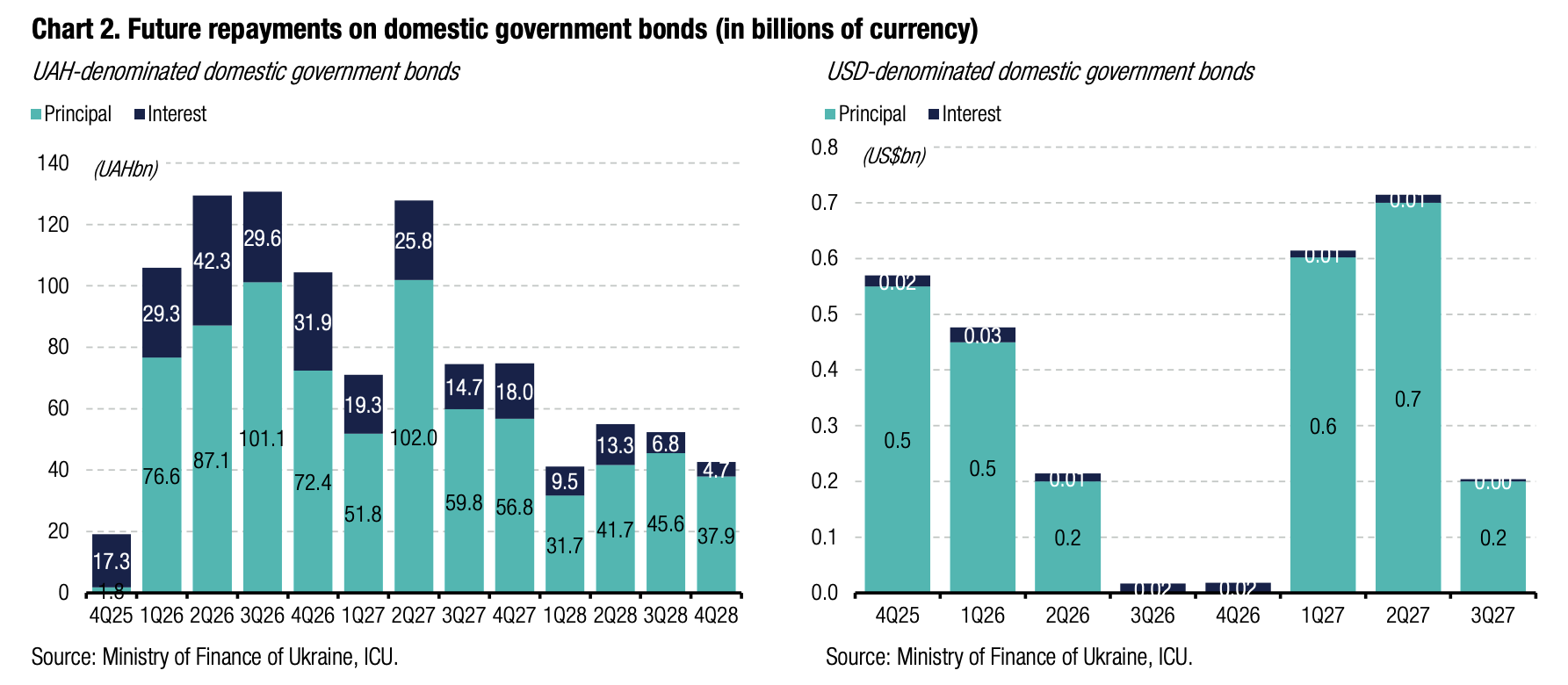

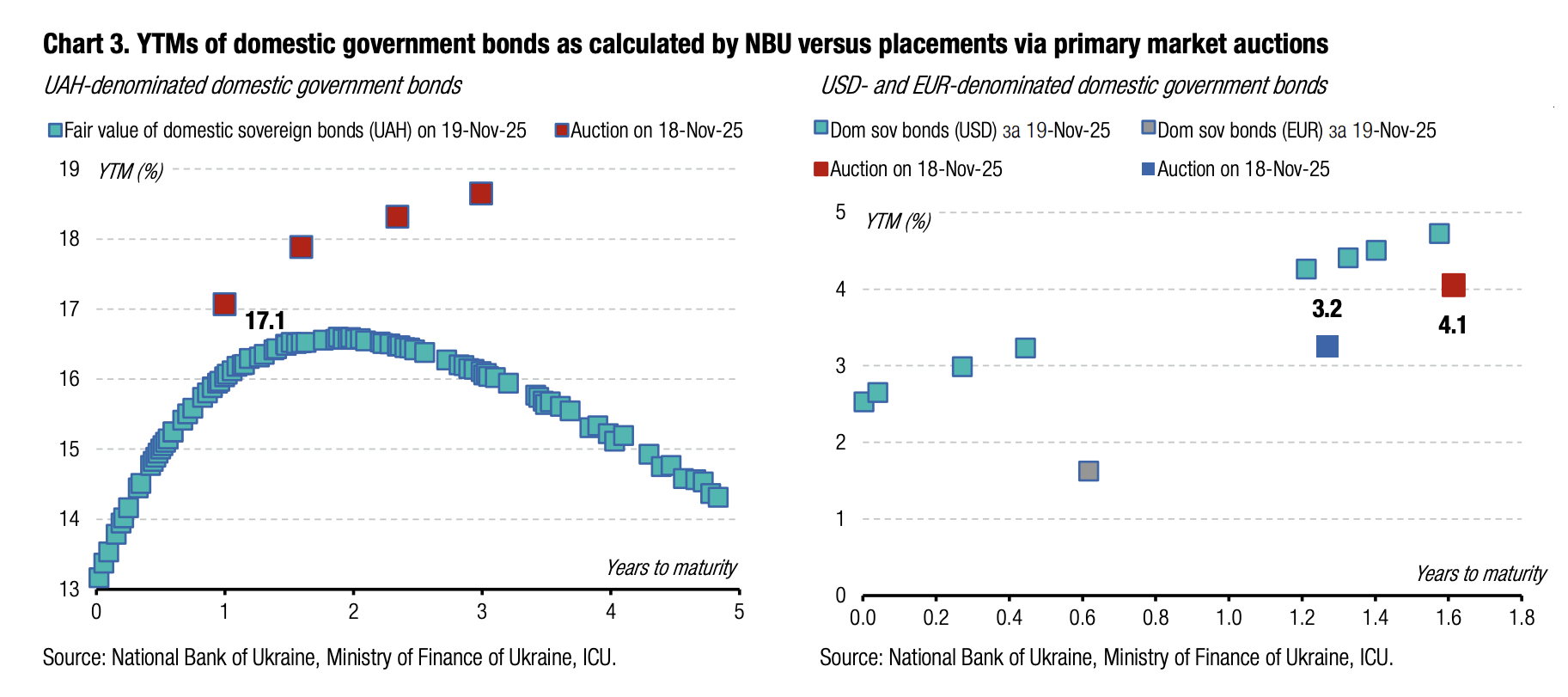

Appendix: Yields-to-maturity, repayments