|  |  |

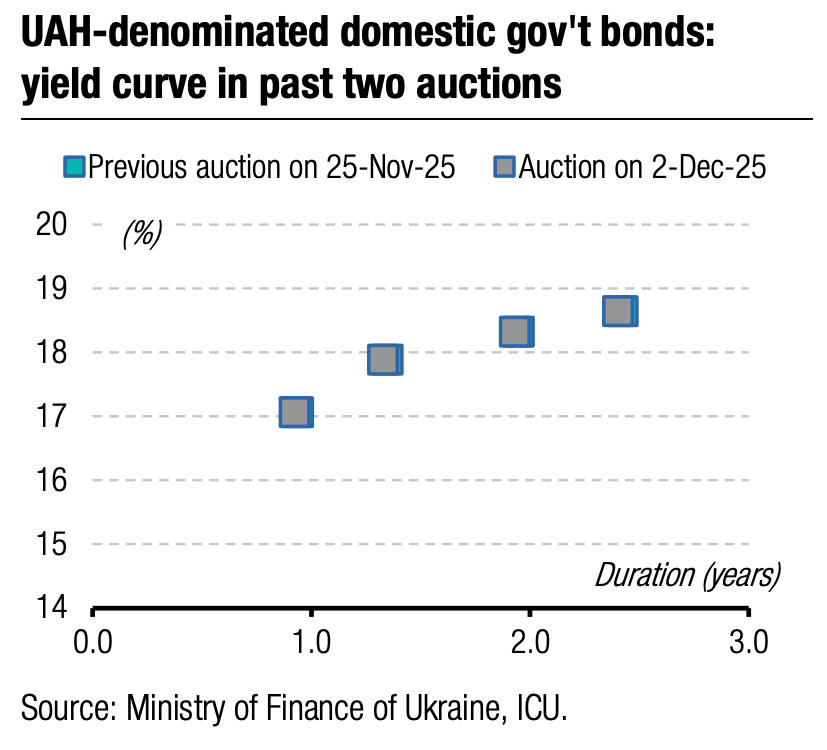

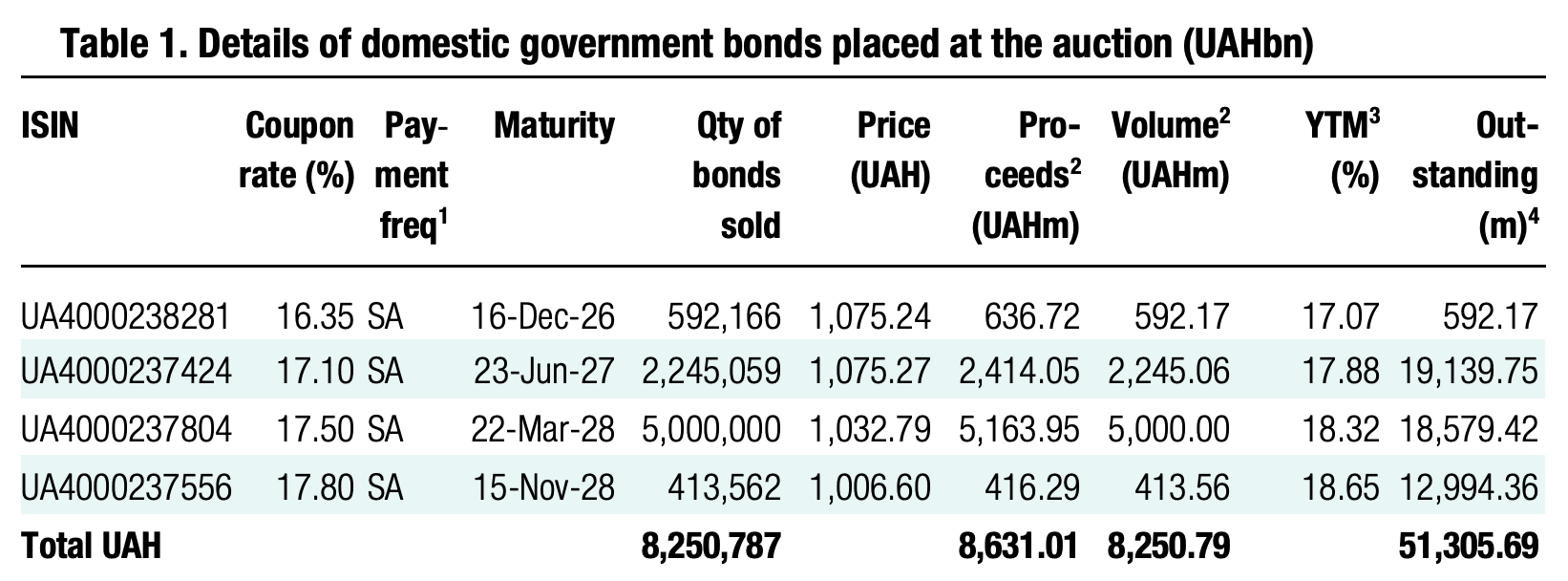

Yesterday, the Ministry of Finance offered the usual set of hryvnia bonds with maturities of one to three years and successfully raised UAH8.6bn. The military bond, with a maturity of more than two years, received the greatest demand and provided the state budget with almost two-thirds of all funds raised yesterday.

The MoF replaced the shortest military paper with a new bill maturing in mid-December 2026. Due to the novelty of the bond, interest in it was insignificant, with demand slightly below UAH0.6bn. The rates in the bids were the same as for the one-year instrument placed earlier, so the cut-off and weighted average rates remain at 16.35%.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.27/USD, 48.57/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The 19-month ordinary bonds received UAH2.2bn of demand, also at the usual interest rates, so the Ministry of Finance satisfied all bids.

As in the vast majority of November auctions, 2.3-year military securities attracted the greatest demand yesterday, at UAH6.6bn, at the usual rates. Therefore, the MoF issued the entire planned volume of such bonds and did not change interest rates. However, some participants did not purchase the whole desired volume of securities.

The three-year note again received the smallest volume of bids, only UAH0.4bn, and the MoF, of course, satisfied all bids in full.

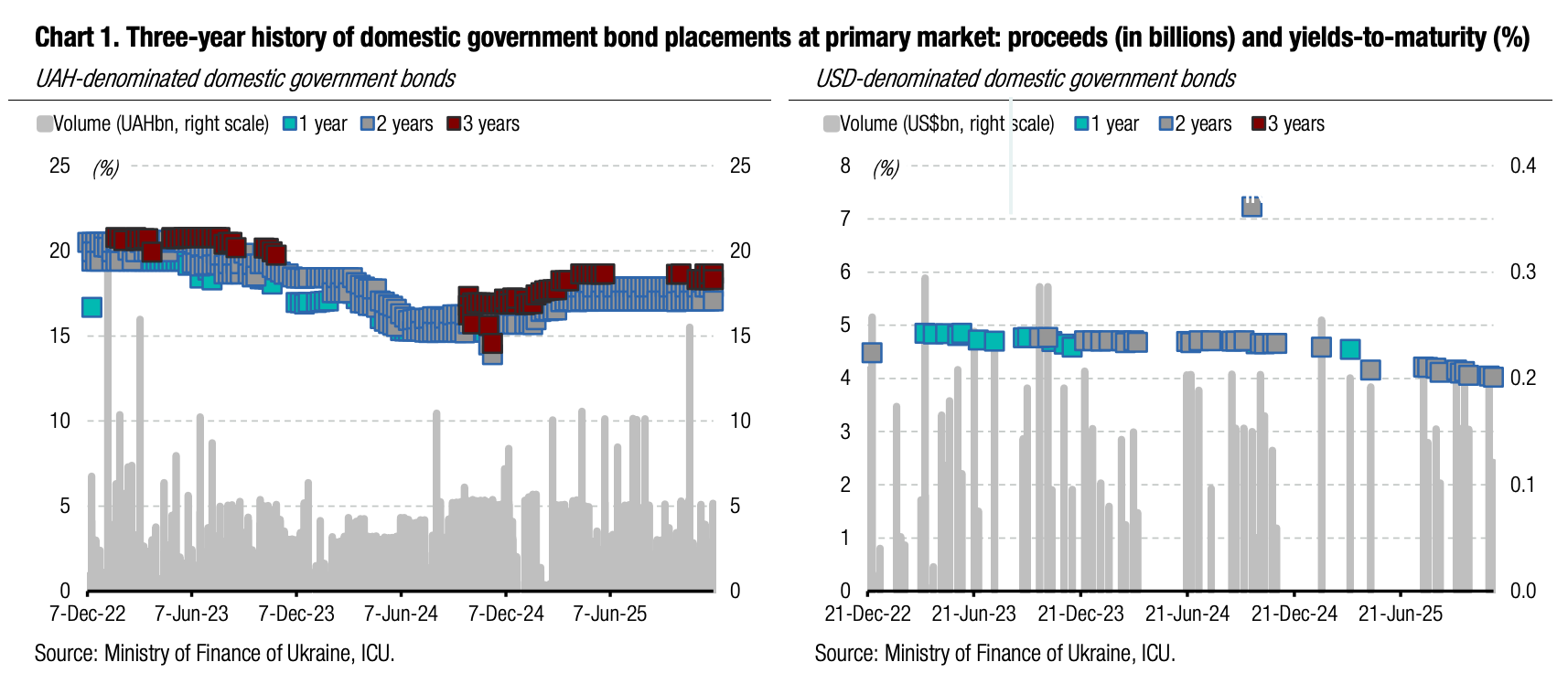

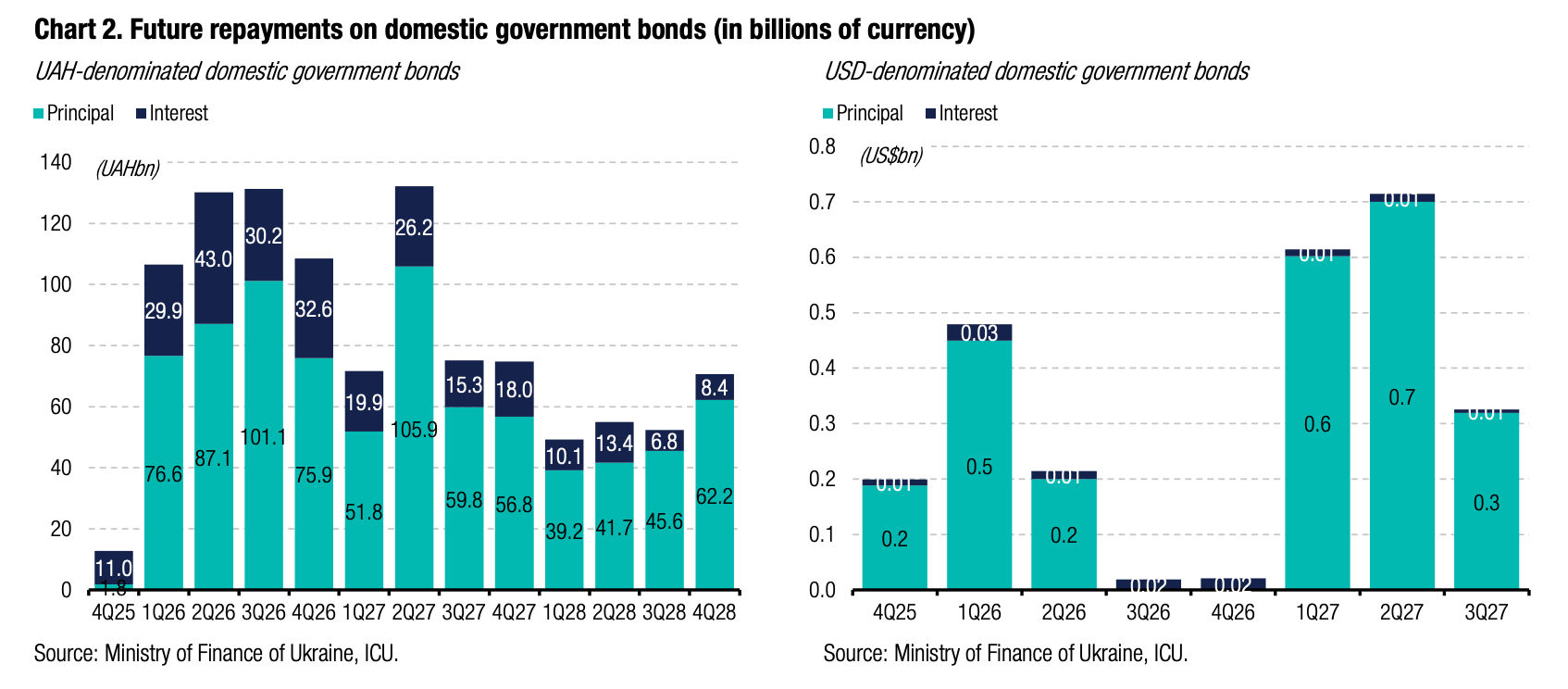

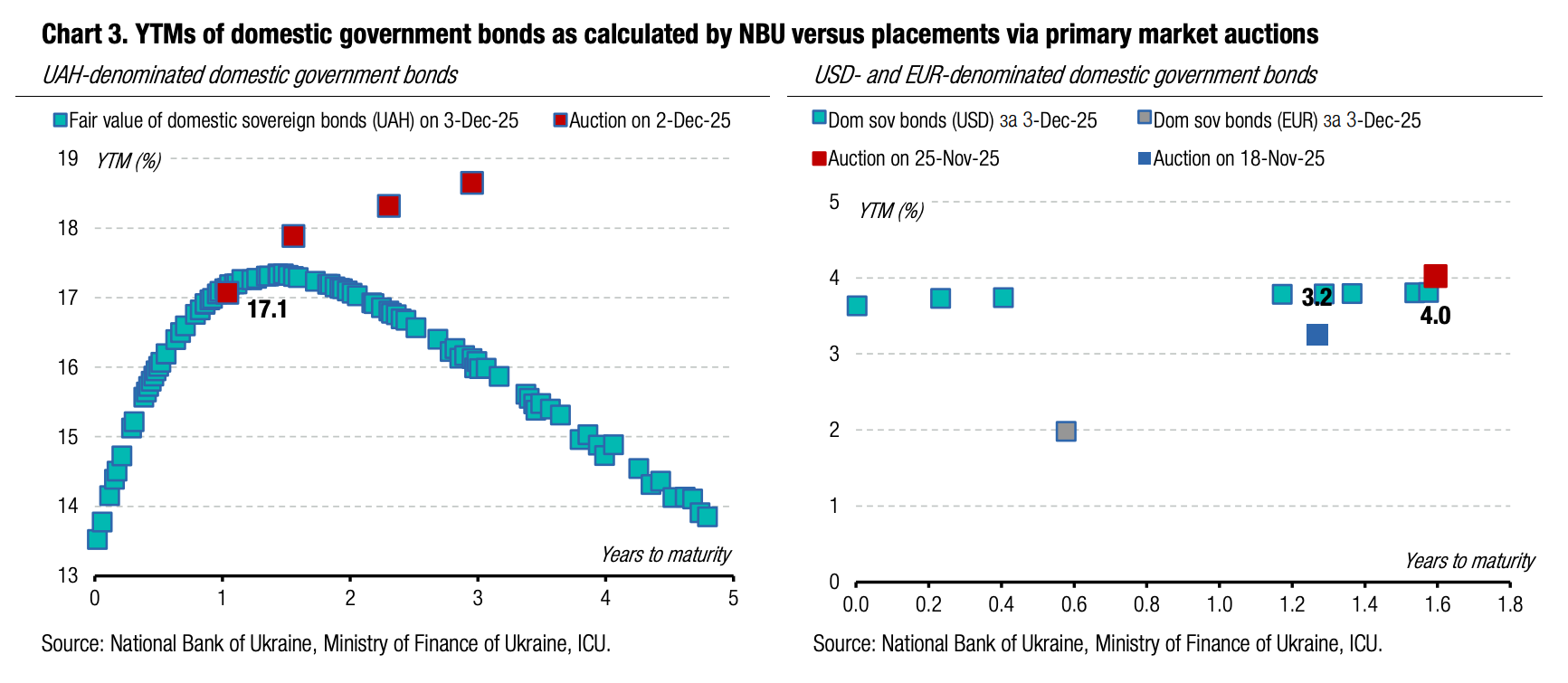

Appendix: Yields-to-maturity, repayments