|  |  |

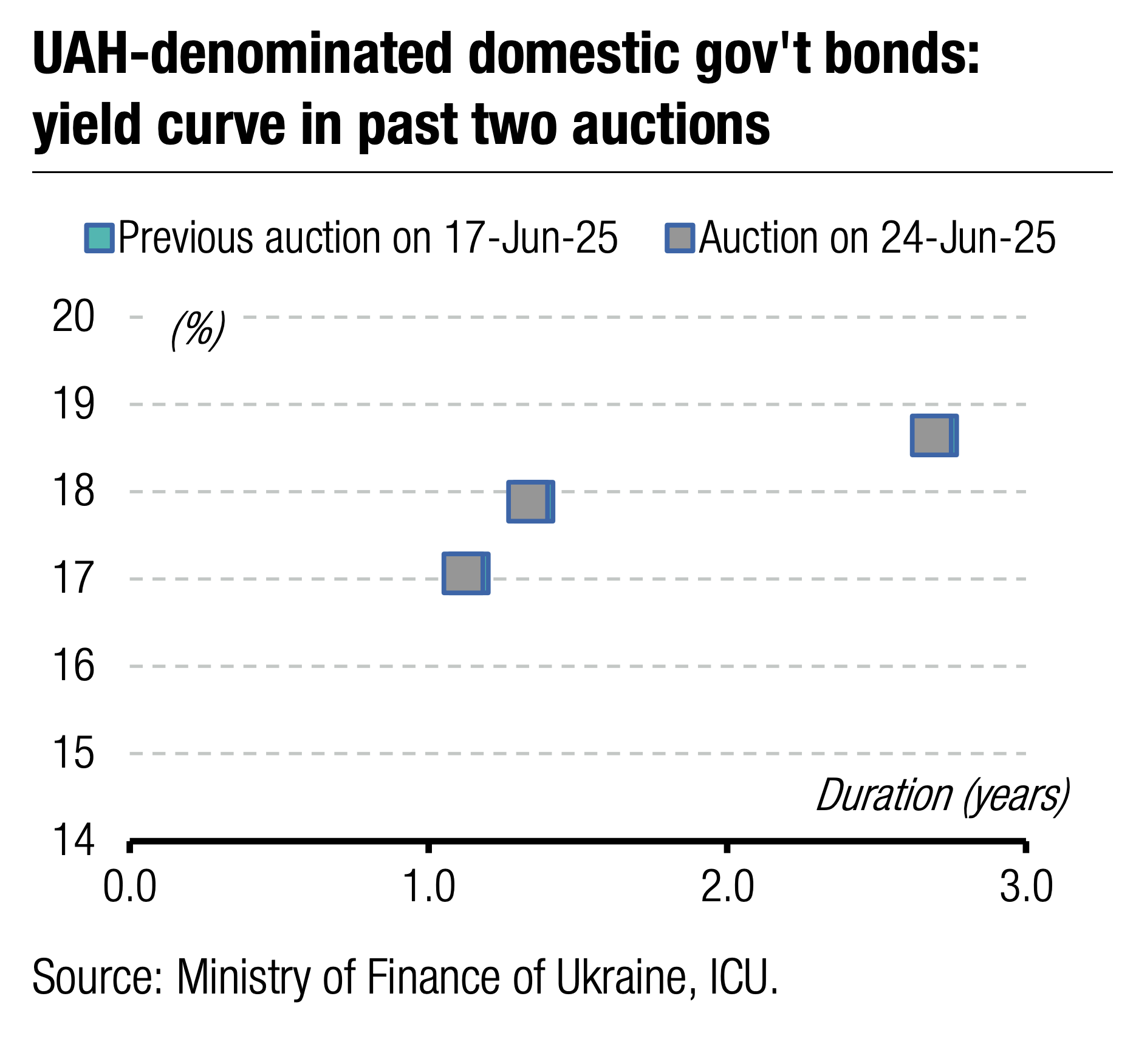

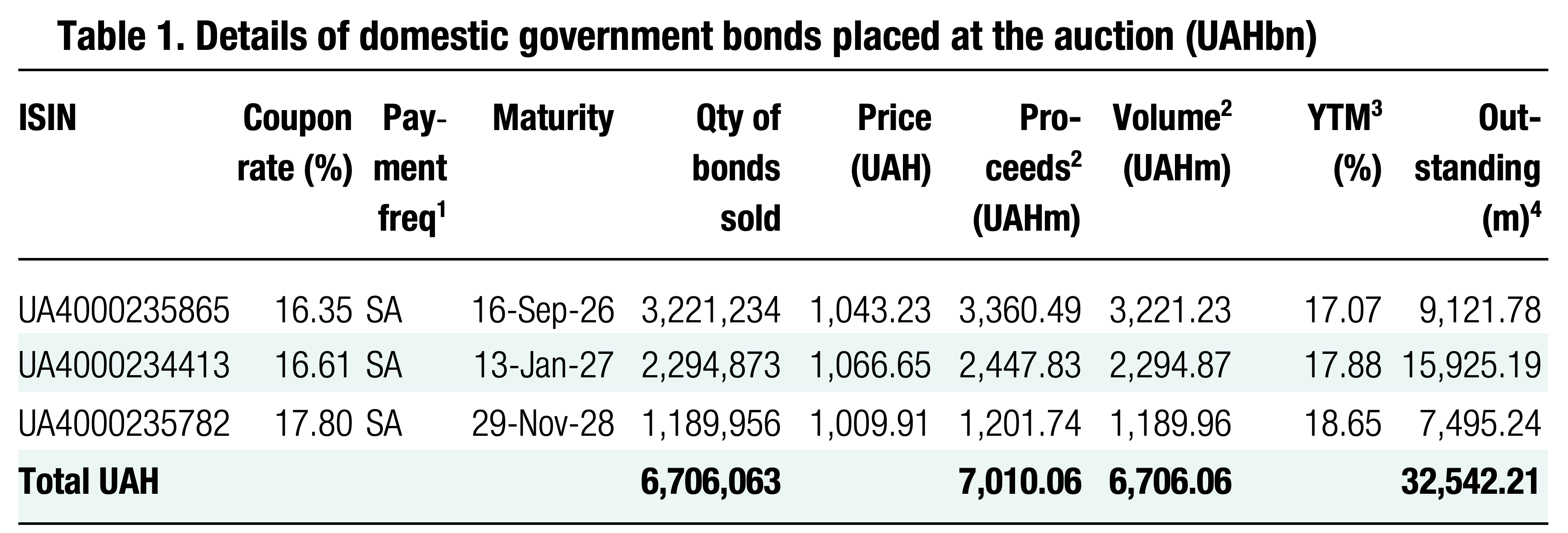

The MoF borrowed UAH7bn yesterday from the usual set of bonds offered.

Fifteen-month military bills received UAH3.2bn in 44 bids; interest rates tracked those of recent auctions. The MoF accepted all bids without changes in the cut-off and weighted-average rates.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 46.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Interest rates remained steady for the 19-month bills, too. The MoF accepted all 15 bids amounting to UAH2.3bn.

The MoF saw another UAH1.2bn of demand in 28 bids for the 3.5-year note. The MoF accepted all of them at the same rates as the week before.

Finally, the MoF borrowed UAH28.6bn in June, which was less than it repaid, but close to the monthly average of 1H25.

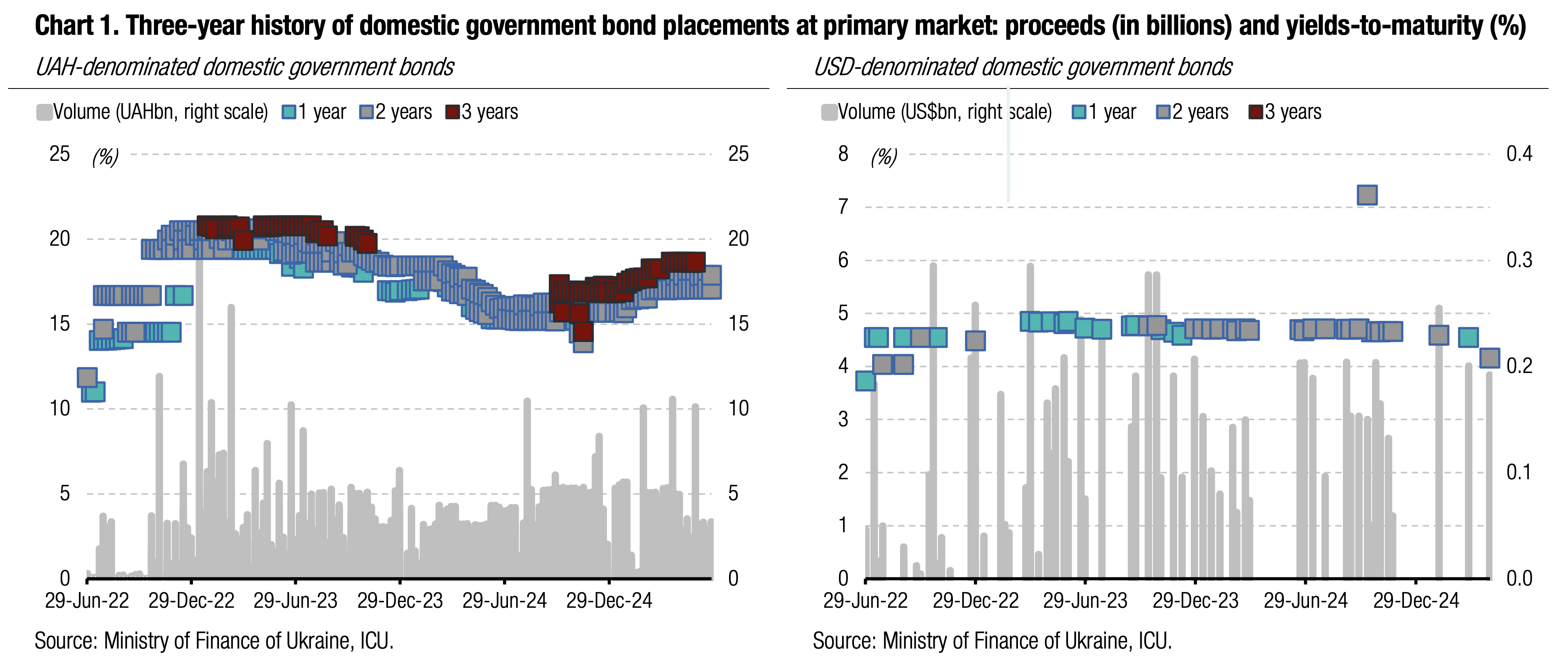

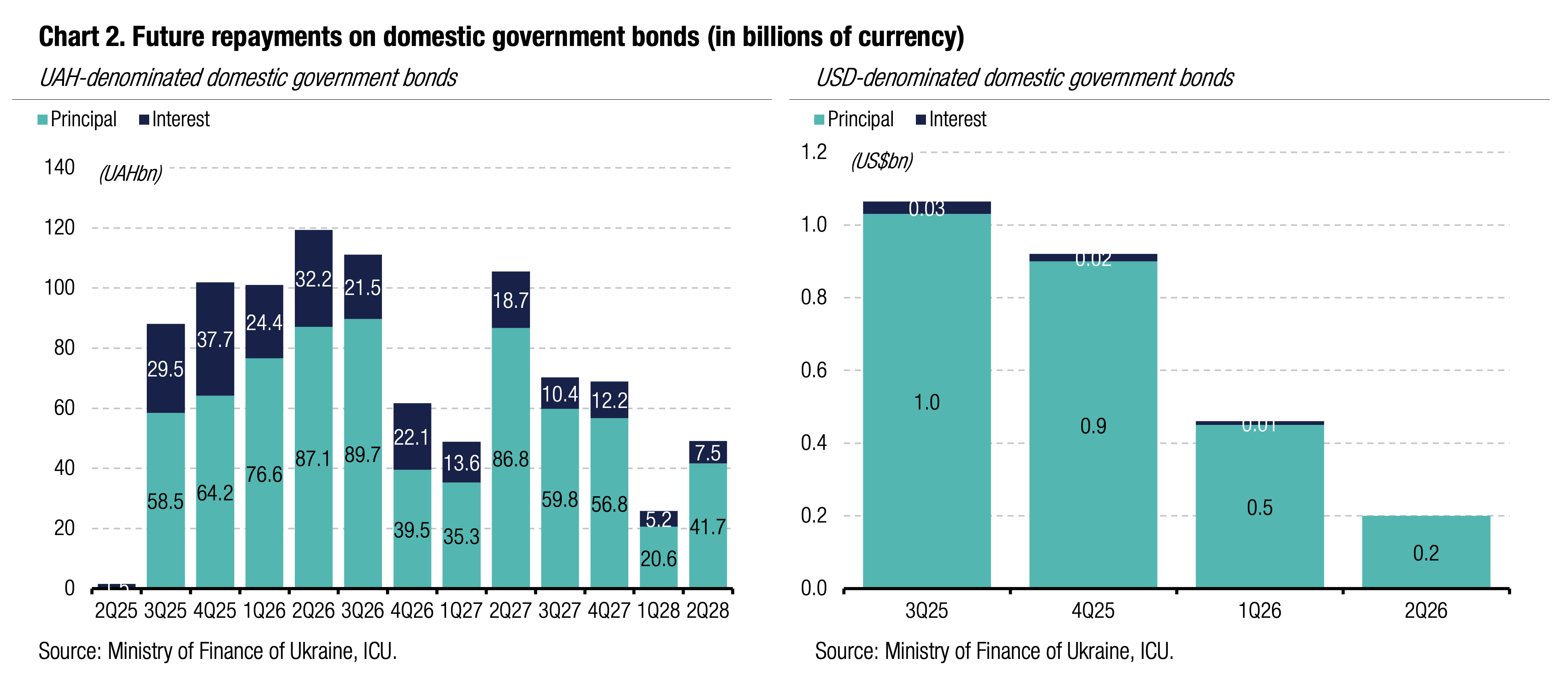

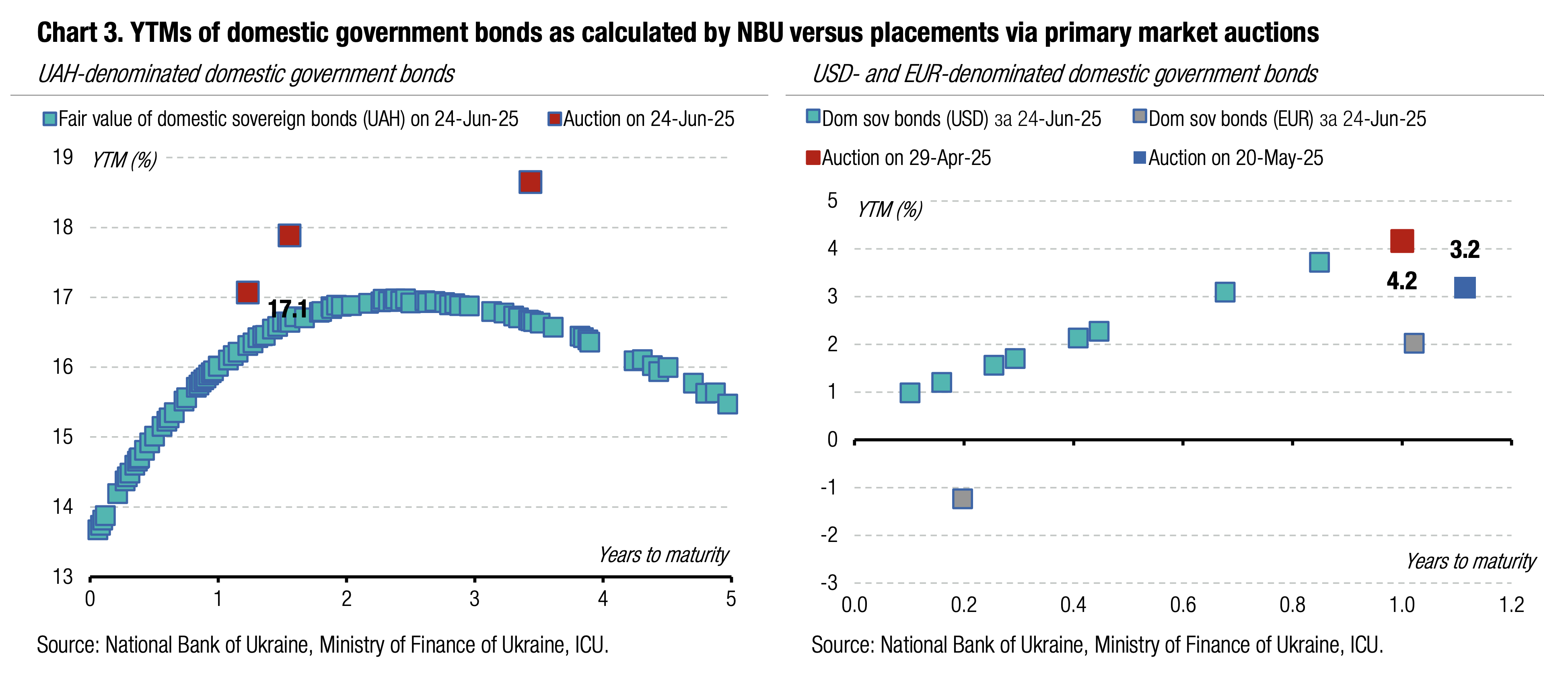

Appendix: Yields-to-maturity, repayments