|  |  |

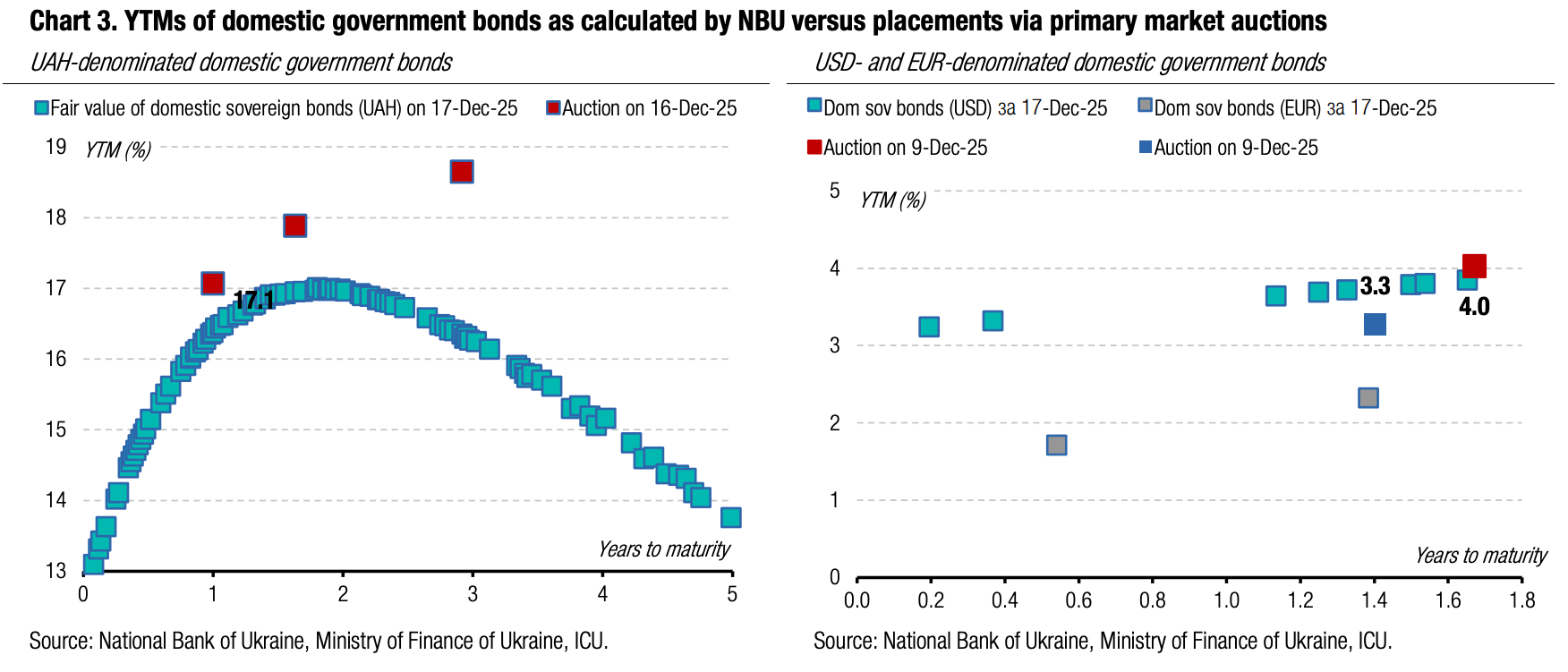

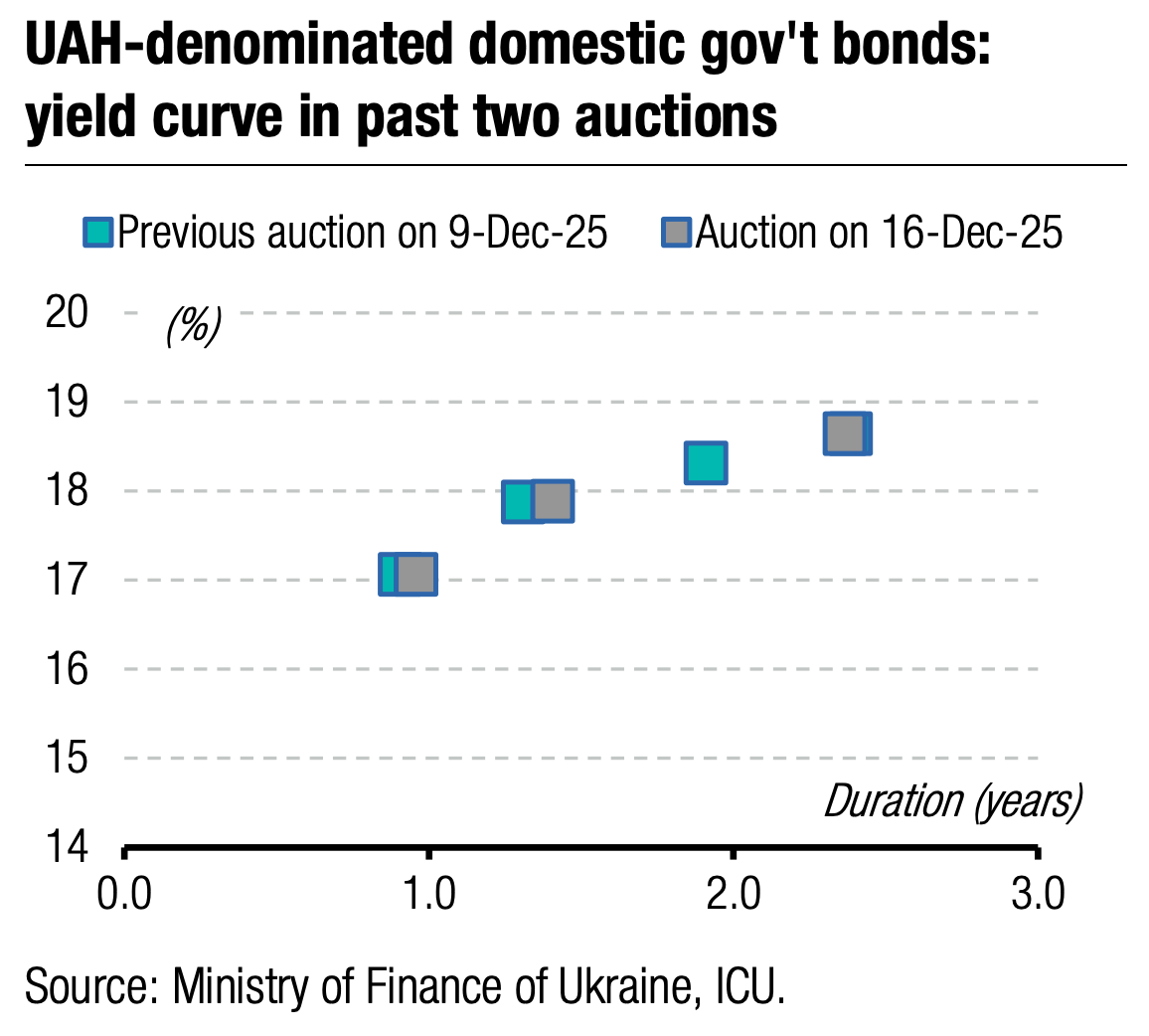

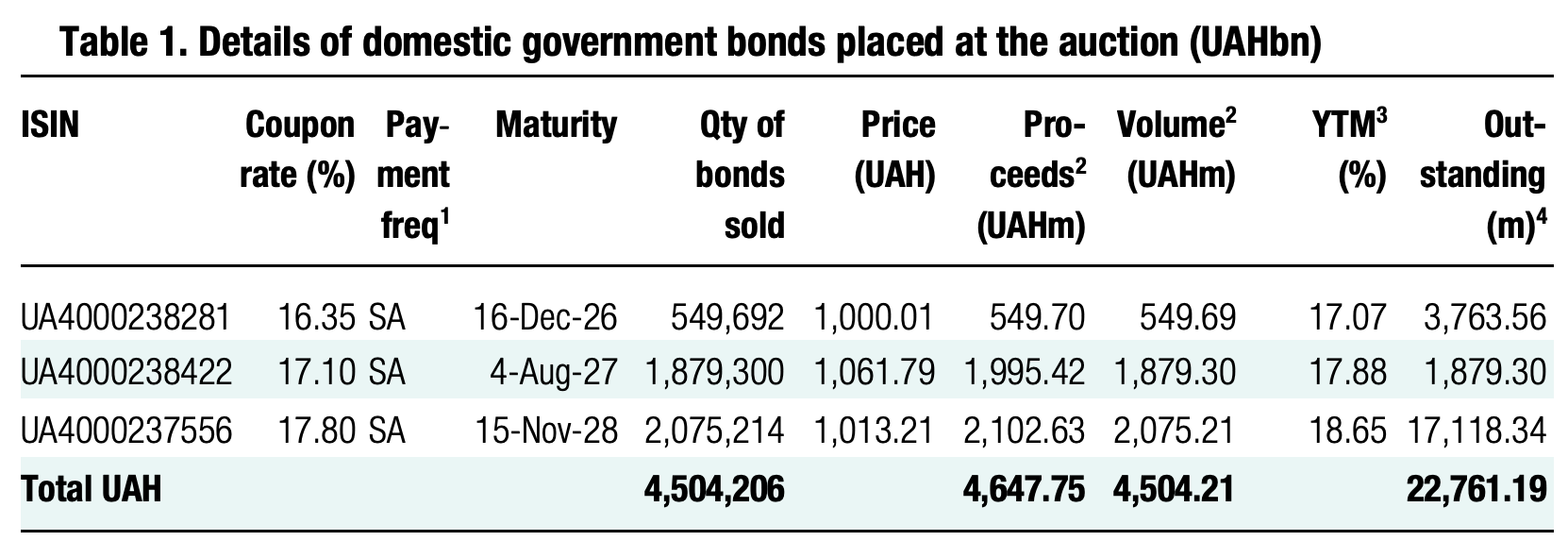

Yesterday, the Ministry of Finance raised UAH4.6bn for the budget only from UAH bonds and without changes in interest rates.

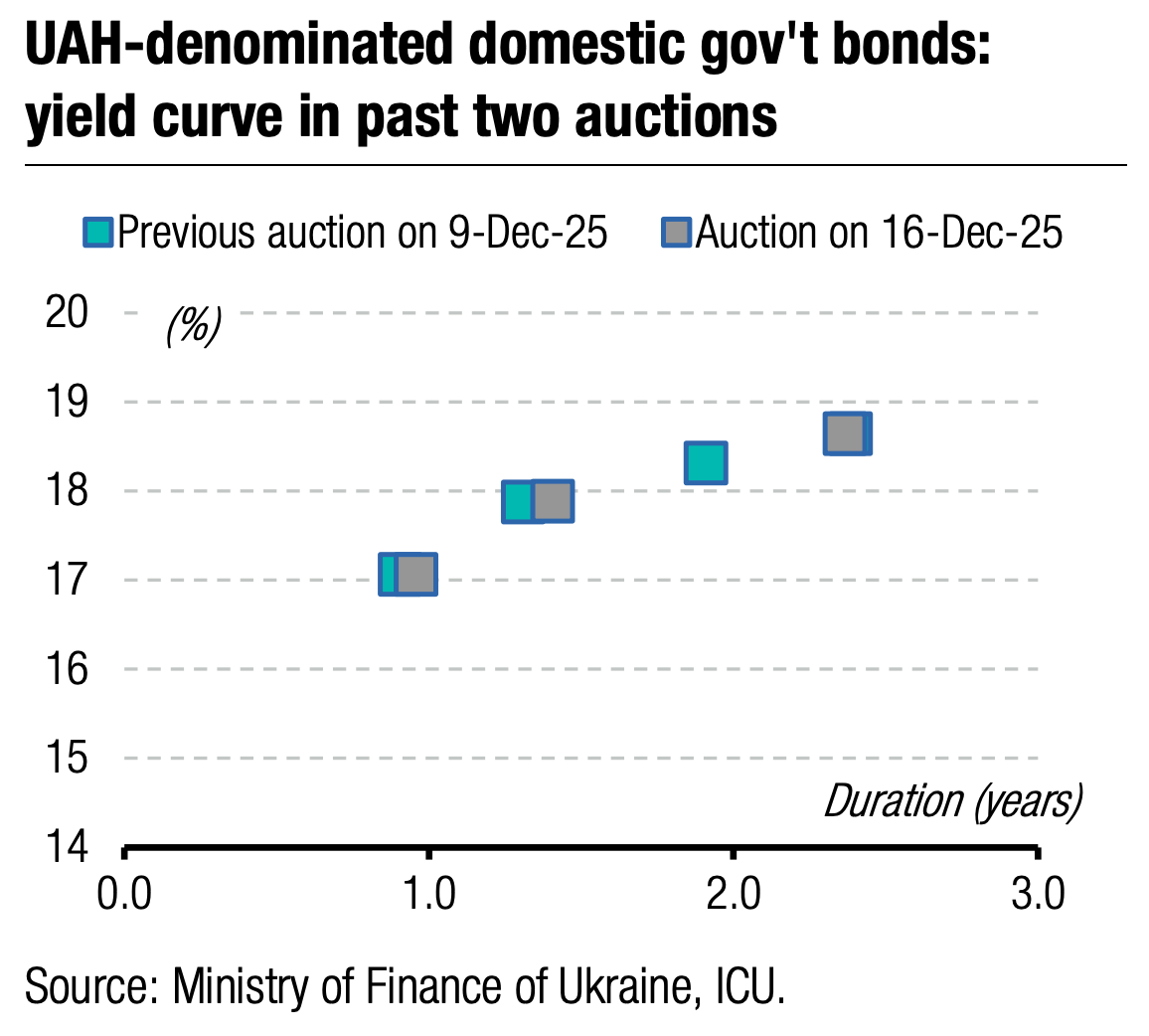

The shortest one-year military paper received the smallest volume of demand yesterday, amounting to slightly more than UAH0.5bn, and brought the budget little more in funds than the face value of sold securities.

At the same time, longer instruments - with maturity in August 2027 and November 2028 - attracted significantly greater demand, becoming the key source of borrowings at yesterday's auction.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.58/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Twenty-month securities received only seven bids, but for almost UAH1.9bn. The yields in the bids were in a very tight range between 17.09% and 17.1%. Since all bids were with rates not higher than the cut-off rate of previous auctions, the MoF satisfied all of them.

Demand for three-year note was similar. The demand was slightly below UAH2.1bn, with yields the same as a week before. This instrument provided the budget with UAH2.1bn of proceeds without changes in interest rates.

The National Bank's decision to keep the key policy rate at 15.5% with a link to foreign aid (e.g., a reparation loan) added clarity as to the reasons and consequences of its decisions. So, those investors who believe that Ukraine will receive a reparation loan could bet on a favourable decision and expect a reduction in rates as early as the end of January.

However, the last auction of this year is next week, and the MoF will resume auctions in January. What investors' views really are on NBU's policy may become clear shortly in the new year.

Appendix: Yields-to-maturity, repayments