|  |  |

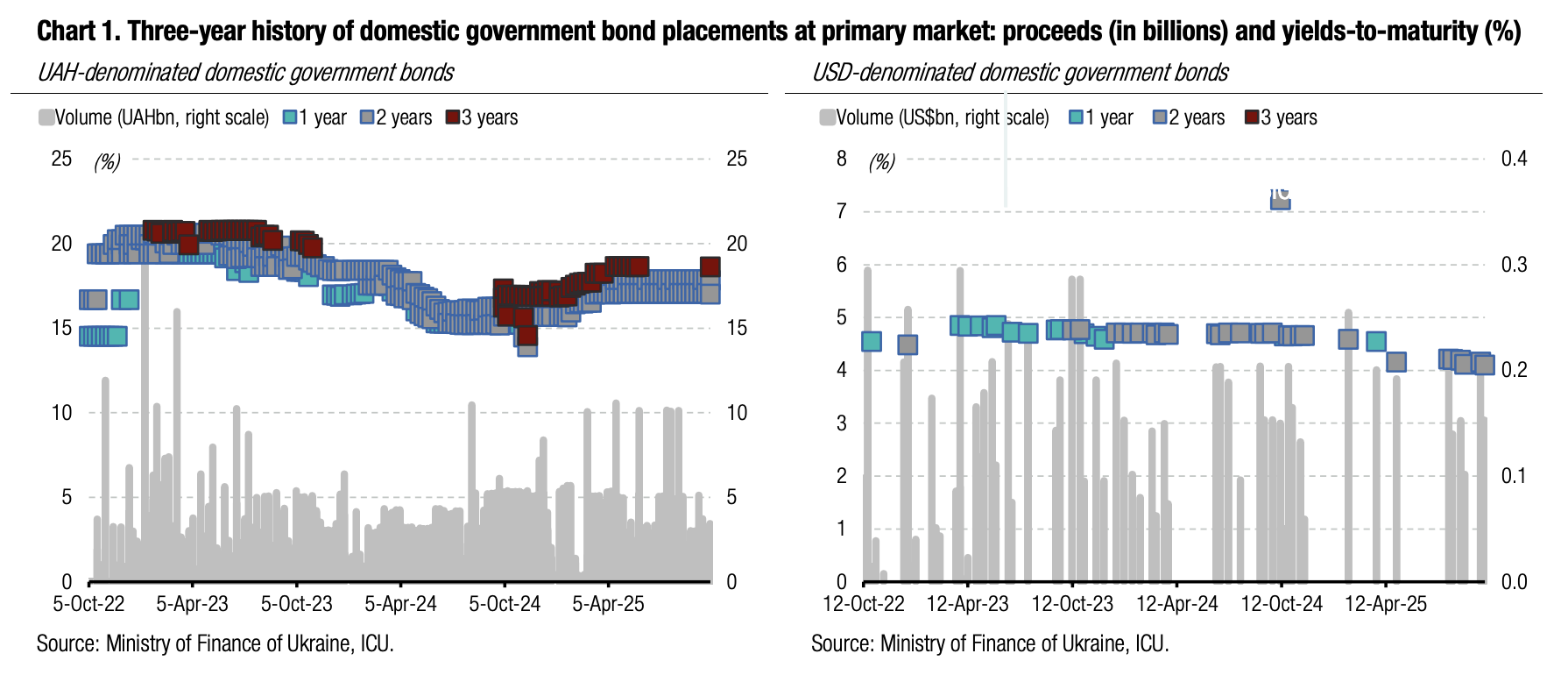

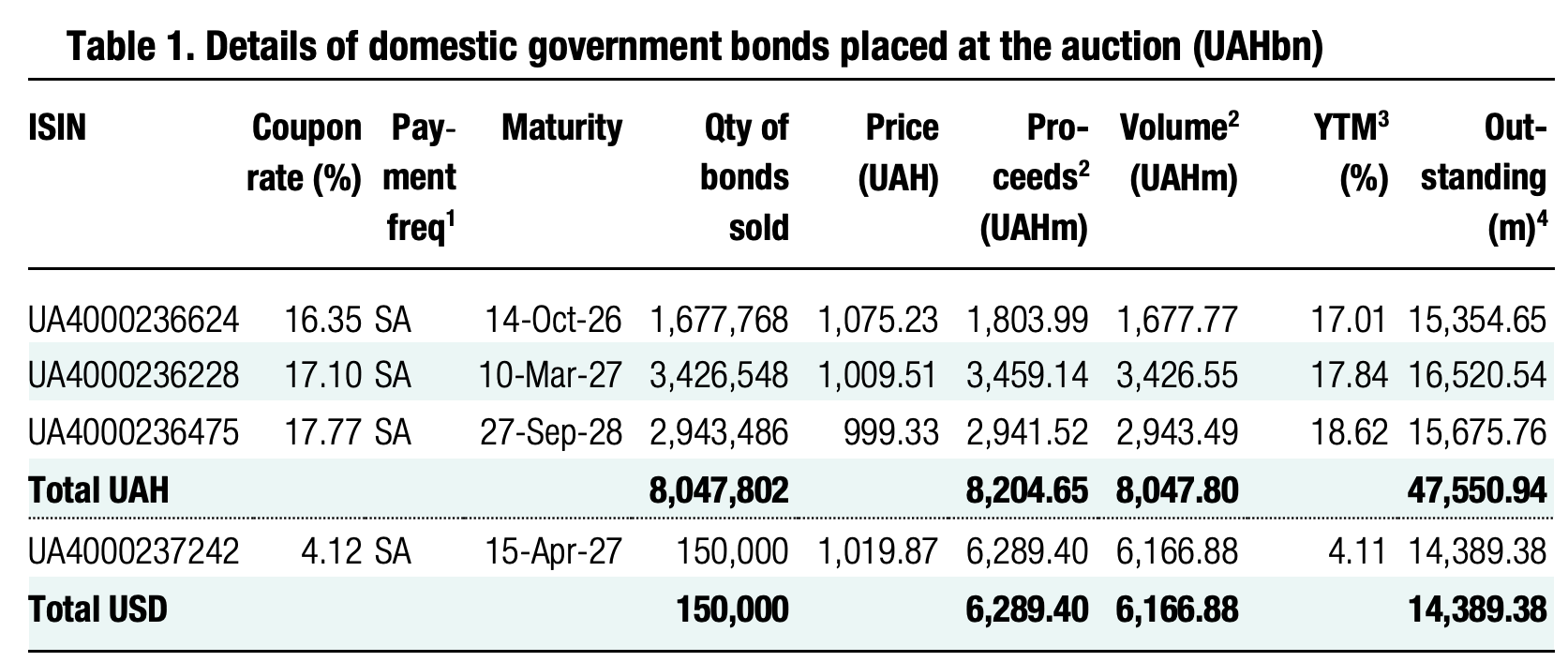

A significant amount of yesterday's budget proceeds was from USD-denominated paper, which saw almost x3 oversubscription. However, the budget received more funds from UAH instruments.

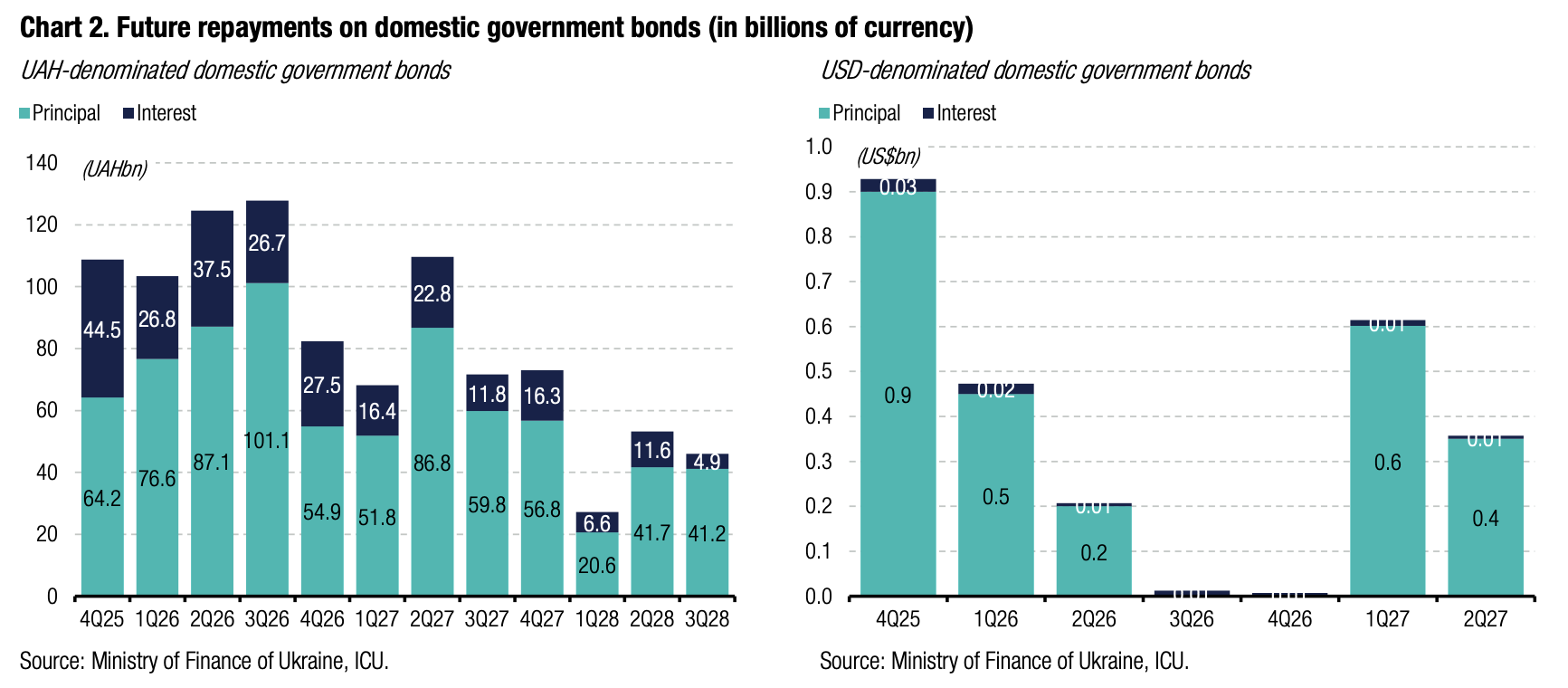

The MoF redeemed US$350m of bonds last week, placing a similar amount of new bonds over two weeks. However, it is unlikely that everyone who wanted to was able to reinvest the funds in new securities. Last week, this could have been the purchase of bonds by banks and traders for the future because the bondholders received payment of funds from the budget after the auction. So, yesterday, demand was formed by many investors, and some could submit multiple bids with different rates.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.11/USD, 48.29/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

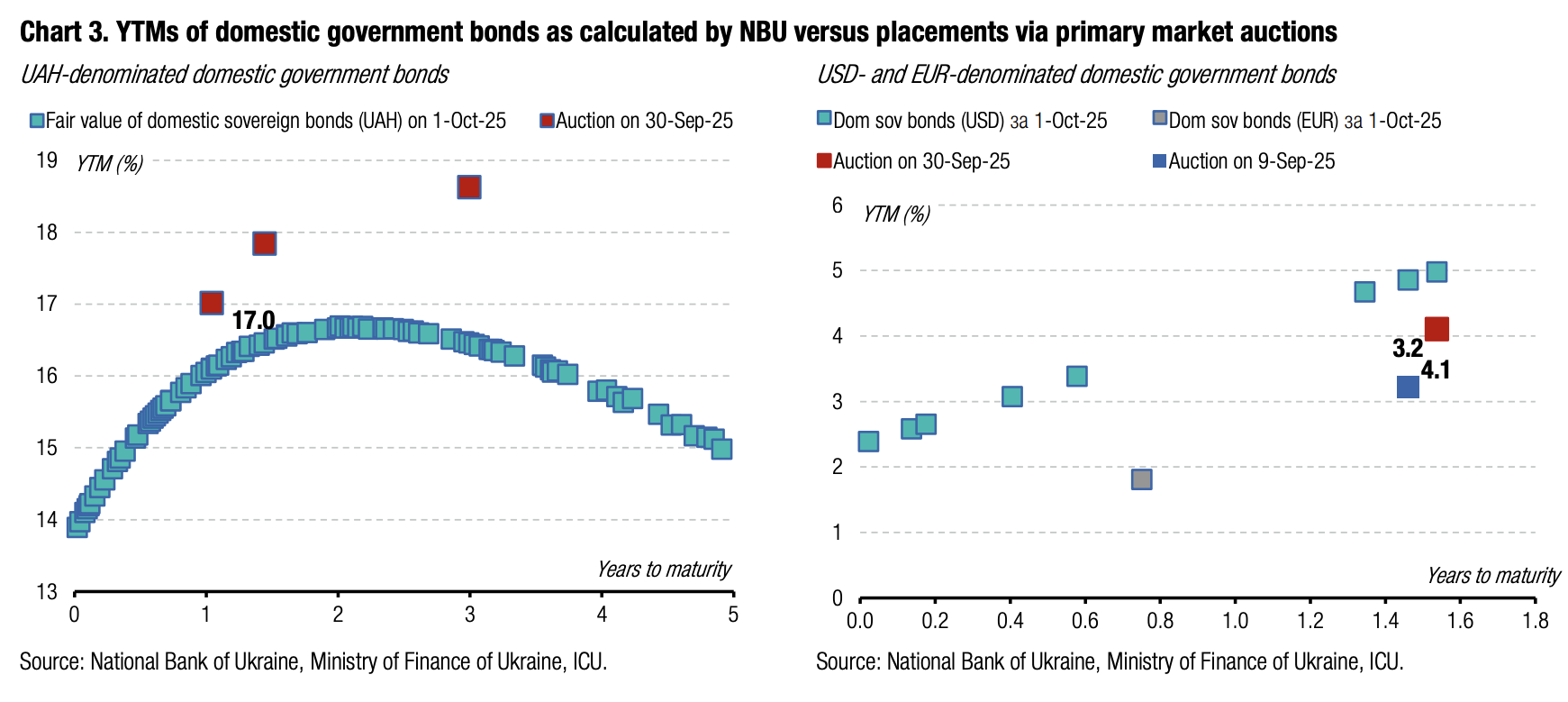

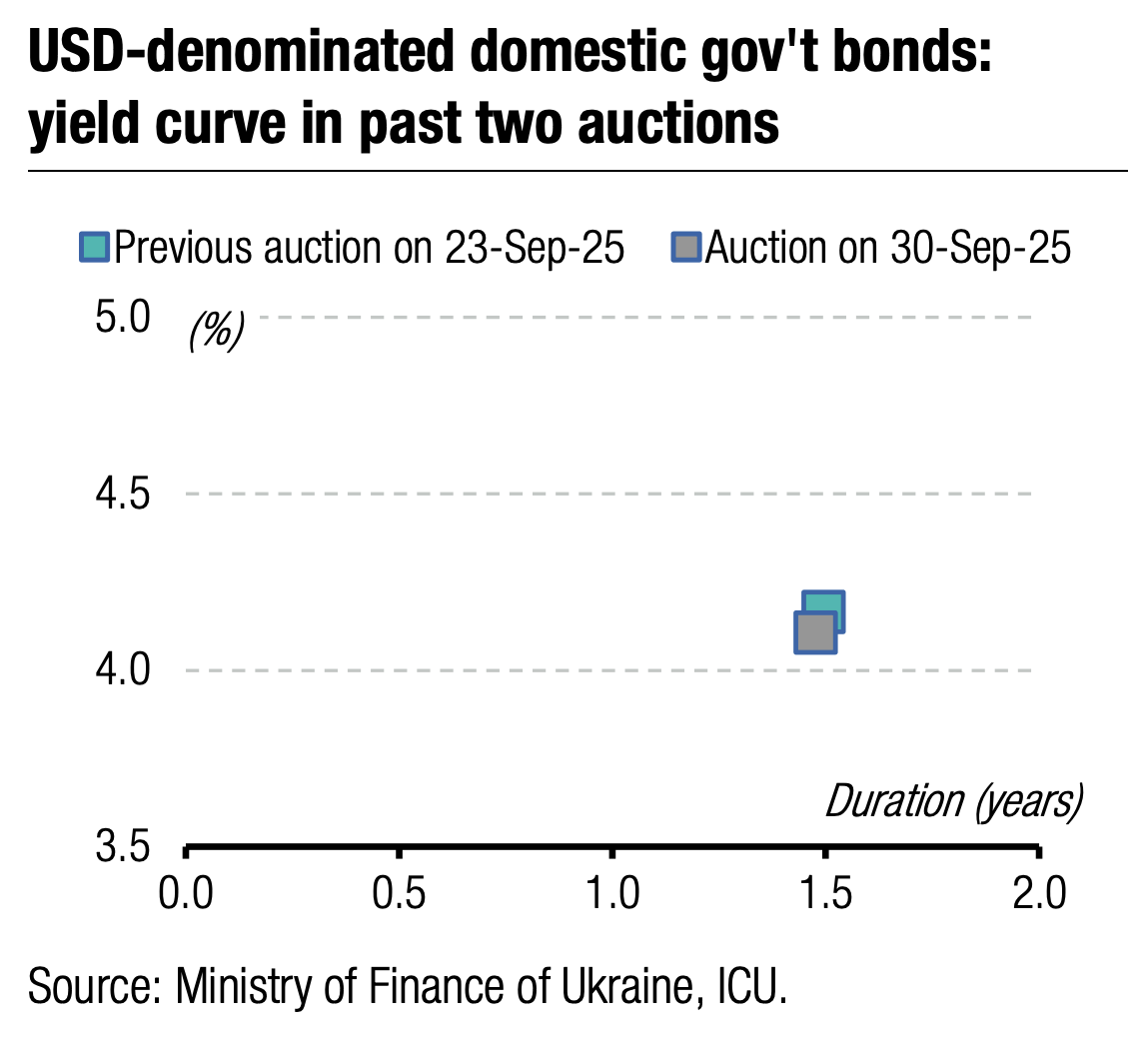

The highest bid rate fell almost to the level of the cut-off rate of the last auction, and the minimum rate decreased by 15bp to 3.85%. The total volume of bids amounted to almost US$431m vs. the cap of US$150m. So, the ministry was able to satisfy only a third of demand and reduce the rates for this bond. Therefore, the cut-off rate slid by 4bp to 4.11%, and the weighted average rate decreased to 4.06% or by 6bp.

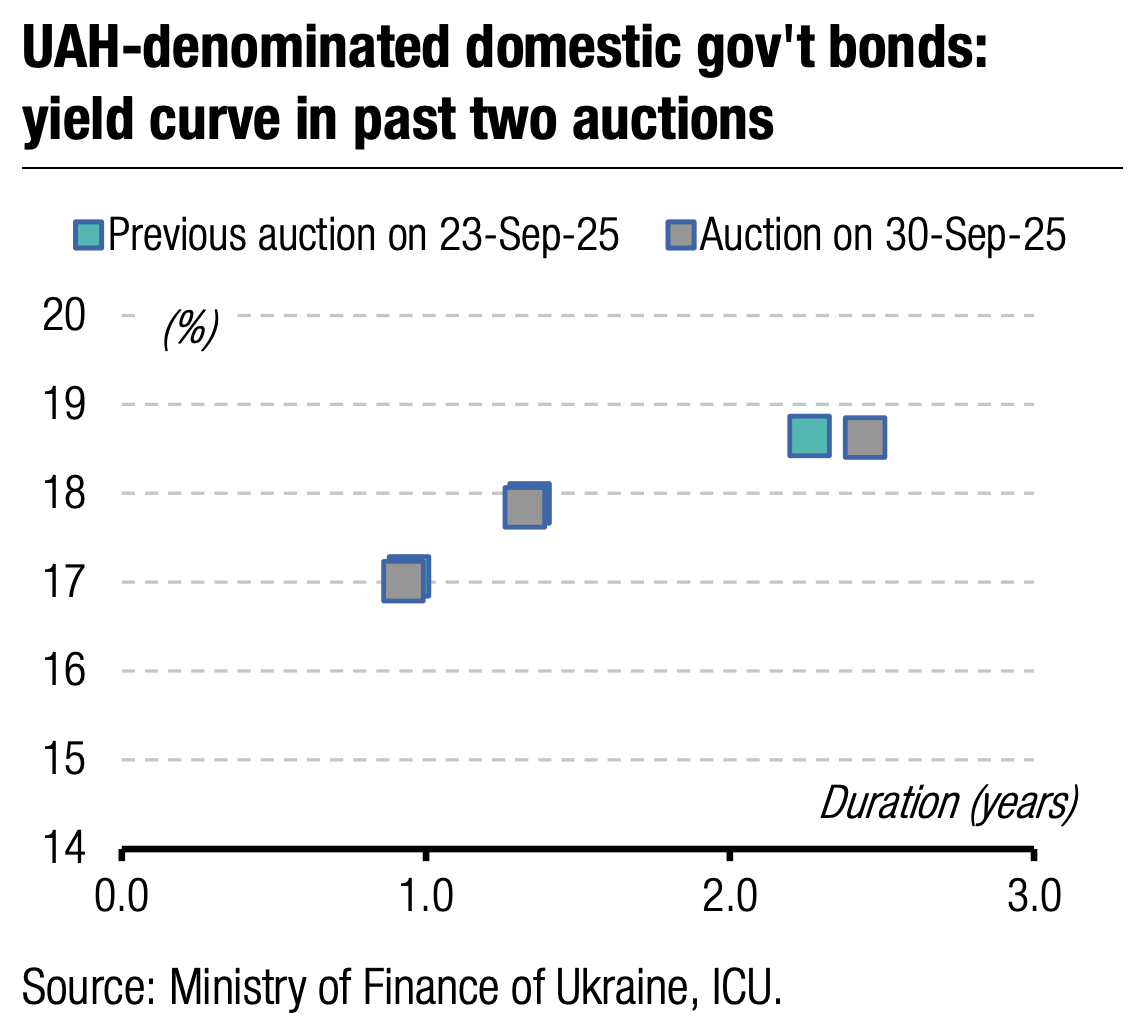

At the same time, there was also good interest in UAH bonds, even without hints of the prospect of a rate reduction. For all instruments, the yields in bids were typical, and the cut-off and weighted average rates did not see any changes.

The volume of bids for one-year military bills increased by a little more than 1/10 to less than UAH1.7bn, providing the budget UAH1.8bn. At the same time, demand for longer instruments increased significantly. The 1.5-year bonds received a third more bids than the previous week, over UAH3.4bn of bids. Demand for three-year bonds almost doubled compared with last week, and the budget received almost UAH3bn of proceeds.

The result of yesterday's auction was not a record for this year. The Ministry of Finance attracted significantly more funds by combining ordinary bonds with reserve and/or FX-denominated securities. However, overall, it is quite good and even very decent for hryvnia instruments.

Appendix: Yields-to-maturity, repayments