|  |  |

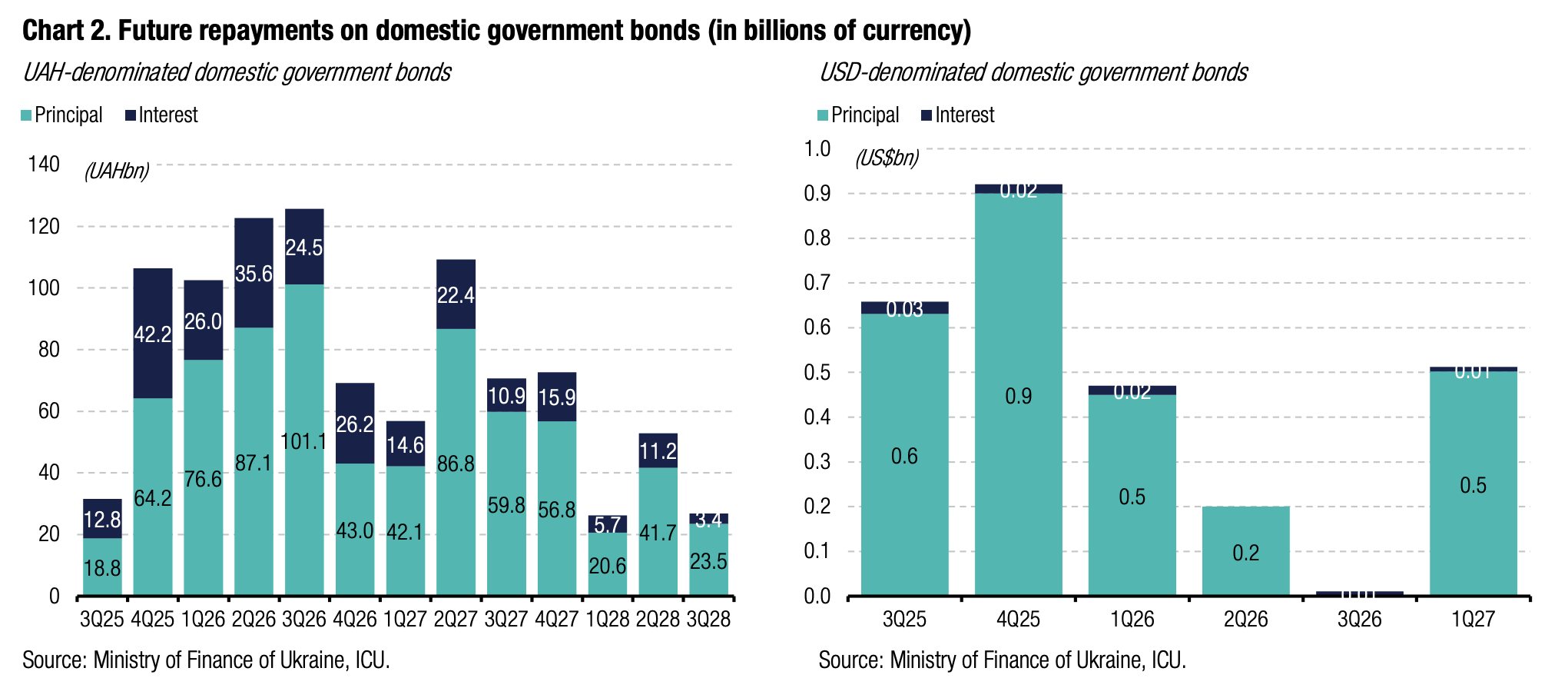

The Ministry of Finance planned four placements of USD-denominated bills after taking a small break last week. However, despite the regularity of placements, USD-denominated securities continue to collect significant demand and consistently bring the budget the planned proceeds.

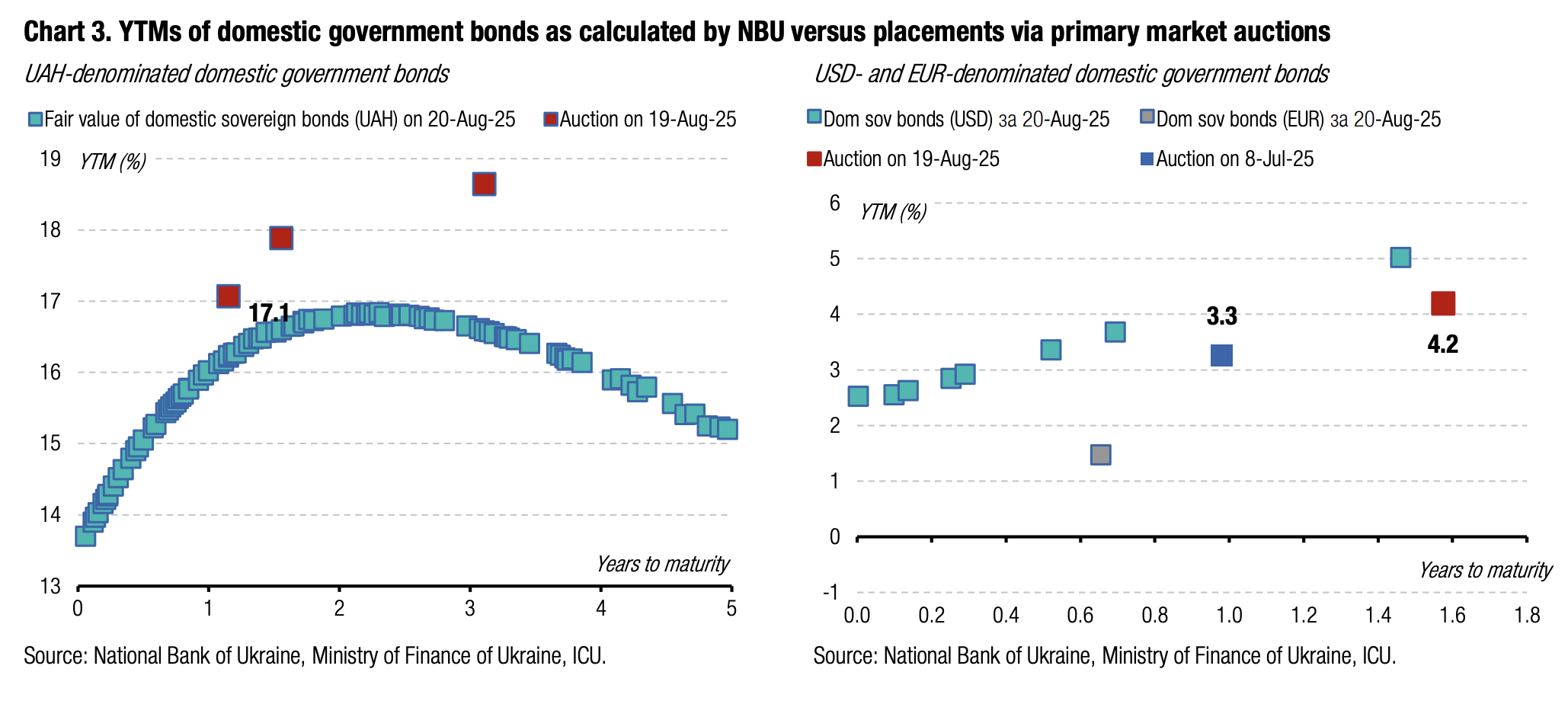

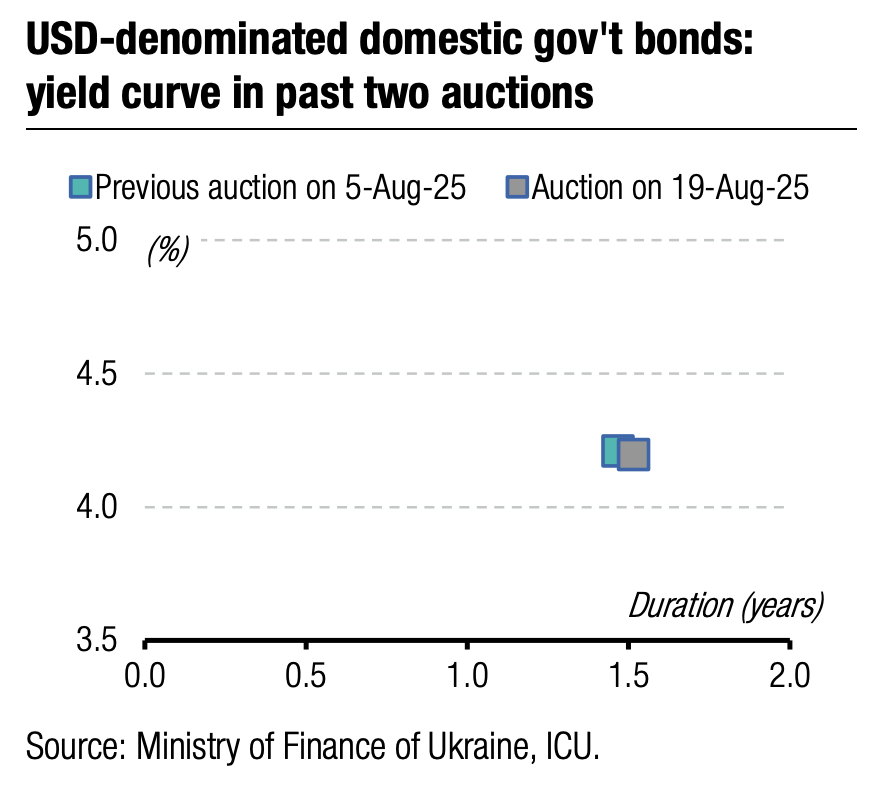

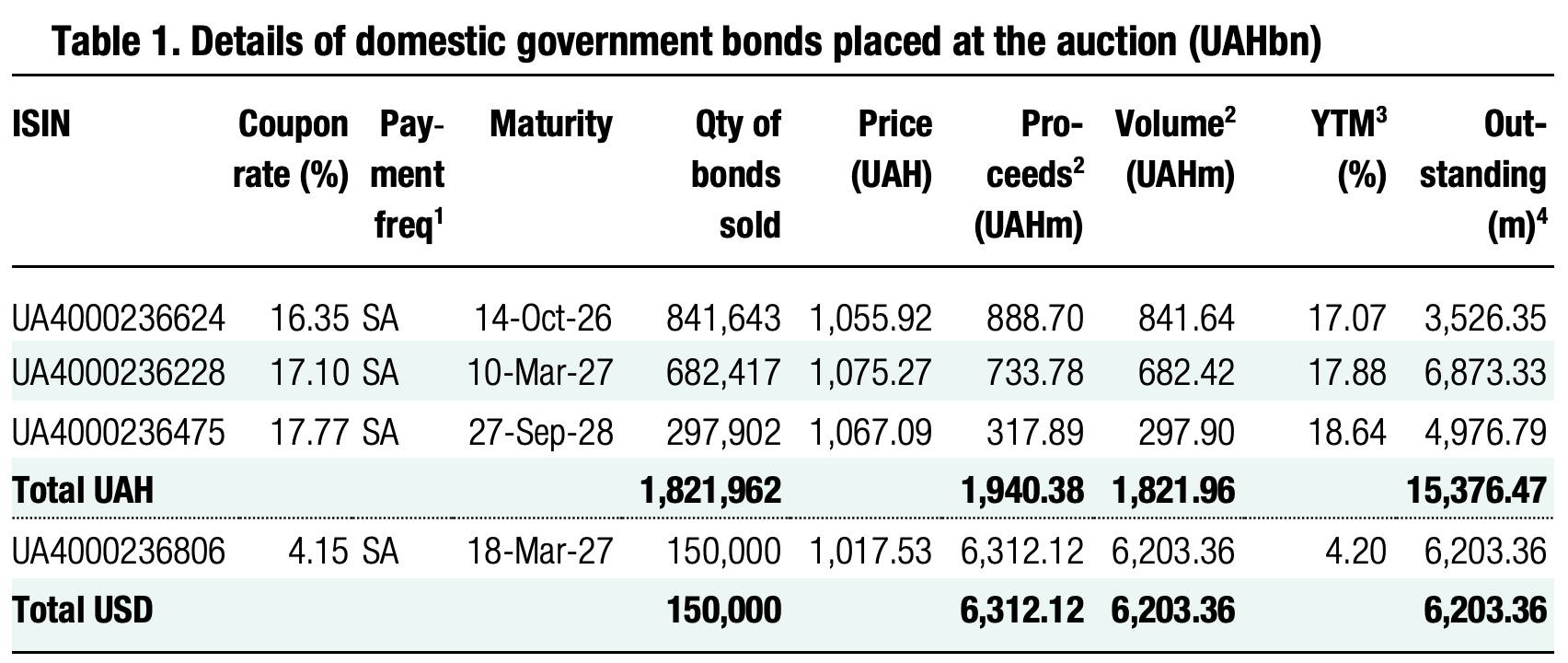

Yesterday, the MoF offered US$150m of bonds. Demand exceeded the offer by over three times and amounted to US$482.5m. Most accepted bids had 4.15% interest rates, as the cut-off rate decreased by 10bp to 4.15%, and the weighted average rate decreased by only 1bp to the same level, 4.15%.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.36/USD, 48.99/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

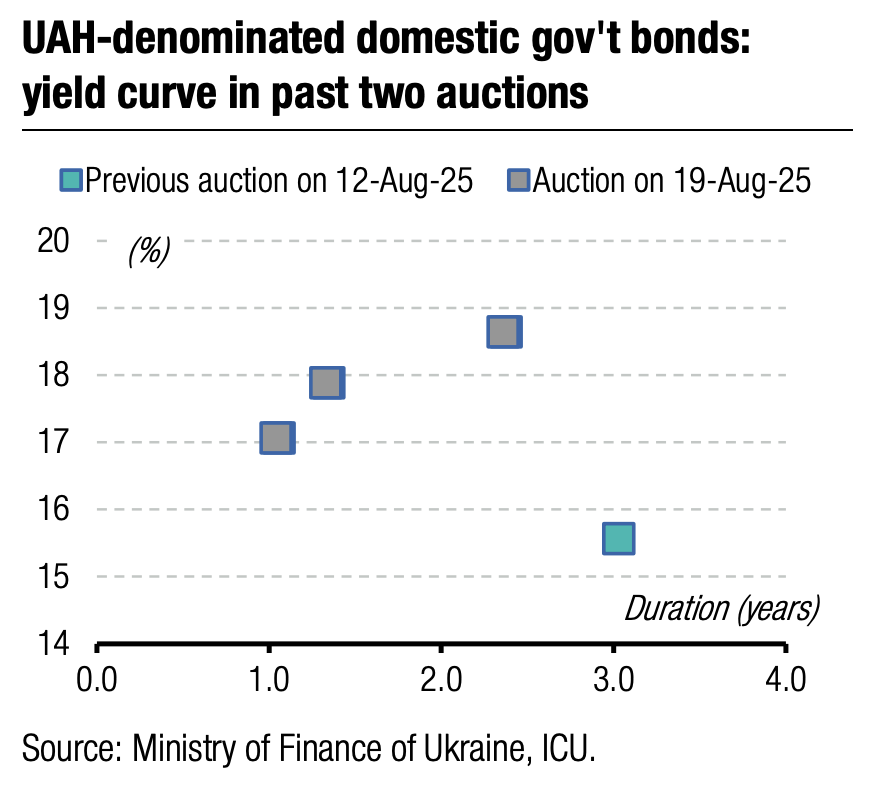

At the same time, UAH bonds attracted relatively small demand and brought the state budget only UAH1.9bn, significantly less than in previous weeks, excluding reserve securities.

The budget received more than UAH8bn in all currencies, and slightly replenishing the foreign currency accounts before tomorrow's redemption. The Ministry of Finance will need hryvnia funds for redemptions in September, so there is no need to rush with reserve bonds now.

Appendix: Yields-to-maturity, repayments