|  |  |

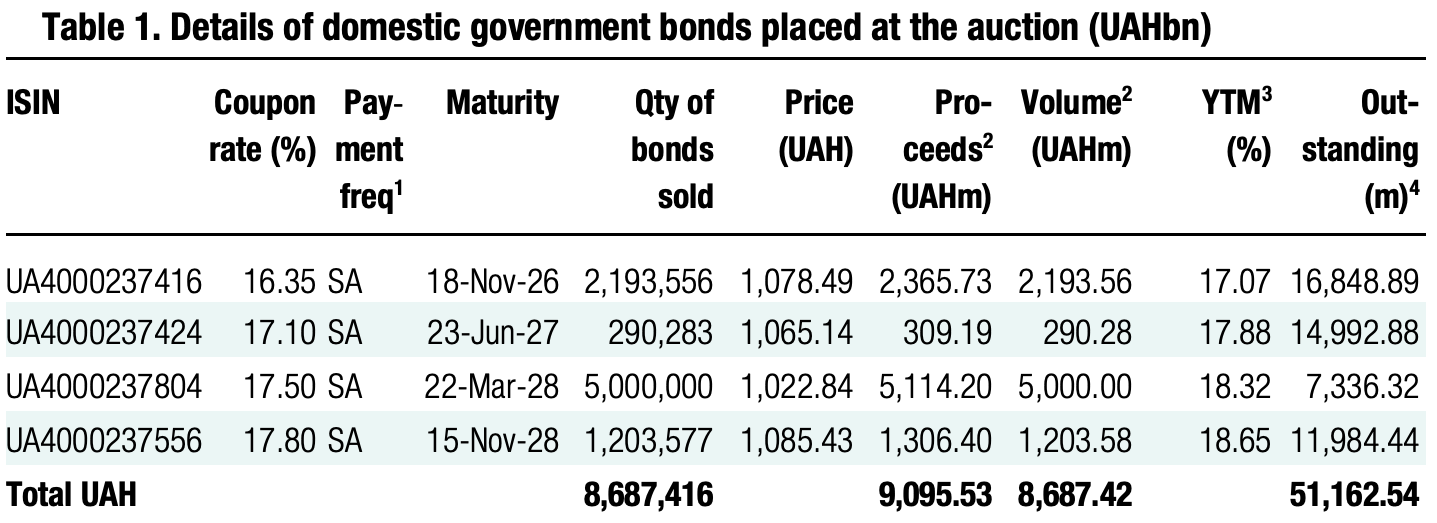

Yesterday's auction provided the state budget with UAH9.1bn, which was almost double WoW.

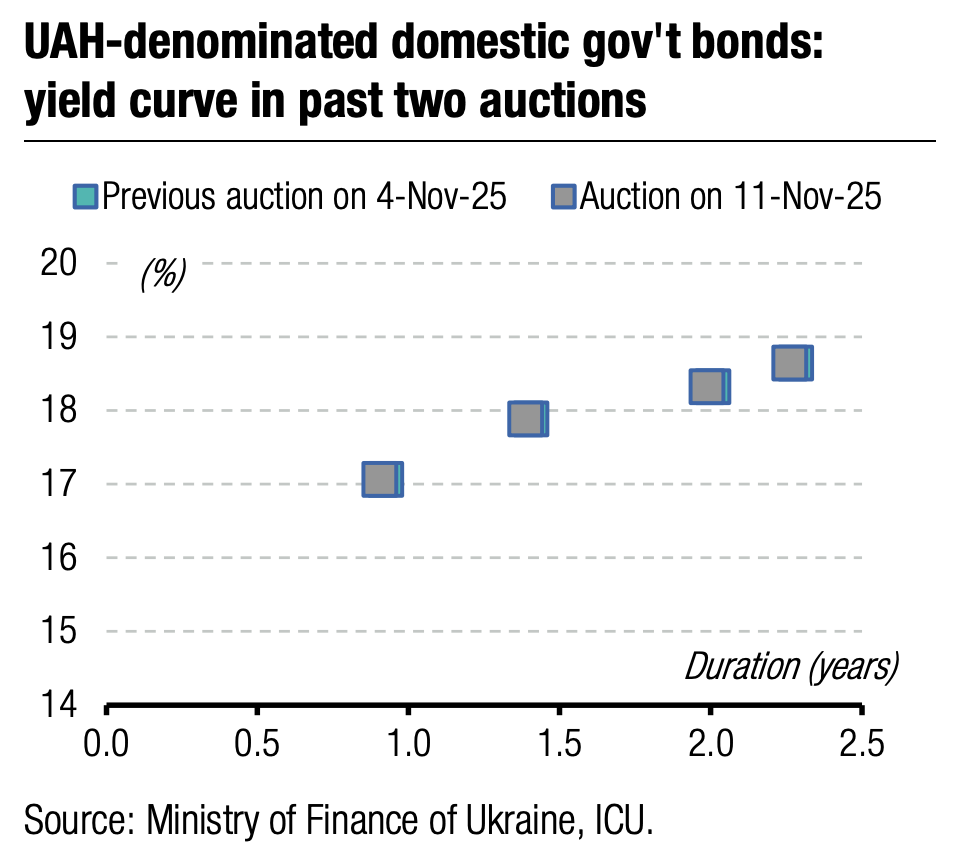

Demand for UAH-denominated bonds doubled yesterday, to almost UAH10bn, while maintaining the structure of the previous placement.

The military note, with maturity in early 2028, saw the most significant demand, amounting to almost UAH6.3bn, a x1.25 oversubscription. The yields in bids were similar to last week, so the MoF satisfied all of them. However, due to oversubscription, most competitive bids were accepted partially.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.66/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Additionally, the MoF received a considerable volume of bids for the shortest military paper with a maturity next year, UAH2.2bn.

Interest in three-year note was the strongestꟷUAH1.2bnꟷx6 WoW. At the same time, demand for the two-year security almost halved to UAH290m from UAH481m last week.

Yields in bids were typical, so the cut-off and weighted average rates for all four bonds remained unchanged.

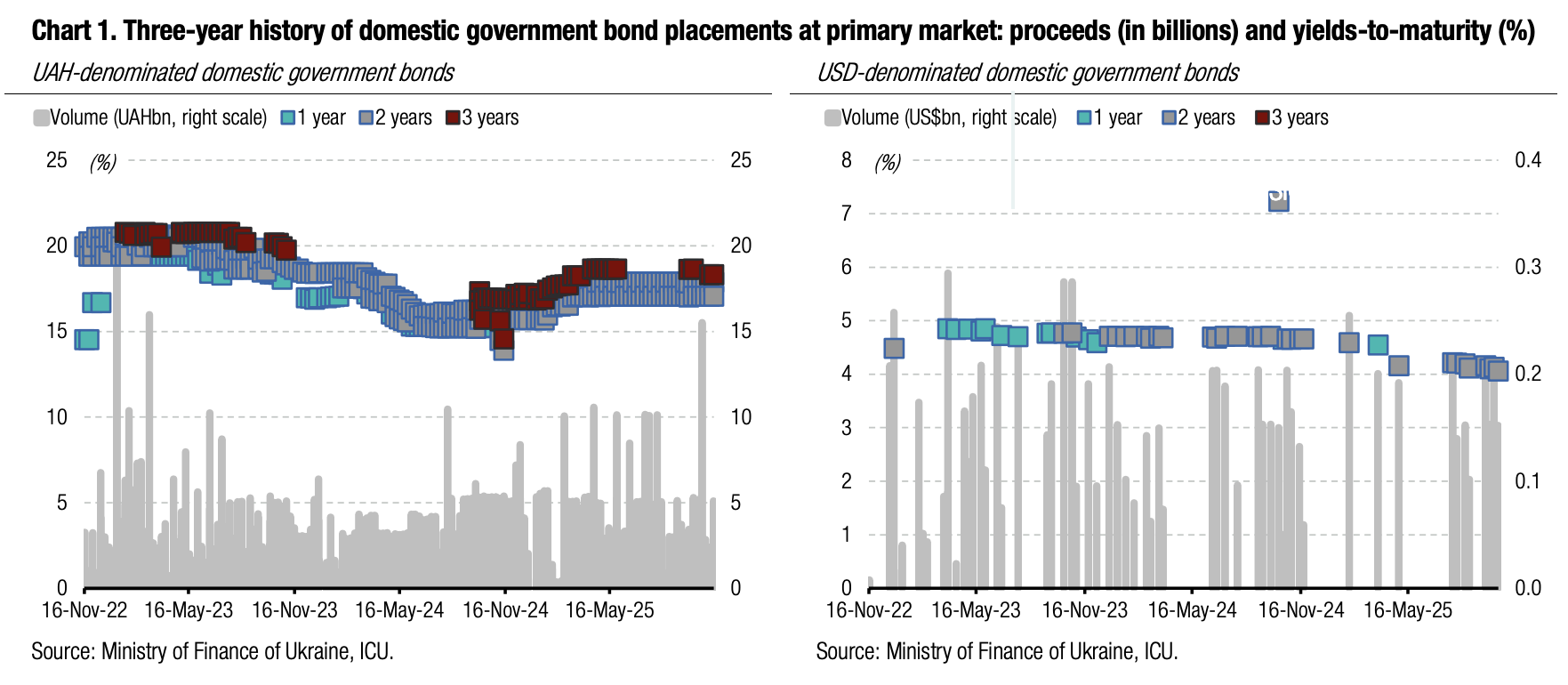

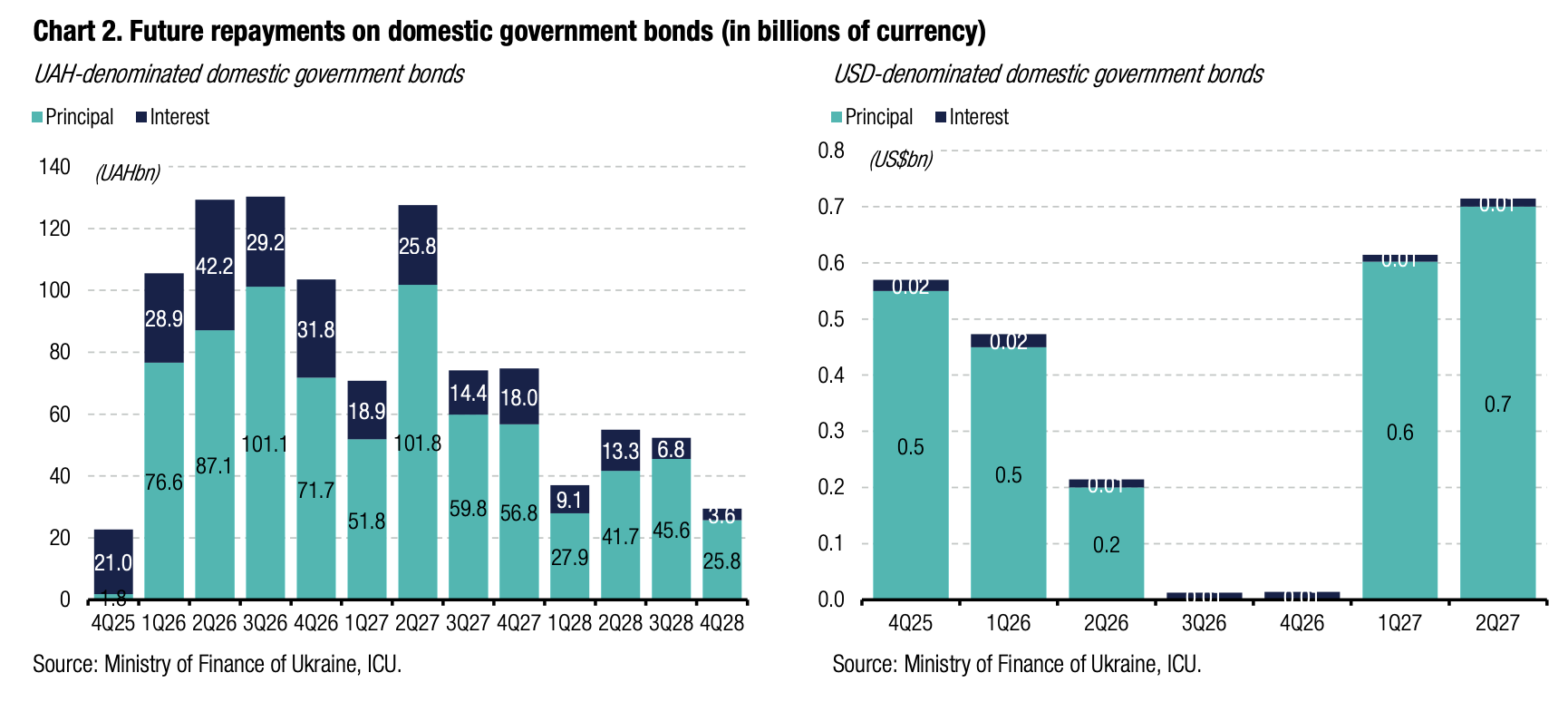

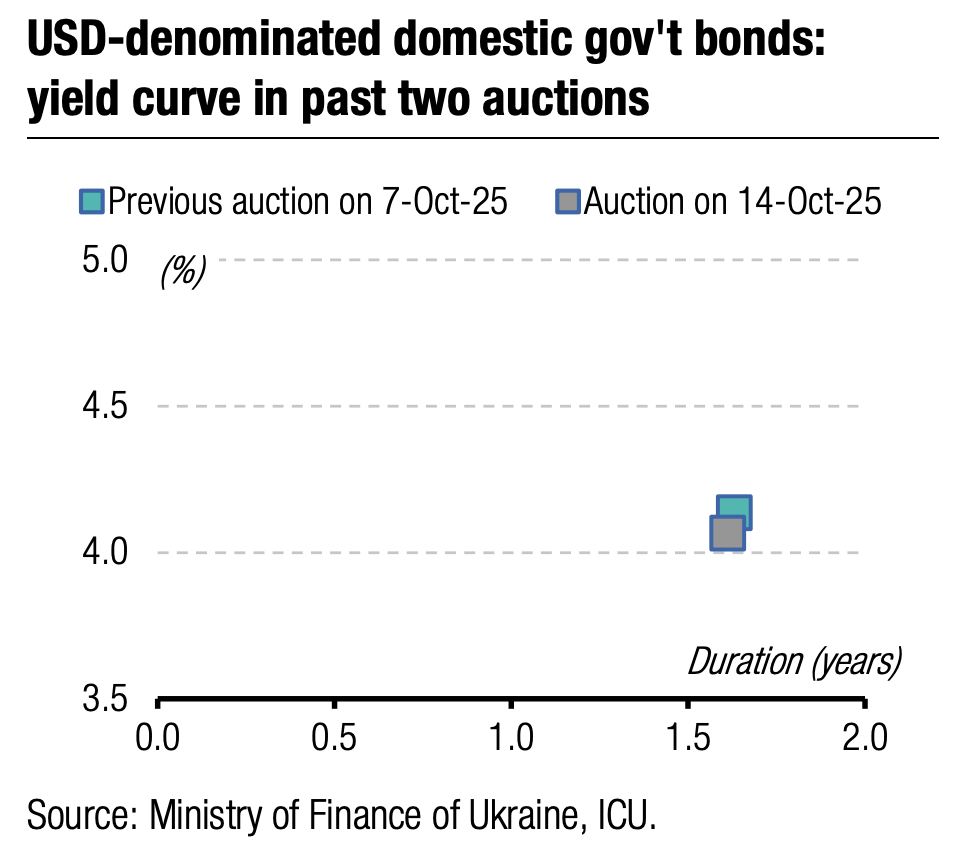

Appendix: Yields-to-maturity, repayments