|  |  |

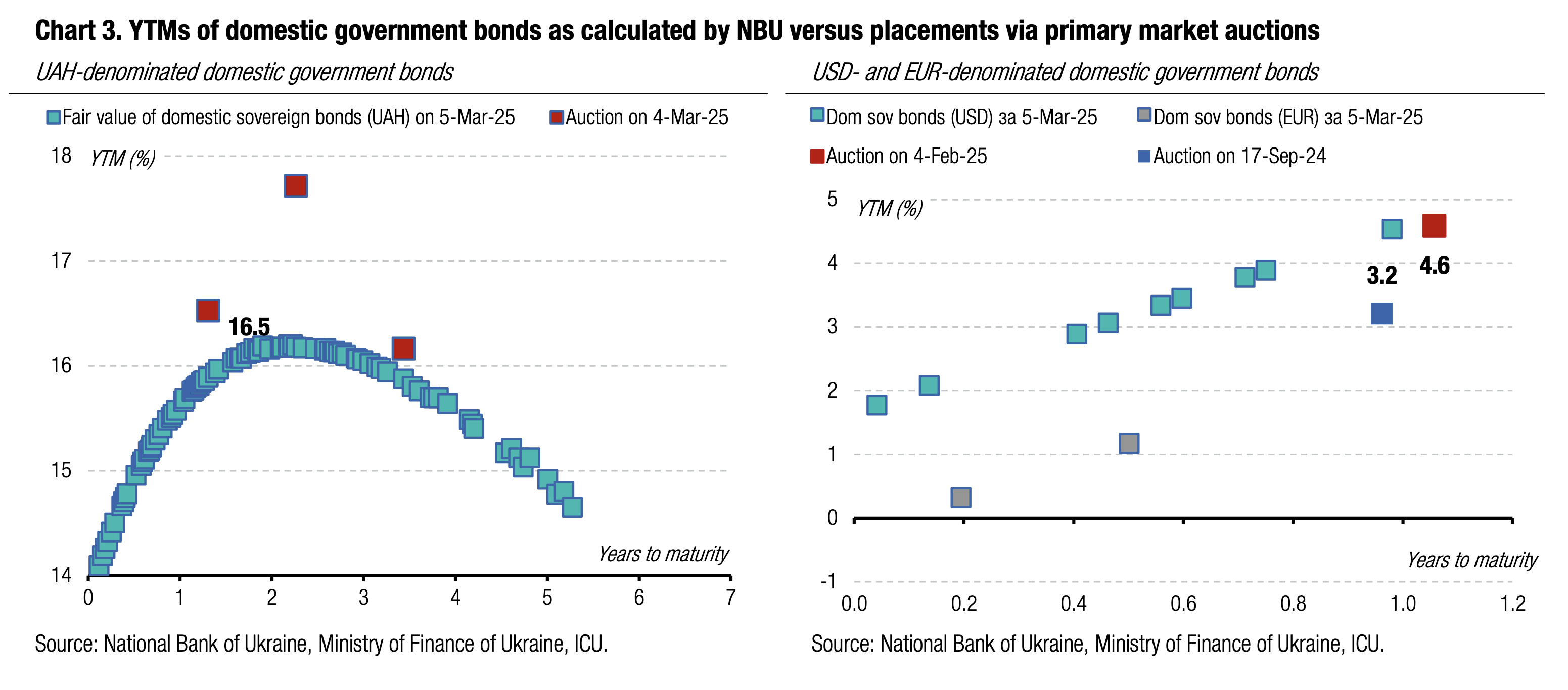

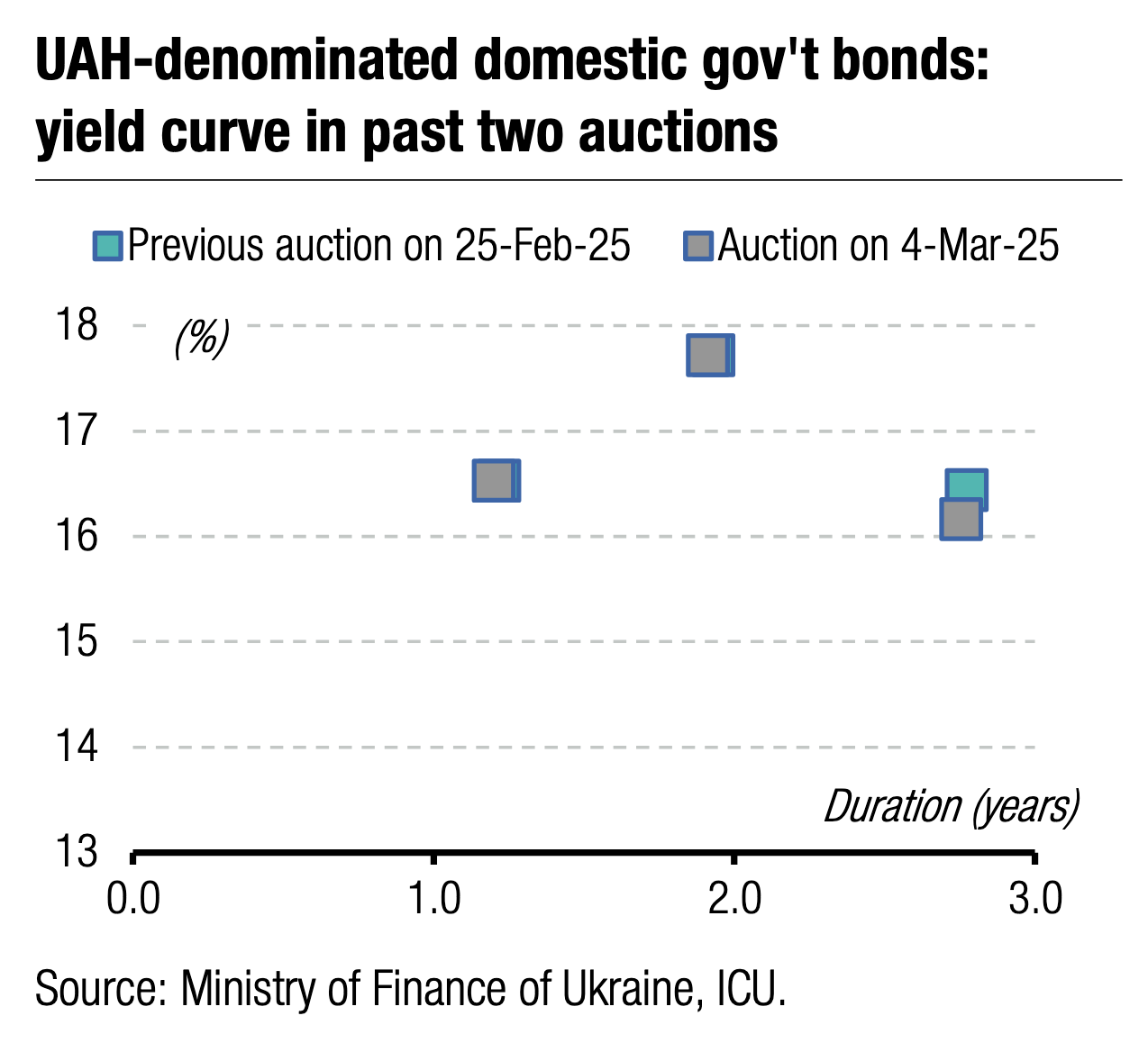

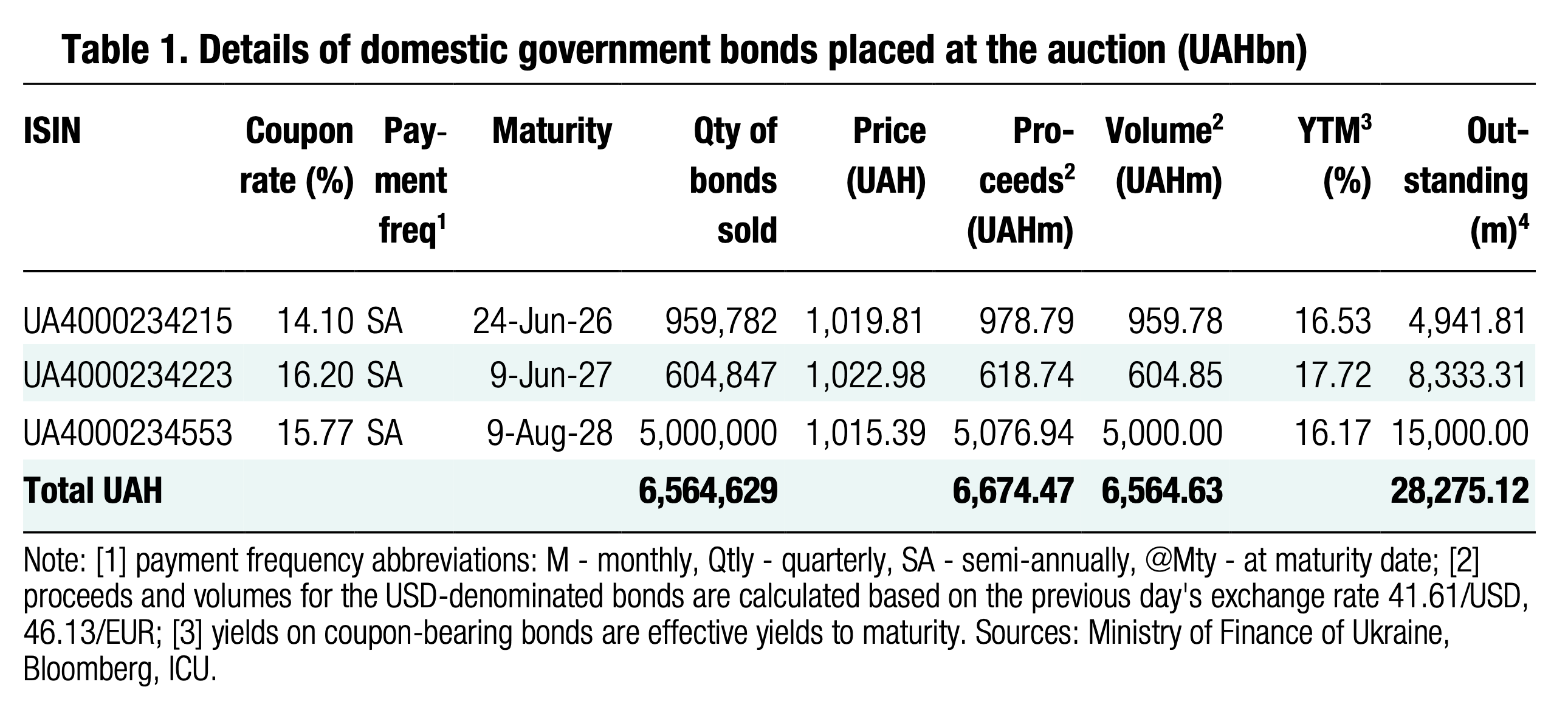

The MoF borrowed almost UAH6.7bn in local currency yesterday with a slight decrease in yields on the 3.5-year notes, which may become reserve bonds.

Military bills, as expected and as usual, received little demand. Retail investors, the main buyers of military bonds, prefer securities with a maturity of up to one year rather than longer tenors.

Accordingly, 14-month bonds received UAH960m of bids and 2.4-year paper just UAH605m. Competitive bids were mainly at last week's cut-off rate and the MoF satisfied all of them without changes in the yields.

At the same time, potential reserve bonds received another significant oversubscription. The volume of demand exceeded UAH26.3bn. The minimum rate was up by 29bp to 14.29%, while the maximum rate remained at 16%. The cap (UAH5bn) was exhausted at a rate of 15.99%, so the Ministry rejected four bids in full, and some participants were not able to purchase the full desired volume of bonds. As a result, the weighted average rate decreased by 25bp to 15.52%.

It is worth noting that such a reduction in the rate on reserve bonds is perhaps the smallest since October last year when the MoF began actively selling reserve bonds and the NBU increased reserve requirements for banks. Banks appear to be buying bonds in advance of the MoF redeeming other reserve paper in April. Therefore, the MoF is in no hurry to significantly lower rates, especially on the eve of the next meeting of the NBU board on monetary policy issues, where the NBU may raise the discount rate.

Appendix