|  |  |

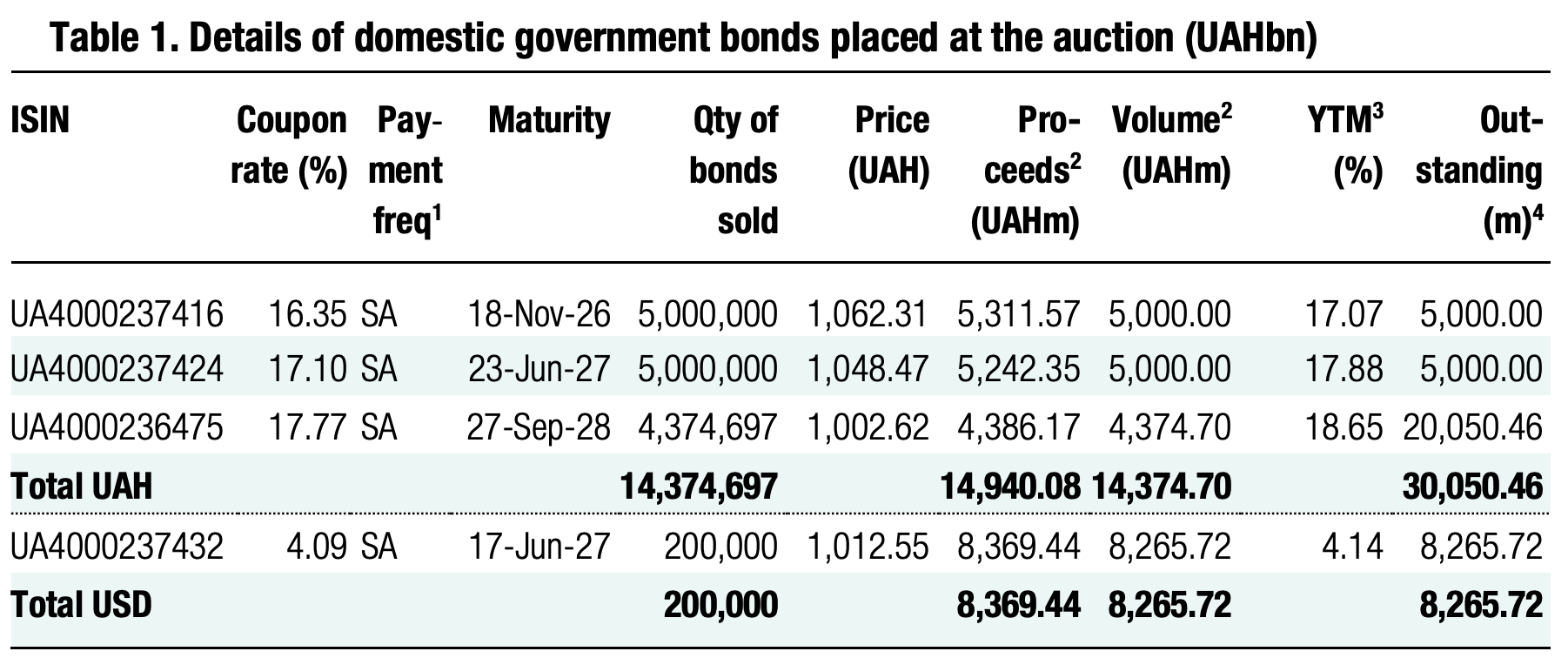

Yesterday, the Ministry of Finance borrowed UAH23bn for the state budget, mostly in hryvnia.

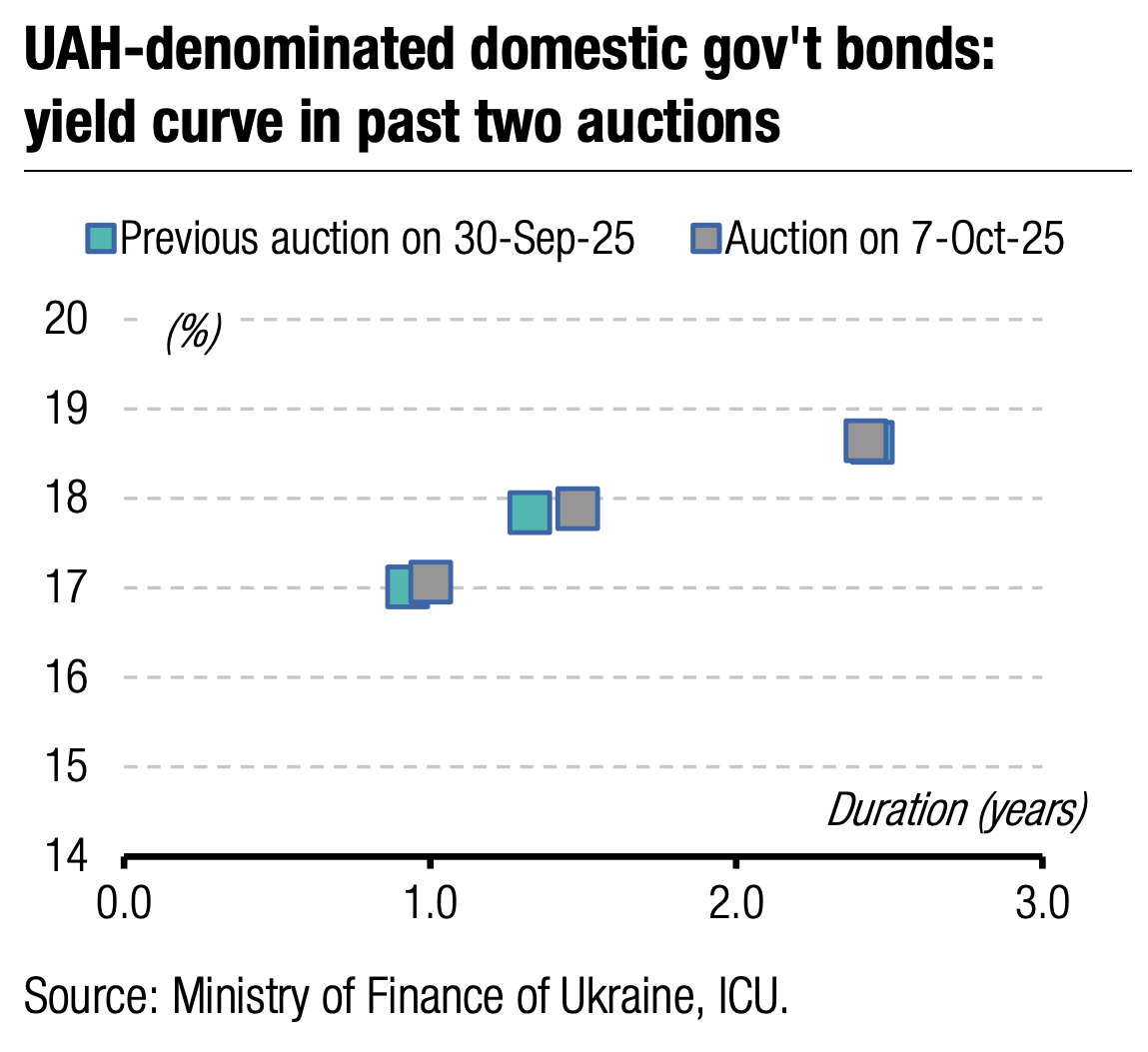

Interest in UAH instruments has significantly increased. For the third time this year, the shortest of the offered bonds (due next year) received demand greater than supply, and paper due in 2027 received demand greater than supply for the first time.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.33/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU

The new military UAH paper was 10% oversubscribed, but mainly at the previous auction's cut-off rate. Therefore, placement conditions have not changed, and the budget received UAH5.3bn of funds.

Placement conditions for 21-month securities have also not changed. Demand reached UAH6.2bn vs the UAH5bn cap, and the Ministry of Finance had to accept all bids, but likely all of them partially.

Interest in the three-year bond also increased, but was slightly below the cap. Therefore, the MoF fully accepted all bids.

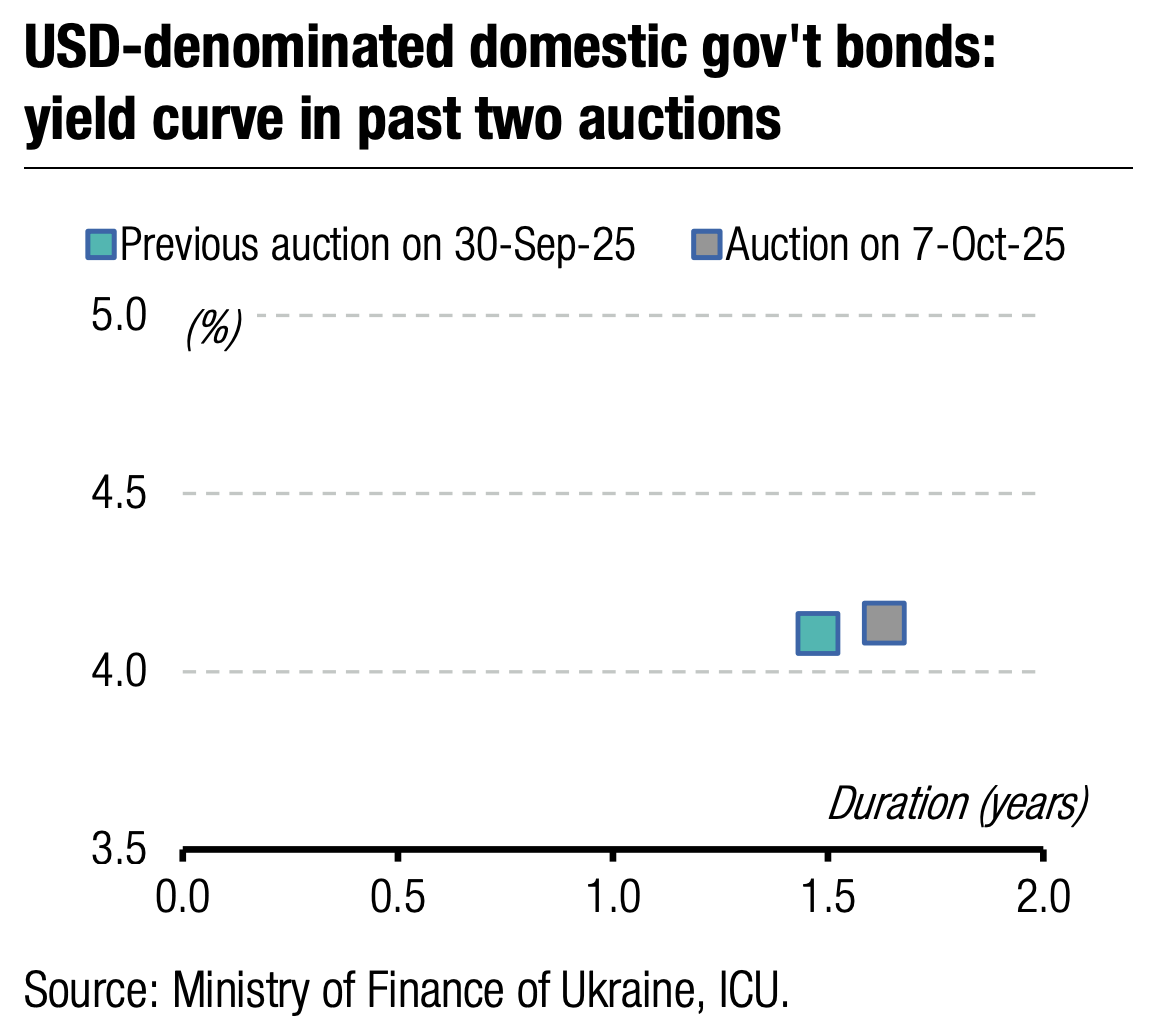

The MoF also sold US$200m of FX-denominated bills. Demand was almost a quarter higher, so the Ministry rejected four bids because they required an increase in the cut-off rate by 5bp. The Ministry of Finance lowered the cut-off rate by 1bp to 4.1%, and the weighted average rate increased by 3bp to 4.09%.

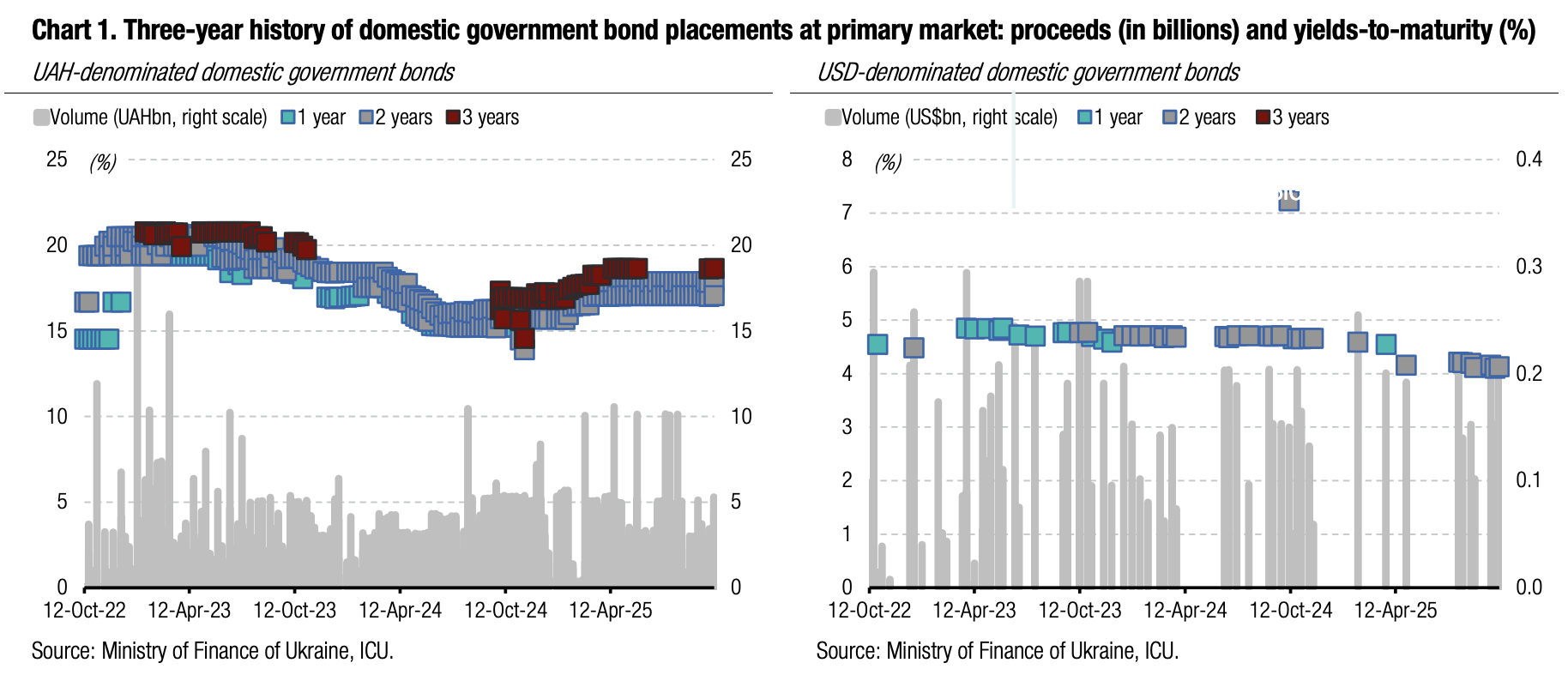

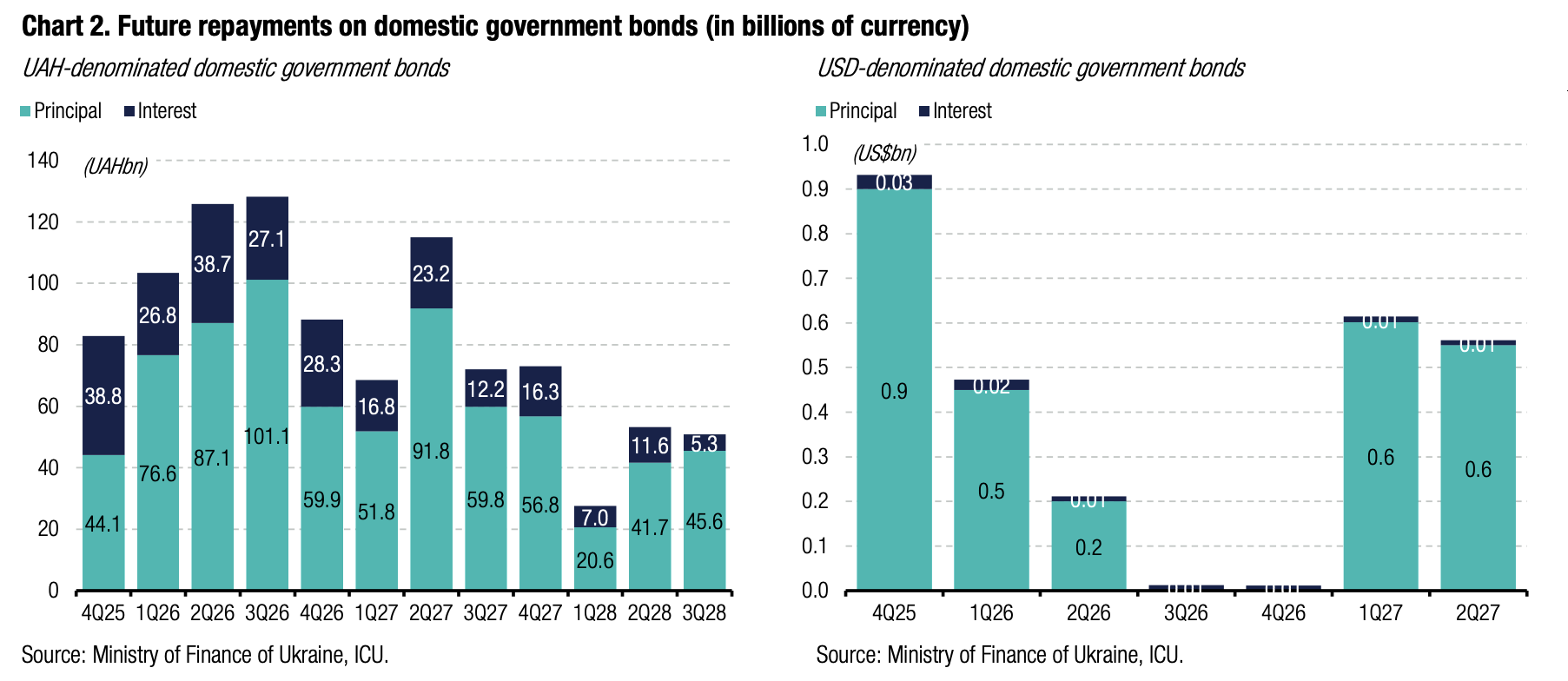

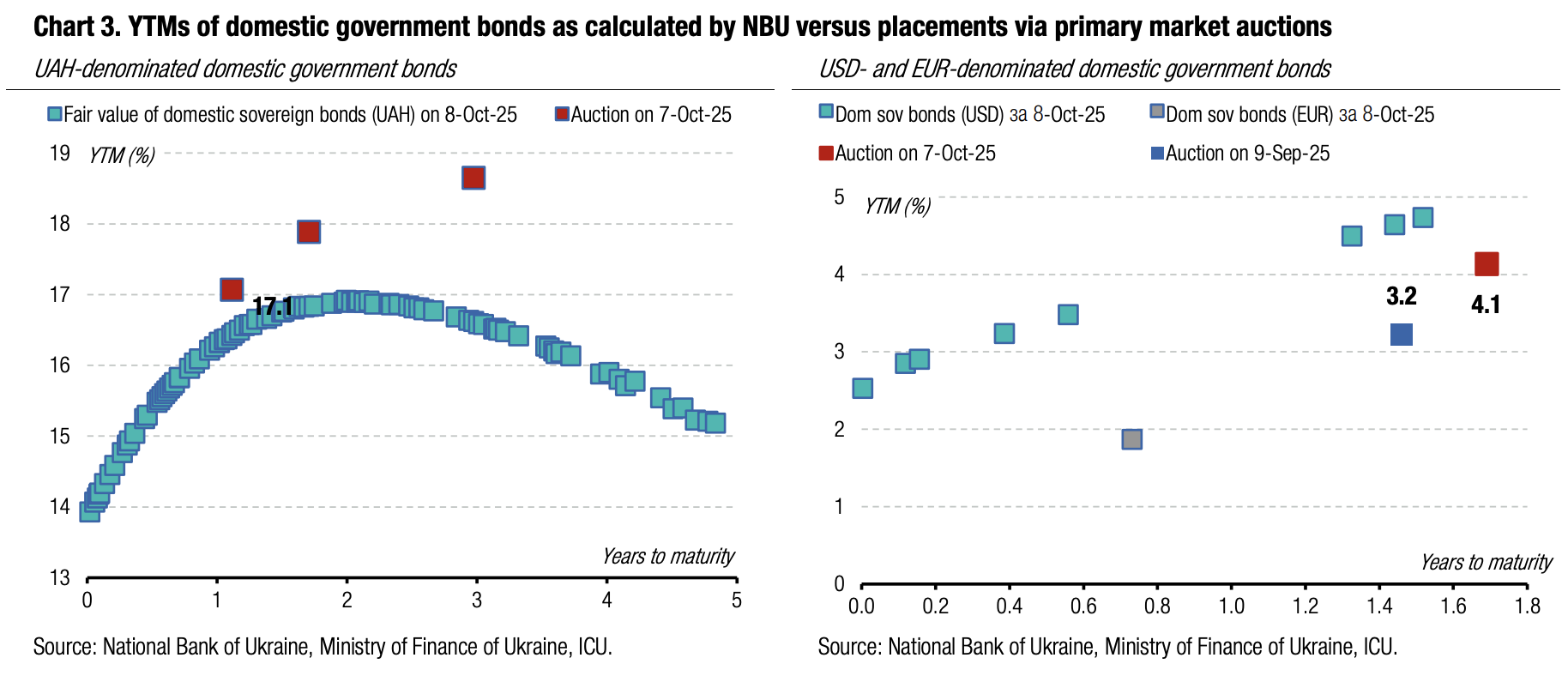

Appendix: Yields-to-maturity, repayments