|  |  |

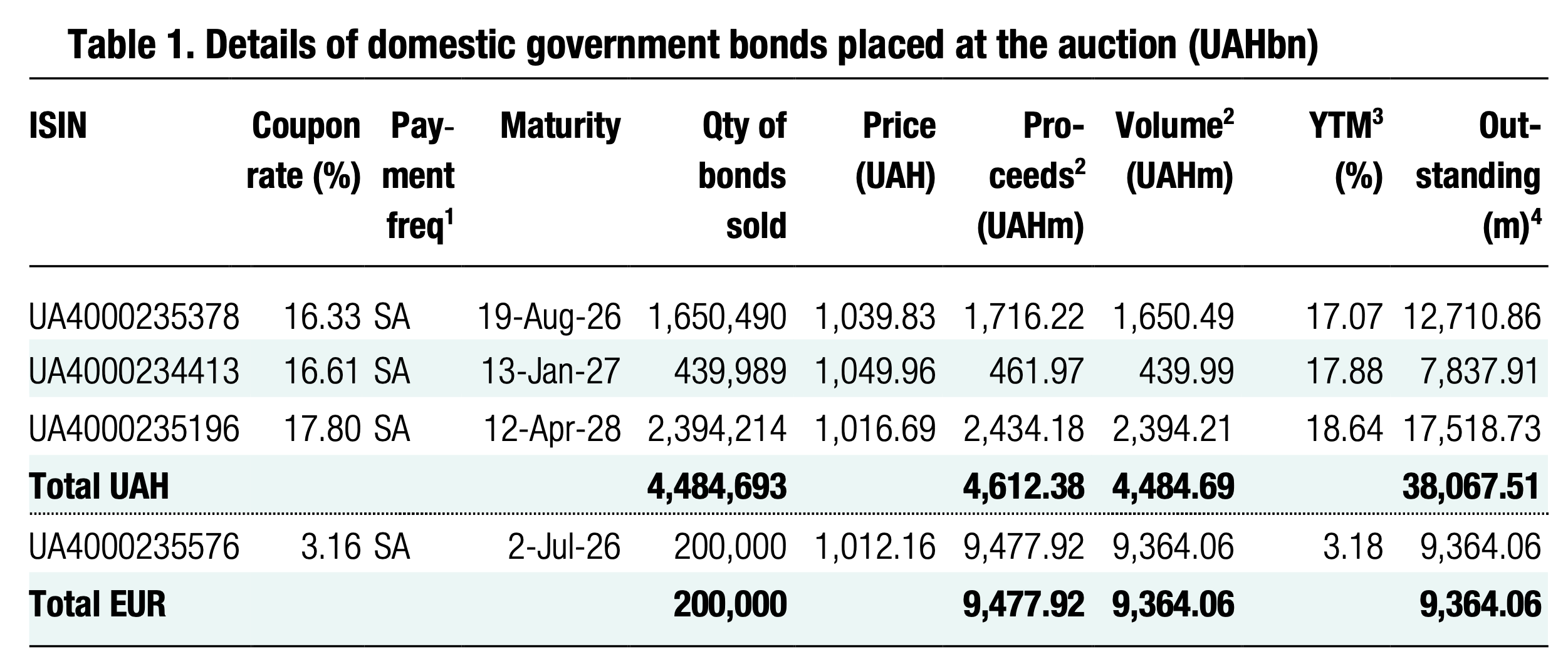

The MoF borrowed over UAH14bn, including EUR202m (UAH9.4bn) from FX-denominated bills.

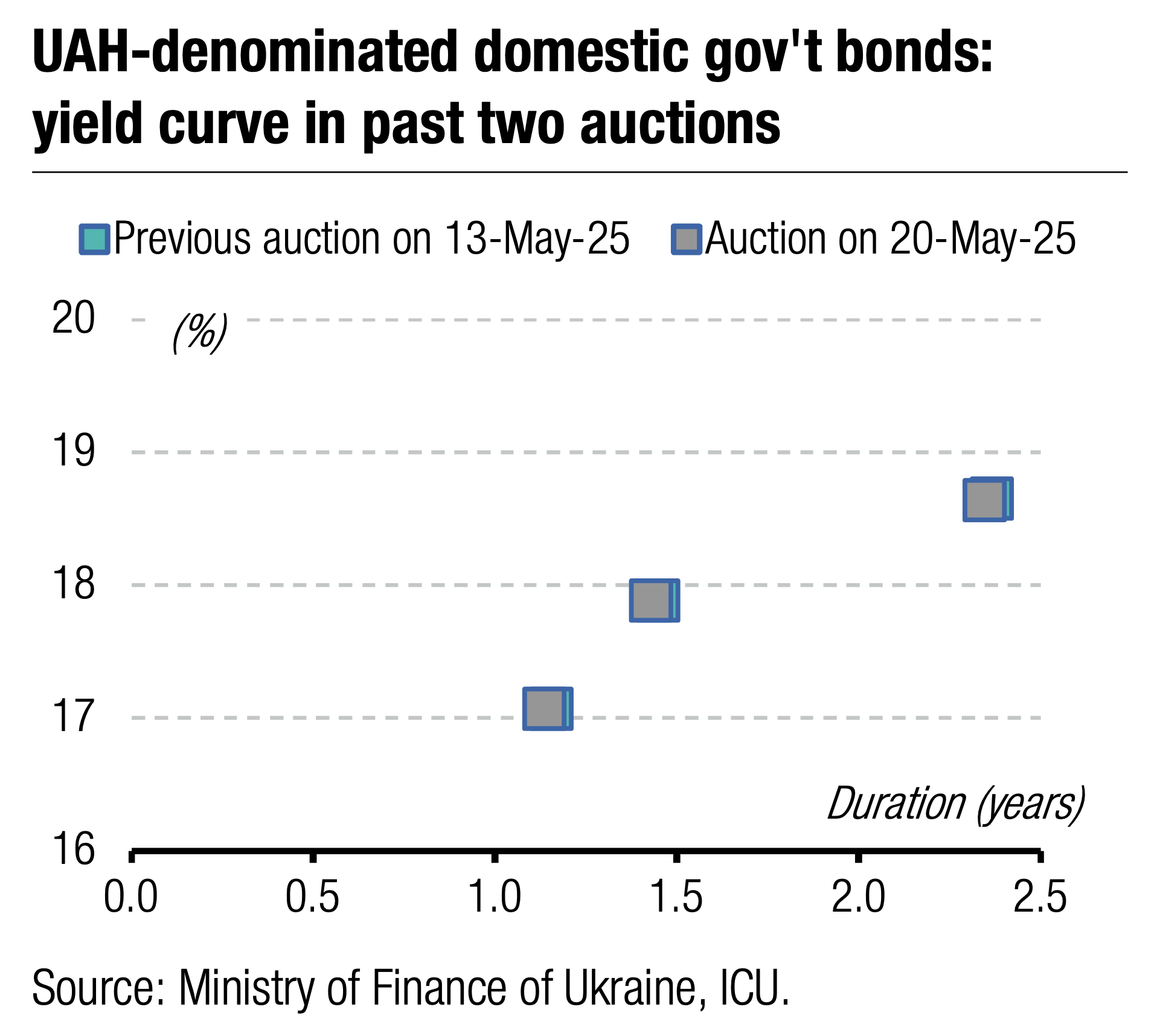

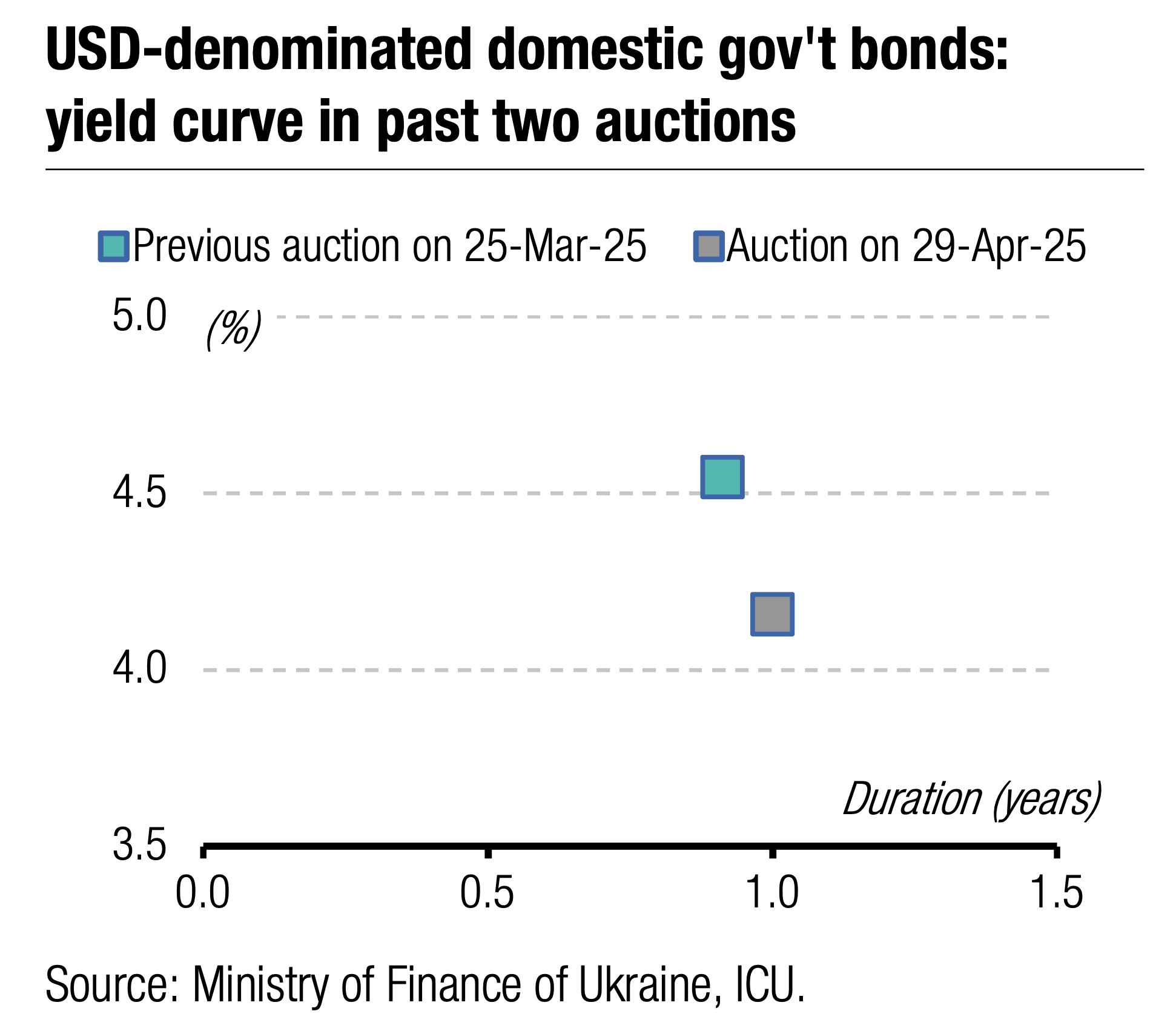

Demand for 15-month military bills halved from last week, but all bids were within the usual range of interest rates. Therefore, the MoF accepted all of them.

The MoF sold UAH0.4bn of 20-month paper to all bidders, as interest rates in bids did not change.

Note: [1] payment frequency abbreviations: M - monthly, Qtly - quarterly, SA - semi-annually, @Mty - at maturity date; [2] proceeds and volumes for the USD-denominated bonds are calculated based on the previous day's exchange rate 41.53/USD, 46.82/EUR; [3] yields on coupon-bearing bonds are effective yields to maturity. Sources: Ministry of Finance of Ukraine, Bloomberg, ICU.

The three-year note received almost the same demand as the previous three weeks. The cut-off rate remains the same for the second month, while the weighted average rate slid a mere 1bp to 17.79%.

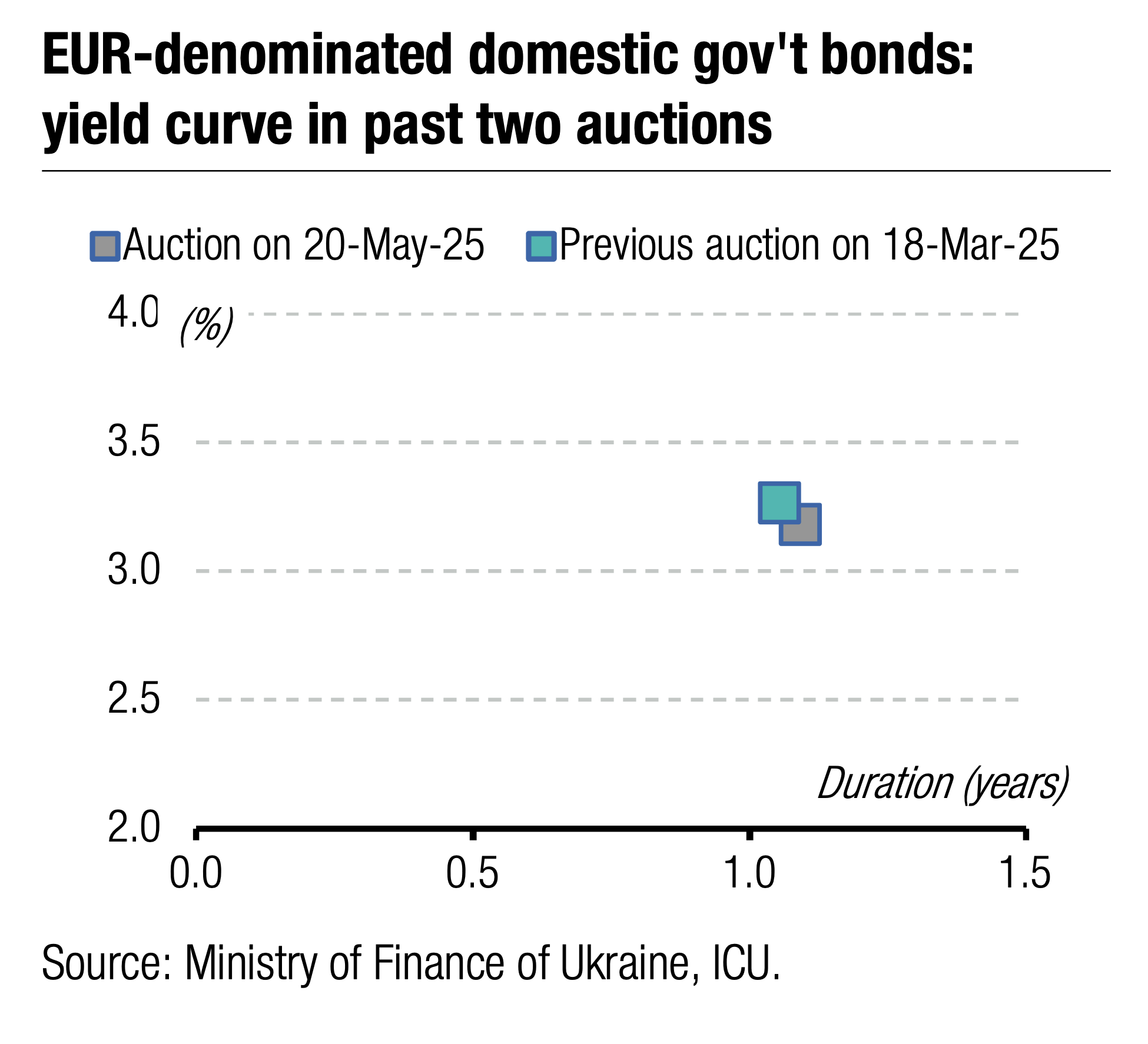

FX-denominated bills received the largest demand yesterday, with 13% oversubscription. The MoF collected 124 bids for EUR226.5m vs. the EUR200m cap and satisfied 123 bids, some of them partially within the cap. The cut-off rate remains steady at 3.25%, while the weighted average rate slid by 8bp to 3.16%.

As the MoF redeemed EUR476m of bills this year, including EUR156m last week, investors hurried to reinvest the funds. The MoF has rolled 82% of redemptions in euros and does not plan to offer FX-denominated bills again in 1H25.

Appendix