|  |  |

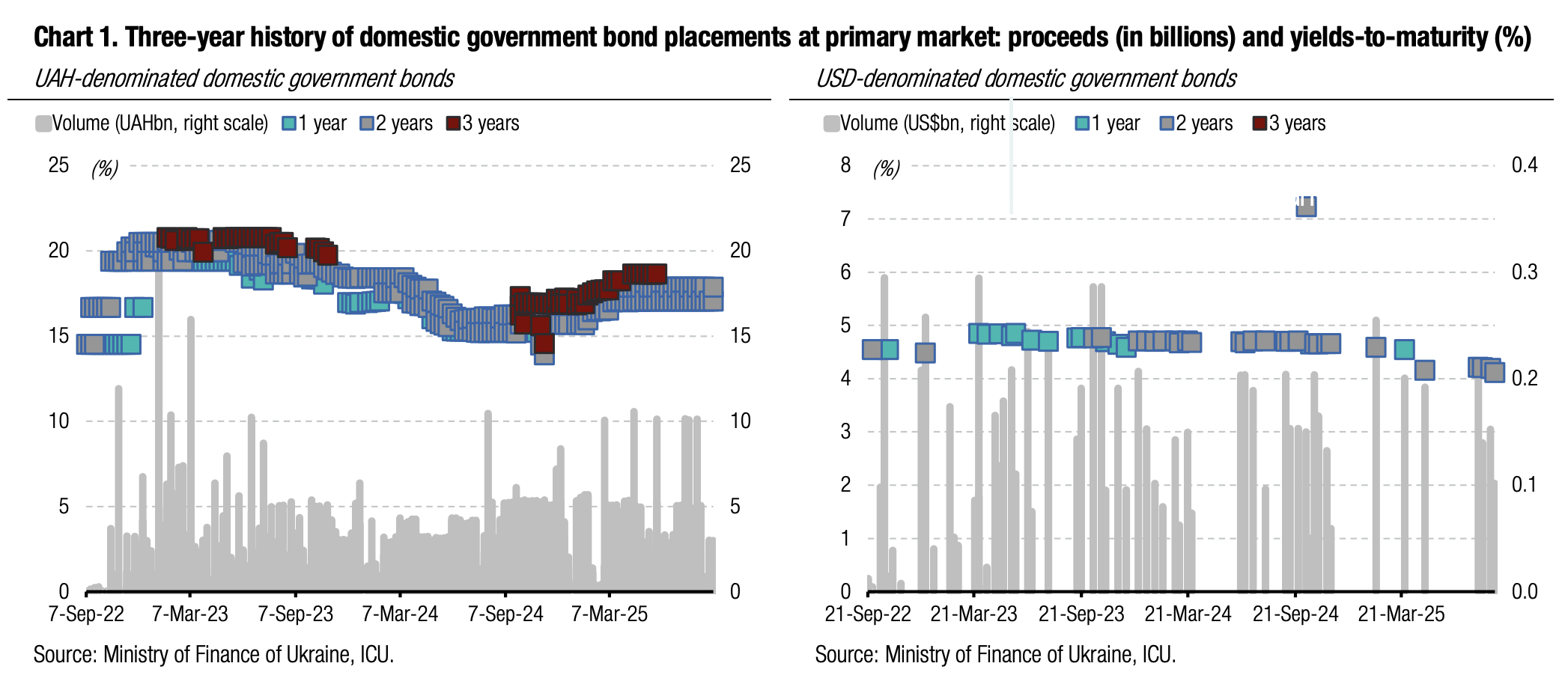

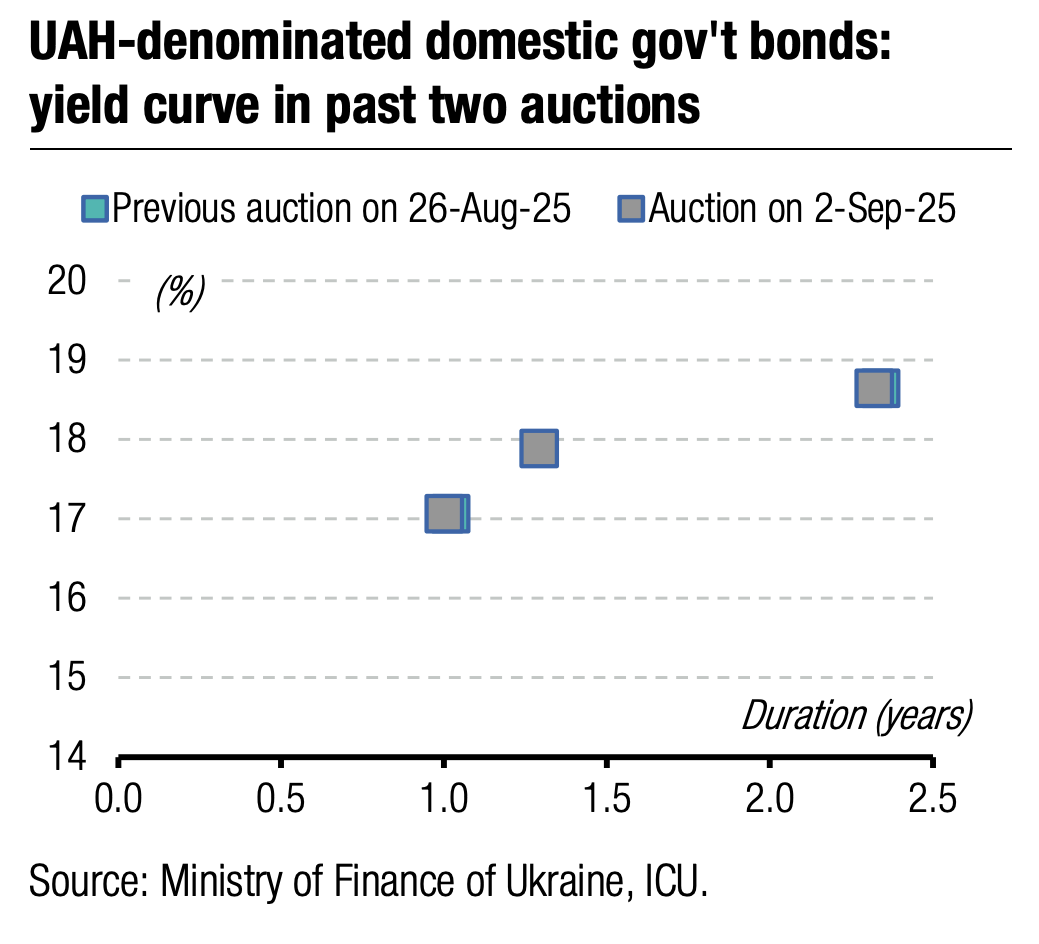

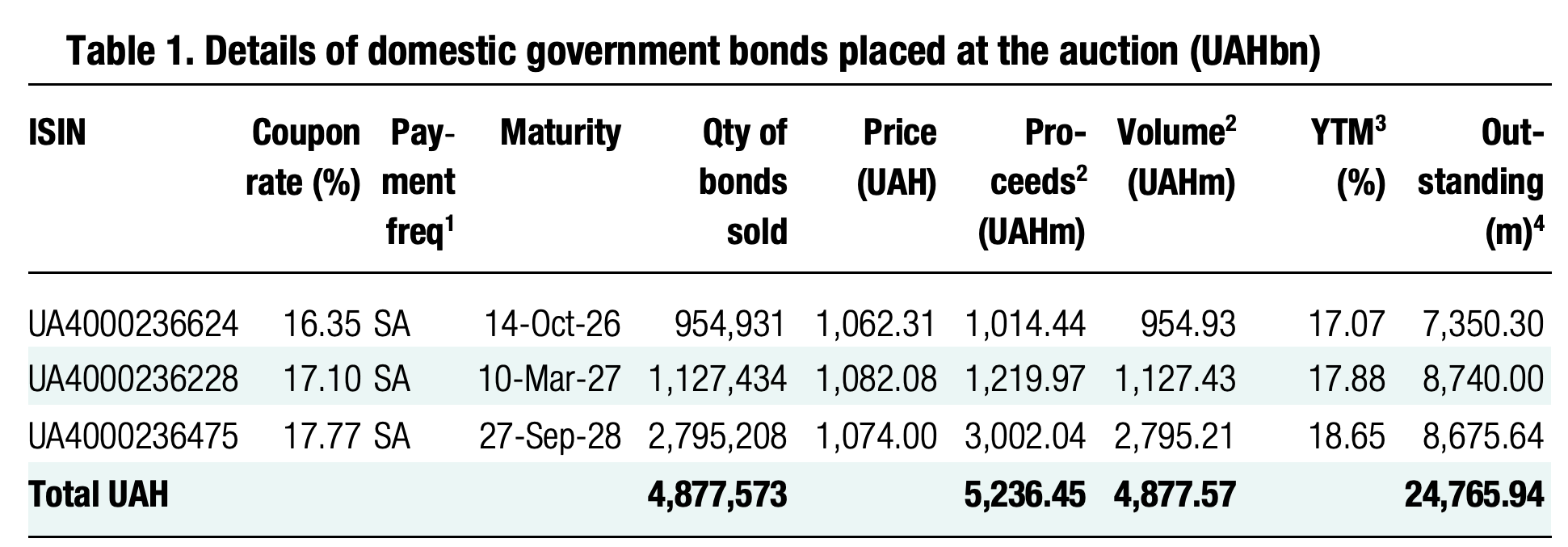

After a break, investors' focus has shifted to longer UAH bonds in the primary market. The longest of those offered—three-year bonds—brought the budget more than half of all proceeds this week.

The total volume of bids for UAH bonds increased to almost UAH4.9bn, a slight increase WoW. However, demand for the shortest, 14-month military bills fell threefold below UAH1bn. Demand for 1.5-year ordinary bonds increased to UAH1.1bn.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.36/USD, 48.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

At the same time, the volume of bids for three-year securities amounted to almost UAH2.8bn. This demand is the largest since the first half of July, when the Ministry of Finance placed almost UAH13.5bn of three-year securities in three auctions. Since the end of July, the volume of bids for purchasing three-year notes has been below UAH1bn. At the same time, there were no attempts to change interest rates yesterday. All bids were submitted with the usual yields, so the ministry satisfied all bids and raised more than UAH5bn.

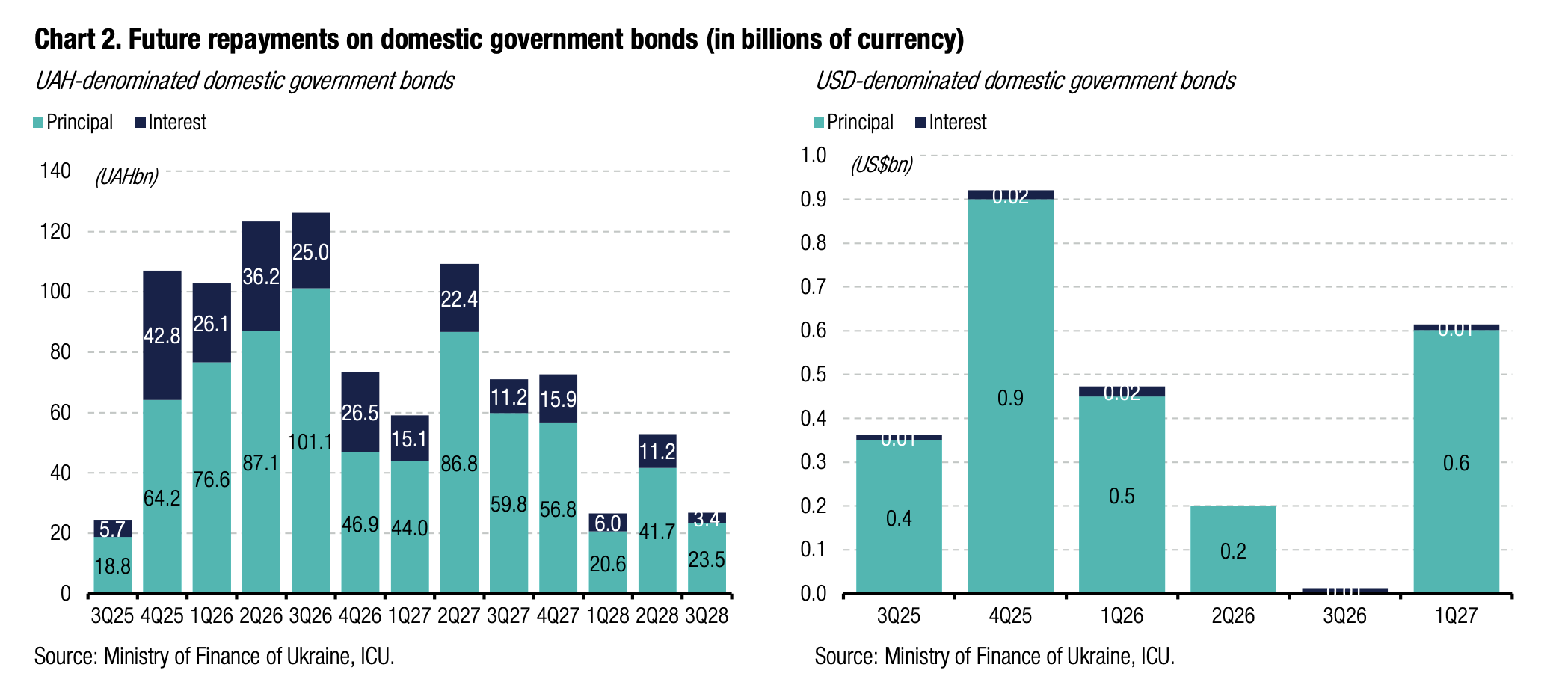

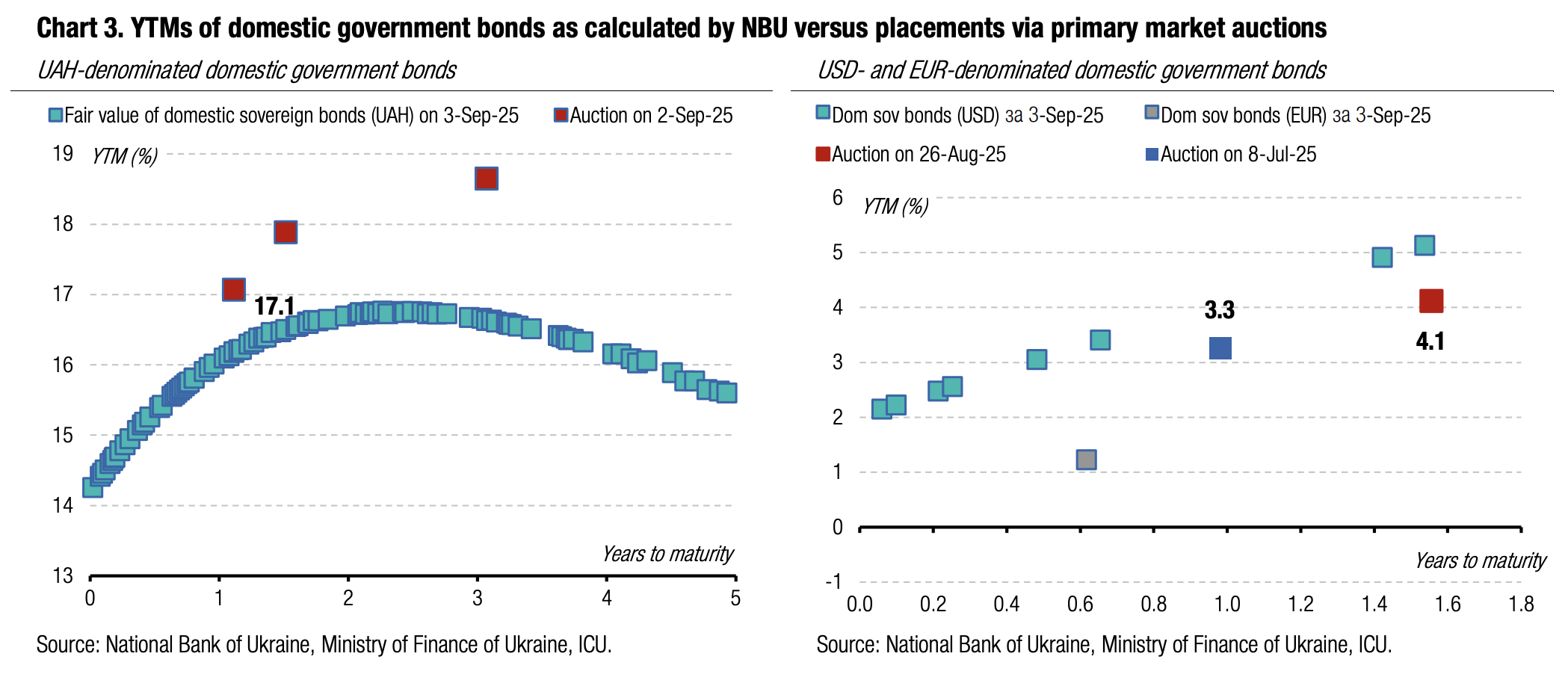

Appendix: Yields-to-maturity, repayments