|  |

|  |

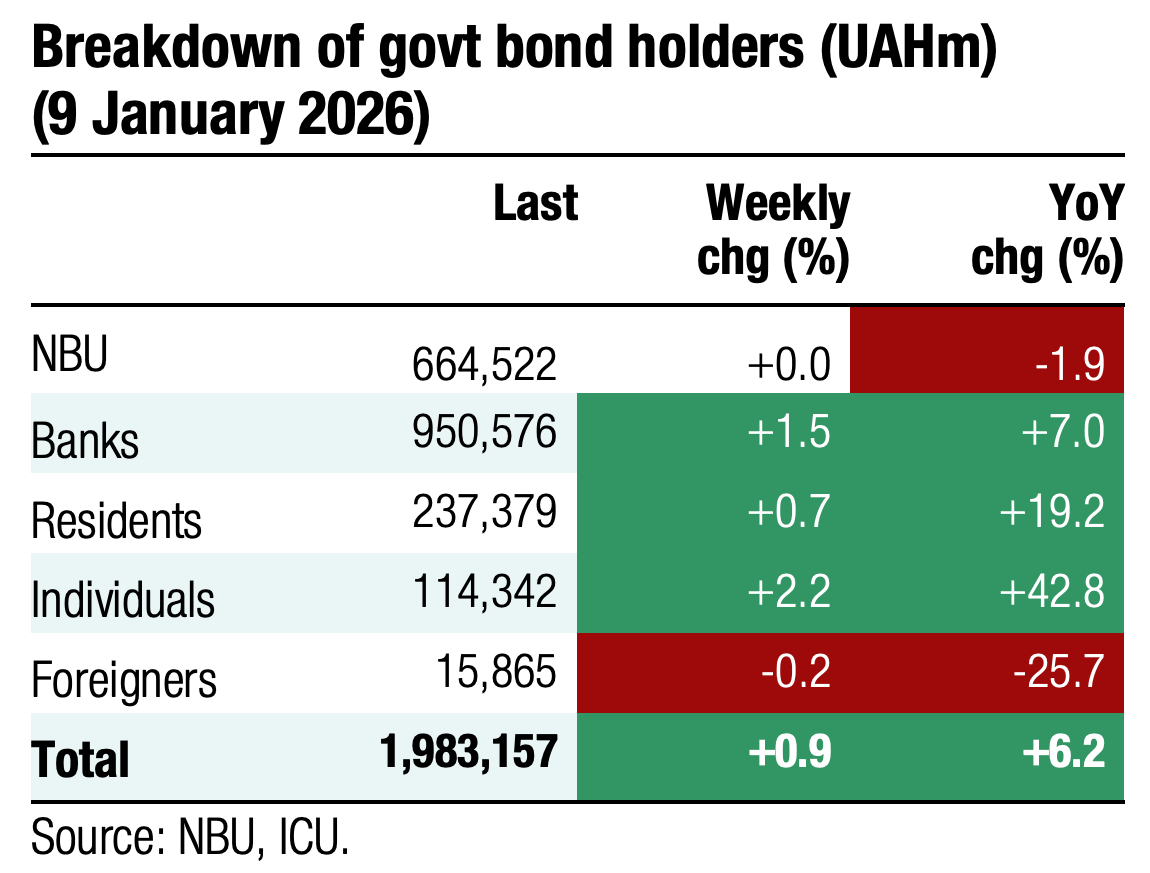

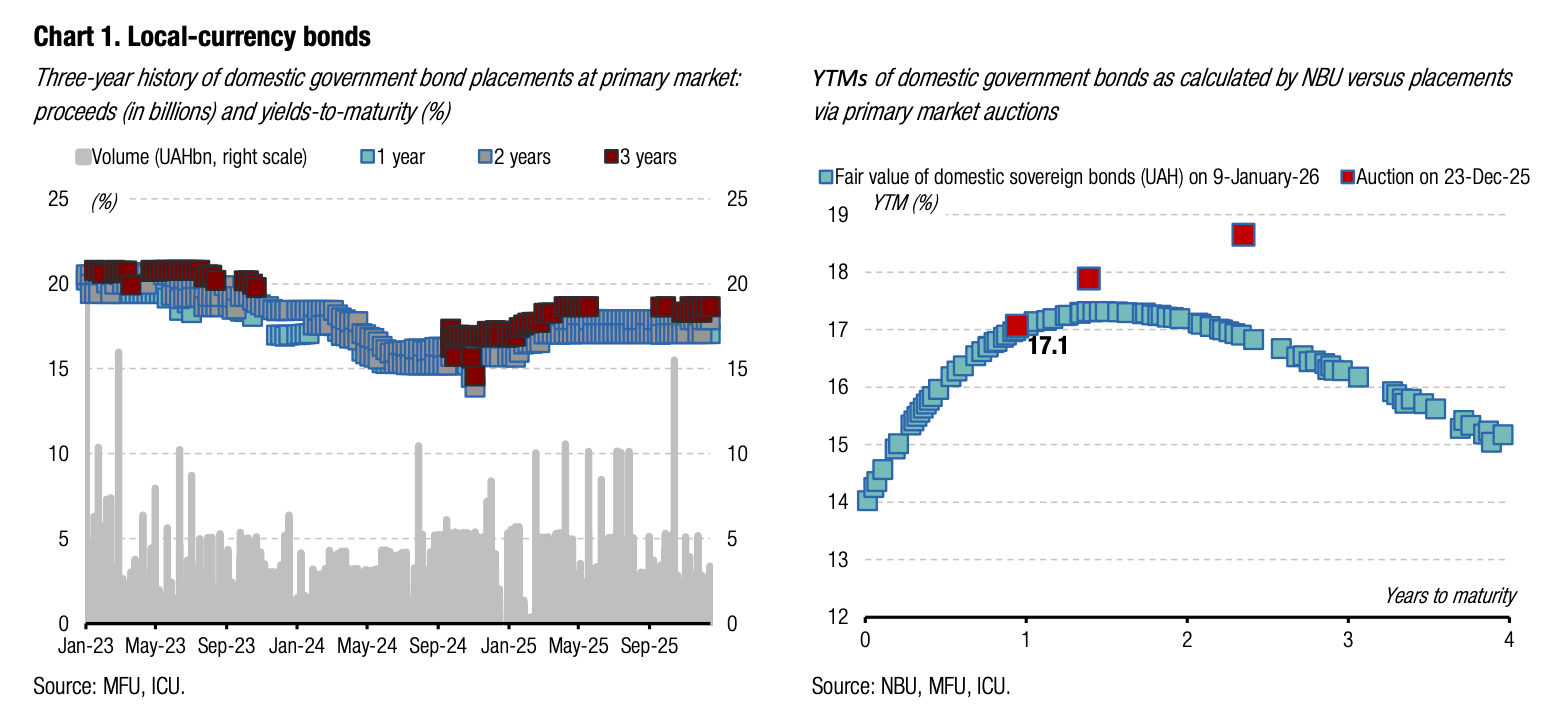

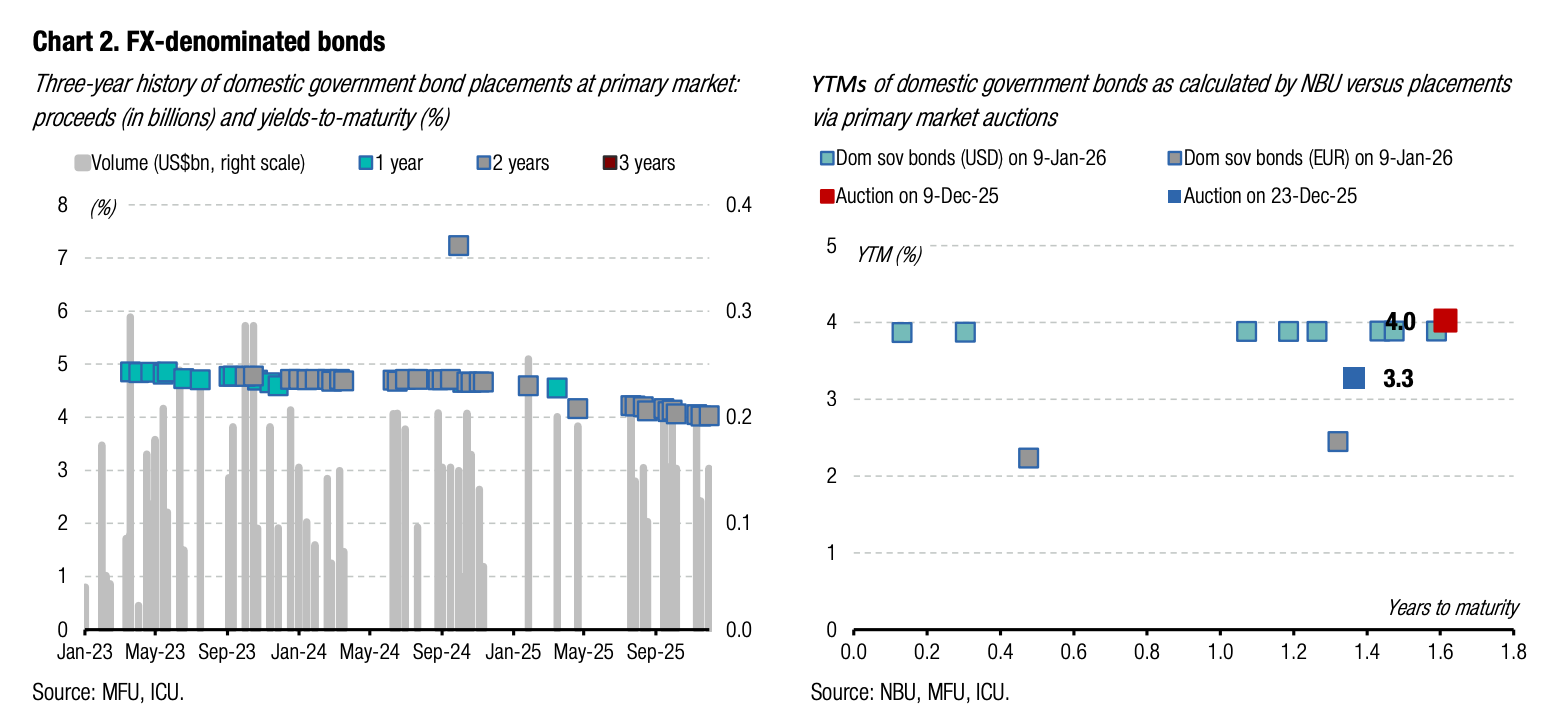

Bonds: Net domestic borrowings tiny at UAH53bn in 2025

MoF’s net domestic borrowings stood at just UAH53bn in 2025.

During 2025, the MoF borrowed UAH414bn, US$2.4bn, and EUR774m in the domestic bond market. At the same time, repayments stood at UAH343bn, US$2.9bn, and EUR750m. Therefore, the rollover was 121% for UAH debt, 84% for US$ debt, and 103% for debt in euros. In hryvnia equivalent, total borrowings in all currencies amounted to UAH552bn while redemptions were UAH499bn, implying net borrowings of just UAH53bn. That is just one-fifth of the plan in the final version of the 2025 State Budget Law.

For 2026, the State Budget Law provides for UAH420bn of borrowings and UAH524bn of redemptions, implying net redemptions of over UAH100bn.

ICU view: The Ministry of Finance expects that this year’s foreign aid will sufficiently cover the state budget deficit. Therefore, under the baseline scenario, there will be no need for significant borrowings in the domestic bond market. The plan for negative net borrowings likely means that the MoF will continue to reduce the outstanding volume of FX-denominated domestic bonds. At the same time, for UAH securities, the MoF will likely strive to meet 100% rollover.

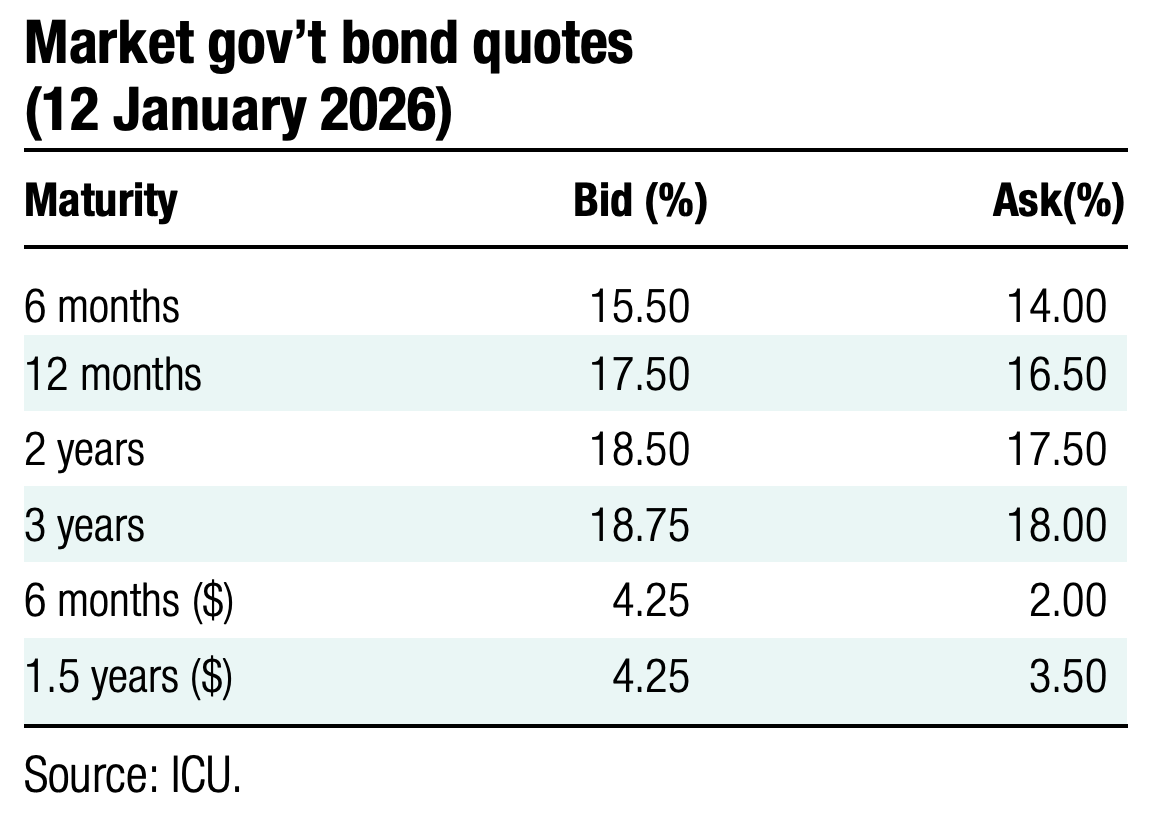

Bonds: MoF starts year with new reserve bond

At the debut auction of the year, the MoF offered a new reserve bond and later announced a reserve bond exchange auction on Wednesday.

Last week, the MoF sold UAH5bn of new bonds due in September 2029. The yield was set at 14.44%, which is significantly below yields on military or ordinary bonds. The MoF also announced an exchange auction for this Wednesday. Banks will be offered the opportunity to exchange reserve bonds due in February 2026 (with total outstanding amount of almost UAH 20 billion) for new securities due in September 2029. The cap for the exchange offering is UAH20bn, implying the Ministry is offering to exchange the maturing bond in full.

ICU view: The Ministry of Finance’s intention to exchange the bond is a good practice that allows it to mitigate refinancing risks in advance.

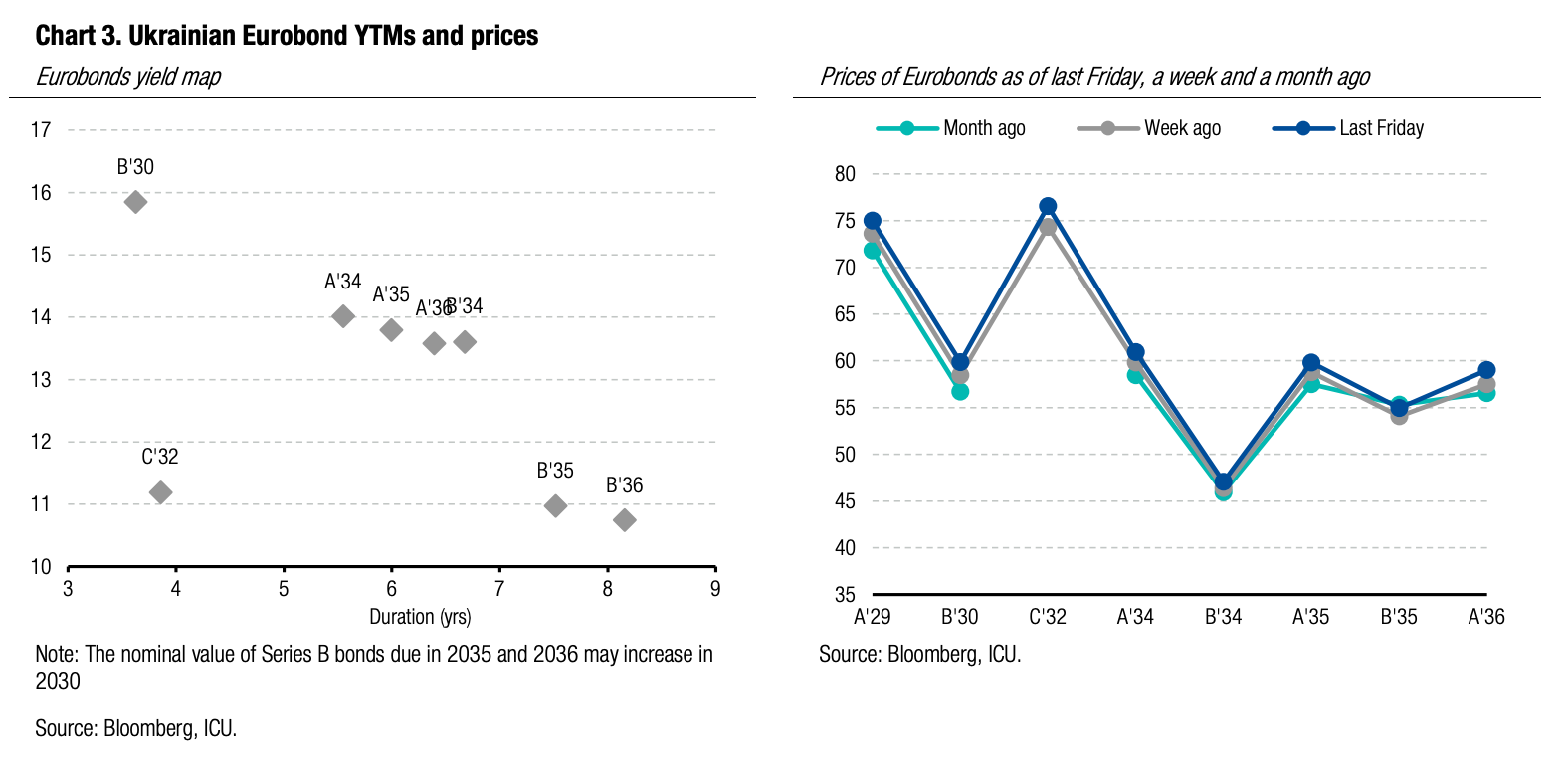

Bonds: New series C Eurobonds start trading

During the Christmas and New Year holidays, Ukrainian Eurobonds traded in a relatively narrow range. Restructuring of VRIs resulted in a supply of new series C Eurobonds.

Over the previous two weeks, Ukrainian Eurobonds traded in a tight range of a few cents. A new StepUp bond C, issued in late December as a part of the GDP warrant restructuring package, started to trade in the market. The new paper was received well with yields just above 11% for a price of 76-77 cents. Last Friday, the YTM of the new bond was 11.2% or 490bp below that of the shortest series A bond with a comparable duration.

ICU view: Discussions of a peace plan for Ukraine proceed albeit at a slow pace, implying limited near-term upside. With the uncertainly around the EU loan for Ukraine fading, peace talks will remain the key determinant of investor sentiment in 2026.

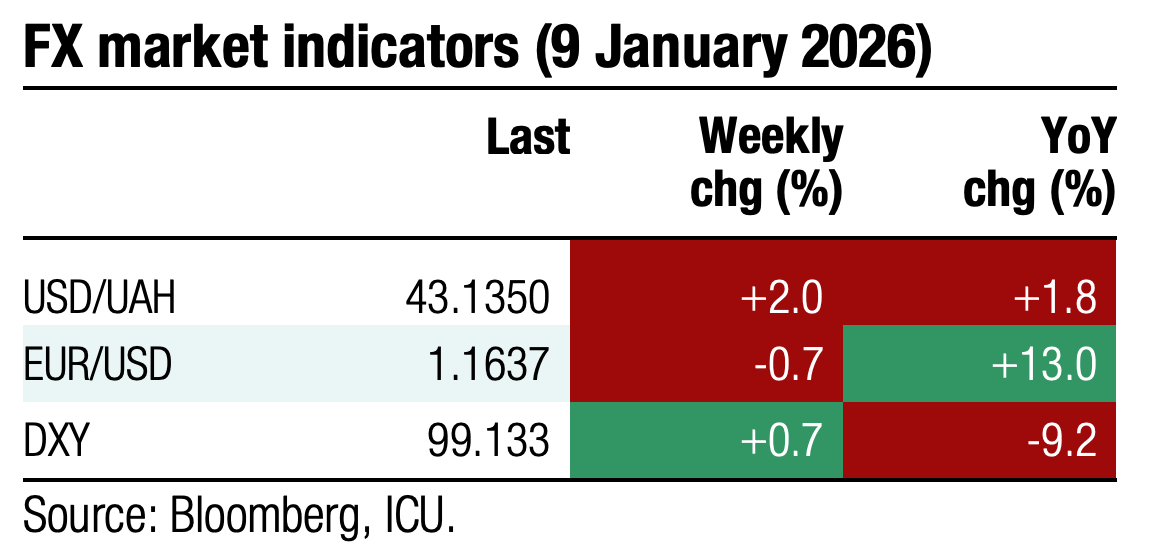

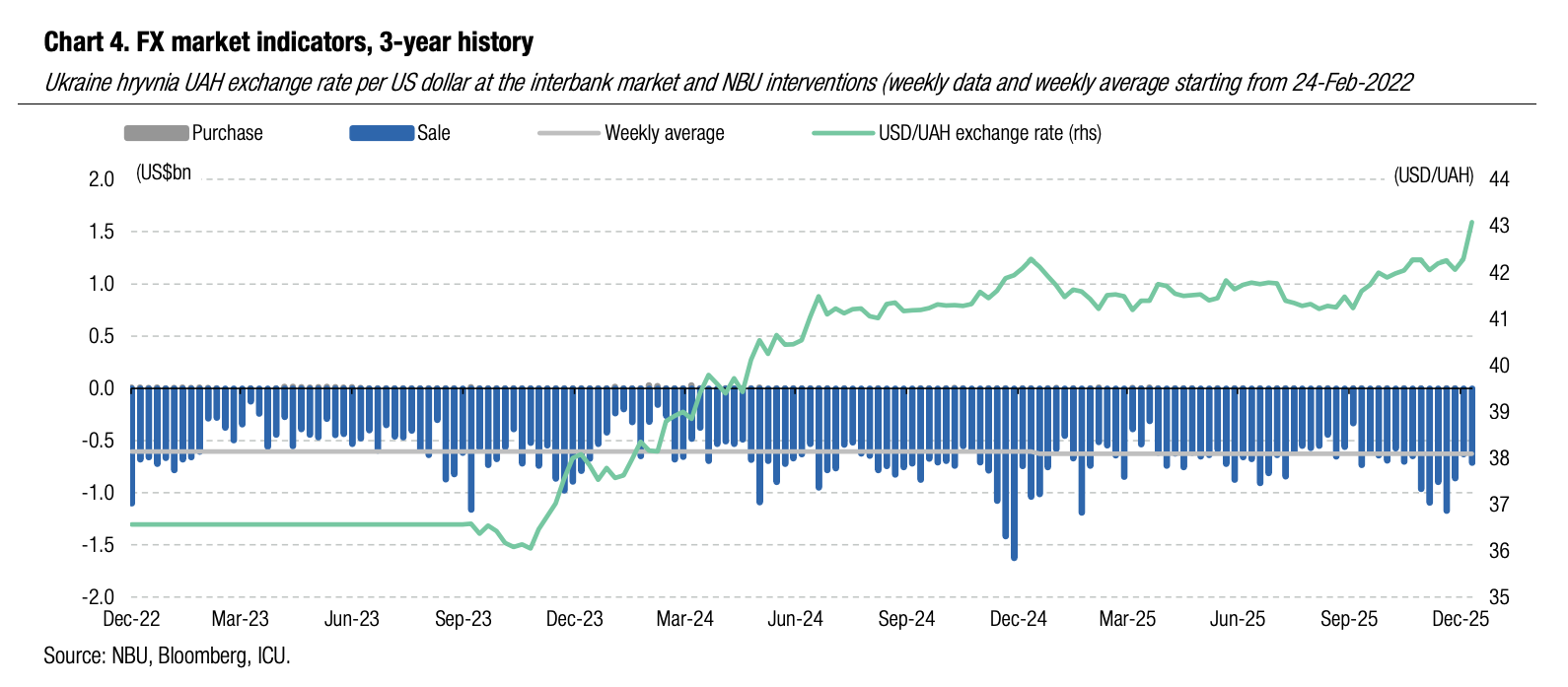

FX: NBU tests new hryvnia levels

The National Bank started the year with a significant weakening of the hryvnia even though its interventions were not excessively high.

In the first nine days of the new year, the National Bank lowered the official hryvnia exchange rate by 1.7% to UAH 43.08/US$. During New Year's week, interventions totalled US$633m, and then increased to US$712m last week. In the same period last year, the NBU spent almost US$1.8bn on interventions. The foreign currency deficit in the first eight days of 2026 was relatively small at US$639m compared with over US$1bn in the same period of 2025.

ICU view: The weakening of the hryvnia at the beginning of the year was a policy decision of the NBU as it is now likely providing some guidance about the new band of fluctuations for coming months. We may see a reversal of the exchange rate closer to UAH42/US$ in the near future. We expect limited volatility in the hryvnia exchange rate during the year, although the volatility band is likely to be wider than last year. We expect a gradual and managed hryvnia depreciation throughout the year with end-2026 rate seen at UAH44.3/US$.

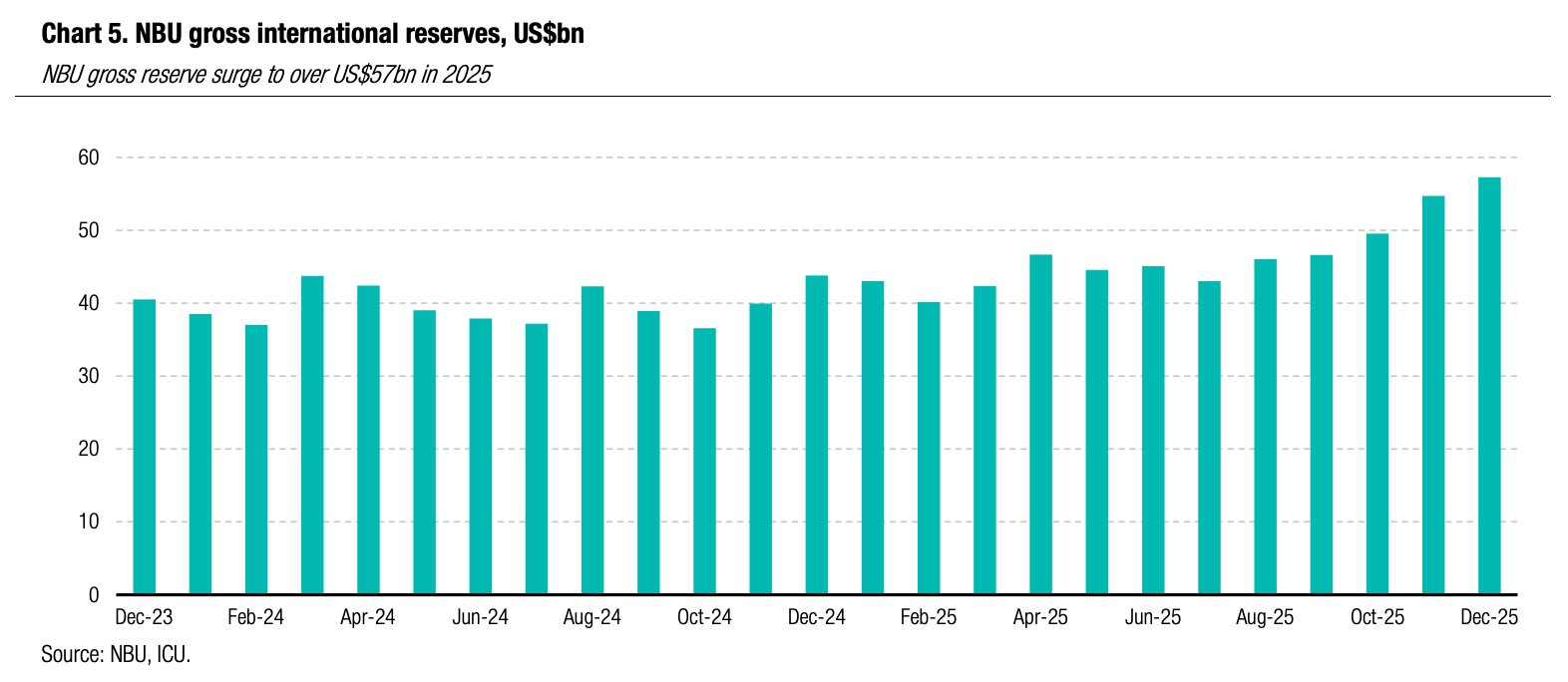

Economics: NBU reserves surge in 2025

The gross international reserves of the NBU were up 4.6% in December and 31% in 2025 to an all-time high of US$57.3bn, an equivalent of 5.9 months of future imports as per NBU estimates.

The increase in reserves was driven by record-high foreign financial aid that totaled US$52.4bn in 2025, including US$32.7bn from the EU. The US$2.0bn aid from the UK within the ERA was not included into NBU reserves due to its targeted nature. Meanwhile, NBU sale interventions in the FX market that totaled net US$36.2bn were the key drag on reserves. Also, Ukraine spent over US$6.0bn on external debt servicing (both principal repayment and interest), including US$3.2bn on payments to the IMF.

ICU view: The surge in NBU reserves in 2025 was fully expected due to significant scheduled inflows of foreign financial aid that included partial budget pre-financing for 2026. We expect that robust inflows of foreign aid will be maintained and exceed US$40bn in 2026 thanks to the recently approved EU loan. This implies that the central bank will have sufficient firepower to keep the FX market and hryvnia exchange rate under its full control in 2026. Its reserves are likely to stay above US$50bn at least through end-2026.

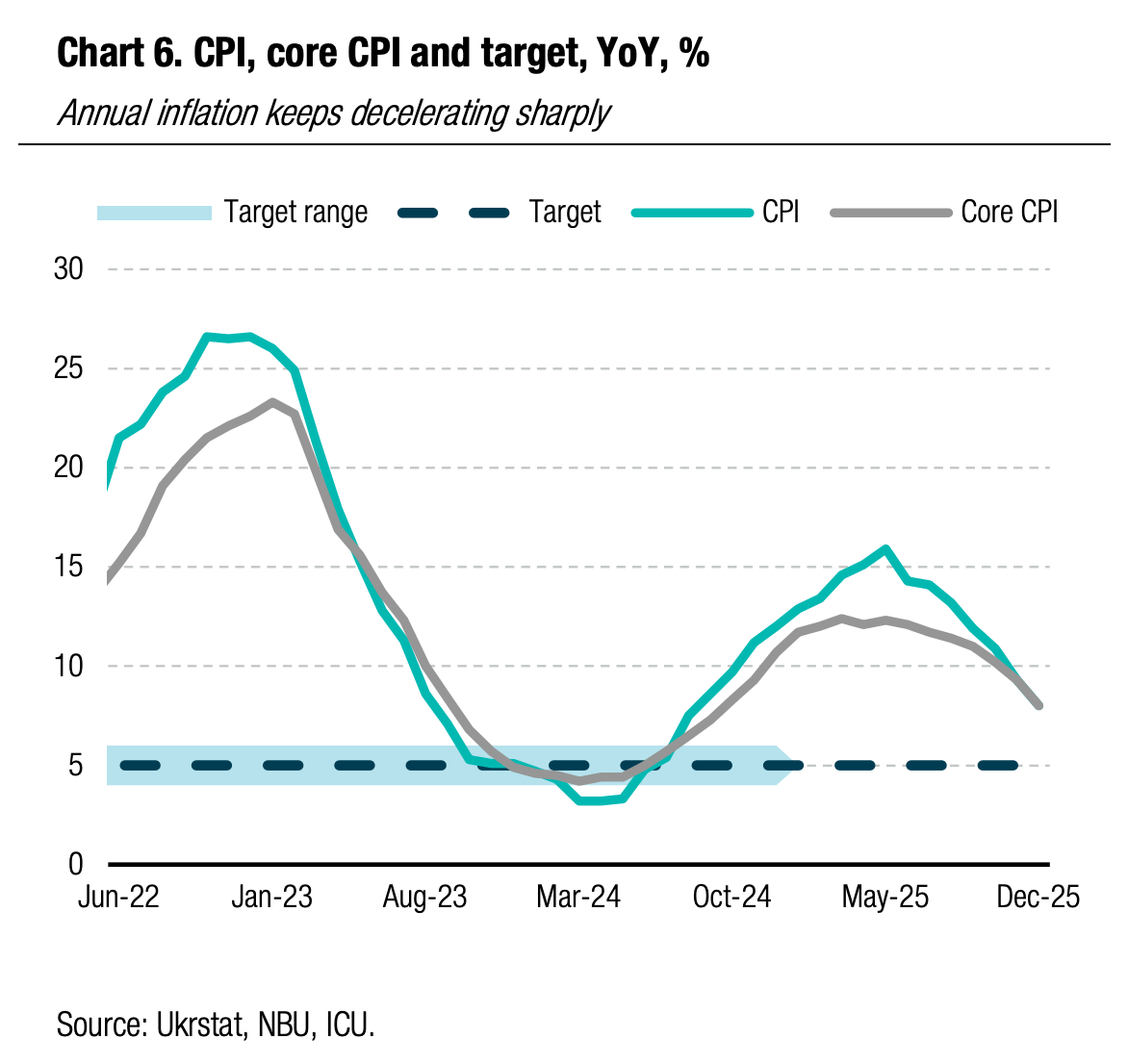

Economics: Inflation falls sharply in 2025

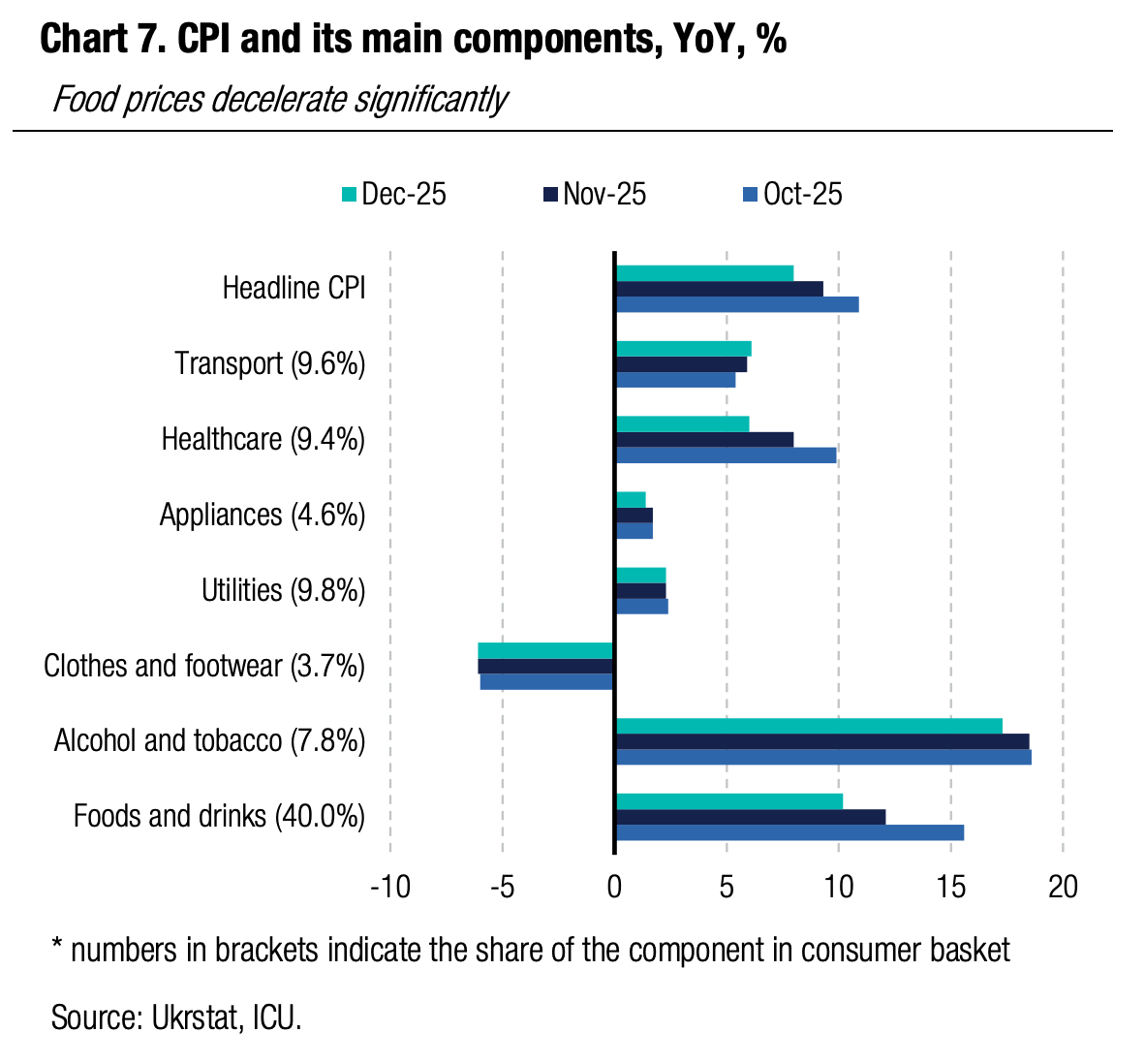

Annual CPI slowed to 8.0% in December vs. 9.3% in November and a peak of 15.9% in May.

Such a sharp deceleration came as a surprise – the NBU expected 9.2% while our expectation was 8.5% for end-2025 inflation. Monthly CPI of just 0.2% in December was atypically low for this month of the year. The deceleration in the annual price-growth rate was wide-ranging, with the most significant declines seen for communication services (12.0% in December vs. 16.4% in November) food (9.8% vs. 11.8%) and healthcare (6.0% vs. 8.0%). Importantly, prices growth in restaurants and hotels, a sector that is very sensitive to cost pressures, decelerated by 1pp to 13.5% – the lowest rate since December 2024. Transportation services were the only consumer-basket component that saw an acceleration (6.1% vs. 5.9% in November).

|  |

ICU view: We expect the annual CPI will keep decelerating robustly at least until June and may slip below 6% in March or April. Inflationary pressures will remain weak in the coming months due to slower growth in household incomes, sufficient last year’s harvest, export constraints for food products (due to russia’s attacks on port infrastructure), stability of regulated utility tariffs, and limited depreciation of hryvnia. Yet, consumer inflation is set to accelerate in 2H26 due to last year’s low base. We expect the CPI to finish at 6.3% at end-2026. The surprise inflation figure leaves no other choice for the NBU but to switch to a (long overdue) monetary policy loosening cycle. We expect a 50bp cut to 15.0% in late January and a cumulative 200bp cut to 13.5% for 2026.