|  |  |

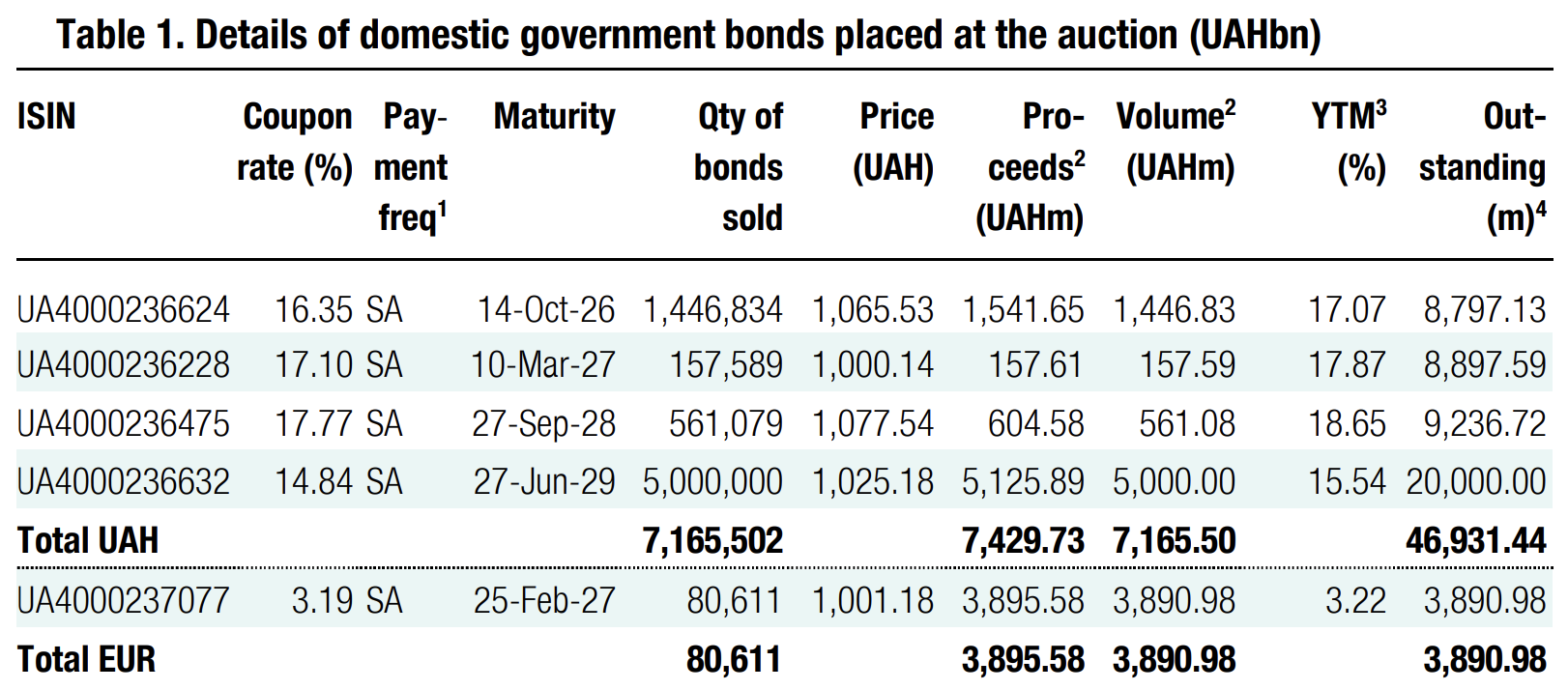

The Ministry of Finance raised UAH11.3bn yesterday, mainly from reserve and euro-denominated bonds.

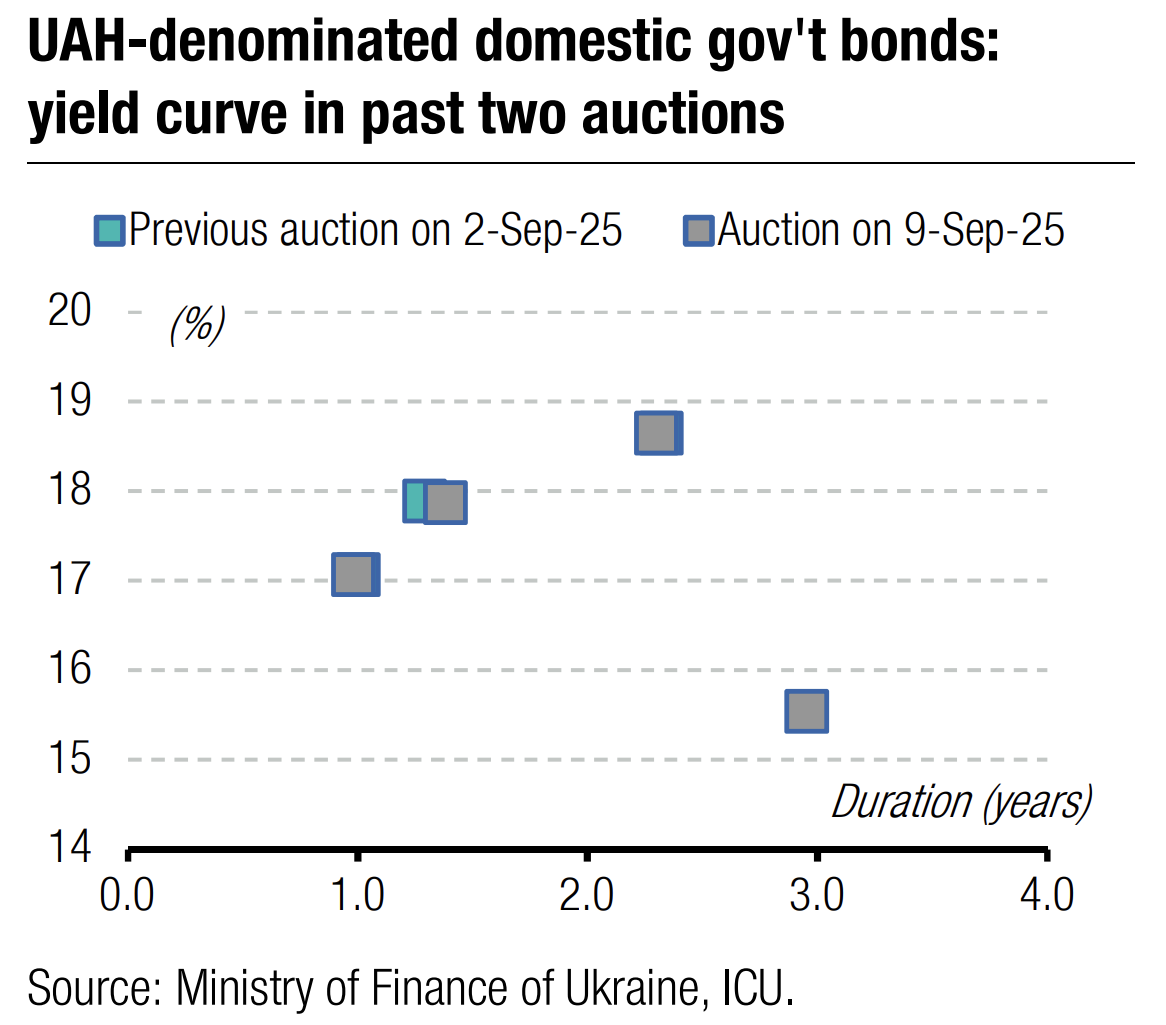

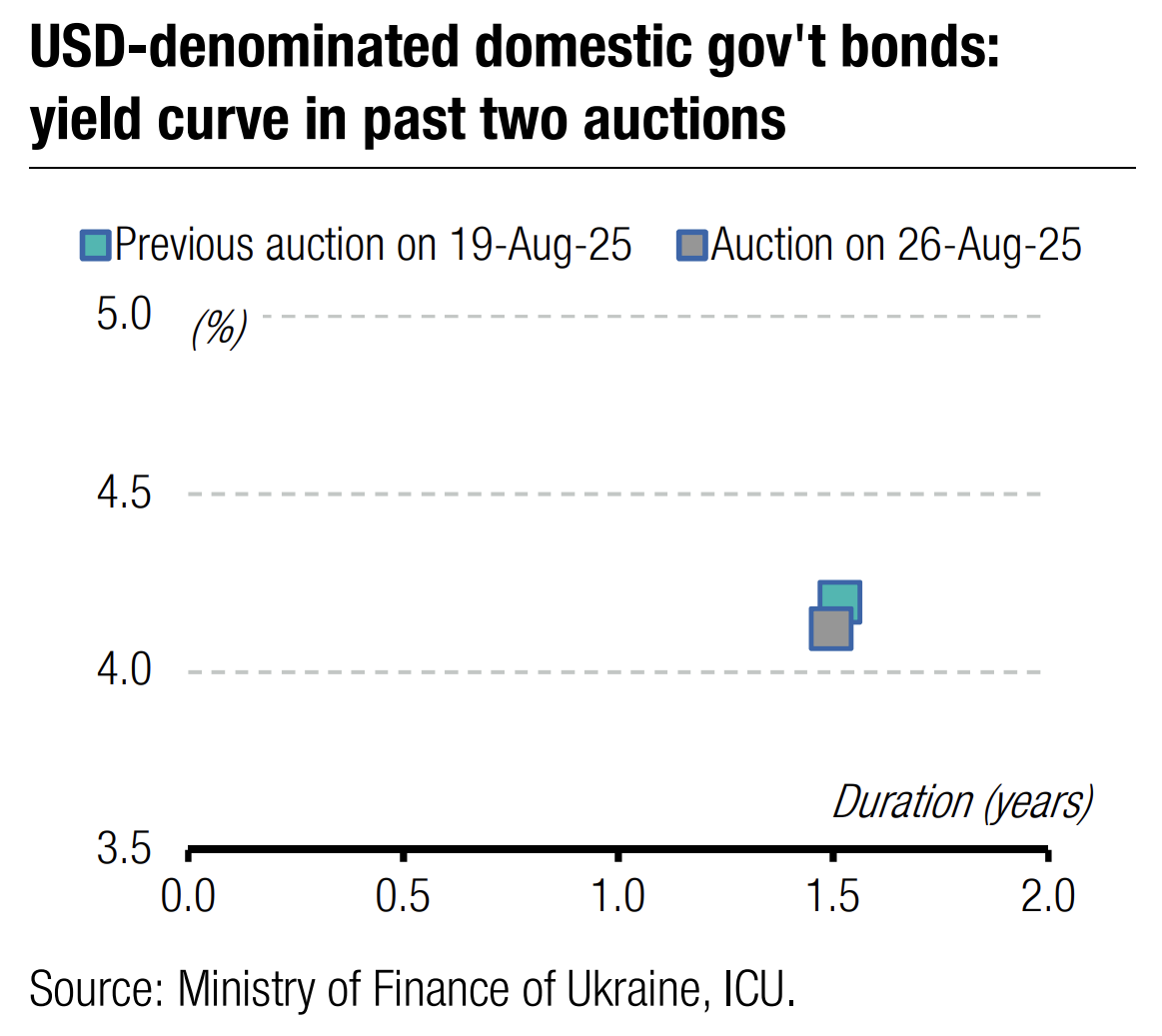

Most of the funds were raised from reserve bonds. The MoF sold another UAH5bn of bonds maturing in June 2029, which banks can use to cover part of their mandatory reserves. Demand exceeded supply by only 43%, and bid rates differed little from the previous placement in mid-August. Yesterday's cut-off rate did not change compared with the auction in August, and the weighted average slid by only 2bp.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.36/USD, 48.27/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

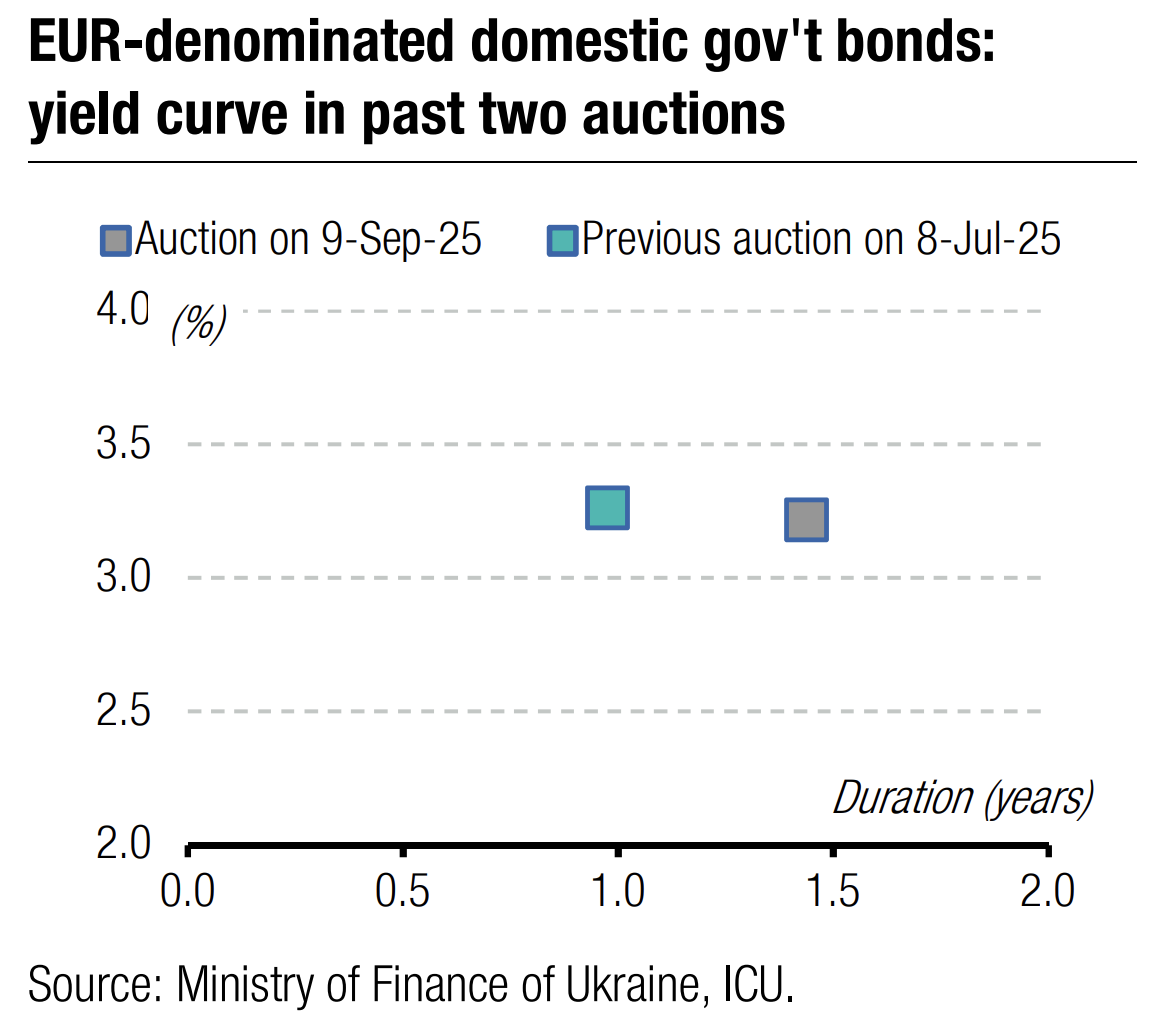

The EUR-denominated bond was second in terms of raising budget proceeds. Demand for them was lower than supply, and one bid also required a material increase in the cut-off rate. So, the Ministry satisfied only 86% of demand, selling bonds for EUR80.6m and receiving the equivalent of UAH3.9bn for the budget. The rates on these bonds did not change materially either.

Military government bonds maturing in October 2026 contributed to budget financing UAH1.5bn without rate changes.

After the MoF accepted all bids, the least amount of funds was brought to the budget by 1.5 and three-year bonds, a total of only UAH762m.

In general, we see little interest in ordinary and military bonds now. The reasons are the expectation of signals from the NBU regarding the transition to easing monetary policy and the misunderstanding of the NBU's hryvnia exchange rate policy and its further dynamics.

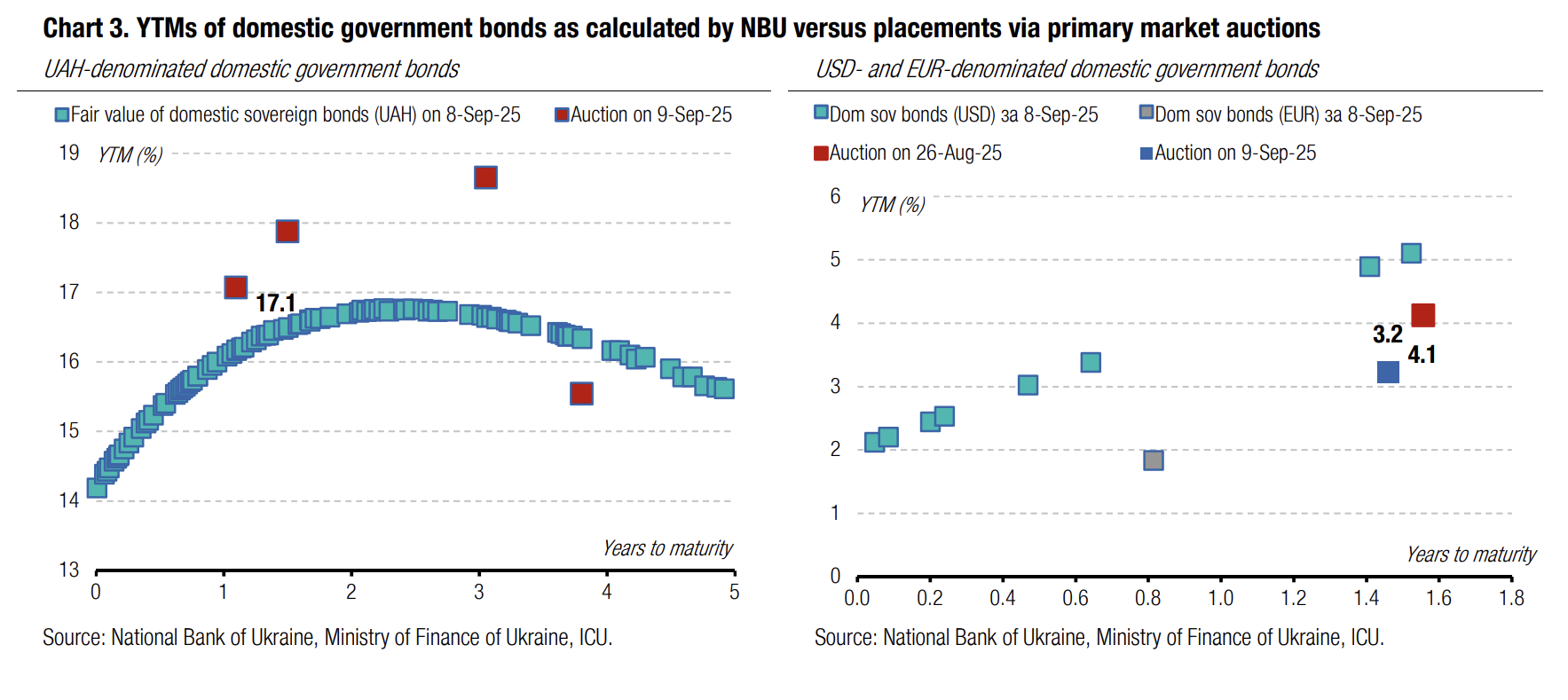

Appendix: Yields-to-maturity, repayments