|  |  |

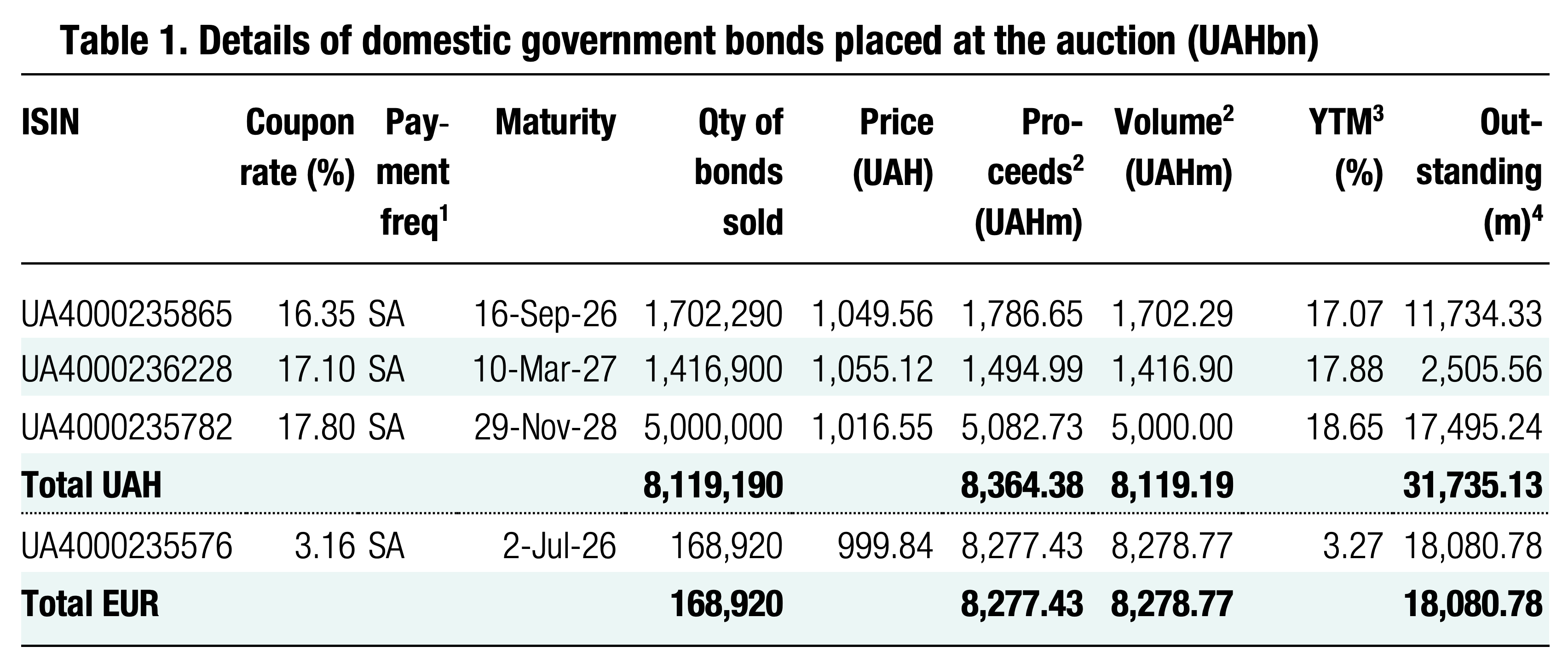

Among UAH bonds, investors preferred the longest offered bonds due in November 2028. However, the most significant amount of funds the MoF received were from EUR-denominated bills.

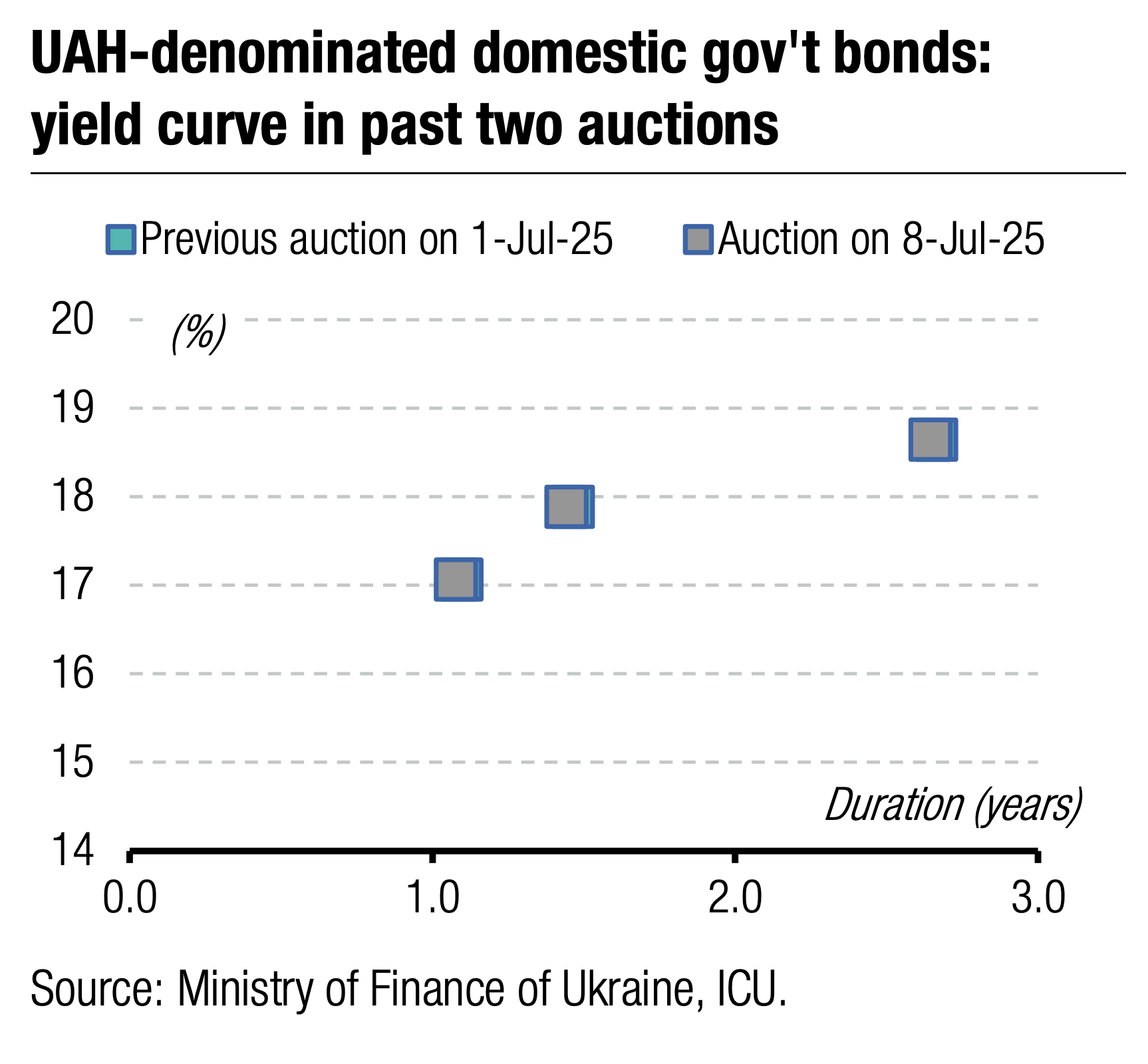

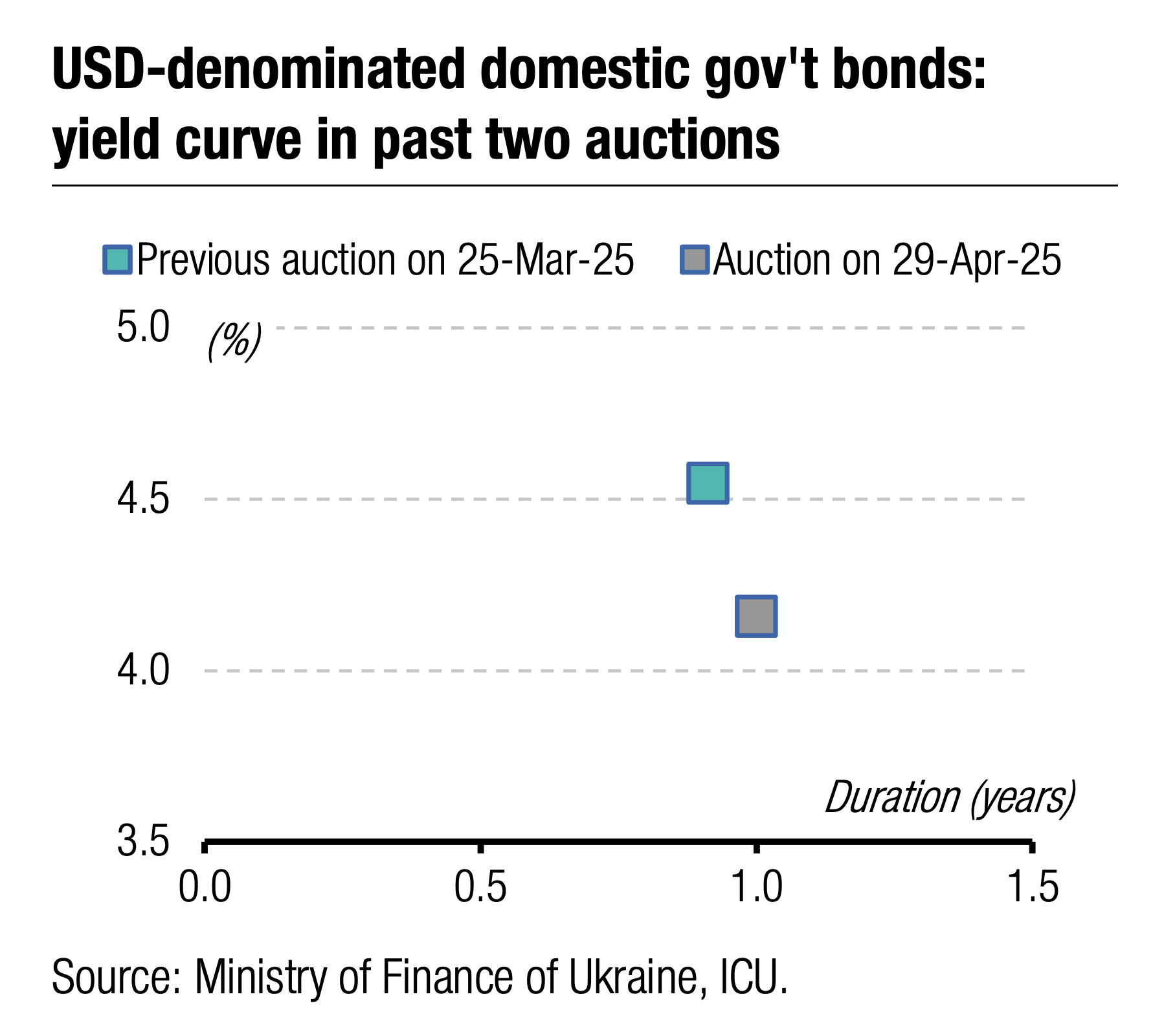

Demand for 14-month military bills almost doubled. The MoF received 20 bids totalling UAH1.7bn with 16.3-16.35% yields. For 20-month paper, 10 bids totalling UAH1.4bn were received with the usual 17-17.1% yields. All these bids were accepted fully.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 49.01/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

For the 3.4-year note, the MoF did not reject any bids, either, but partially satisfied most of them within the cap.

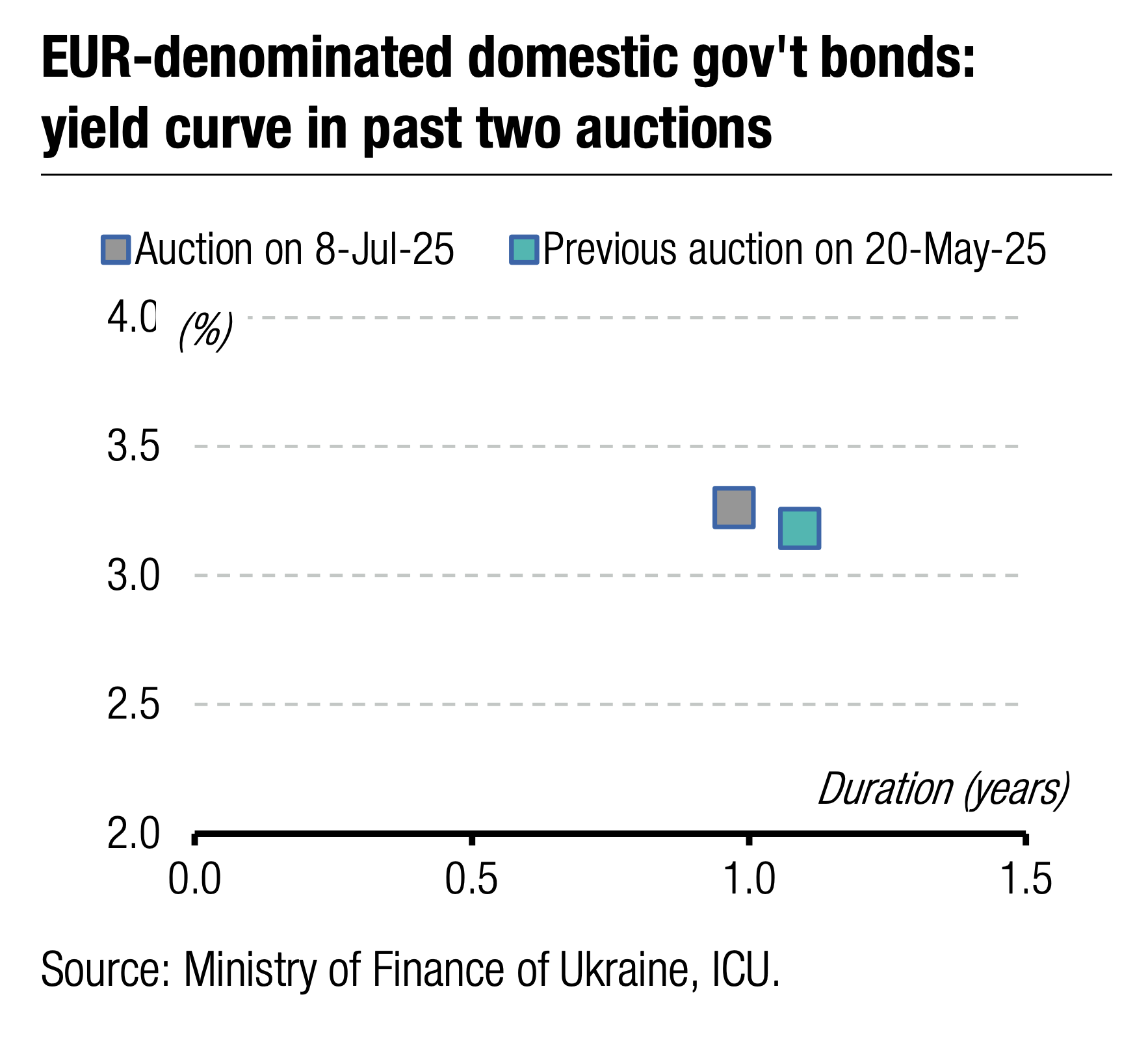

At the same time, the EUR-denominated bills provided the state budget with the most funds from among the offered securities. The MoF sold EUR169m of bonds or just 84% of the cap.

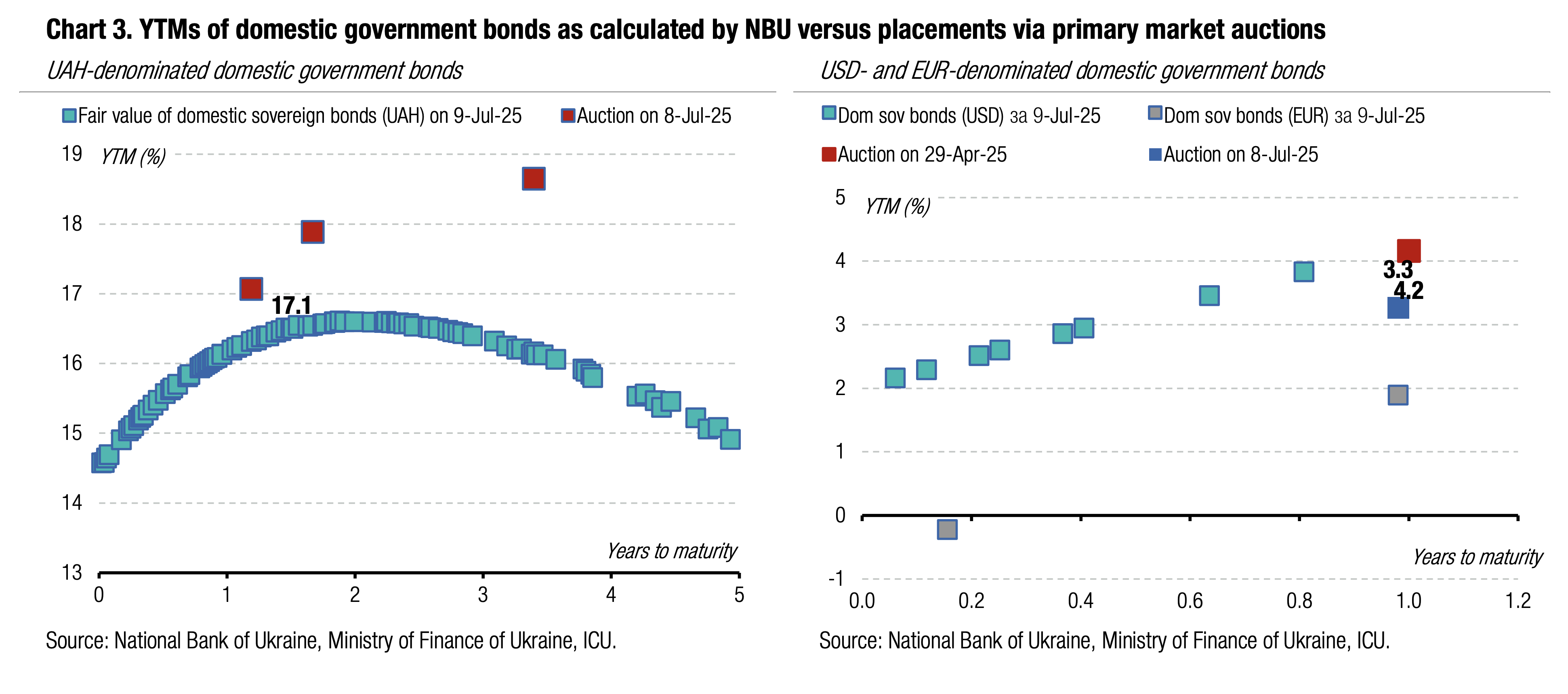

For the second week, investors focused on the 3.4-year paper, which had the highest yields. This is not to be taken as a signal that the NBU will decrease the key policy rate, more, some investors prefer to lock in the current yields for the next three years.

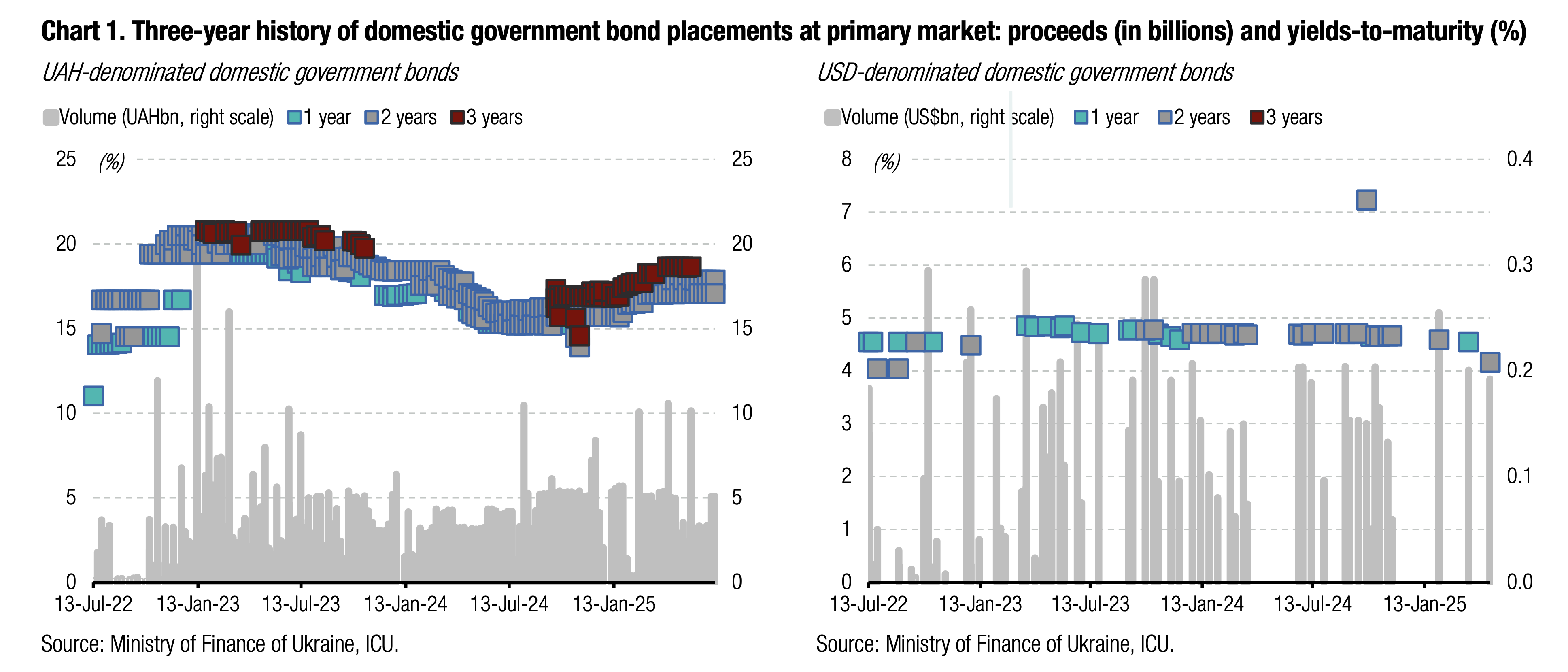

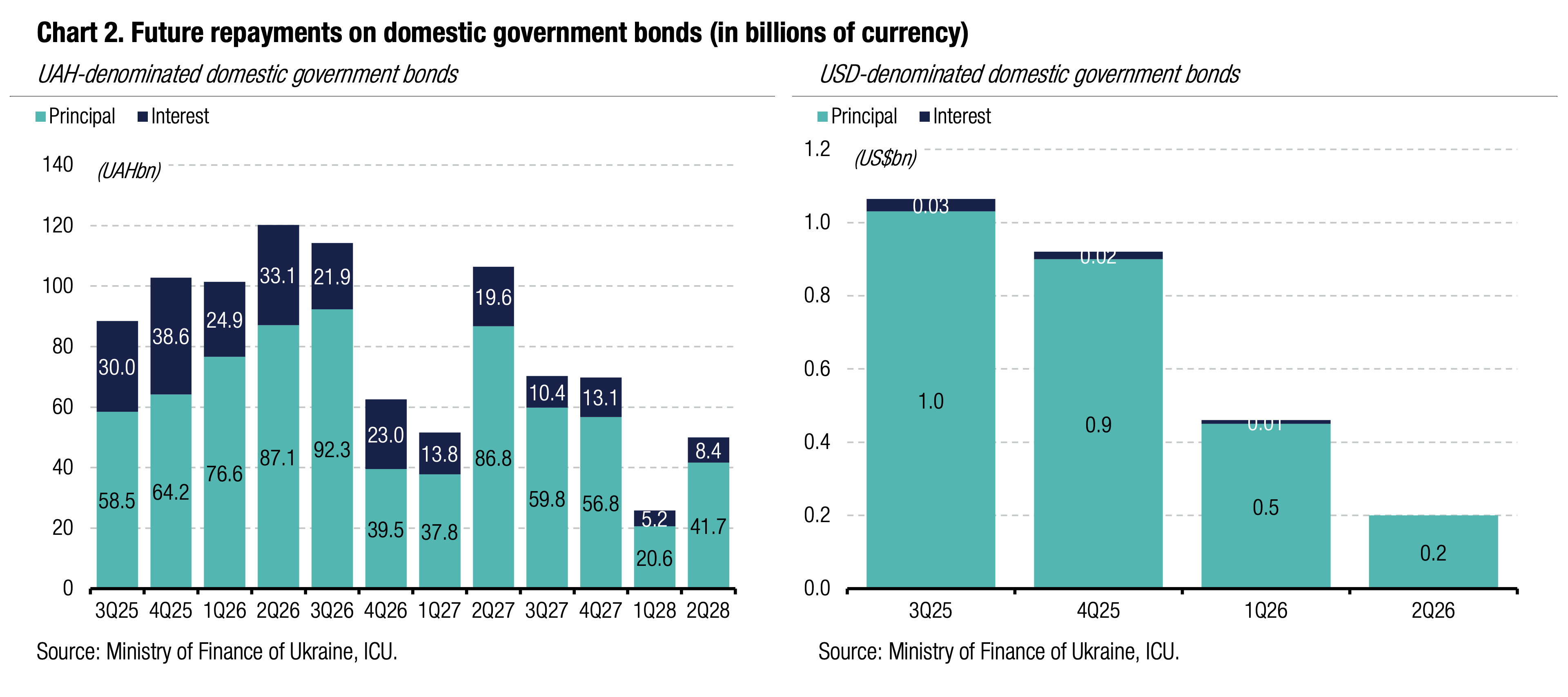

Appendix: Yields-to-maturity, repayments