|  |  |

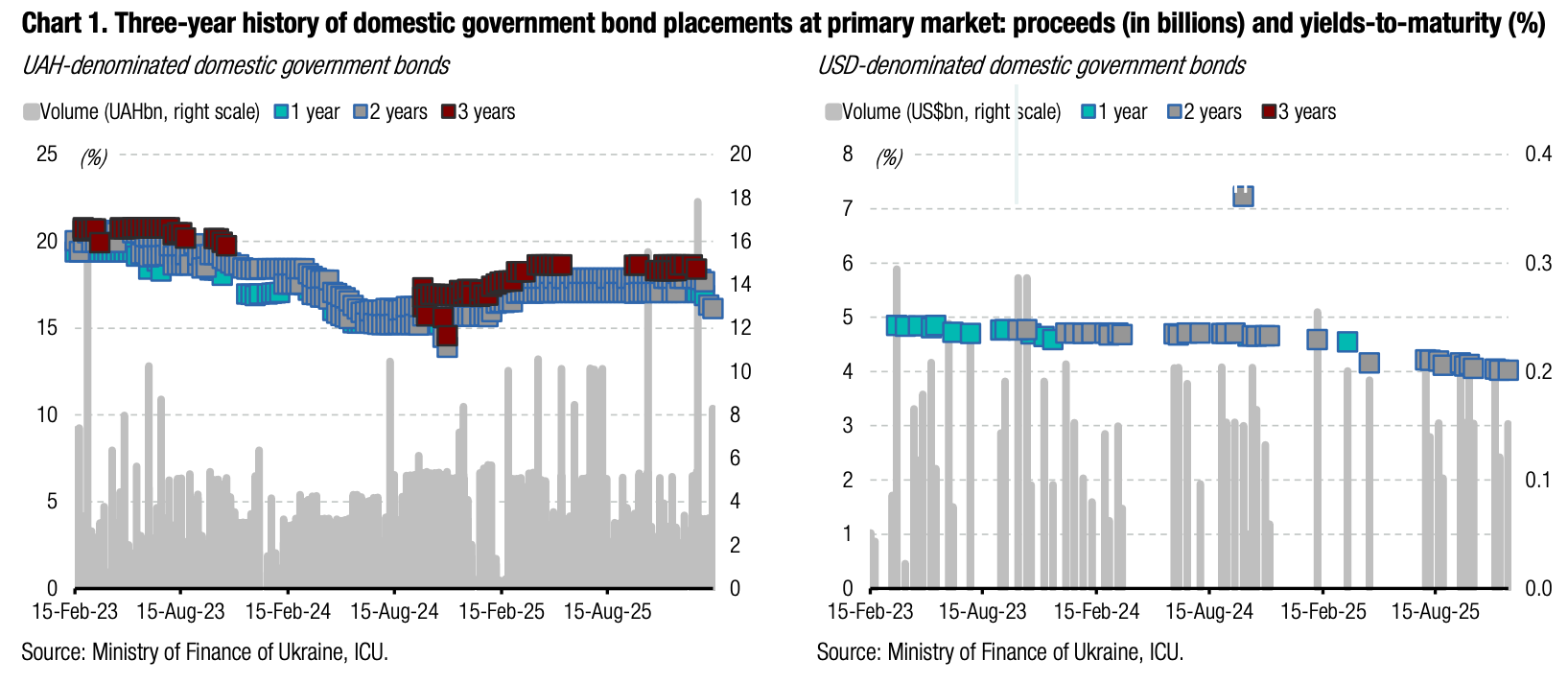

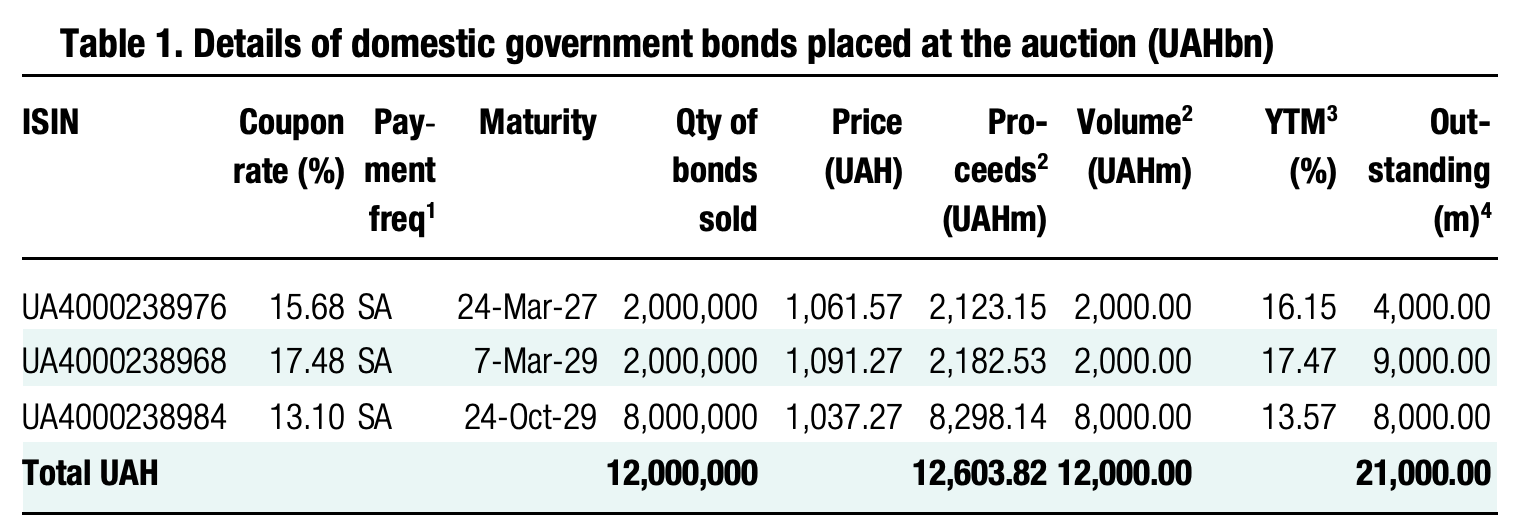

The MoF continued to reduce yields on government bonds in the primary market, offering a small volume of bonds and not rushing to attract large amounts of funds for the budget.

Yesterday's auction demonstrated investor’s relentless desire to purchase new government bonds as early as possible, without postponing the purchase even to today's swap auction.

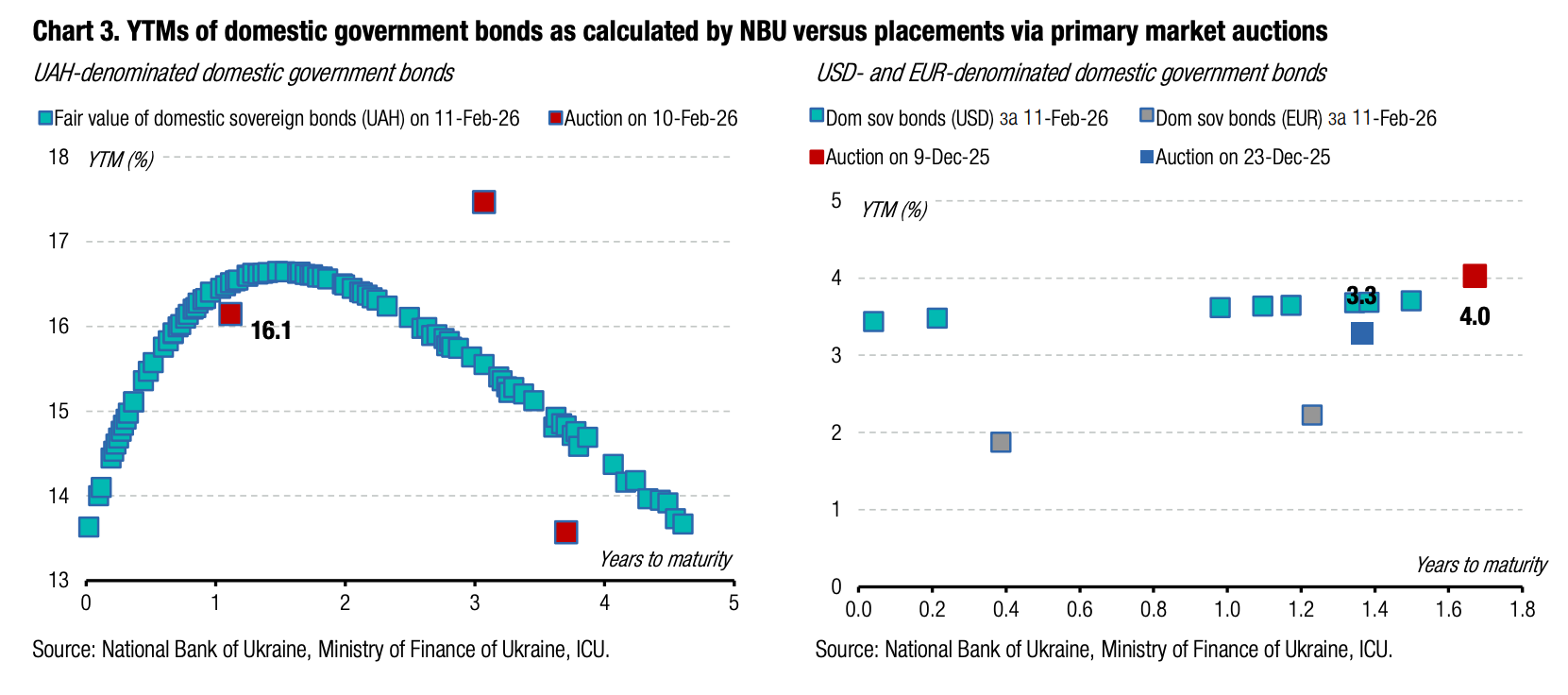

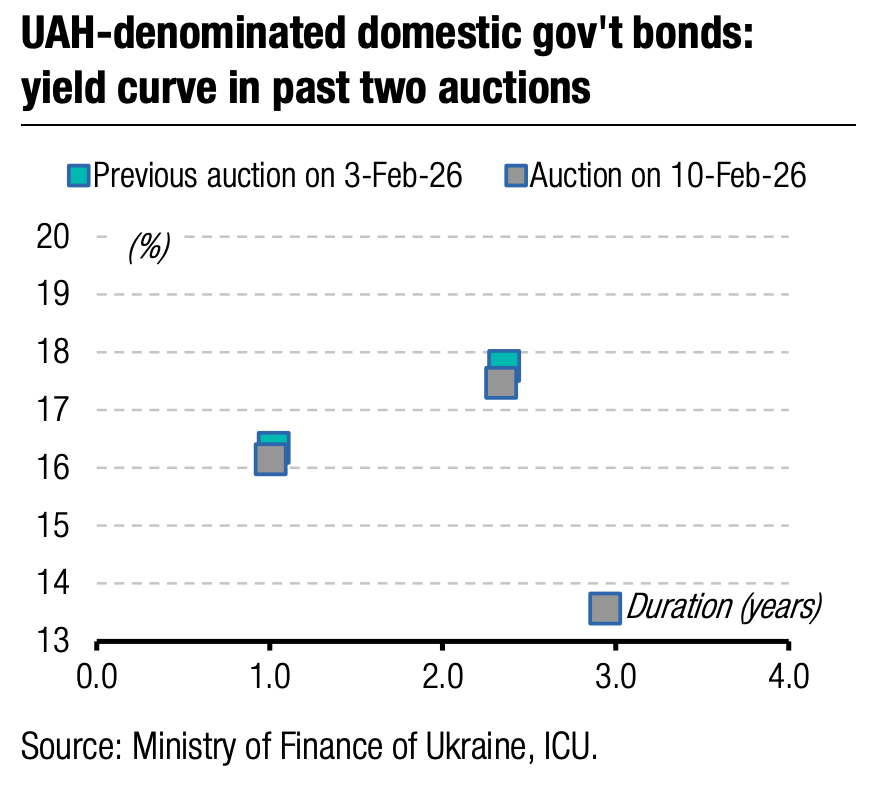

Yields on one-year securities declined at the slowest pace. The maximum satisfied rate decreased by 14bp to 15.58% and by 81 bp since the beginning of the year.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 42.39/USD, 49.53/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

Yesterday, the decline in yields on the three-year note exceeded 100bp cumulatively since the beginning of the year. The cut-off rate decreased by 21bp to 16.79%, and the weighted average yield by 27bp to 16.72%. So, in general, the cut-off rate has decreased by 101bp YTD and the weighted average rate by 108bp YTD.

Yields on the new, almost four-year instrument have decreased even more. It seems that the new bond will be a new reserve paper, so it is worth comparing it with similar securities. The cut-off rate has decreased by 14bp compared with the auction two weeks ago and by 124bp YTD. The weighted average rate has decreased even more, by 37bp to 13.1% in two weeks and by 134bp YTD.

Significant oversubscription, which was even greater yesterday than last week, became one of the key factors driving the decrease in yields. After all, the Ministry of Finance offered one-year and three-year bonds of only UAH2bn each, and the yield range in the applications was very wide due to placement participants' desire to purchase the bonds as early as possible.

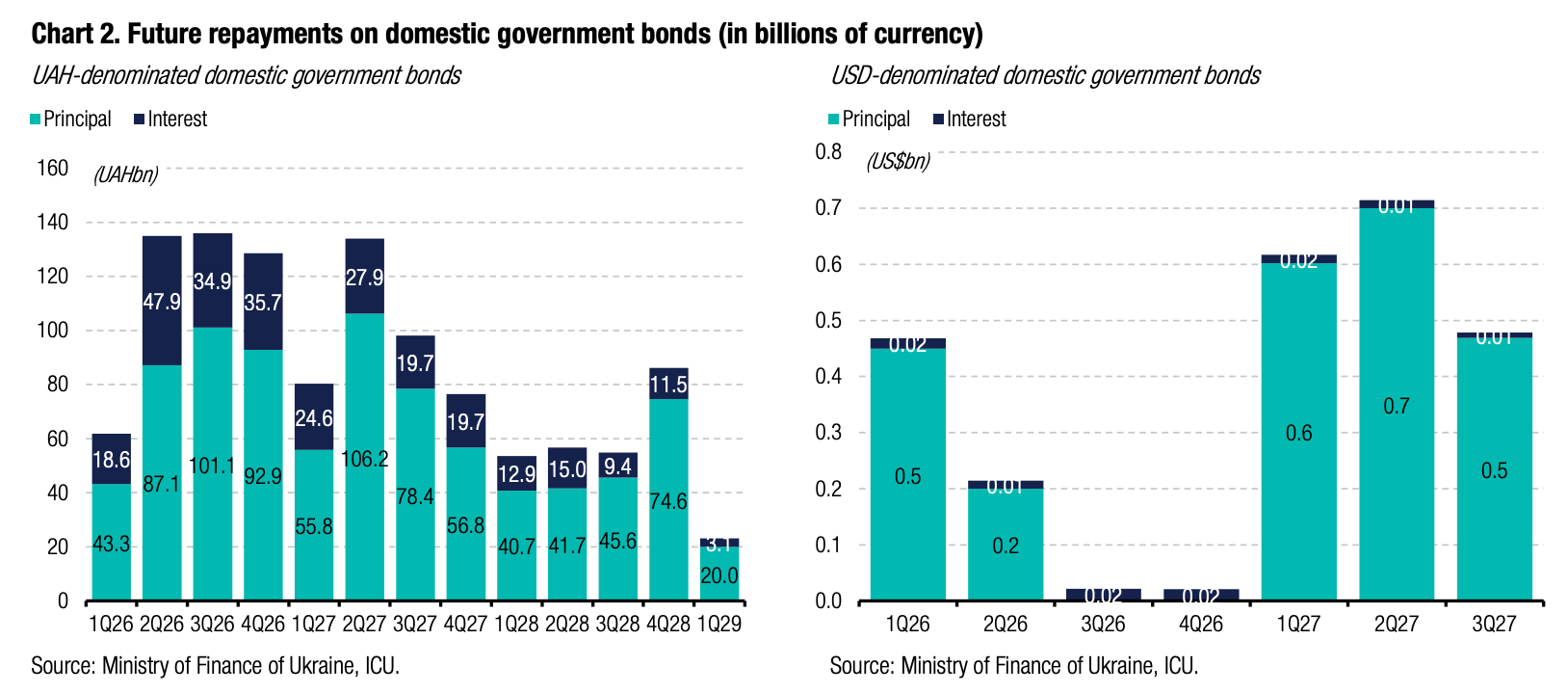

Appendix: Yields-to-maturity, repayments